The One FACT About Trading You NEED to Know

One of the most important aspects of forex trading that many traders seem to be unaware of is that they should not expect any particular trade to be a winner or a loser. That’s right, it may sound a little strange, but it’s a fact. You see, even if you have a trading strategy that you know has a specific win rate, you still do not know when any given instance of your edge will result in a winning trade or a losing trade. Think about it, if you have a 60% win rate over the last year, do you ever know which trade is going to fall into the 60% winner column and which will fall into the 40% loser column? No. You don’t know, and you can never know, do you know why? It’s because in trading, there is a random distribution of winning and losing trades, no matter what your trading edge is.

One of the most important aspects of forex trading that many traders seem to be unaware of is that they should not expect any particular trade to be a winner or a loser. That’s right, it may sound a little strange, but it’s a fact. You see, even if you have a trading strategy that you know has a specific win rate, you still do not know when any given instance of your edge will result in a winning trade or a losing trade. Think about it, if you have a 60% win rate over the last year, do you ever know which trade is going to fall into the 60% winner column and which will fall into the 40% loser column? No. You don’t know, and you can never know, do you know why? It’s because in trading, there is a random distribution of winning and losing trades, no matter what your trading edge is.

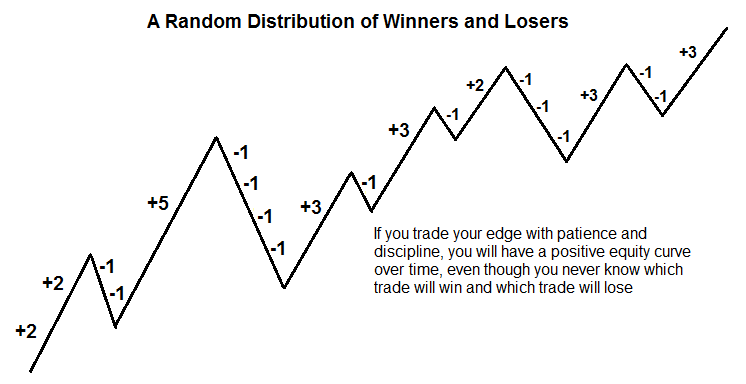

Now, this might seem like something you already know, but the fact is that MOST traders do not trade as if they understand or are even aware of the fact that their winning and losing trades are randomly distributed. If you are still a little unclear as to what I mean by “randomly distributed”, it simply means that you never know when you’ll hit a winning trade and when you’ll hit a losing trade, EVEN IF you are following your high-probability trading strategy to the T. Thus, the outcomes of your trades will be randomly distributed, but if you ARE following your trading strategy to the T, over time, you should be profitable. The key here is ‘over time’, and it’s this part that most traders forget about or have trouble with; they simply don’t have the discipline and(or) the patience to stick with their trading edge and money management strategy over a large enough series of trades to see it become profitable.

Here’s an example of what a random distribution of winning and losing trades might look like. Note that because the equity curve is increasing over time it means the trading strategy being used is an effective and profitable strategy over a period of time. The implications of this are profound:

The implications of randomly distributed trading results

Perhaps the biggest thing that you need to understand about the FACT that your forex trading results are randomly distributed is that if you REALLY understand this fact and accept it, you would never want to risk more money than you are comfortable with losing on any one trade. This is because traders who understand that they NEVER know when a losing or winning trade will pop up in their distribution of trades, would never behave as though they did.

Traders who risk more than they know they are comfortable with losing on a trade are behaving as if they KNOW they will win on THIS trade. It’s perhaps this attitude and belief that gets traders into more trouble than any other. If you trade in-line with the fact that your trading results are randomly distributed then you would always be consciously aware of how much you are risking and you would always weigh the potential risk reward of the trade before entering, rather than only thinking about the reward.

How your expectations are killing your trading account

You probably don’t enter very many trades and expect to lose on them; in fact, you probably expect to win on every trade you enter. It’s human nature to want to win on every trade you take; after all, we have an innate need to be right and to feel like we are in control. This is why most people are more afraid of flying than they are of driving, even though statistics show that flying is significantly safer; people like to feel like they are in control.

The problem with trading is that you need to release all of your expectations about any given trade, and for most traders this is nearly impossible. When you lose on a trade there are two things that happen; 1) You lose money, and 2) You are wrong about the direction of the market.

We have to learn that both losing money and being wrong about the direction of the market on a trade are both just ‘part of the game’. You need to remember that Forex trading is a business, but the costs are a little different than most other businesses. Your costs are very direct and in your face; losing money and having the market tell you that you were wrong on your trade. You have to learn to ignore these things and not let them make you emotional.

Expectations kill most traders. You have to learn to release ALL of your expectations about any given trade; instead you should have long-term expectations. For example, it’s good to expect to be profitable at the end of the year IF you follow your plan and trade with discipline and patience. However, it’s not good to expect to win on the next trade you take. The reason why it’s not good is because it simply doesn’t matter if you win on the next trade, what matters is if you are being disciplined and only trading when your edge is present and always controlling your risk. If you do those things consistently, you can expect to make money over a series of trades. But, most traders become emotional and up over-trading and blowing out their accounts because they expect every trade to be a winner. When you expect to win on every trade you are like a freight train of emotion heading towards a brick wall of reality; meaning when our expectations are not in-line with reality, we get emotional, and when we get emotional in the markets we lose money!

Real-world examples of randomly distributed trading results

Ok, we have had enough theory; now let’s get into the application of it. I want to go over a few charts of real-world recent examples of price action trade setups. I should first mention that these examples are just to present the point of random distribution and to prove the point that we never know when we’ll hit a winner or loser. I am not saying all these trades would have been taken in reality.

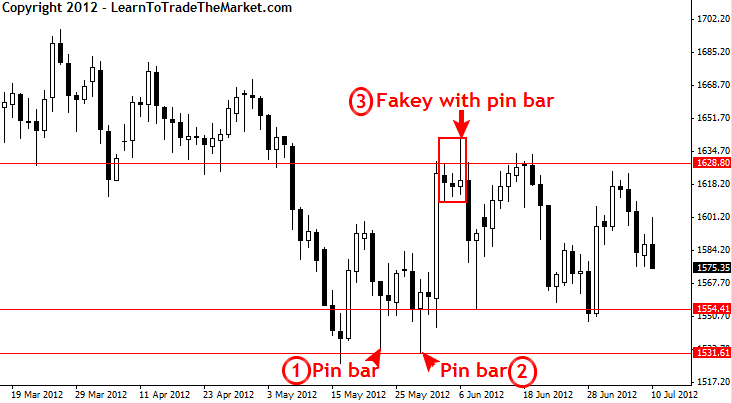

XAUUSD

The chart below is the XAUDUSD daily chart, or the spot Gold market. We can see examples of three different price action trade setups that occurred recently in that market. Let’s go over them according to their number:

1: This setup was a large pin bar that formed off a key support level. Even though it was counter trend the setup was still valid and obvious, so this is a good representation of a valid instance of our price action trading edge. This particular pin bar would probably have resulted in a losing trade for most traders as we can see it briefly broke higher and then reversed to just below the pin bar low before forming another pin bar off that same support. Thus, even though the setup was valid and obvious it resulted in a losing trade; the point being that you need to release your expectations of winning on every trade!

2: Another pin bar, this time off the same support discussed in the previous setup; $1530.00 area. This setup was also a large pin bar off a key support, thus it was another valid instance of our trading edge. After briefly retracing to about the 50% level of the pin bar the market then launched higher and provided us with a winning trade. Again, no reason to expect it to be a winner, it was just a winning instance of our trading edge; price action.

3: Next, we can see a well-defined fakey setup that formed with a pin bar as the false-break. This was a well-defined setup that formed off a key resistance level, so certainly it was a valid instance of our price action trading edge. We can see price quickly fell lower and provided us with a nice profit, especially if you would have entered near the 50% level of the pin bar on a 50% retrace entry, one of the pin bar entry techniques I discuss in my price action trading course. All of these setups were valid examples of my price action trading edge, two of them happened to be winners and one happened to be a loser, but there was NO WAY we could have known for sure WHICH ONE would lose and which one would win before they came off.

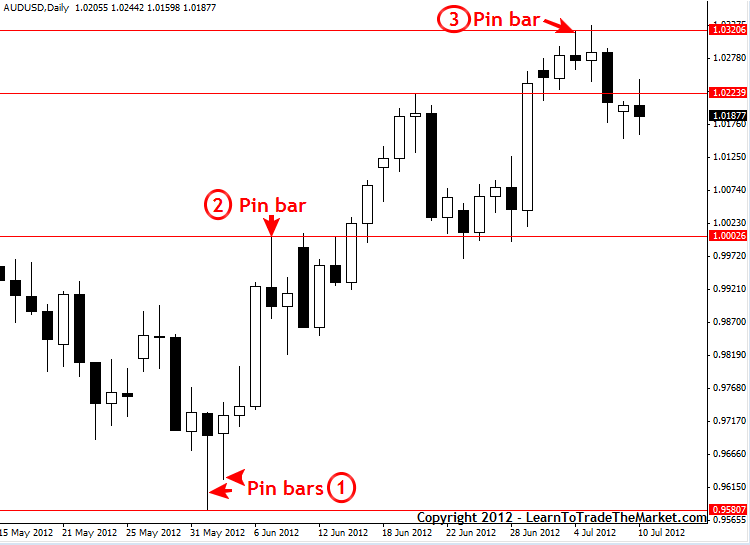

AUDUSD

The chart below is the AUDUSD daily chart. We can see examples of three different price action trade setups that occurred recently in that market. Let’s go over them according to their number:

1: This first setup was a pin bar setup, actually two nice pin bars formed consecutively, so even if you passed on the first one you may have taken the second one since they both formed showing rejection of a key long-term support. We can see quite a large winner could have resulted from these pin bars, depending on your stop placement you could have got a risk reward of 1:3 or 1:4 or maybe more. Again, many people may have ‘expected’ these pin bars to lose since they were counter to the recent downtrend. But the fact is that they were valid counter-trend setups, so we should just set up our trade and then let the market do the work. Don’t expect to win or lose on any one trade, just follow your trading edge and trading plan religiously and know that if you do that you will succeed over a large series of trades.

2: This was a well-defined bearish pin bar reversal setup which would have probably resulted in a losing trade for most traders who took it. Even though this trade lost we should not have become emotional or upset, because we KNOW that our winners and losers are randomly distributed, thus we have no expectations for any one trade.

3: This was a smaller pin bar but it was showing rejection of a solid resistance level and after the huge run higher that had just occurred it would have been a price action sell signal many traders would have taken. We can see the market ended up moving lower but then reversing higher to test the resistance again and this would have stopped most traders out for a 1R loss. So, on this chart we had one big winner that would have netted us 3 or 4R and then two losing trades of 1R each, and as you can see we would still be ahead even though we had no expectation as to which trade would lose and which would win.

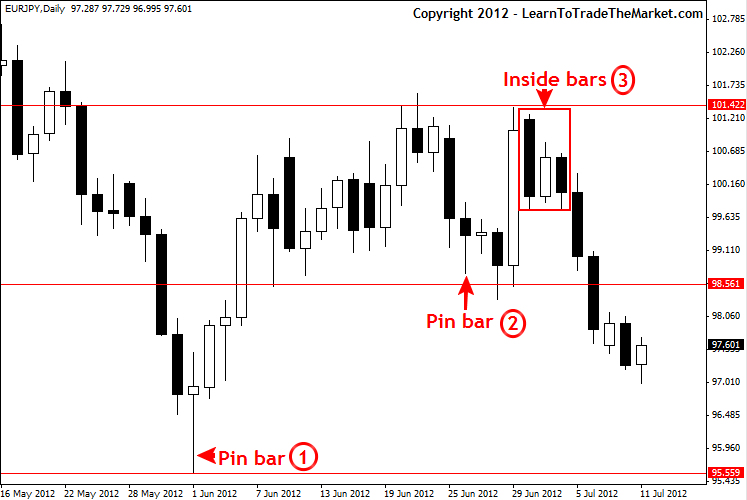

EURJPY

The chart below is the EURJPY daily chart. We can see examples of three different price action trade setups that occurred recently in that market. Let’s go over them according to their number:

1: This setup was a long-tailed pin bar that was showing rejection of a long-term support level near 97.00 – 96.00. Note that price moved substantially higher off this pin bar providing us with a very nice risk reward potential.

2: This pin bar setup would have been a losing trade if you entered it at market after the close or on a limit entry near the 50% retrace of the pin. It was valid pin bar since it formed close to key support near 98.70 – 98.50 and had obvious pin bar definition. Still, no reason to expect it to be a winner or loser since we know our trading results are randomly distributed; just follow your plan and when a valid trade setup forms you enter it and then let the market do the ‘thinking’.

3: Next, we can see an inside bar setup that formed just under the resistance near 101.40 in this market when it was range bound recently. Note that this setup came off aggressively to the downside and if you placed your stop near the 50% of the mother bar you would have made a very nice risk reward return, and of this writing this market is still moving lower off that setup.

Stop expecting to win on every trade, and you just might become a winning trader

The reasons why so many people have trouble making consistent money in the markets can essentially be boiled down to the fact that they simply expect too much. Most traders try really hard to control all aspects of their trading, whether they realize it or not. In reality, the market cannot be controlled; all you can do is control yourself. But, it’s more difficult to control our own actions and thoughts than it is to over-trade or risk too much on a trade because you’ve convinced yourself that that ‘this’ trade will be a winner. People convince themselves they are right about their trades; it feels good to think we are right, indeed many traders actually become addicted to the feeling of entering a new trade, even though they have long histories of losing in the market.

You have got to learn to look at yourself as the root of your trading problems. It’s not your broker’s fault, it’s not the market’s fault, it’s your fault you are losing money, and you’re probably losing money because you expect to win on every trade and so you largely ignore the risk involved with trading. People tend to focus way too much on the potential reward of a trade and not enough on the risk. However, as we have already discussed, the potential to win or lose on ANY ONE trade is essentially equal. This is because your winners and losers are randomly distributed, you have to remember this. You can assign an overall winning percentage to your trade strategy over a long series of trades, but you can’t assign a winning percentage to any one specific instance of your trading strategy, this is a difficult concept to grasp at first, but it’s very important. I can help you learn an effective trading edge in my Forex price action trading course, but it’s up to you to understand the points discussed in today’s lesson. You need to understand them as well as trade in-line with them by not becoming emotionally attached to any one trade and by understanding that you can be a profitable trader if you stick to your trading edge and trade it with discipline over a series of trades.

I want you all to re-read this article and really think about its implications on your own trading, then leave me a comment below.

enlighten trading. Nial

Hey Mr Nial, firstly i would like to thank you for all the very informative articles you share with us including this one. The reason i post this comment is because All the knowledge i have on the market is from you and im currently on a winning streak, since the 23rd of december 2019 i have made 514% in 18 days on the free $30 from your preferred broker. That performance now scares me, after reading this article because should i hit a losing streak this account would be blown, im just thankful that i got hold of this article in time.

much love mentor.

I’m already profitable with forex trading , but the articles on ur website are very nice. It gives a lot of advice on how to improve as a trader!!! Now Apply it in my journey and become better

Strong article! Thanks

Excellent article. Bookmarked for future reference.

Right on the money Nial.

I am really going to have to re-program my thinking to be more successful, as the trading mindset goes counter culture to normal thought and emotion.

Excellent article.

Thanks mate.

I have a very good understanding of how the japanees candlesticks can turn into a large profit in forex market when used correctly. However,your instructions has really sharpened my knowledge on how to view the market in general rather than convincing myself that a particular trade is going to win. Am not a prof yet but am looking forward to that in the coming years,thanks.

Nial, great piece of advice.

you realy have a greater understanding of the forex market. thank you

Gold Article Mr. Nial :)

Thank you for very quality information. Beginer should write his trading strategy on the paper and folow strictly his plan.

Simply a great piece of writing..

This one is essential, truly.

This is the best article I’ve read. This should be the first information any one should keep in mind at the beginning and throughout their trading career. Thanks for sharing you knowledge Nial.

Really appreciate the effort you put into LTTTM, so valuable.

Hi Nial,

Another great article with explanation. I have been following your website from long time. I learnt lot like 50% retracement entry.

Nial stands out as one of those generous forex instructors.He gives out so freely and yet concisely and clearly.His writing style is so lucid,I will not hesitate to suggest that a newbie can simply study his greatly written articles,videos and strategies and emerge a successful trader. Nial amazes in his unique and easily readable articles. Good job Nial

Nial…this is without question your best article. Using your suggestive PA set ups, some are doomed to fail. In the long run, should see a profit in conjunction with using proper stops and money management. Do plan to completely detach myself once the edge trade is set up…thanks

Best,

John

Cracking good article and so simply explained by the “MASTER”

Thank you

John

great article like ever

Lol at myself, I have been studying the course material dilligently, have done 70% of things correctly, but the above article truely explains why I have almost blown my account.

However there is no tears over spilt milk, the loss was a lesson that needed to be learned, thankfully it was learned very early in my trading carrerr.

Look out for the future nial, your techniques and guidence are developing a, master trader.

Cheers mate,

Ant

Hi Nial,

another great lesson!

Thanks!!!

Hi Nial,

Thanks for this invaluable information.

A very important article.

All the best.

Love it, listening to my head as I read the article, not me, I can do this etc, the problem is my head not the system or market :)

Outstanding stuff, Nial. You’re the man!

Thanks Nial, you sure are an inspiration. I will soon get on your course, its the only way to really get to grips with the markets!

Looking forward to your next article!

Amazing information Nial. Thank you so much for being honest (not like most trading mentors) and opening our eyes to winning and losing in Price action.

Love it

thanks nial!

Astonishing !

It’s really true that if we accept the concept of random distribution of winners and losers in our trading method we can be less emotional and more separate from this need of being right every single time.

Nice touch Nial

Nial,

Saw this concept recently in book regarding trading discipline. You explained it so well. The principle is so powerful. After a losing trade how can one get upset if he (she) truly understands it? THANKS AGAIN FOR EVERYTHING! Larry

Oh… You are a genius Nial. You cover every aspect of trading.

Whenever I lose a trade, I get emotional and tweak or try to improve my trading plan making it more complicated.

Now I understood the concept of random distribution.

Thank you Nial!!

This is indeed one of the most important lesson.

Thank you!! You have won me as a student!

:)

great …. refresh my emotional in trading ….thanks

ty for this article,i still work hard on my emotional part in trading

Excellent article…thanks for sharing this trading jewel!

Good lesson, challenge is truly to control your own actions and thoughts. Will re-read again.

Thank you so much for this lesson coach, I consider the information you are sharing in this article to be very advanced, so you giving it away for free, tells me once again the good person and trader you are. keep it up!!!!

Nice article again Nail.thanks a million……

Nail, your trading concepts are great. I really absorb this article. I can’t believe you are doing all this for free.

Thanks Nial… awesome as ever!

Great article! 10x

Dear Nial,

Don’t expect to every trade and can’t know any happen next surely. Extremely right . Thanks

All the articles you have posted up are very important but this one is probably the most important for all traders to grasp if they wish to have a long and happy prosperous trading career. The moment the trade is entered I kiss that money goodbye and emotionally move on regardless of its potential outcome. Looking back at my trade journal and the statistics shows that im profitable by sticking to my plan with no expectation. It seems a weird way of making money but it is what it is and this is how it truly works!!! –

Cheers Nial

VERY EXC. LESSON I HAVE READ

You’re right on the mark as usual Niall. Although I’ve been trading for three years, I’m only now learning to be emotionally detached from my trades. It’s actually very liberating.

Very well said. It makes sense to me. Most of the times traders are so much attached with their trades expecting to win. If we always expect to win, so our life as a trader will be controlled by our emotions in the market. It is not helpful not only as a trader but as a person. We are not products of circumstances. Being affected by the losses in the market creates an inner trouble that may destroy not only our trading accounts but also the other aspects of our life.

Thanks for the lessons Nial. Keep it up!

Thanks very much for your generosity Nial. I believe what you are saying is: repetition, repetition and repetition is reinforcing the correct psychology, this will ultimately create the long term outcome which is the great trader vision I have for myself – just another leap of faith I have to keep the faith.

This article is directed to me! Got it! Thanks.

hi Nial,

Great article! I have always tried to be perfect in every trade and have struggled all along. Now I realize that I shouldn’t expect it, that kind of thinking just causing more problems.

.Am glad am part of this, thanks Nial.

I take the idea of “all you can do is control yourself” one step further. I don’t believe I can control myself in the way that’s implied in Nial’s piece. I understand that I don’t need to control myself, rather, I must question my beliefs about “winning” and “losing.” That’s where the real problem resides.

I know–from everything that Nial teaches and my own research–that I will trade successfully OVER TIME if I apply my Trading Edge and follow my Trading Plan. It’s that simple and that hard.

If you don’t question and understand what motivates you to trade, if you don’t question and understand your ideas about “winning” and “losing,” you will lose in the end. I believe our trading plans should address these ideas, and many more, before we ever put a dime in the market.

Thanks for this essential lesson. Looking back, I can see that all I’ve lost in the markets is related to leave out of account the facts you describe in this masterful article. Still have not bought your course but sure I’ll do before end of july.

Hi Nial,

Another great lesson about the right mindset of a trader.

Thanks

Souto

dear nial,

where did you keep this article since all these days? imagine, i started turning over my account 200% to 400% in a day after i read your articles on trading the daily time frame. The person who taught me FX even asked me how i do that..i use my trading egde, but when i get on a loosing trade,i just try to stem the tide hard..you are the best,because you are factual and real..but i heard one guy said he never lost in a full year…

Hi Nial, another awesome article it really hammers the point home any trade set up can be a winner/loser even with an edge. thanks.

Nial, the concepts discussed in this lesson are similar to those in the book “Trading In The Zone” by Mark Douglas. A book which I believe to be the gospel for mastering trading psychology, and thus trading in it’s entirety. Excellent job condensing the significant aspects of thinking in probabilities. If there ever was a “Holy Grail” of trading, THIS IS IT!

Thanks,

Hi Nial

Excellent piece of trader training prose as always from you

Incredibly valuable information provided that may not be appreciated on the first reading through. Not only do you reconcile the ‘trade with a positive expectation’ to ‘only risk what you are comfortable with losing’, but also provide recent, real world examples of perfectly valid trading set ups that were losers. Yet over a series of trades on that same pair / commodity, there were sufficient winners to more than cover the losers and thus return a profit over all

This will help me master the negative emotions I still feel when a position closes as a loser

have a great weekend and thanks again

Very easy to understand,also make sense!! thanks Nial!!!

Hi all,

1) Anything can happen

2) You don’t need to Know what is going to happen next in order to make money

3) There is a Random Distribution between wins and losses for any given set of variables that define an edge

4) An Edge is nothing more than an indication of a higher probability of one thing happening over another

5) Every moment in the market is Unique

Good theory and detailed examples therewith you gave. Thanks Nial for that. Very useful article. Please keep going.

this is very useful to me and timely..thank you Nial.

very incisive article and so helpful as with all of your other insights on trading psychology and self discipline

many thanks Nial

Outstanding article as usual Nial.

It really is hard to believe that trading can be that straightforward, if we stop “expecting” to be right all the time and just trade our edges, understanding that there is a higher probability that are trade will be a winner rather than a loser when we only trade our edges.

I have a big sign in front of my computer that says:

Stop forming opinions about what you “think” the market is going to do or not do, and just trade your edges….and Nial teaches us great edges that work!!

Great article, as always. Thanks Nial!

This article,as far as I am concerned , covers the most important concept in trading for both the pros and newbies provided one understands how and why markets move the way they do and why we need a proven trading strategy(proven by the trader over a series of trades) with a positive expectancy.

Risk control and money management coupled with what Nail has covered here makes the difference if one wants to trade professionally.

So so true, very sound advice. Thank you very much Nial

After trading with Nial these 8 months, I don’t really care about the market and result anymore. I just believe in the edge I have and let the market plays out. And this method helps me turn from losing to profitable now. Cheers

This article is like a piece of diamond ! unfortunately most of the people cant go on keeping this in mind..:)

Nial,

Great lesson today and extremely relevant with current markets. I am going to tag this lesson and read it several more times. Over my last 7 trades, the first 4 were losers, and the last 3 so far have been winners. I have come to accept that. And actually one of the winners I did not feel that confident about but it turned out to be my biggest winner.

Great lesson for all of us – David

Great examples Nial. I was equally impressed with equity curve example because even though there were more losers than winners the equity continued to rise because a correct R:R was applied. Awesome! Just Awesome!! :-)

Great article.The pain of loss is real and it could be mind shattering.The challenge is to remain neutral to either a win or a loss.One way to get around this is by determining how much you can afford to lose per trade without being psychologically affected.This amount differs from one trader to another.It doesn’t even depend upon how much you have in your trading account.

I have great respect for Nial’s opinions as far as the forex mkt is concerned.He is a great Teacher.

Nial

Another great and appropriate article by you. I think a lot of us know (at the back of our minds) what you are saying is true, but sometimes it needs to be heard from someone with vast experience for us to ‘take our head out of the sand’ and face reality.

Thanks for taking the time to publish it, with working examples. I also like the fact that you show losses as well as winners – a lot of your peers refuse to.

Kind regards

A very interesting insight into this aspect of trading, traders expectations. I am very new to trading, and very much feeling my way, but right from the outset I have tried to take on board the concept of “probability” of winning or losing. You have confirmed my thinking, thank you.

Thank you so much Nial for this extremely helpful article.

The examples you used really helped me to understand the truths thereof.

What is left now is to APPLY that knowledge to my trading.

You really are a brilliant teacher and once more a HUGE thank you!

This is like set and forget mindset. You have dealth with some salient points. You cannot know what MR market would do or offer. Thanks Nial.

I’m guilty of doing this. Gotta win every trade. Thanks Nial for the insightful knowledge. You write very well. I enjoy reading your lessons. Thanks and Take-Care. Michael.

Yes, that’s true, and trader must believe. Thank you for your lesson.

opened my eyes for sure

The issue of random distribution of winners and losers has never been this thorough.

Thanks Nial for your honest opinions of the markets.

Regards,

Michael

Great article of course, now I started real money acc, after 4 and half months demo trading just pin bars with good results.

I think this will help me a lot now.

and as writes Marton …

You should feel OK when you used perfectly your setup, the result of the given trade does not matter. And you should feel down if you let yourself down by not executing your edge the way you should have done – even if the trade was a winner in the end.

;)

Thank you Nial, you brought me to this great way of trading and I am really looking forward to my trading future becouse of you now.

It must read for every trader who need to win in market

Brilliant article, thank you.

I think this is the missing nugget for me. Thank you for spending the time writing this article. I WILL have to read it several more times before it truly sinks in and has a positive affect on my trading mindset/behavior. Its a hard concept to wrap your mind around.

Its all good if you understand the context of trend in relation to candle formation. One does not work without the other..:)

Its a pity that you only use Candle Stick Charts, add Bar Charts to your Presentation and you got me won over. Kind Regards Ralph

Good insight,thanks Nial.keep it up

Great simple concept again Nial. Shared this with the guys on the floor and they fully agree that this is truly an important concept that most beginner trades struggle to grasp and what makes the difference between making a career out of trading and falling short.

Excellent article,

So true about expectations, it’s so easy to think that every setup should be a winner instead of realizing the fact you are showing us here.

Thanks

Tomson

Very good article, explained with clear concise chart graphics. Good work! thanks

cheers Baz

thank u.great writing!

Thanks

Revise and to improve trading.

cheers

Nice article again Nail, i’m trading for a month now, first week 25% profit on my balance, now overall 30% losses, but my goal is to have a modest profit at the end of the year. So, long term thinking!

Regards,

Paul

Thank you Nial,

this is useful

thank you

Great article Nial…I am a member and just loving everything..Its the best thing I have done in forex so far..

I have been with Nial and the community for the past 18 months and I think by far this is the best and most important writing. If I may add one thing – we (rookies) always feel high when a trade works out OK and go depressed when one scores negative. This is the wrong set of feelings. You should feel OK when you used perfectly your setup, the result of the given trade does not matter. And you should feel down if you let yourself down by not executing your edge the way you should have done – even if the trade was a winner in the end.

As long as your feelings do no work this way, you will be a loser.

I think every beginner should read this article each day before opening the platform. Me included.

cheers

Marton

Hi Nial, just purchased your course and started going thru it. Wish I had your info when I first tried trading, because man, you make a lot of sense.

Great article and very important.

Cheers