Why Trading Against the Trend Will Destroy Your Account

In light of the current market conditions which consist of some very strong ‘one-way’ trends in the U.S. dollar pairs, I wanted to write a lesson not just about the advantages of trend-trading, but also about how trading against the trend can and will destroy your trading account, if you let it.

In light of the current market conditions which consist of some very strong ‘one-way’ trends in the U.S. dollar pairs, I wanted to write a lesson not just about the advantages of trend-trading, but also about how trading against the trend can and will destroy your trading account, if you let it.

Simply put, the easiest way to make money as a trader or investor, is trading with the dominant daily chart trend. However, during my time teaching people how to trade, I have found that it almost seems to be human nature to want to trade against the trend, at least in the early-stages of one’s trading journey. So, I hope today’s lesson will help you avoid making this gigantic mistake that so many beginning traders make, by showing you tangible proof of why the trend is definitely your friend and why you should not trade against it most of the time.

Don’t fight the path of least resistance…

When markets are trending, they want to move in the direction of the trend because that’s the path of least resistance. As I teach more in-depth in my course and members area, when a market is trending it will make a strong move in the direction of the trend and then it will typically pullback or ‘revert to the mean’. That basically just means price will rotate back to its recent ‘average’ price, also sometimes called the ‘value price’.

Knowing this, we can look to trade from value in trending markets, because at the point of value in a market, the trend has the biggest chance of resuming. By looking for price action entry opportunities that have the confluence of the trend and the ‘value area’ behind them, we can significantly improve our chances of trading success. Let’s take a look at some examples of recent trades where we could have traded from value within a trend and how we would have lost money trading against the trend:

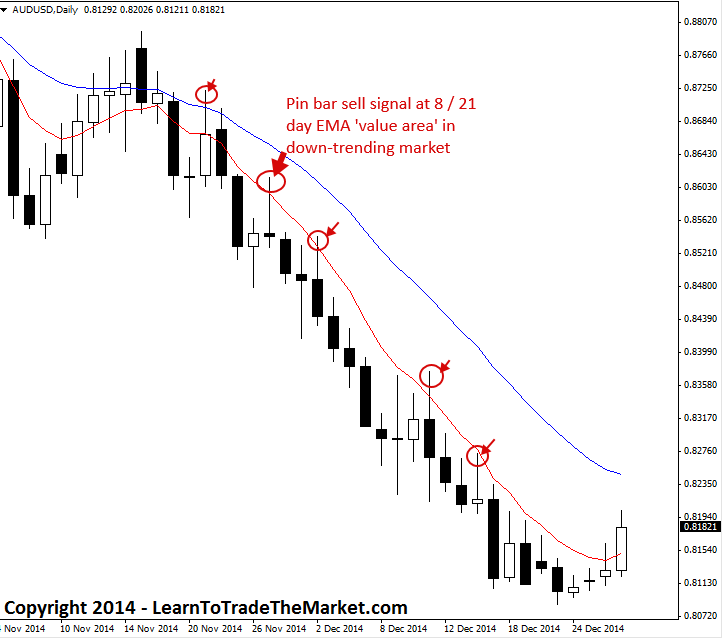

In the AUDUSD daily chart below, we can see that the path of least resistance was clearly down. Note, the red and blue lines are the 8 and 21 day exponential moving averages (EMAs), remember above when I discussed the ‘average price’? These moving averages show the recent average prices going back 8 and 21 periods respectively, this provides us with a ‘value area’ to look for price action selling opportunities to re-join the downtrend:

Notice there was one good pin bar sell signal in the chart above as well as multiple other opportunities to sell at the moving averages as price rotated higher. Price won’t always respect the moving averages this well, but in strong-trends like the current AUDUSD chart above, we do often see it doing just that.

The point of the above example is this: in strong trends, you need to only look to trade with the path of least resistance, i.e., WITH the dominant daily chart trend. Let’s look at the same chart above from the viewpoint of a trader trying to trade against it…

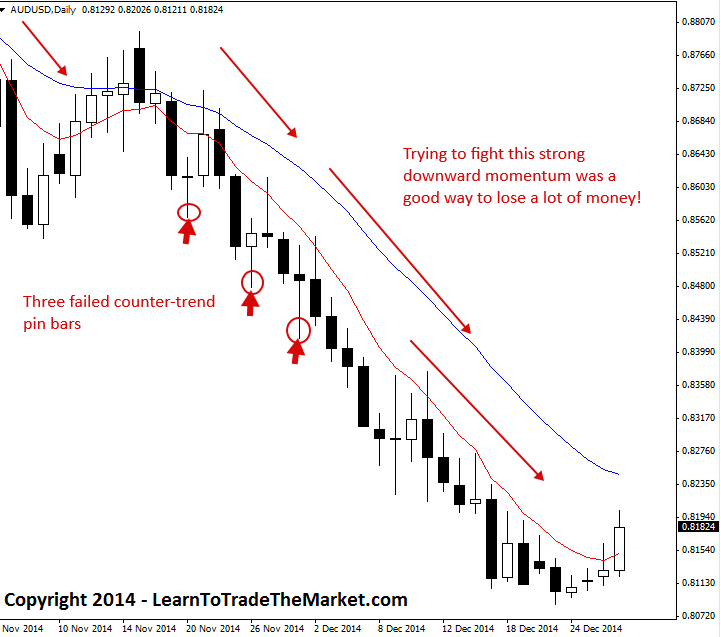

In the same AUDUSD chart that we looked at above, we can see what the experience might have been like for the ‘bottom picker’ trying to trade against the strong downtrend. Clearly, he or she would have lost money on any one of the three pin bars shown below. Some people get so obsessed with trying to pick the bottom (or top) in a market like this that they would have taken all three of these counter-trend buy signals. You can easily see now why counter-trend trading will destroy your trading account!

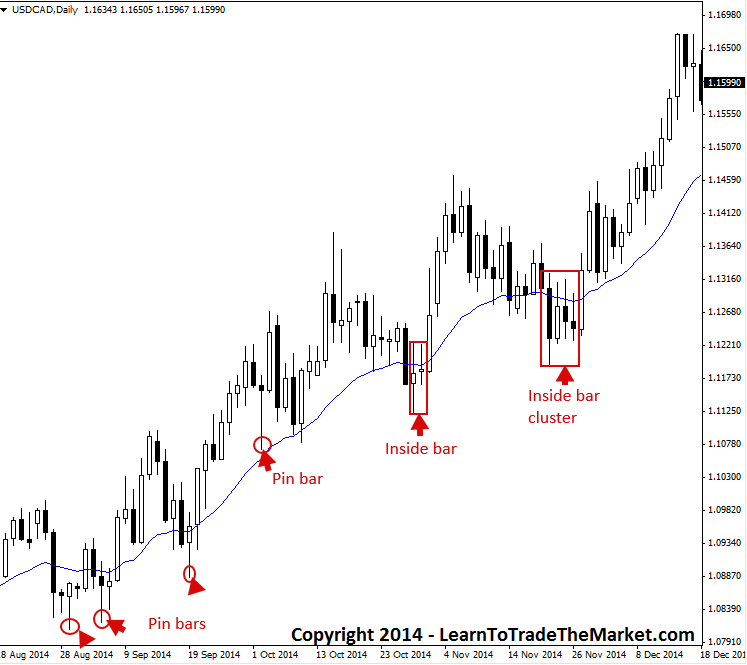

In the USDCAD chart below, we see a clear uptrend has been in place in this market since about the beginning of August 2014. The blue line is the 21 day EMA and it shows us the trend direction as well as a value area that we can look to buy from in order to trade in-line with the uptrend from value.

Note, there have been multiple price action buying opportunities from value near the 21 day EMA in the form of pin bars and inside bars over the course of this uptrend. We can clearly see that the path of least resistance has been to the upside in this market and so looking for buy signals was the obvious choice over the last five months…

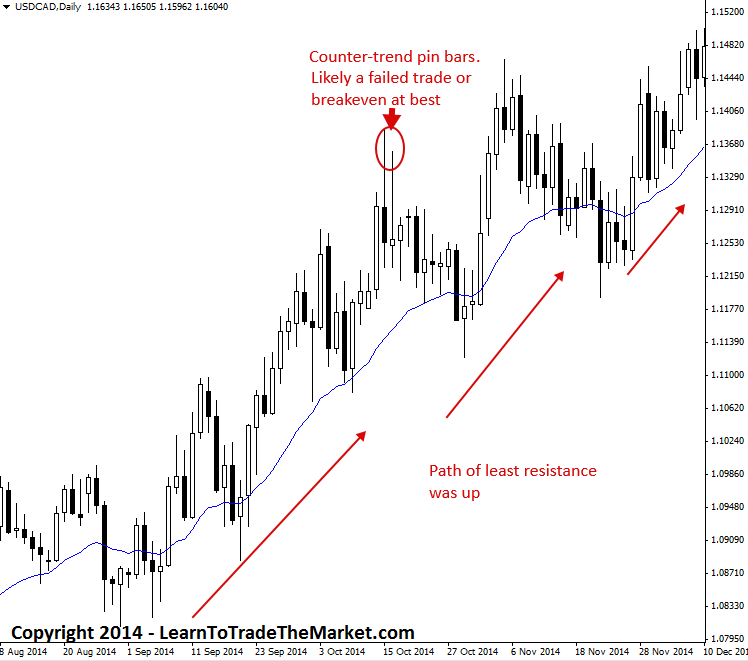

In the same USDCAD chart we looked at above, we can see that the experience would have been totally different if you were trying to ‘pick the top’ of this market by looking for a counter-trend sell signal. Even a long-tailed bearish double pin bar setup like we see below probably would have been a loss or breakeven at best, as we can see in the chart below. When there’s a clear path of least resistance in a market, don’t fight it!

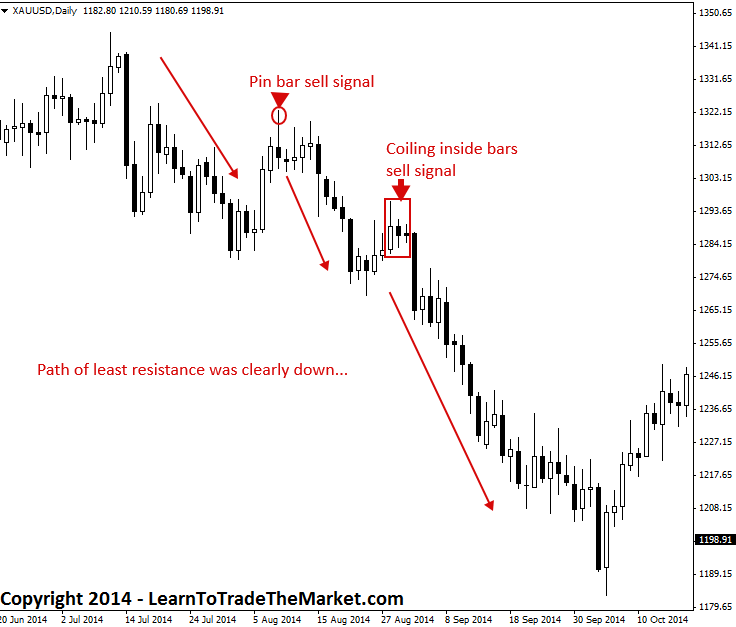

In the next chart below, we can see the daily spot Gold market earlier this year. There was a nice downtrend in place and so the path of least resistance was clearly down. Therefore, we were looking for price action sell signals on retraces back to value / resistance in order to trade in-line with the downtrend. We can see a nice pin bar sell signal a coiling inside bar strategy that formed following retraces higher within this falling market, both setups led to the resumption of the downtrend and big down moves…

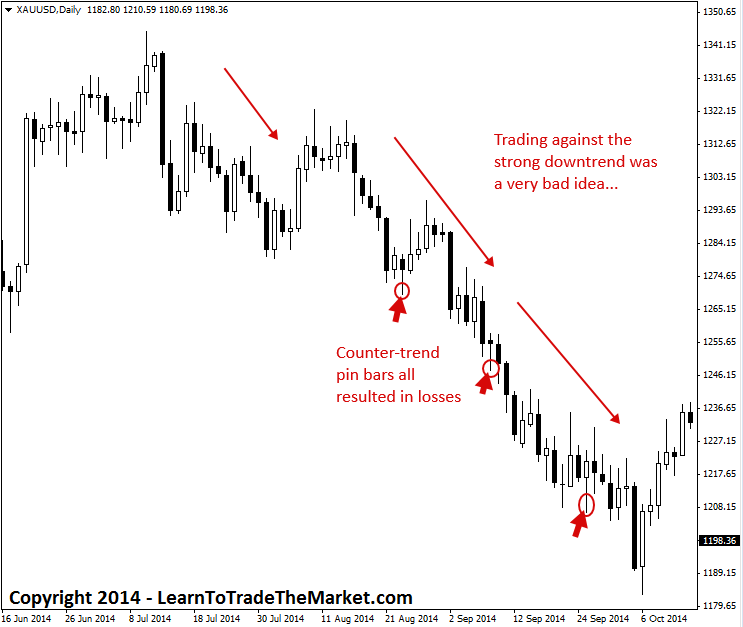

Finally, we are looking at the same spot Gold chart as above, except this time we are looking at it from the viewpoint of an unfortunately lost trader who is trying to trade against the trend. Note, in the chart below we can see multiple failed counter-trend pin bars that would have resulted in losses if a trader took them against the trend.

Conclusion

I hope it’s becoming more obvious to you just how dangerous trading against the trend is. Traders also tend to try and trade both sides of a trend, both with it and against it, and in doing so they typically give back most or all of the profits they made on the trades with the trend. This is one of the biggest mistakes I see traders make that prevents them from achieving real success in the market. During your career, you should make it one of your biggest trading goals to stick with the dominant market trends and avoid trading against them at all costs. Your trading account will thank you later. To learn more about trading with the trend, checkout my all new updated price action trading mastery course and members area.

PLEASE LEAVE A COMMENT BELOW – I WOULD LIKE TO HEAR YOUR FEEDBACK :)

QUESTIONS ? – CONTACT ME HERE

I love your teaching, thanks

Thank you Mr Niall for these insightful articles.

You are indeed a kind and generous personality. Your teachings have totally transformed me into a better trader, but I have a question regarding trading reversal signals. It is a well known fact that trend reversals don’t ring bell when they about to happen. If you don’t trade these reversal signals, how will one be able to catch a new trend since we don’t know when a trend reversal happens, except when it is already in play, or are you suggesting that when we see a reversal signal we should ignore it totally? If for instance your answer is yes, don’t you think we will always miss a good chunk of the trend when an old trend reverses and changes direction? Now my last question is how do we know the reversal signal to take and the one to ignore?

Thank You for sharing your knowledge. I’ve been trading for awhile and was wondering what I was doing wrong to have such little success in the market. This article has helped me see, as well as using a demo account and trading like it was real, I could see that for some reason I am always trying to trade against the market, I need to fix this, thanks again for freely putting your knowledge out there, and good luck trading.

Hello coach thank you for your lessons

hi sir

please tell me the beast sitting of moving evrage for gols i mean xau usd

your niall teachings are contributing in an essential way to my correct trading mindset.I am very grateful!

I have followed you and learnt the right way of trading and this infor still add value in improving my skill in forex trading always learning new things.othe though I know but never knew the power behind them.so thank you

Nial, this is an awesome article! This is something that I sometimes struggle with (even this morning) and hopefully this would improve my success rate.

Honestly, I have been avoiding to read this article because I thought I knew what you wee going to say. I was proven completely wrong!!!

Thanks a lot!!!

Great article thanks alot

THANK YOU

I have the same opinion with Otto. You also said the market doesn’t follow a straight line for long. In some of the charts above, some of the counter-trend pin bars were as strong as their opponents and the trend reversal was lasting for a few days after that.

Niall Fuller, you are indeed a great FOREX mentor. Thanks for this eye opening article.

you are definitely a Forex prophet, i made you my MENTOR the very first day i stumbled upon your site, i must confessed that my trading has really improved and i have become a seasoned trader just following your teaching and advice, thanks for turning my trading life around for good and thanks for beign NIAL FULLER.

Thank U so much.It’s a great lesson to me.

When I started learning about pin bars, I just traded them without the knowledge that I have to check the trend, I was frustrated because I did not know what was I doing wrong until I realise that one should pay attention to the trend. To top it up this article has pleased me I can confidently say that last week Tuesday I saw a pin bar on EURUSD, took it and it hit my TP. I realise that trend is very important. Thank you very much for your articles :-) Keep them coming. Lol!

This is very informative and its explained clearly, thank you for such a wonderful presentation.

Thank you. Great advice.

Excellent reading, valuable information.

Indeed,the lesson is really an invaluable and imparting,also an eye opener to some of us who are just beginning new.thank you very much sir. Am very blessed with this lesson.

Great work you are doing. Keep it up

Thanks Nial for a valuable lesson.

Sound advice as always, Nial. Just go with the flow! Many thanks for your continued support and guidance.

Cool Nial

Cheers Nial, great article. A real no brainer in reality but temptation and arrogance takes over. I agree totally with you. Trade with the trend and the probability of making a profit is with you. Trade against the trend. You will lose money.

Good one

You rock my world

Thanks Nial because this was the biggest mistake I was making but I have to be disciplined now and trade with the trend.

Good article. Hi from Malaysia

Thanks for that powerful lesson, I picked a lot from it.

I completely agree with you. Go with the trend is the key in trading!!!!

Trend trading is recommended, however, a market can exhibit predominantly downward movement for maybe 6months and start moving upward for next one or two months, now do you consider that a trend reversal or a retracement? What am asking is how far back do you look at the price action in other to narrow decision on a trend reversal (as all makets do reverse at some point) inorder not to trade a retracement.

THANKS A LOT FOR YOUR GOOD WORKS,.