You Don’t Have To Be Right to Make Money Trading

It’s natural to want to have a high percentage of winning trades, it makes us feel good when a trade turns out to be a winner because we make money and we were right about the direction of the market. However, as we will discuss in today’s lesson, being right about the outcome of any given trade and having a high percentage of winning trades are two things that are not necessary to be a profitable trader.

It’s natural to want to have a high percentage of winning trades, it makes us feel good when a trade turns out to be a winner because we make money and we were right about the direction of the market. However, as we will discuss in today’s lesson, being right about the outcome of any given trade and having a high percentage of winning trades are two things that are not necessary to be a profitable trader.

Being right and wrong are two things that we are all very familiar with. In life, people seem to have an inherent need to be right about almost everything. Even when we are wrong about something and we know it, we still tend to rationalize our actions to ourselves to gloss over the fact that we were not right. Indeed, we often tend to get upset when someone tells us we are wrong about something; people don’t like to be wrong because they internalize that information to mean they are inferior in some way. This is an important point to consider as a trader, because as traders one of the things we have to learn to deal with on a regular basis is losing, A.K.A. being wrong about the direction of the market.

Proof that being right about a trade is irrelevant

Being ‘right’ about the direction of the market on any given trade is not really relevant to your overall success or failure as a trader. As I will show you below, you can be wrong more often than you’re right about the direction of the market and still be a profitable trader. Therefore, it’s paramount to our forex trading mindset and to our overall trading performance that we learn to detach ourselves from the feeling of needing to be right about every trade.

For proof that you should not worry about being right or wrong on any given trade, let’s discuss the topic of risk reward…

When you start thinking in terms of risk reward and truly understand the power of risk reward, you will begin to understand that things like winning percentage and being ‘right’ about any singular trade are simply irrelevant to whether or not you become a consistently profitable trader.

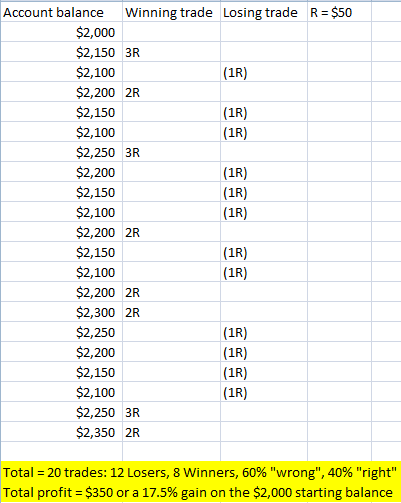

If you examine the chart of hypothetical trade results below, you can easily see the power of risk reward. That power can be seen in the fact that if you keep your risk (R) constant, and you obtain a reward of 2R or more on all your winning trades, you can lose substantially more than you win and still come out comfortably ahead. That is to say, you can be “wrong” about market direction more than you are “right” about it and still make money in the markets.

A 20 trade hypothetical sample of randomly distributed winning and losing trades:

For most traders, this idea of being wrong and still making money is not something they think about very much. Most traders think they are going to be right on every trade they take right after they enter it. It’s natural to think that your analysis was right and that this trade is “going to be a winner” just as you enter it. So, we basically set ourselves up to expect to win and to be right every time we enter the market. However, this obviously clashes with the FACT that we are not going to win on every trade…thus we have the recipe for an emotional reaction to a losing trade. In essence, when our expectations don’t mesh with the reality of a situation, we tend to become emotional, and this is especially true in trading.

So, to remedy this situation, we simply have to accept the FACT that we aren’t going to be right about every trade we take…AND that ‘being right’ is not necessary to make consistent money in the markets. Don’t take it personally if you lose on a trade and remember that it’s just another execution of your edge. Over a series of say 20 trades like we saw above, you are GOING TO have losers, you shouldn’t become emotional about any losing trade if you’re following a plan and maintaining your pre-determined risk tolerance. Look at that chart above, it shows only a 40% win rate but over 20 trades the account was still up 17.5%. Even if that hypothetical trade set took place over 3 or 4 months, a 17.5% gain on your trading account is still very good.

It will help if you study the chart above and imagine you have a bigger account than what you have. If you won only 40% of the time like in the example above, but you hit 2R and 3R winners whilst keeping your losers all at 1R, you would make a lot of money after those 20 trades on say a 50k or 100k account. That $350 hypothetical profit would be $8,750 on a 50k account…that’s not a small chunk of change by anyone’s standards. So, always remember that if you can consistently make money on a small account, even if you aren’t “right” all the time, you can also make money on a bigger account; an amount of money that would be life-changing.

So, don’t be discouraged if you have a small trading account, don’t try to over-trade it or over-leverage it because you think you can “make money faster that way”. Instead, understand that if you maintain a consistent risk amount that you’re comfortable with, and only trade high-probability price action strategies, over a series of trades you should come out profitable, even if you lose the majority of the time.

Check your ego at the trading room door

Losing a trade or being wrong about the market direction doesn’t mean you’re inferior in any way. It just means that the market didn’t move in your favor this time…there’s no reason to take it personally. Losing is part of being a trader and it’s something you can’t avoid. The more you try to avoid losing trades the more money you will lose because you will begin assigning too much importance to any one trade.

Losing a trade or being wrong about the market direction doesn’t mean you’re inferior in any way. It just means that the market didn’t move in your favor this time…there’s no reason to take it personally. Losing is part of being a trader and it’s something you can’t avoid. The more you try to avoid losing trades the more money you will lose because you will begin assigning too much importance to any one trade.

Many traders become fixated on trying to avoid all losing trades. They take losses way too personally. They forget that losing is part of the business of trading and they let every losing trade affect them on a personal level.

As traders, it’s important to understand that even if we see what we think is a ‘perfect’ trade setup and it turns into a loser, we didn’t do anything wrong…we just had a losing trade. It doesn’t mean we suck at trading or we that we aren’t smart enough to “figure it out”, it just means that that particular instance of your trading edge was a loser. In a different article I talk about how there’s a random distribution of winners and losers for any particular trading strategy, and if you understand and accept that fact, it will significantly help you trade with less emotion.

If you’ve participated in any public forums about trading you probably have figured out that most traders tend to discuss their winning trades far more than their losing trades. You may have even caught yourself doing this. It’s natural to want to gloat about our winning trades to our friends and on online forums, even if overall we have lost money in the markets…because it makes us feel good when we are right about a trade.

What you have to do is understand that whether or not you win on any one trade really doesn’t matter in the grand scheme of things. As we showed in the risk reward diagram above, being “right” about the direction of the market is not relevant to your success or failure in the market. You can be “wrong” more than you’re “right” in the market and still make money if you make proper use of risk reward and you are trading a high-probability trading strategy like price action in a disciplined manner.

The point is this; don’t let your ego get the best of you in the market. If that trade that you waited patiently for and that looked “perfect” ends up not working out, don’t immediately jump back into the market just because you feel angry or you feel “cheated” by the market. Instead, think of it as just another instance of your trading edge, and this trade just happened to be one of the losers that you will inevitably have. Two key things you need to do to make money in the markets is to remove all feelings of “needing” to make money fast and of “needing” to be right about every trade. If you can do these two things you will be light years ahead of most traders who can’t see the forest for the trees.

Learn to lose gracefully

Trading is the ultimate test of being able to ignore short-term temptations like trading when you shouldn’t and risking more than you should, for the longer-term gain of being a profitable trader at month’s end and year’s end. We need to constantly remind ourselves than any one trade does not dictate our success in the markets, but what does is how consistent our behavior is in the markets, day in and day out. Consistency and patience are what makes traders money over the long-run; these traits are rewarded by the market whilst impulsiveness and unpreparedness are not.

The way that we ignore these short-term emotional trading temptations is to think about the bigger picture, which is that our trading results are measured over a large series of trades, not over a small handful of them. This means that getting upset about being wrong about any one trade is both irrelevant as well as counter-productive to making money in the markets. As traders, we have to learn to ‘lose gracefully’ by simply moving on after a losing trade. By “moving on”, I mean carrying out your trading plan as usual, not reacting after a losing trade, just take it in stride and always remember that you don’t have to be right on every trade to make money in the markets. If you’re trading with a high-probability trading strategy like the price action strategies I teach in my Forex trading course, you can make money over the long-run by sticking to your trading plan and understanding the power of risk reward.

Good trading, Nial Fuller

As of now this article is truth.

I trade mainly inside bars and pin bars and engulfing bars on higher timeframes.

I have taken 31 trades in 4 months.

I have lost 21 trades

I have won 10 trades

Yet I am still profitable. I still need to work on keeping risk constant and not closing trades early.

This article is real and you really can lose more and still come out with profit.

Don’t give up traders.

Thank you Nial for your honesty and integrity.

Roy.

Wonderful truthful article Nial

A great reminder of doing things correctly even though i may want to go against what i know works

Thank you

D

Hello, Nial.

Great article Nial, I’m really enjoying being part of this trading site.

Thank you very much.

i didn’t read a simple and worhty stoploss,target and risk rewards before.i guess this will help me in the future to trade best.

Hi Nial. I want to commend you on your fantastic ability to not only understand the language of the markets but also the underlying human behavioural tendencies w.r.t trading. I have been trading on and off for almost 4 years now without success(lost a lot of $) but the one thing I keep coming back to is your website. Your words fill me with a deep knowing that i’m within striking distance of being a more disciplined and consistent trader. The trading experience and value you provide on this website is astounding! You have made me a firm believer in Price action trading. Nothing beats PA. I give you full credit for my upcoming trading success! Thank you.

Thanks Nial. That’s another great article. Been applying your teachings.

Thank you very much Guru. Your teachings are pushing me to success.

No one had ever taught about keeping the R in fixed amount.

That’s very good advice. It takes a lot of reminding to shake off the bogey of losing trades.I am always working on it ! -your article is a great help.

Yes you are right Nial! The three things – adequate risk/reward, trading according to trend and accurate entrance from lower timeframe are the basis of profitable trading

Thanks again Nial,

Really great explanations for the important things that needs to be added to make a great FX trader of me.

Thx

Tomson

one more time, great!!!

Thank you, gained great wisdom by reading this blog

thanks nial

Fantastic article Nial. Thank you.

Hi Nial, Thank you for that excellent piece of trade wisdom. I too am a perfectionist and believe most of my trades should end up winners. I often find that I get stopped out only to see the market go where I figured it would initially. Appreciate hearing that losing is just a part of winning.

Cheers, Matthew Sutton

Thanks Nial for other wise trading advice. I’m following your advice as a newbie, to trade only on daily charts and with the obvious trend. I have a question, actually I’m looking to trade in long term only, can you share with us, how far we have to look back, in order to follow a trend? A month ago? 6 months or a year? Thanks

This lesson was always a really hard one for a newbie like me, but thanks to you and your continual clear and focused PA guidance, I think I have really got it nailed now.

Cheers Paul

hello,

your writing style is each time better man

i really like whole your work on this page

it’s really not so that hard to now about your enemies in trading

the biggest problem is to keep the ego on the chains of long term disciple as you write and it’s not easy for me on my small account

i sometimes fail in staying on my trades enough time, overleverage my position by size or opening another on the next pair in correlate situations.

only sometimes but still enough to be on zero or less ..

i always still smiling but its not so funny to be that crazy and know about the problem : )

hope i will beat these stupid human temptations with your help soon

thx Nial : )

peter

You are more and more sucessful, master. I’m very lucky to have you on my way to become one of the most profitable forex trader in the world. It’s impossile to reach that level without you. Please provide us more useful and interesting article like that.

No doubt…good advice..Thanks but knowing myself, I’ll probably have 19 loses out of 20. Like some people here have asked…how rigid should you be with stop loses and targets? I’ve lost a lot because of being stopped out early and missing targets fractions off the mark.

Tks a lot Nial.

You’re a real guide

Nial my strategy sometime get into the market late the reward gets to 1.5 most time but sometime the trade moves pretty well please advise how can one manage such trades to get to 2 or 3R.

What a great teaching by a good teacher i have always been a victim of emotion trading, now i can move on .Thanks Nial God bless.

Hi Nial, Been studying and trading the market for the past 12 years. This has to be the best article I have ever read. It applies 100% to me. I am a perfectionist and I over study the trade trying to validate the action. Way too much stress and thinking. i believe this will be history changing for me.

Thankyou so much!

Hi Nile,

I love reading all your articles .Your work is very encouraging. However, I am waiting for time off from work to do the course.

Regards,

Krishna

In essence, this means that if your strategy is lousy, but your money management is good (1:5 say), you can still come out a winner. Theoretically if you lose half (the actual probability of tossing heads or tails), you can still win in a major way. The key perhaps is knowing where to put in T/P or S/L so that an effective (true) result will take place- judging this takes some savvy/experience(?). This came out in the tape offered by one of the members some time ago- knowing precisely where to put in stop and take profit, before entry, so that the ratio of 1:2 or 1:3 is possible (may be something for a future input).

Thanks Nial!

Great article there Nial, keep up the good work!

Thanks Nial very much appreciated. Trading is a very humbling business!

Yes, the proper reward to risk ratio makes the winning/losing trade ratio work in our favor.

tnx

Great article and so much fun to read! Thank you Nial. You are truly the God Father of the trading business out there..:-)

LOVE your price action system, LOVE your little Pin bars..I am doing so so fine since I discovered you on the net..

:-)) NOW I just need to get that ratio risk:reward right…My Stop Loses are still way out of whack and much too large. When they get hit damage to my account is too large. But over all I am getting ahead…:-)) AND having more fun while doing it..:-))…Thank you and cheers!

Thanks for the great reminders!! Those of us who love trading can sometimes forget the big picture and what our long-term goals should be. Thank you for reminding us!!

Thanks Nial for another great lesson,im still a newbie but u make trading much simpler than it is,cheers

Thanks Nial, like always a great article and you explain these psychlogical side of the trading so well. Thanks again for a great article.

Great insight as usual. It’s like being a shop keeper. Not every person that comes into your shop is going to buy something, but that just because people are walking out empty handed does not mean that you’re not going to be profitable at the end of the month. Also, losing trades are the costs of doing business. If you run a shop you shouldn’t get emotional about paying salaries, buying stock, and so forth. When you take the macro view to trading it suddenly is not anywhere near as intimidating as it appears. Trying to win on every trade is incredibly emotionally draining. When Messi comes on the field he is not thinking “I’ve got to score a hat-trick.” That would mentally paralyze him if had to play under that kind of pressure. He knows that his team can win without him scoring the hat-trick, which is what it’s all about. In other words, you can win the game of trading without having to win every round of the game.

Nial youre right losing is part of the trading ,thanks for the information as its important that u follow your game plan and results will show as u clearly showed in the documented article

thanks again Nial for your great support

Well said Mr.Fuller !

Great lesson Nial, I want to know if you use a set and forget strategies with your stop loss and target, or you move your stop as the market is going in your favor?.

Your article is great. makes me feel more confidence and at ease while trading. I agree the the most important thing in trading is not winning trades but making a profit.

thx, very good!

You say check my ego at the door? NICE! I’ll do that, Nial..

Hi Nial,

Very effective and an useful article on trading, thanks a lot.

Thanks

Cheers

Hi Nial

You nailed the point about R/R..

and yet…

all these examples look fine provided you BEGIN winning from the very first trade…

I think that winning the first 2 or 3 trades is of paramount importance because it gives you MOMENTUM that eventually will compensate for the inevitable loses..

I want to see the same table with 3 straight losing trades how you will seek for a 3 to 1 or many 2 to 1 trades in order to break even at least…

Regards

mt

If there ever was one article that should be printed out and taped on the wall in front of your computer screen, this is it!!

If there was a secret to trading, this is the essential message!

I wish I could have absorbed this message and how important it was 8 years ago, or really understood it (not just give it lip service, you know, yeah I get it) But REALLY get it, because it would have saved me tens of thousands of dollars.

I like the message to learn to accept losses gracefully. As Mark Douglas would say: Every moment in the market is unique, and ANYTHING can happen.

If you really think you can possibly know how every other market variable will play out ie what every other person thinks about price, and how they will act, just because your “edge” says price will go up, then you have a long and bumpy road ahead.

You have to be comfortable in not knowing, and just trade your edges, and let it play out over time. We will have lots of losses, but come out ahead over time.

Thank you Nial for this message, for your mentoring, and your great methodology that is price action trading.With your method, I don’t have to try and guess what will happen next, I can just sit back, and wait for a legitimate signal and then get in and see what happens.

Good trading to everyone :-)

Pls i really want to know more about forex trading because it is a sucessful business.

Very important issue, and thanks for bringing it up frquently

best

Steve p

Nial this is an article that sums up trading.This article is the most important bit of information that any person should (KNOW) and learn before they attempt any trading at all. Thank you your a great teacher. (The best teacher).

Another great lesson,looking forward to join your Fx course.

Thank Nial.

That’s all very well…if you can get the 2:1 or 3:1 Risk Reward on ALL your Winning Trades..which is something that i am failing to do at the moment..!?

One of the best article I have ever read on RR and %Win use.psicology in trading is a delicate subject.Nial you have the secret to handle it.thanks!

Enjoy reading your articles, it’s easy to aquire the knowledge but difficult to apply. I’ve been practicing this guidance from your previous articles and others as well. Great stuff.

Respectfully.

I remember the line out of a movie years back in which the actor said, “sometimes you have to lose to win.” As the years rolled on by, that made a whole lot of sense to me and still does.

“Check your ego at the trading room door”, I like that bit

I have been on the market a few years now and found my stoploss is always hit and my target is never reached. any suggestion to improve will be appreciated.

How very true- and how to overcome it?

PRICE ACTION=SUCCESSFUL TRADING. Thanks Nial you are changing lives!!!. Regards!

Nial is a true GURU , very consistent in all his the teaching, his reply to our quiries fast and swift almost no delay and had not been disapponting at all times.

Thank You Nial once again!

Another great lesson, very useful.

thank Nial.