Putting The Trading Probabilities In Your Favor

If you feel that you are getting defeated by the market, it very well could be because you haven’t tried hard enough to tilt the scales of trading success in your favor. It is not the market that is ‘defeating’ you, it is you who is defeating you, and if you really want to have a solid crack at making consistent money in the market, doesn’t it make sense to do everything within your power to make that happen? Are you doing everything you can do to put the probabilities in your favor as you trade the market? I think the honest answer for most of you reading this is “no”. If you’re not consciously making an effort to do everything within your power to put the probabilities of trading success in your favor, it will be very difficult for you to make money trading.

If you feel that you are getting defeated by the market, it very well could be because you haven’t tried hard enough to tilt the scales of trading success in your favor. It is not the market that is ‘defeating’ you, it is you who is defeating you, and if you really want to have a solid crack at making consistent money in the market, doesn’t it make sense to do everything within your power to make that happen? Are you doing everything you can do to put the probabilities in your favor as you trade the market? I think the honest answer for most of you reading this is “no”. If you’re not consciously making an effort to do everything within your power to put the probabilities of trading success in your favor, it will be very difficult for you to make money trading.

If you’re the trader who has great money management skills but constantly over-trades, you’re going to lose money over the long-run. If you are patient and pick quality setups but you risk too much of your account all the time, you’ll also lose money over time. Similarly, if you have not really mastered an effective trading method and every trade is basically a “hunch”, you’re probably also going to lose. You see, every aspect of your trading needs to be in tip-top condition so that you have put the probabilities of success in your favor as much as possible.

You cannot control what the market does, so you need to focus on controlling yourself and all the variables you can control. If you don’t put the proper time into mastering the components of trading that you can control, the market’s volatility and constantly changing conditions will end up controlling you. So, what are some of the most important aspects of trading that you can control to put the odds of success more heavily in your favor?

Have a ‘battle plan’ before you go to ‘war’

I get a lot of emails. Many of them are from traders who clearly have no strategy and no real consistent trading routine, they are just randomly entering the market from any reason they can justify to themselves. If you have a hodge-podge of indicators on your charts and you’re trying to combine bits and pieces of different trading methods and systems into something you like to think of as a “hybrid” trading strategy….you’re really just gambling.

This is how you need to think about trading: The more you do to prepare and plan before you start entering live trades, the better you will do in the long-run. Imagine just jumping into a battlefield without knowing what your objective is or having any type of plan of what you should do…you would unfortunately get killed very fast. Or, let’s say you did have a battle plan but you deviated from it as soon as the war started…all your preparation would be wasted. When we make a plan of action for anything in life, we need to stick to it, otherwise what’s the point? At least stick to it long enough to see if it works or not…give it a chance.

Emotional decisions are the enemy of any trader, thus, your primary goal as a trader is to do everything you can to avoid making these types of decisions. If you haven’t truly mastered an effective trading strategy that you can easily explain to someone who doesn’t know anything about trading, you probably don’t have a solid strategy or trading routine worth mentioning. Your trading plan, daily trading routine, guide or whatever you want to call it, is essentially where every component of your trading is aggregated into a cohesive, comprehensive, yet concise and practical plan of action that should be thought of as the first defense layer against emotional trading mistakes. It also is a critical component to making sure you’ve done everything to put the probabilities in your favor as you trade because it gives you structure and consistency in your trading approach, and this is key to not becoming just another losing trader who is gambling his or her money away in the market.

Avoid the noise of short time frames

In last week’s lesson on end-of-day trading for people with jobs, I discussed the importance of making the most out of the time that you have available to trade the markets each day. If you’re like most of my readers, you probably don’t have all day to sit staring at your charts, and even if you did have all day to that, you shouldn’t. Sticking to higher time frame charts will help you put the probabilities of success in your favor as you trade.

Focusing on higher time frames is something you should be doing if you want to increase your chances of making consistent money in the market. I am a huge proponent of daily chart time frame trading as well as 4 hour chart time frames, if you’ve read my lessons in the past you probably already know these are my two favorite time frames. But how exactly do they help us tilt the scales of trading success in our favor even more?

There are two primary ways higher time frames help us achieve trading success:

1) They give us a clearer, more relevant and significant view of the market

2) Because of number 1 above, higher time frames naturally give us higher-probability price action trade setups.

Focusing on the higher time frames is probably the easiest thing you can do to immediately increase the probability of making money in the market as you trade. If you can’t dig up the self-discipline to stop looking at those 5 minute charts and eliminate them from your mind, then you probably don’t have the discipline it takes to manage your risk effectively and stick to a trading plan either. You should make focusing on higher time frames your first step to proving that you can remain disciplined as you trade.

Don’t shoot yourself in the foot

One thing that you need to be very careful with as you trade, is to not let your previous good efforts at remaining disciplined and patient go out the window when market conditions change. Very often, a trader will do well when a market is trending, but then when the market stops trending and starts consolidating and getting choppier, they lose all the money they made while it was trending.

One thing that you need to be very careful with as you trade, is to not let your previous good efforts at remaining disciplined and patient go out the window when market conditions change. Very often, a trader will do well when a market is trending, but then when the market stops trending and starts consolidating and getting choppier, they lose all the money they made while it was trending.

A big part of knowing when to trade and when not to trade is knowing how to read and interpret the price action in market. I get a lot of emails from traders asking me about how to know when a market stops or starts trending or how to tell when a market is choppy. The truth is that, the only way to confidently tell when market conditions are changing is to have a solid command of how to analyze and interpret the price action in the market, there’s no indicator that can help you determine market conditions as well as price action can.

Giving back trading profits is probably the most frustrating and also the most common mistake that traders make. The story typically goes something like this: A trader does well for a while, sticking to his plan and hitting some nice winners, now his perception of risk in the market has decreased because his confidence has increased, so gradually he starts entering lower and lower probability trades. It doesn’t take long before a low-probability trade leads to a ‘revenge’ trade where you try in vain to force the market to give you back your lost money. It’s a very slippery slope to blowing out your trading account once you start letting your guard down by deviating from your trading routine and risk management strategy that was working for you before. Don’t let over-confidence and cockiness get the better of you, remember the old saying “Bulls make money, bears make money but pigs get slaughtered”, it’s quite true.

Avoid rushed trading

With the prevalence of smart phones these days, many traders now have mobile trading apps that they regularly use to stay in touch with the market when they are away from their computers. For the most part, I am not a fan of mobile trading and I feel that it’s really counter-productive for most traders.

For one thing, you are looking at a much smaller screen on your cell phone than on your computer, and I’ve found that the view of the charts on a cell phone can be misleading and very limited compared to that of a regular laptop or desktop computer.

Next, the very fact that you have a mobile trading app is probably going to induce over-trading. It’s like having a little slot machine in your pocket for most traders, just itching you to play with it. Mobile trading sort of makes traders feel like “now I will never miss any opportunities”, when really all it does is cause a trading addiction for most of them. The truth is, the best trading opportunities are typically on the 4 hour and daily charts as I discussed above, and you really do not need a mobile trading app to trade those higher time frames.

All mobile trading apps really do is cause traders to look more closely at the intra-day price movement as well as influence a frantic trading mindset of feeling like you “always need to be in the market”, and so I feel, especially for beginning and struggling traders, mobile trading is something to be avoided if you want to increase the probabilities of making consistent money in the market.

Understand risk management and demo trade first

I get a lot of emails from people asking me how much they should risk if they have XYZ amount of money in their trading account, but who are also clearly not ready to be trading live…

If you are in a situation where you aren’t even sure how much money you should risk per trade or how to calculate position sizes and properly manage your risk in the market, you have no business trading a live account yet, period. There is a very good use for demo accounts; figuring out the ins and outs of your trading method as well as figuring out position sizing and risk management.

Before you start trading a live account, you should be at the point on your demo account where you have no more questions about what to do, and you should have just had at least two or three profitable months of trading the same exact strategy that you plan on trading with your live account. If you email me asking anything about lot sizes or trading strategies or basically anything else, and you also tell me you’re already trading a live account, I am probably going to refer you to this article. You are not putting the probabilities of trading success in your favor by starting to trade live before you are truly ready.

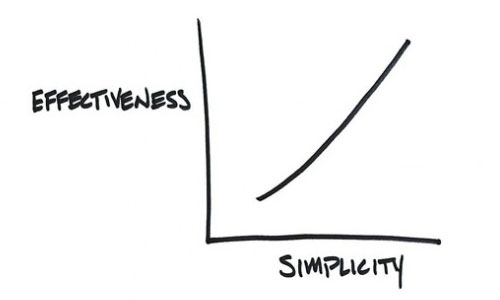

Simplicity significantly increases the probability of trading success

If there is one dominant factor to increasing the probability of making money consistently in the market, it would be to simplify every aspect of your trading as much as possible. You’re probably already familiar with this concept if you’ve been reading my blog for a while, but it is nevertheless a very critical one to discuss again. Trading, perhaps more so than any other field, causes people to over-complicate it. People do all kinds of crazy things when they start trading with their hard-earned money, and really if they just slowed down and took a minimalist approach to trading, they would be much better off, both financially and mentally.

If there is one dominant factor to increasing the probability of making money consistently in the market, it would be to simplify every aspect of your trading as much as possible. You’re probably already familiar with this concept if you’ve been reading my blog for a while, but it is nevertheless a very critical one to discuss again. Trading, perhaps more so than any other field, causes people to over-complicate it. People do all kinds of crazy things when they start trading with their hard-earned money, and really if they just slowed down and took a minimalist approach to trading, they would be much better off, both financially and mentally.

The biggest part of simplifying your trading approach and perhaps the easiest part, is having a simple trading strategy like price action. It always amazes me how so many traders tend to look at every trading method and trading system under the sun and it’s only later, after perhaps years of lost money and frustration that they finally ‘wake up’ and see the proverbial forest for the trees and realize that the raw price action on the charts has been the best and simplest way to trade all along.

Conclusion

Our most potent weapon in the market, is simply being prepared as much as possible before we place a trade. The market is uncontrollable and unforgiving, it doesn’t discriminate between traders with $1,000 or with $1,000,000, and the more prepared you are, the better you will do, no matter how much trading capital you have. Trading can really be thought of as a type of “war” between you, yourself and the market, and the less prepared you are and the less you’ve tried to put the probabilities in your favor before you enter the market, the more likely you are to be defeated. The truth is, you have within your own mind, everything you need to succeed in the market, but like most traders you’re probably defeating yourself by trying do to too much after you enter a trade, and too little beforehand.

The first step to increasing the probabilities of trading success, is doing the things discussed in today’s lesson. If you need help getting started and you want more structure and support in being properly prepared before you enter a trade, my trading course and members’ community can help you put the probabilities in your favor.

Thankyou Nial minimalist approach, trading plan and longer time frames that’s the way to go.

great article, thank you …

You have shared very valuable points for a trader. This line “It is not the market that is ‘defeating’ you, it is you who is defeating you” is perfectly right. Be a master in forex trading by applying all described points on yourself.

Hi Nials

Thanks for uplifting my trading spirit.

It is always great to hear from u.

You are a blessing to nubie traders.

Maya

Nial, great article. I am srtuggling with.earlier successes and letting my risk increase…then getting my brains pounded out by allowing disks

that didn’t have sufficient ,cntrol. Thank you for the reminder that poigs get slailughterex. I’m looking into next week after reading . Thank you! , ll be adhereing to the plan & controlling risk.

Well, after eight months of trading, this is what I learnt so far: building a trading account takes time, lot of discipline and all what Nial mentioned above and in his other gracious and professional articles.

Destroying your account is so easy. it takes one single mismanaged trade…. again one single mismanaged trade is enough to put your account to its knees.

DISCIPLINE IS THE KEY DIFFERENCE between success and failure in this business.

it seems that I learnt it finally.

Thanks lot Nial, again and again, for this inspiring article.

Thanks Nial.I made a 19R profit for the past 4 months trading with discipline. Because of what you just said in this article which is true i got overconfident and am now reduced to zero in just one trade that i over leveraged and when in a loss in that trade i kept hoping for at least my risk when it retraces to 00.(hope is one of the deadly trading sins, check the four horsemen killing your account, article Nial gave us last time)Last time Nial said for trading to work for us we must have ‘3 ms’ that is money, method,mindset and its true.I had the last two but this time i wanted to boost my account(so that i can also trade like a Baller ,joke!!)and that was my downfall Thanks again for this great lesson

Nial,

with the broad range of articles you are trying to help whoever is out there reading them.

it’s like trying to teach the same thing to many different people. we are all unique and that’s why one article clicks for one person but not for another. still, you’ve written so many articles, i would say most people who read them should be covered.

you are basicall teaching philosophy and it’s great to see that.

true, trading could be like a war, but it’s the war of the soldier versus the BANKS-TERS. not fair for the dying soldier, which we know quite well happens every day.

most people don’t know what they want to do with themselves. trading is just another activity, hobby, game, a hope for financial stability or indepedence etc.

you are trying to instill in us discipline, the discipline of waiting for the right moment to shoot, to engage in the battle of a trade and come out unscathed as much as possible. being prepared is the name of the game, no matter what stage we are on in life.

so far, i’m a survivor, not a veteran yet, like you are.

thanks for your time, effort, energy and especially for SHARING the experience you’ve learned from your scars along the years.

all the best to you.

Thanks

Still another comment would be, maybe mini account trading would recommendable over demo trading it will give the real experience of trading without the risk of losing your shirt.

Anyhow there are hurdles to take for any beginning trader, you can tell a child not to touch the heater because it is hot, but once you’ve burnt yourself you really know.

Cheers

This is reality for every trader, so true. You have helped me more than anyone else ever in my life with free information, soon not free anymore because I am going to pay you and become member.

Thanx mate,

Alexander

Good one again!

Nial sir is the best coach, who helps a trader to start trading by keeping his or her baby steps as perfectly as possible.

This is truly a supporting article, thank u sir.

Thanks , Im the one who got overconfident and lost all my profits and then half of my account money the next week trying to compensate my losses , this article is really helpfull , thanks again..

Thanks Nial and really appreciate as always….

Yes Nial , I am defeating myself. So addicted to the race and enter knowing defeat. But I cannot help it.

I want to be in the race allways and so intoxicated with the pain and joy alternately and i enjoy both.I want to change myself for becoming a profitable trader than to be in the race as now.Thank you.

” mobile trading app is probably going to induce over-trading. It’s like having a little slot machine in your pocket for most traders” very funny and I could’nt agree more

Emotional decisions are the enemy of any trader……….

I like ur article – useful to all of us…

Really good article …. It’s great Nial.

Thanks Nial. Using price action is to me the best way to trade because it is simple it is therefore me who makes it complicated and through time patience routine discipline and having a mentor like yourself has been the difference between looking for quality trade set ups and just guessing which is I can’t control what the market is doing but I can control how I trade in the markets.

Yes Nial you so right about short time frames. Experienced the affect today.

Thank You for the lessons.

Great Nial

Oh well…thanks for this topic good to refresh the rules. I trade the forex 2y on indicators last year is just bad for me. 3 weeks ago i don’t even know about price acction nothing. Before i use only 5,15,30 min charts…Nial as you wrote ” If you can’t dig up the self-discipline to stop looking at those 5 minute charts and eliminate them from your mind, then you probably don’t have the discipline it takes to manage your risk effectively and stick to a trading plan either” i don’t even think about this hehe… but hey! I don’t look on 5,15,30 min charts 3 weeks already after 2y of using only! After you said that i feel now …like i quick smoking. Now you make me pround what i did and don’t event think about this before. Looks like im not totaly lost in head…for chenge trading thinking after 2y of using. I see huge potencial to stay in simple Price Acction 1,4,1D charts and lov it! Thanks

Nial. I’m addicted to your posts. Great job,Thanks

I am a newbie and have been working very hard at learning the basics thru BabyPips, then demo trading different strategies for months all helping me to understand what kind of trader I am. I have followed a few “trading mentors” and I have to say that Nial has hit the nail on the head for me.

Great Post. Nial, put some trading examples 4 hours please. Thank very much.

Every time your articles coming at the right time,when i need some inspiration.

i still see to much entry opportunities, but it is getting better thanks to the articles.

Thanks so much.

Great blog Niall, one of your best

Dear Nial,

Each article is useful and eye openner. Fantastic and great.

Thank you again the generous man.

Thanks Very Much !

Thanks !

Thank you Nial.