How To Trade Trends In Forex – A Complete Guide

We’ve all heard the saying “The trend is your friend”, and while it sounds nice it doesn’t really teach us anything about trading a trending market or how to identify one. In today’s lesson, I am going to give you guys some solid information on trend trading that you can begin using immediately. Today’s lesson is all about trading trending markets with price action, and we are going to talk about how to tell when a market is trending and how to take advantage of these trends.

We’ve all heard the saying “The trend is your friend”, and while it sounds nice it doesn’t really teach us anything about trading a trending market or how to identify one. In today’s lesson, I am going to give you guys some solid information on trend trading that you can begin using immediately. Today’s lesson is all about trading trending markets with price action, and we are going to talk about how to tell when a market is trending and how to take advantage of these trends.

I hope you guys pay close attention to today’s article and refer back to it when you have any questions about how to trade or identify a trending market. In fact, if you email me asking about trends…I will probably refer you to this article!

Let’s get started…

The first step: Learn to identify a trend with nothing but raw price action

As you probably already know, there are tons of different indicators that you can put on your charts to ‘help’ you identify a trending market and trade with it. Many traders spend countless hours and dollars on trend-following trading systems or on indicators that just end up confusing them and making the process of trend discovery a lot more difficult than it needs to be.

I have always been a strong proponent of visual observation of the raw price action of a market, as you probably know. I also believe that simply observing a market’s raw price action, from left to right, is the easiest and most effective way to identify a trend and to spot high-probability entries within it.

Let me make a quick note before we proceed: A trend is not actually a strategy by itself; it’s just an added point of confluence that increases the probability of a trade. However, just randomly jumping in with a trending market is not an edge or a strategy.

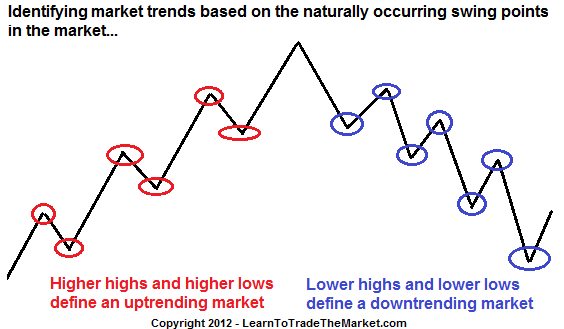

As a market moves higher or lower, its previous turning points, or swing points as I like to call them, become reference points that we can use to help us determine the trend of a market. The most basic way to identify a trend is to check and see if a market is making a pattern of higher highs and higher lows for an uptrend, or lower highs and lower lows for a downtrend. This is just plain old visual observation of a market’s naturally occurring price action…no mumbo-jumbo trading systems or magic-bullets here. I’d like you guys to take a look at this simple diagram that I drew below; it shows us the basic idea of looking for higher highs (HH) and higher lows (HL) for uptrends and lower highs (LH) and lower lows (LL) for downtrends:

Note: each colored circle is highlighting what we would consider a ‘swing point’ in the market:

Thus, general observation of a market’s swing points is the first point of call in determining if a market is trending. If you do not see a pattern of HH HL or LH LL, but instead you see sideways price movement with no obvious general up or down direction to it, then you are probably looking at a range-bound market or one that is simply chopping back and forth.

Tip: You shouldn’t have to think too hard about whether a market is trending or not. Most traders make trend discovery WAY too difficult. If you take a common sense and patient approach, it’s usually fairly obvious if a market is trending or not just by looking at the raw price action of its chart, from left to right. Make sure you mark the swing points on your chart, as it will draw your attention to them and help you see if there’s a pattern of HH and HL or LH and LL, as discussed above.

Characteristics of trending markets

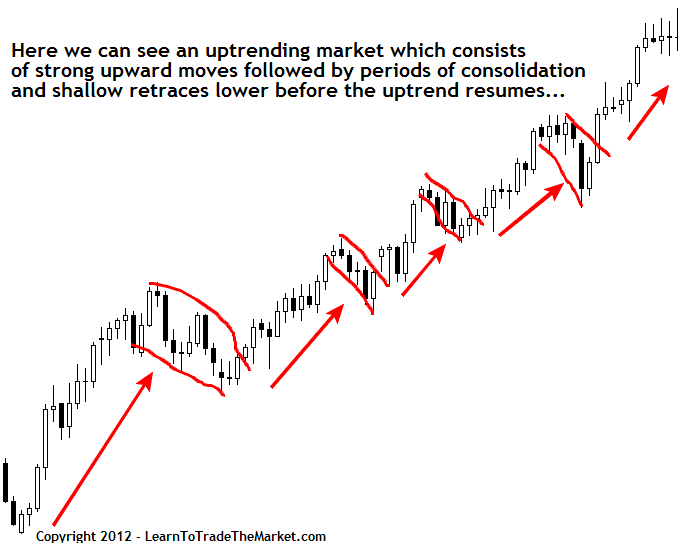

Trending markets tend to make strong moves in the direction of the trend followed by periods of consolidation or a counter-trend retrace before the next leg in the direction of the trend. You will notice this pattern happens in almost any trend you can find. Typically, what happens to many traders is that they will make some money during the periods of strong directional trend movement, but then they continue to trade as the market takes a breather from the trend and consolidates. It’s these periods when traders give up all of the gains they just made when the market was moving aggressively.

You need to learn to identify the different parts of a trend, this will help you avoid over-trading during the choppy / consolidation periods and will give you a better chance at profiting when the trend makes a strong move.

Here is an example of what I’m talking about:

In the diagram above, we can see that a trending market tends to move in spurts, moving in the direction of the trend and then stalling to take a breath before another leg in the direction of the trend. Now, all trends are obviously not exactly the same, but we do typically see the general pattern described above; a forceful move in the direction of the trend followed by a period of consolidation or a retracement in the opposite direction.

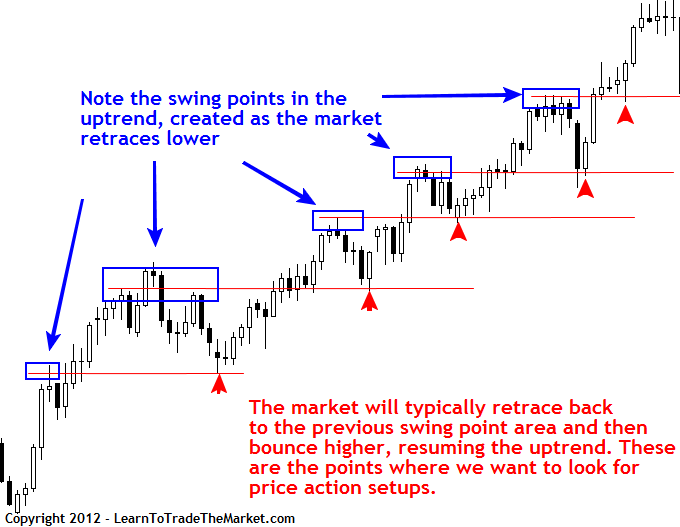

Now, these retraces are when we have the highest potential for a high probability entry within the trend. Often, a market will retrace to approximately the level of its previous swing point before the trend resumes. In an uptrend these swing points are support and in downtrends they are resistance. Look at the very first diagram in this article for a quick refresher on what I’m talking about. Also, let’s look at the chart we just looked at but this time with the support levels marked. These support levels resulted after the market began to retrace lower within the structure of the broader uptrend.

Note the ‘stepping’ pattern left behind by the swing points in this uptrend. As the market retraces back down to these ‘steps’ or support levels, we would focus our attention and watch for price action signals forming near these levels to rejoin the uptrend:

Note: These same principles apply in a down trending market but we would be looking for price action setups from resistance rather than support.

As we discussed previously, a trending market will tend to surge in one direction and then slow down and either consolidate in a sideways manner or retrace lower or higher, depending on what direction the dominant trend is. It is during these contraction or retrace moves that we can focus extra hard through our ‘sniper-scope’ and begin searching for high-probability price action trading strategies forming from previous swing points within the overall trend.

Trading from value in trends

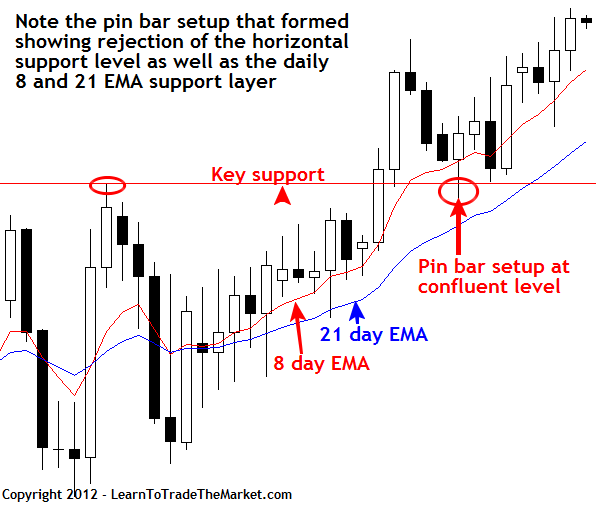

My primary mission as a price action trader is to watch for obvious price action setups that form after a market retraces back to a confluent level in the market. This can be a swing point like we discussed above, a moving average level, or some other support or resistance level. Whatever the case, I am looking to trade from ‘value’ in a trending market. By value, I mean from an optimum point in the market that has proved significant before.

For example, in an uptrend I would consider ‘value’ to be support, since that is where the price of the market is likely to be seen as a good ‘value’ for the bulls, and thus they will tend to buy from that level and push the price higher. Whereas, in a downtrend, ‘value’ is seen at resistance, since the price has rotated higher within the broader downtrend; so it’s a good ‘value’ to sell from resistance in a downtrend. These rotations back to value points can also be called ‘trading from the mean’ or the ‘average’ price, this is why moving averages tend to act as dynamic support or resistance levels.

One tool we can use to find ‘value’ in a market is a moving average. I don’t use them all the time, but when I do I like to use the 8 and 21 day exponential moving averages. I use them as a general guide and a helper to find confluent points in a market. For example, often the 21 day EMA will align with a swing point in a trending market, this would be considered a confluent level since you have multiple factors lining up together. Then, if we see a price action signal there, we know we are seeing a setup form in a very high-probability area on the chart. See here:

Note: these moving averages should only be used as a ‘general guide’ and never as an actual signal (as in the old ‘moving average crossover signal’). We only use them as a helper to see dynamic support and resistance levels (to add confluence) and for trend direction. But just to be clear, our main focus is on visual observation of a market’s price action and levels, that is to say without any EMAs.

Don’t fall into the ‘breakout’ trap – Many amateur traders get stuck in a cycle of trying to trade breakouts all the time…this is not really an effective long-term strategy because the ‘big boys’ all know that amateurs are constantly trying to buy and sell breakouts. Instead, we want to enter closer to key market levels, swing points, EMA levels (confluent levels) in the market…always with confirmation from a price action signal. As a ‘regressive’ price action trader, we are looking to buy or sell from value within the trend…waiting for the inevitable pullback and then pouncing on an obvious price action signal if one forms.

Forex trends vs. other markets

One aspect of trend trading that I want to touch on briefly is that trends in Forex tend to differ from those in other markets, especially equities.

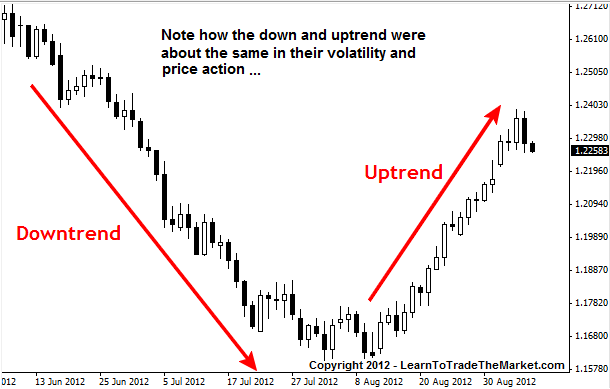

In Forex, bearish and bullish trends are typically equally as violent and potent…whereas in equity markets we tend to see slower moving price action in a bull market, along with lower volatility. Down-trending markets tend to be fast and volatile in equity markets. Forex trends tend to be the same in their volatility and price action whether the trend is up or down. The main reason is because it’s one currency against another in any given currency pair and this results in more balanced price movement.

Thus, in Forex, your trading strategy and plan will generally be the same for both up and down markets. Here’s an example of the EURAUD daily chart recently that shows just how consistent both down trends and up trends can be in this market…note how the volatility and speed of these trends were about the same:

In the equity markets, traders typically need to adjust their strategies or systems as a market moves from bull to bear or vice versa. But in Forex, whether you’re trading long or short, bull or bear, the volatility of a currency pair tends to say about the same. That’s not to say that volatility never changes in Forex, it just means that the particular direction of a Forex pair doesn’t have a very big impact on that pair’s volatility or price action, as it does in the equity markets for example.

Final notes on trading with trends:

Take advantage of trends when they happen – There is never anything concrete with trends…meaning you never know how long they will last for, so try to take advantage of them when they do occur. Markets typically only trend about 25 to 35% of the time, and the rest of the time they are range-bound or chopping in a sideways fashion. The trick is to learn how to identify a trending market so that you can get the most out of it and get on board as early as possible.

Counter-trend trading – Overall, trend trading should make up about 70% of the trades you take, and the other 30% might consist of counter-trend trades or trades in range-bound markets. It’s best to learn how to trade with near-term trend before you try trading counter-trend, because trading with the trend is naturally higher-probability than trading against it.

In conclusion, trend trading is perhaps the ‘easiest’ way to make money in the forex markets. Unfortunately, markets don’t trend all the time, and it’s the time in between trends that traders do the most damage to themselves. This damage is a result of not having the discipline to wait for high-probability setups to appear, and not being able to properly read a market’s price action to determine whether or not it’s trending.

I trust that today’s lesson has helped you get an idea of how to determine whether a market is trending or not and how to trade a trending market. Remember, there’s no ‘Holy-Grail’ for trend trading, but if you’re in doubt, the best thing to do is to just relax and take some time to visually observe the last few weeks of price data in a market…without indicators. This no-nonsense approach is hard to beat and will work if you know what you’re looking for.

Finally, I leave you with this little formula:

The Best Trades = Trend + Confluent level + Price action signal

I’ve touched on some topics that traders can use for short-term trend analysis today, and I expand on these topics in the members’ article section of my price action traders’ community. Trend following is a large part of my Price Action Forex Trading Course and of my general trading strategy. I’d really love to hear your feedback today, so please remember to leave your comments below & click the ‘like button’.

Good trading, Nial Fuller

Mr. Fuller,

Just like your name sounds, am delighted in the manner you present what you know and obviously love to talk about.

Am asking you a question here: do I first to register for the course in order to join your community of traders?

Thanks Nial

Thanks alot I really appreciate this free lessons in future I m planning to have a full membership so I can have it all thanks

Thanks Nial for this valuable article

thank you so much!! my teacher

Hi nial thanks for the post.can you tell me which moving average I will use h4 and d1

I did trade since 2017, but after reading your materials my mind became very stong on treading thinking now will get all losses soon. Thanks for your wonderful help on this. I have seen lots of hard work on this material to make it simplicity. If you could put video version for each topic under then thought would help even better and better. Boss you are great.

Thanks a lot and videos on a topic will also play a good role if it is possible.

Nothing but appreciation to be said Master …

Best Regards .

Safwat.

P.A LET THING EASY TO READ MARKET

Thank u mr for the lesson,as am still new i do get you point here and ther, what make me confuse is the price different .how to learn the price different.i can sometimes see the support level but been confuse when i see different direction compare the way i was thinking is going to be.

Hey NIAL,

I’m really getting there with all the explanations you are giving on Price Action Trading Signal and on how to Trade the Market.it will be a pleasure for me to become one of your student and learn more about Trading.

now is just up to me to go over what you have given me as tips over and over again.

thank you so much. You are my “God sent”.

GOD BLESS

Dear Nial,

Thanks so much for your great lessons.

Plz remember always that an EASY ENGLISH in your lessons it will increase the number of persons that will read u. If it is not like this, we shall not understand u, and we shall look for similar information in our native languages.

Plz try to understand this and try to solve the problem of a lot of students of your fantastic price action.

Many thanks for helping us and all the best

The article was great and easy to understand, Iam going to follow you all the way!!!1

Perfect et excellent.

Thank you for this article, Nial. Very explanatory!

woooooooh wat an eye opener the lesson was,actually am a beginner but now i have the confindent to trade.thanks alot doctor Nail

I like it

Thanks Mr. Nail, I have learned something from this lesson and am willing to start with visual power to look out for trends very well before any trade ambition.

Thanks again.

Great ! Trend is your friend HH HL long- dicipline -LL LH short -discipline-

Hello Nial,

You have a brilliant and unique way of teaching forex trading which makes you stand out from the crowd. And anyone who really wants to take forex trading serious needs your lessons which I think are priceless and generous of you to give. Thanks and God bless you.

thanks Niall,u r d best

thanks Niel,u r d best

Thanks Mr Nial

I’m seeing the fact why I should get closer to seminars and other learning tips on forex.

Hi Nial.

Thanks for the trading formula. It will be helpful and effective. Straight to the point to keep focused on choosing quality trade set ups.

To me your teachings has being remarkable so far. I will be trading real money next month but unfortunately starting with just 400 dollars account. But I firmly believe i`ve being well trained by merely reading your articles, today making it one year I discovered it. Though I already had the knowledge of japanees candle stick signals but your teachings has really made me to know key areas to use them on daily time frame,one trade per week,at confluence level and strong money management which I have decided to risk just 20 dollars per trade per week to make 40 or more out of my 400 dollars account. Nial indeed I can really confirm you are truly a prof in the world of forex and if I really succeed in it,its in fact directly as a result of your lack of greed in disclosing to the world the best way to make it in forex. Ones more thank you so much. Perhaps I will let you know my progress when the time comes.

Thank you for all your teachings, they have been wonderful.

ur articles had provided me a lot of new insights on forex trading. I m still reading thru n trying to implement these into my demo account. I hpe to get it right soon. thks so much

You are the best Nial thank you, your teachings make

my future looks bright.

i am from nigeria.your work has helped me survive had economy.God bless you man

Hai Nial. Thanks for the knowledge…….you’re one of the best !

Really profound strategic lessons. One day trading part time.

This is one of the few articles that changed the way I view price action.

Yo! Nial you are the Main Man ! Thanks you for this email , it is very fruitful to me, call it mental Armour ! I’m armed with knowledge now and I’m about to go to war, and I’m loaded. Thanks you Nial God bless you over and over !

You are an indeed good mentor I have ever seen that expose the Golden mystery of forex trading. A million thanks to you sir.

Excellent, clear, and concise, Great value Nial, thanks.

Its a beautiful and clear article… I love it!!!

Thanks Nial

thanks, I will keep and use this information from now own. you are a god send.

Excellent article, thanks Niall. I have been following your site for the last few months. Although only trading with a dummy account, I made a profit in the last 5 months by only following your basic price action strategies. Eager to enrol on your course when my live account is set up

Nial

like to thank you for the nice article on trading trends.

very knowledgeable info. thank you

A good article on trend trading…you told about price values as deterministic factor to make an entry but would like to know when to exit before the retracement and how to find it…Thank you very much

Thanks Nial, for the great article as evidenced by all these comments. Now that we know how to identify a trend lets put our knowledge into practice. You don’t want to put such resource/knowledge to waste. The challenge is that trends not as common as we would want them to occur! Lets also add patience to the mix and sharpen the Sniper mentality.

One of the best, common-sense articles on Forex I’ve read. After years of listening to complicated explanations, use of endless mathematical formulae, indicators, “systems,” and “expert advisor” robots, I finally had to set them aside and use my own eyes. What I like to do is look at the Forex market in real time and see the raw trend. That’s NOT theory or a mathematical model. It’s the real thing. I do better trading with that, than anything I learned from “experts.” Anyway, Nial is on the right track.

Wonderful explanation on FX Trends. Many thanks.

Dear Nial, your way of viewing market has started changing my perception too.

thank you nial……i have learnt a lot from this price action trading strategy,and your encouraging article has given me hope of becoming a better trader….And i would like to be professional and inspirational as you are or even better if i may say..GOOD JOB

Nail Sir

Thank you to sharing this article.I follow your site every day that help me for trading in the market.Now i am a perfect trader of price action.

excellent article. direct and easy to understand. thank you

Thank you

for ur Great Lesson thanks lot

Dear Nail,

Thanks, great wisdom and practical points for trading.

Thank you, Niall! All of your articles carefully study (week) and put into practice. I believe in a positive result. Your article is fundamentally changed my attitude to the trade. My heart was calm and quiet confidence in the results.

Elena, Russia, the experience of 3 years))

21/11/2013

Thank you sir,

much appreciate this for reinforcing my trading habits.

Wonderful article is understatement.

Your words about trend are very important for me. Thanks so much.

I am brazilian, so, my english not is very expansive.

Sorry.

Thanks again to the master of “price action trading” you are my forex trading mentor.

Love you Nial.

Thanks Nail for sharing your knowledge. God bless you..

Million of thanks. Its a great article i ever seen. once again thanks nail.

The Best Trades = Trend + Confluent level + Price action signal.I love that part.Thanks Nial for this Great Article.

is it important to check the economic news when you trade in strong trend??

Fuller, you are the one that God sent to deliver me from 6 years of ups and DOWNS in this business. May the Lord God of my fathers continue to bless you in Jesus Name

Greatly valued lesson Nial. After all this time you open the door to useful strategies.

Hi Nial

Nice work you have teach me a lot

Nice article Nial. I really liked the formula at the end, which provides a beautiful summary.

excellent work sir..

great wisdom in this article, although I am no beginner I still learnt a lot.

Dudley W.S.

— Jamaica –

Yes…..trade the pullback….of a trend. Appreciated the part @ breakout trading trap.

the article was quit splendid thanks mr fuller,s

thanks nail bhai

What an amazing article

It’s just what I needed to improve my edge!

Thanks Nial, you are the best…

Thanks Nial,

I think that your formula + money managment is ‘Holy-Grail’ for trend trading

Hello Nial, you made it so simple for me to understand how to trade the trend. Thanks

Thanks Nial,

As I practice in my trading, I will not trade until I confident with the price direction (trend).

That’s just how how I made money consistently in forex market.

And this article I considered as the best one from you.

Thanks again.

Great article Nial. Huge difference in my trading results.All thanks to you. God Bless.

Thanks Nial. Well written & easy to understand

wonderfull article. thank you Nail.

thanks nial.. great article

“It is literally true that millions come easier to a trader after he knows how to trade, than hundreds did in the days of his ignorance.” (Jesse Livermore)

Thanks Nial

Awesome Nial…

Thanks Nial,

I always forget the basics, it’s so nice to be constantly reminded of them,

All the best, mate

Nial,

Thanks again. Larry

I am currently trading only pin bars in trending markets and this article has given me insight into my way of trading. Thank You :)

Very usefull thanks

Nial: You continue to build a great resource library that is growing in knowledge and if used appropriately will turn to gold!

Thank You,

Gordy

Thank you Nial

Hi,

I’ve got a feeling like every new article from Nial is more in deep and he reveals us more things he learned in his career that I would expect will keep for himself.

Thanks very much Nial, I think without your web I would be stucked on nearly the same place where I was before I found it (about half year ago).

Have a nice day there,

Stany

Thanks Nial, great article. I love this way of trading with the inside bar strategy. But patience is the key here. But once you master the patience then you’re good to go. Thanks loved this article heaps.

NOW I know why all my profits are gone before I can even start bragging about making them!…lol…I have learnt so much already since discovering you on the net Nial..:-) Candles are no longer a mystery, pin bars are my best friends..now I will be able to recognise the consolidations and sideways moves…So here is hoping!..:-)…this makes so much sense!…will definitely draw those support/resistance lines

– practice will make it perfect..:-)..thank you and cheers!…:-)

Nial,

Excellent article, direct and concise on how to identify the trend. Regardless of how long I’ve been trading, these “reminders” and your insights are invaluable to be….it’s easy to forget what you already know as a trader, and another’s voice can get us back on track!

Thank you once again. As you said, many times I have given back my profits in the retracement period.

Another excellent article…

Hi Nial. Great article as usual. After a year of hard work and many hours of learning I can say with confidence, that You are probably the best teacher that one can find on the internet, price action is the best way to trade, and indicators create only confusion in market analysis. Take care and best of luck to You.

Price Action Is King

nial you are a super trader keep more of the articles coming please

Your article is really amazing. but i have 1 doubt Nial, tat suppose the market is in uptrend making HH & HL , during news time suddenly the market falls down and make a LL breaking the trend. At this position whether we have to wait for the confiirmation of the uptrend continuation or we have to decide tat the trend ends up and the downtrend started ?

The Best Trades = Trend + Confluent level + Price action signal

not enough!

Above this formula: Grow up to be patient enough to sit tight and wait for this triple combination. Otherwise it won’t work :).

Very valuable lesson. Hats off !!

Your a stud nial!!!

i always waiting your great new articles every week, and this is another great lesson you’re send to me. Thanks nial

What an excellent information for us to clarify and make our mind clearly while we are trading.

Thanks Nial.

Thanks Nial.

Excelent refreashing guide.

Cheers

Hi Nial

Thank you for the revision. Good to have some refreshment/revision.

Many thanks Nial, you have a articulate way of explaining your approach to trading. This transfers into my enthusiasm for your next posting. I look forward to your next lesson.

Best regards Rayh

Thanks Nial for such an excellent article

Thank Doctor Nial, you change my life for ever in forex

God Bless you

Another great lesson Nial. When you put up an example chart could you put what time frames the chart is in or dosen’t it matter? When I change from 1hr to 4hr to daily it seems to throw out of wack the support and resistance levels. Can you use the same techniques described in this lesson to scalp trades on shorter time frames eg. 5min,15 min, 30min.

Regards

Bill

Hello Bill!

If you want to loss 7 years like I was, then you can scalp. But if you won’t to consistently make money (years after years) then I recommend that you follow Nial TO the point!!!

Have nice day

Thanks my inbox is so full of e mails but for some reason yours is not deleted I read it all with intrest thank you. signed Marc.

Thanks Nial. Great article great read plenty of educational information to soak up and learn.

Boa noite! Estou aprendendo muito com os seus artigos. Faço cursos desde 2008 e confesso que seus textos são bem superiores a todo o material que já paguei. Gostaria de fazer o seu curso. Mas não falo inglês.

Another interesting article, and so needed when to make good trading decisions.

I guess this really is one of the harder things to learn, when is it a good time to trade?

Is it a trend, or is it choppy?

We can see how the different setups looks like, IB, Pinbar and Fakey, but where is it ok to use them?

This is a help to make a choice if it is or not.

Thanks a lot.

Cheers

Tomson

What a great lesson again from my “Professor”.

Thank you so much.

very intresting article and valuableone.

Nial, thank you for this excellent article. Each and every article you post here is better than the previous ones, which are, without exception, also very useful.

Thanks a lot. Those were vital info.

Thank you, Nial!

I learned so much with the above lesson. The 21 EMA as a guide to swing points and taking advantage of trends, when they are present, are great pieces of advice.

Best,

Judy

Very educating article…. This very article can change some bodies life forever… Nial, more grease to your elbow.

An eye opening article. I can see several areas where I can sharpen up my trading. Thanks Nial.

Nial: this lesson is the best one I have seen on the subject of trend put into a shot concise perspective, thank you for your excellent lessons. Louis

It’s really important that You don’t just give traders enter and exit points, like others do, but teach them how to identify trading opportunities making them think and learn and get into what they are doing, not just blindly following the signal.

Great job, keep on going!

Dmitry

Very helpfull. Thanx Nial

@Nial,you are a great teacher…Thanks for sharing your knowledge, experience and observations here with us….God bless you!!

Also, Thanks for your time.

hello

once again only thing I can say is that we do not have enough words to thank you for your great teachings

b rgds

Nial it took me 4yrs to finally get what you have been saying all these years. A couple of days ago I was watching an old interview of you and the lite bub came on in my head it was one of those moments where everything came full circle….. I so get it now……. I Thank you a BILLION TIMES you have changed my life forever!!!!

Great work mr fuller ! I’d like to catch 6000 pips with this strategy

Thanks Nial

Hi Nial,

Thank you once again for your great article, well explained in a simple manner.

I have learned a lot since I joined your course.

Regards

Adam

Great Lesson Nial..Very straight forward

great-great article….million thanks mr.nial…..

Great article

Thanks Nial

Allways learning from you trend and pasient

are the frend of a sniper

Thanks a lot Mr. Fuller. This is a free lesson very valuable at all time to me and may be other forex traders. The support and resistance you have been talking about have shown its perfect us in this lesson.

I hope to be a paid student very soon so that I can enjoy the mentorship I need from you.

Ray Imomon

Cheers Niall , another excellent article , very well researched , explained and written. Thanx for all your efforts once again. Kindest Regards