Feel Like Giving Up Trading? Here’s How to Fix That…

The idea for today’s lesson came to me from a member who emailed me recently asking for help with his trading. He had become so frustrated with his trading that he was ready to throw in the towel and give up on trading completely.

The idea for today’s lesson came to me from a member who emailed me recently asking for help with his trading. He had become so frustrated with his trading that he was ready to throw in the towel and give up on trading completely.

This members story is very real, but I have changed the name to keep his identity private. You will probably identify with much of this story if you’ve been struggling or have become frustrated with your trading recently.

Here’s the plan of action I gave to this member, to help him re-ignite his passion for trading and start improving his results…

Meet Johnny

Johnny had spent years trying to trade. He felt like he tried everything and after much trial and error, he was finally getting confident in his trading abilities. Yet, he still couldn’t seem to make it work. He still wasn’t profiting, after nearly 10 years in the markets. He was feeling jaded, like he was ready to throw in the towel and simply admit defeat and give up on trading forever.

However, he wasn’t one to admit that he wasn’t good at something, and so it was a hard pill to have to swallow, that maybe trading just wasn’t for him. Maybe he simply didn’t have the genetic makeup for it or maybe he wasn’t using the right method. He wasn’t sure. Yet, he still didn’t’ want to totally give up hope.

The same things that drew him to trading were still calling to him from the back of his mind; no more working a job he hated, no more bosses telling him what to do, no more sacrificing family time to work to pay bills, unlimited income potential. The allure of total freedom was what initially drew Johnny to the markets, and it has such a huge pull, that it was just too hard to give it up completely.

So, after reading Johnny’s story, I sent him a detailed email, outlining some psychological pitfalls I saw he was making, as well as an outline of how he could get his trading back on track. Here are some of the points I included…

Remember what first attracted you to trading…

What drew you to trading in the first place? How did you feel about it when you first found out about it? Just as in a marriage, to keep the flame alive in trading, we sometimes must stop and remind ourselves what we liked so much in the beginning. For me, it was the opportunity to truly be free, to not have to do boring work every day, to not have to be another drone, endlessly typing in a cubicle all day, or doing mindless physical labor that rendered my body useless right at the age I was finally ready to retire.

If you need a refresher, go read my article on why it rocks to be a trader, it will remind you the main reasons why we trading can be so awesome.

Read about successful traders

If you feel isolated and like no one is making money trading, you can simply go and read some interviews with very successful traders. There are many people who have already achieved great success in trading, myself included. But for some good reading recommendations on this topic, go and read some of the Market Wizards books by Jack Schwager. These books will tell you the story of real-world, very successful traders, and it will motivate you to read about how other people did what you are trying to do.

I would suggest that whilst you are doing the above things, you are not in any live trades. If you’ve been losing and feel lost in your trading approach, give it a break. You will come back feeling better and more clear-headed when you’re ready to trade again. This break is meant to re-calibrate your mind and help you re-discover your trading passion.

Stop trying to get rich fast

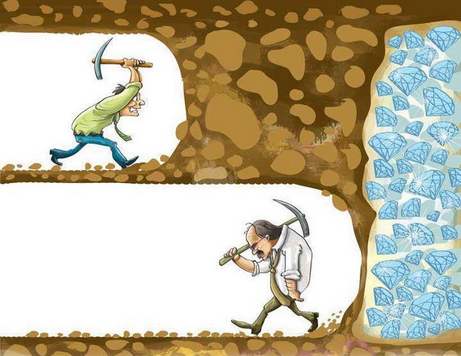

One of the primary reasons so many traders get burnt out and eventually want to give up trading or do actually give up, is simply because they are trying to get rich quick.

I have good article on why trying to get rich fast never works and you should definitely read it because it has a great metaphoric story about this topic. But just to expand on this topic a little bit…

Obviously, trying to get rich quick in trading means you’re probably doing almost everything wrong. It means you’re probably trading too frequently and risking too much per trade, which are two things that quickly lead to a lot of lost money as well as frustration and mental anguish.

I strongly urge you to change your perspective on trading and stop trying to think you’re going to make a lot of money fast. The ironic and difficult part about trading, is that to eventually make a lot of money at it, you must start out slowly and methodically and totally unconcerned about making money.

FINALLY make a trading plan

I know that everyone knows about trading plans and knows they should make one. But, I don’t think most people actually ever make one, which is a huge mistake. Especially, in the beginning, it’s very important you spend time writing out a trading plan and trying to follow it with discipline.

After you learn an effective trading strategy, making yourself boil it down and aggregate it into a comprehensive yet concise plan is something that will help you further understand your method and when you should trade it. You will also then have a physical / tangible document to guide you and to help eliminate emotional trading mistakes.

You have to stay accountable to your plan. If you break your trading plan rules you essentially are proving to yourself that you don’t have what it takes to be a trader, and to me, that is something I always wanted to avoid. I have always had a trading plan; at first it was a physical one that I read and followed each day, but now, due to my experience and developed skill, it is more of a mental checklist, but I remain disciplined and accountable to it. However, if you are new, or ready to give up at trading, you need to go though the process of making a physical trading plan, for the reasons mentioned above. (fyi – I provide a detailed trading plan template at the end of my trading course.)

Take calculated risks

Here’s an easy way to figure out how much you can risk per trade. Sit down and think about how much money you have that you consider risk capital; money that you can potentially lose in the market. Now, divide that amount by 20 and that is your per-trade or 1R risk amount.

Your risk should be a dollar amount that you could lose 20 times in a row and still be able to take another trade with the same risk. This will make it so you aren’t risking too much per trade, which in turn, will greatly help you develop and maintain the proper trading mindset.

I promise you that if you get into the habit of risking more than you’re comfortable with losing per trade, you are going to start having some big losses and quickly blow out your account which will lead you to wanting to give up on trading. So, let’s avoid that!

Demo trade

If you aren’t sure what you’re doing or you have an overly complicated method, you will lose money and eventually give up. Keep it simple by sticking with simple price action methods, ‘naked’ charts and higher time frames.

Make sure you aren’t trading live without having first learned and mastered the trading strategy you are using. You also should not trade live before having made a trading plan, as discussed above.

Demo trading is a critical component to getting back your trading passion. If you’ve recently felt burnt out and ready to quit, stop trading live for a while and just go back to demo. Demo trading returns you to a neutral, emotionless mindset, which will help you regain focus and perspective. It also restores the market to more of a competition or a game, rather than just about making money, which is a huge help in getting back your passion. When you think of trading as a game that you are just trying to play as good as you can, so that you win, you will be in a much more effective frame of mind than if you are just thinking about it from a profits / money perspective.

When you are ready to go live again…

When you feel like you want to give live trading a shot again, I recommend you try aiming for smaller wins for a while, maybe 1 to 1 risk to rewards up to 1 to 2, to build some confidence and get some wins under your belt.

Once you have some runs on the board and if you’re confident, you can increase risk gradually up to your 1R amount, whilst remembering each trade needs to be carefully planned and shouldn’t exceed your pre-determined 1R amount.

Conclusion

When you feel frustrated and ready to give up on trading, just remember that it’s not the ‘end of the world’. Take a big step back and remove yourself from live trading for a while to get back on track. Reassess your trading method and make sure you like the method and it’s not overly-complicated and that it makes sense to you. All you need is a method that gives you an edge that provides slightly more than a 50/50 chance over series of trades, you don’t need the ‘Holy-Grail’ of indicator-infused perfection (also it doesn’t exist).

The determining factor in one’s success or failure in the market is always their own mind. That is why I cover trading psychology in my professional trading course, in addition to the other topics. Anyone will get burnt out and want to give up if they don’t have the right trading method, mindset and money management approach, I call this the 3 M’s of trading.

Good trading, and let me know if you have any questions by contacting me here.

I WOULD LOVE TO HEAR YOUR COMMENTS & STORIES BELOW :)

QUESTIONS ? – CONTACT ME HERE

You are amazing

I am in the middle of Nial’s Price action Course…I have been trading Short time frame futures for a year or so…all the problems Nial covers in his articles, I suffer from…I will complete Nial’s Course in a week or so…Its a good training course and I have learned much..

I’ve been trading for 8 years. I haven’t ever made a profit. It’s all very well saying ‘come up with a trading strategy and stick to it’ but I’ve never even found or created one that has been profitable for more than a week. :(

I would I have given up before now but when I read you articles it encourage me to continue.

Good advice to maintain our trading spirit from giving up.

for me, trading is doing the right things at the right time and here is my biggest problem (lack of patience) I swear I’ll leave trading, but when I saw this cartun I changed my mind. KRZYSZTOF (poland)

Make a Trading Plan !! I am thinking this will sort out my problem. I trade with a few good wins after a long break, then I seem to start loosing after about the 5th trade.

Now having another break I can now see that I am steering away from my plan and start to trade way too much. (Make a trading plan and stick to it) I am thinking this will fix my problem. And stop me from overtrading.

Thanks a Heap keep up the good work.

I was glad to hear you say 5% of bankroll is a good amount to risk per trade – exactly the figure I imagined when first I began putting your teachings into practice. I love it when I experience “confluence” with you, Nial! As always, thank you for everything, Mike.

nice article….all true, this is a game of patience , money management and believe in your metod

thanks, nial

I wish i had read you articles early before i blow out my account, but i know what to do. my problem i used panic thanks

Your the best

This is just for me thanks.But i find trading a naked chart without any indicator so scaring.Its difficult to know the direction of the market.

It’s so good to know you’re there, Nial. Thank you for everything.

Fantastic article! Just what I needed to hear on my trading journey. You could not ask for a better coach than Nial. Thank you.

Thanks Nial for the advice I’m about to blow my account,but my problem is that I don’t have a plan and I don’t know what to do, maybe a template will do.I’m going back to the drawing board.

Thank you very much

Godbless.

Hey mate, If you’re blowing out your account then the first thing to do is to stop trading with real money. You’re right, go back to the drawing board. Switch back to demo trading for a while and regroup. If you have not learned how to trade with price action yet, then you need to focus on that, as learning how to read the chart is one of the keys to trading success. Drop me an email if you have any other questions.

Thanks Nail. Now a days I minimize my trading mistakes…..

I also didn’t do well on my first attempt of live trading, I did a lot of stupid mistakes, subsequently I almost blew my account. I disregarded most of the points you’ve mentioned above, I wanted to make money quickly and that was my biggest mistake I’m glad I took a break, now I’m able to rectify my mistakes on the Demo account.

Thanks, Nial I have learned a lot from your article and the mistakes you have mention are the ones I’ve been making since I started trading.

Very good article. I am Brazilian and I do not speak English, however I bother to translate some of your articles because the information is really very precious in some of them. Thank you.

This is really talking to me. I have given up for months now cos I was so frustrated by my tidings and I lost interest because it was just not going well. After reading this article I am now motivated to give to a try and will definately start with my demo account. Thank you Nial

Excellent, just what I needed at this point.

Exactly where I am at… Thank you Nial.

It’s a good article. I can relate much with Johnny. I have develop my trading plan but never included the calculated risks. Thanks for the advise Nial!

How do I start trading?

This article is talking to me, I have been running in the circle for couple of months now. Thanks Nial, I’m taking a break I’ll come back stronger n wiser