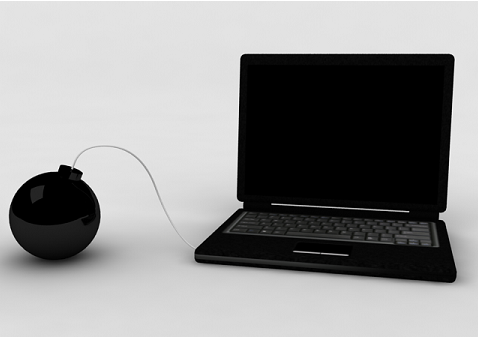

How To NOT Blow Up Your Trading Account

So, you’ve been studying the markets for two years now, you’ve read all the books, taken numerous home-study courses and even attended a trading seminar, your demo trading results seemed pretty good, then you went live and lost 50% of your account in two weeks. You decided to go back to the drawing board and learn a different system, because you figured it must be your trading system’s fault that you lost all that money so fast; you just need to find the ‘perfect’ trading system…

So, you’ve been studying the markets for two years now, you’ve read all the books, taken numerous home-study courses and even attended a trading seminar, your demo trading results seemed pretty good, then you went live and lost 50% of your account in two weeks. You decided to go back to the drawing board and learn a different system, because you figured it must be your trading system’s fault that you lost all that money so fast; you just need to find the ‘perfect’ trading system…

Sound familiar? For many traders, this story is all too familiar. The majority of the people who come into the markets end up blowing up their trading account at some point, and many traders blow it up multiple times. Trading can almost seem “rigged” at times, because it seems so easy and effortless when your demo trading or when you’re not in the market and you’re just observing. But, the minute you enter the market with real money it seems like the whole game changes and someone changes all the rules to keep you from making money. I know it seems that way, I’ve felt like this before too, every trader goes through the same trials and tribulations while learning how to trade successfully. Some give up, some never change and just continue losing money without trying to make a real change in their trading habits, and some traders push through to the other side and become consistently profitable. In today’s lesson, we are going to discuss how you can become one of the profitable traders and how you can stop blowing up your trading account.

The typical journey of a Forex trader…

There are different stages in the journey of learning how to trade the markets. The stages consist of approximately the same elements and traders tend to progress through these stages in a similar sequence. Some traders progress through each stage quickly whilst some get stuck in one stage for months or even years. Let’s take a look at the 6 general stages of a Forex trader…

Stage 1:

Problem – You hear about Forex trading from a family member, a friend, a colleague, a T.V. commercial, the internet etc. It seems like a legitimate and exciting way to make money. You get dollar signs in your eyes and dreams in your head. You can’t wait to learn all about trading so that you can tell your boss to “shove it” and live the life you’ve always wanted. Case in point, you’re interest switch has been turned on and your gas tank is full of rocket fuel…you are chomping at the bit to absorb everything you can about trading, open an account and watch the money pile up.

Solution – While there’s nothing wrong with being excited and interested in the potential lifestyle to be lived by being a full-time Forex trader. You should be cautiously optimistic at this stage rather than planning to put all your eggs in the Forex trading basket and dreaming of life styles of the rich and famous. Trading is anything but a ‘get rich quick scheme’; it takes discipline, dedication, organization, logic, and patience, if you think it’s a way to some ‘fast and easy’ money, then you’d better think again. If you want to build a sustainable Forex trading career you’ve got to be realistic and understand from the beginning that developing the proper trading habits is what determines whether you become a successful Forex trader or fall to the wayside like most traders.

Stage 2:

Problem – You start doing some research on the internet, Googling everything you can think of regarding Forex trading. There are a lot of different options for trading systems, trading strategies, trading software, trading courses, seminars, and the like. You decide to learn the basics of Forex by taking a good free forex beginners course like mine or another. After this, everything is making sense to you, you are excited about the opportunity in Forex and now you just need to decide on what trading strategy you will use. After a lot of research and thought, you finally decide on a trading method that you feel confident will help you trade the market successfully. The problem with this stage is that many traders start out by learning a trading system or strategy that’s far too complicated. They’ve got Elliot Waves, MACD’s, Stochastics, expert advisors, and other indicators plastered all over their charts. These things are not conducive to developing and trading from a relaxed and confident Forex trading mindset.

Solution – Instead of learning about a million different indicators or purchasing expensive trading software, you should begin by learning how to trade off the raw price action of the market. I’m not only saying this because I teach price action trading, but also because you really do need to know how to read the raw price action of a market, no matter what trading method you eventually end up using. I suggest you stick with pure price action trading strategies, like the ones I teach and trade, but whatever method you end up using, you will trade it better by understanding the price dynamics occurring on the chart below it.

Stage 3:

Problem – Whilst the first two stages discussed above are pretty consistent amongst most traders, stage 3 is where traders’ paths might diverge. At this point, most traders are trying to learn a trading system, a trading strategy, they’ve purchased a Forex trading robot or they are trying to trade with a bunch of different indicators. Most traders tend to demo trade for very little time, if any, on their first attempt at learning to trade. It seems to be human nature to want to jump into the markets as soon as possible and start risking our hard-earned money.

So, at stage 3 most traders have spent a little (too little) time learning some trading method and then after they see one or two instances of it working out they open a live account and begin trading with real money. Typically, traders make stupid trading mistakes like entering the wrong lot size or buying when they wanted to sell, etc. These are mistakes that are the result of not taking the time to properly learn about your trading platform and how it works. In stage 3, traders typically blow out their first trading account, or lose such a large portion of it that they take a break from trading for a while, at least until they learn another trading system. (Note, some traders do avoid ever blowing out a trading account, and it’s typically because at this stage they begin trading with proper trading habits and they never waver, they stay on track and don’t give into the temptations of trading like a gambler).

Solution – Whatever system or strategy you decide to start learning how to trade from, BE SURE TO DEMO TRADE IT FIRST. Many traders seem to think they don’t need to demo trade, or they don’t do it for long enough. You need at least one or two months of demo trading the exact same strategy or system you are planning on trading live with, if you don’t do this you’re a fool. Remember, this is your hard-earned money you’re risking, waiting two or three months to start trading with it is not going to hurt you, especially if you consider that doing so will allow you to become more familiar and confident with your trading method, which will ultimately cause you to trade much more effectively. Demo trading your trading strategy and the trading plan you’ve built from it, will increase your odds of not blowing out your trading account dramatically.

Most of the time, traders blow out their first account by getting too excited and too anxious; they skip demo trading, they have a mediocre grasp on their trading method, and let’s face it, they really just want to get in the markets and throw some money around because it’s fun at first. Well, I assure you that blowing out your trading account that you worked 6 months or a year to save up for will not take you 6 months or a year to blow out, and the fun and thrills you felt when first starting to trade live will end very quickly once you realize you have no idea what you’re doing and the market is eating your money like a hungry Great White Shark. So, make sure you have MASTERED your trading strategy and that you have demo traded it for at least two months or more before you even think about risking your real money in the markets.

Most of the time, traders blow out their first account by getting too excited and too anxious; they skip demo trading, they have a mediocre grasp on their trading method, and let’s face it, they really just want to get in the markets and throw some money around because it’s fun at first. Well, I assure you that blowing out your trading account that you worked 6 months or a year to save up for will not take you 6 months or a year to blow out, and the fun and thrills you felt when first starting to trade live will end very quickly once you realize you have no idea what you’re doing and the market is eating your money like a hungry Great White Shark. So, make sure you have MASTERED your trading strategy and that you have demo traded it for at least two months or more before you even think about risking your real money in the markets.

Stage 4:

Problem – In this stage, most traders begin a frantic search for a ‘better’ trading method than the one they were using. There are so many options for trading systems and strategies on the internet these days that it can be nearly impossible to not get tempted into buying one of the ‘too good to be true’ sounding ones… and there are plenty of those. This is the stage where traders really try to find that “Holy-Grail” trading method that they ‘know’ must be out there…after all, someone is making money in the markets so there must be some ‘ultimate’ trading system out there (or so they think). In this stage, traders end up dropping some serious money on some Forex trading systems or other trading products that they feel will help them correct their previous trading mistakes.

Solution – This solution is pretty straight forward; if it sounds too good to be true…it probably is. The Forex industry is FILLED with trading systems, strategies, courses, books, and you name it that sound really great; they make trading seem easy. Truth is, trading is not easy, and it’s a battle against your own emotions that only you can overcome. Yes, the strategy that you use matters, a lot, but it is not true that more expensive trading systems or more complicated and fancy sounding ones work better than plain old price action trading strategies. In fact, I can tell you from experience that they don’t. I’ve tried them all, in my early trading days I too set out on the “Holy-Grail” trading system quest. Eventually, through trial and error, logic and commonsense, I realized the markets were best traded by just analyzing the naked price action of the charts that had been staring me in the face the whole time.

Stage 5:

Problem – This is the stage where traders feel they have found the ‘perfect’ trading system or strategy and they are ‘finally’ ready to start making money in the markets. Typically, in this stage, a trader will either develop good or bad trading habits and this is also the first stage where some traders have a real shot at going on to make consistent money in the markets. However, what happens to most of them is that they aren’t properly prepared with a Forex trading plan, trading journal, and a concrete trading routine. Instead, they are all hopped up over their new trading system and they start trading with it without any sort of organized structure or plan behind them. This typically leads to over-trading, risking too much, and for most traders it starts them down another path to blowing out their trading account, again.

Solution – Don’t fall off track. Many traders get excited about doing the right things in the market. They have a trading plan, they have a trading journal, and they know what they are looking for in the markets. Then after a few losing trades they seem to forget about their trading plan and they start ‘winging it’ a little more, they’ve also stopped filling out their trading journal, etc. You see, it’s REALLY REALLY easy to stop being discipline and to get out of control in the markets. In fact, it’s far easier to trade in an undisciplined manner than it is to remain disciplined and patient and develop the proper trading habits. The trick is that the longer you remain disciplined, organized, and patient, the easier it will become, and eventually you will enjoy trading the right way because you will have forged these things into positive habits. You’ve got to stick it out long enough and endure some ‘pain’ to see the long-term reward. Nothing worth doing in life is easy, trading is no different. If you give in to what you ‘feel’ like you want to do in your trading, rather than what you know you should do, it will only be a matter of time before you blow out your trading account.

Stage 6:

Problem – At this stage, you’re either on the right track because you’re remaining disciplined, organized and patient, or you blew out your account in stage 5 because you got too excited and emotional. Having blown out two or more accounts at this point, you are really starting to feel depressed about your trading, you think it’s ‘impossible’ to trade successfully and that you just don’t ‘have it’. You fall into a ‘downward spiral’ of losing money because you feel like you’ve lost so much to this point that you start to feel like you don’t care if you lose anymore, so you start taking bigger risks and trading more frequently, in other words, you’re gambling in the markets now.

Solution – Time to take some time off. Stop trading real money, and if you need to, stop demo trading and forget about the markets for a month or two. They will be here when you return. The best medicine for ending a period of emotional trading is to simply remove yourself from the markets for a while. If you feel like you’ve reached this stage, and you really need some help, then I suggest you simply stop trading for a while. Come back later after you’ve got some trading education and you’ve demo traded for a while. There’s no rush. In fact, the more you rush and try to ‘force’ money out of the markets, the more the money you so badly desire will elude you.

In closing,

I hope today’s lesson has helped to open your eyes to the fact that you are NOT ALONE as a trader who has committed emotional trading mistakes or who has blown out a trading account or two (or three or four). It happens to all of us, it’s part of the game. You either figure out that what you were doing before wasn’t working and try to fix it in a logical and straight-forward manner like we’ve discussed here today, or you continue on in your old gambling ways, or you give up trading all together. Those are really the only 3 things that can happen to you from here.

I trust that because you’re on my website and you’ve read this whole article, you’re committed to righting your trading wrongs in a logical and no-nonsense manner. If that’s the case, I suggest you check out my Forex trading course and members’ community for further training and fellowship with like-minded traders who are committed to learning how to trade with simple, logical and effective price action trading strategies. If you have any questions or feedback, please feel free to contact me.

I’d really love to hear your feedback today, so please remember to leave your comments below & click the ‘like button’.

Wow! Today’s lesson make me to learn more about not to blown account,the secret discpline only and practice on demo before trading live money,thnk u my mentor may God bless you forever

I have been through all of this also, this is a good article, when I first learned about Trading, I learned about heiken ashi, it all seemed so easy, red sell, white buy. So I deposited £600, 2 months later it was all gone but it taught me a lot. I re-deposited to my account and started to Trade again, constantly changing my strategy after a loss and refining the wrong things. I got down to my last £50 and I FORCED myself to learn how to trade, now the future has potential and I am at the markets every day ready to pull the trigger, now my gains are much higher than my losses and I am back to plain old japanese candlesticks, they relay the price action much better than heiken ashi. I made all of the mistakes but less than £700 was a small price to pay to invest in myself and learn HOW TO TRADE. If the markets don’t move, neither do I.

Simply, Real. :-)

You are the best !

nail

after losing heavy i come back in market

i read your articular and promise my self to do not

mistake i tell some one to keep gun to my head

I went through all these stages and after stage 6 I stopped trading completely for 2 months and then discovered Nial!!

Now I am trading more consistently and intend to go live once I have double my account in demo.

So far I have found every piece of advice that Nial gives to be absolutely real.

Thanks Nial

Hi Nial,

thnx for the wonderful article,

This one article is enough to bring back a sinking trader to the shore.

Regards

Geetha

Its good to know that clearly I am not alone. Without really seeing the bigger picture I have found myself at step 3 and feeling a bit sick. Time to take a break, regain discipline, forget the live account, and pretend my demo account is my live account.

Great insight, this should be sent out to new members as required reading, along with the comments, as a warning.

You are doing a splendid job for who lost their money many thanks for u.no one advice like u.goodluck and bright future for you.

.

The truth hurts but it will set you free. Great insight into the journey of a trader.

Nial,

Im always reading your blogs and lessons. For your next lesson can you be the Mr. Perfect Trader? I mean whenever I read your blog it’s always the newbie out of control forex trader freak lol. What about a newbie disciple-of-Nial forex trader? Would be interesting. :)

As usual, you are “spot on” Nial. Your progression of stages fit me hand-in-glove. You articulate the series of problems very well indeed. If you ever decide to quit trading FOREX, then you can become a successful behavioral psychologist with your keen insights on human nature.

Thx again,

Tim

Dear Professor Nail,well written and constructed articles. These type can only come from the person who has experienced the cause and applied tested method and see results.

I always thank almighty God for having to know this website.When all roads seem locked mentally,and needed some advise to start again and move ahead,I resolve to this site.

Thank you very much sir.

Hope to see you face to face one of this days.

If i have seen further ,its by standing on the shoulders of those who have gone ahead of me….Isaac Newton.

Thanks Nail for letting me stand on your shoulders,its a new day to my trading,the trading affirmation has done alot in me,for this article i have been a victim of all,but since i became a member of this community & gone through your course lessons every of my discipline affect every other discipline in my trading,17 trades so far on the daily time frame,11 winning trades,2losses,1 stopped out at break even,& still have 3 winning trades on,all from the pin bar set up from your course lesson,thanks to all the guys in the community,you guys have been brilliant in the live forum,once again thanks Nail i appreciate you,no questions at the moment,its been great with understanding your teaching,God bless.

Great info thank you again Nial!

only just started on forex and making the silly mistakes mention nial,selling when should be buying and vice versa

Thanks Nial much appreciated.

hey nial, just another thank you. i still read your free newsletter and joining ltttm a few years back was THE turning point in my forex ‘swing’ trading…hope you got a big old chunk of the euro’s move of late…i sure did! all the best to you and your family…richy

perfectly outlined, exactly all the stages i have gone through, now i am becoming better in trading by doubling my account in 2weeks, though the outburst of gbpjpy of 14th sept2012 is making my account go negative,let me wait and see if my money mgt habit will be able to withstand the outburst

Total Truth, we’ve been there, all all those stages!!

Cheers! Daniel Kenya.

I want to thank you because you really keep me in the right path. I think with small steps forward day by day, I will become a Trader.

I am in love with price action trading and it is all I do. I have come to realize trading forex has to do with a lot of self-control and once you can master that with forex trading, it helps in other aspects of your life.

thanks Nial

Thanks Nial

Went through all these stages. At stage 5 now started to make good money foe a while and exactly what you described happened: I started to be a a little too complacent with myself , stopped to report my trades in my journal and started to loose money again. I learned my lesson and I have got myself back into a ultra disciplined mode. Thanks for this article… It really helped me understand why all this was happening to me.

Nial,

As usual, another great article.

I took some hard knocks on my demo account before I stopped and starting really paying attention to Nial’s advice. I became a member and started trading only two pairs, using only two Price Action methods, and looking for the confluences for each method. I developed a trading plan and an execution log, and I use them religiously on every trade. I found that questioning my motives and intent on every trade seems to work in getting at my emotional state and what’s driving me to trade. Trading MUST be detached from your emotions.

I blew up my Trading Account just yesterday. I kept 3 sell EURUSD trades from 1.2410 to over 600 pips, and I blew up over $800. I will recover. Stop Losses save our Trading Account :).

Simply Excellent mate…!!!

Thanks again Nail for another great article.Keep up the good work

Thank you NAil where are you all this while, all you wrote are what am experiencing, i have spend thousand of dollars on systems while thousand of dollars had been blown away. I just decided that i have to make head way, but i promise myself not to spend penny on any system again. Two weeks ago i discover you site and i believe the price action couple with discipline and following ones plan we see me through. I will join the community soon.

Thanks n Cheers

Thank you Nail..:-)) again brilliant read..;-).. personally I LOVE your price action set up and I have great admiration for your skill analysis…Price action does work, patience does pay off big time and all the rest you listing above is a MUST as well..I am quietly hopeful here that I will finally not only start making money BUT KEEPING it as well thanks to your mentoring…cheers and thank you!

These stages are all to familiar and you delineate each stage so accurately. Your article is great, i enjoyed reading it. Thank you.

Hi Nial : A great article and very useful information in it – I blew my first account by starting to trade too soon. Now I have learned my lesson and this time, I am going to take my time to learn all the tricks and do it properly.

Santokh Rayat

Toronto, Canada.

I am currently going through a phase where it seems every setup I take is stopped out, and every one that I miss because I am at work or asleep is a profitable one. It is frustrating!

Nail you are telling my real forex trading experience. I can count how many times I have blown my hard earned money. At a point I feel like forgetting and stop trading forex forever. But after taking a two months brake, I bounce back trading profitably. Like you said, the emotion thing is very very disastrous if not put under control. Being patience and following once own trading strategy and rules pays. Thanks for the article. Another great one.

Thanks Nial. Absolutely true and invaluable advice. I’ve only been trading real money for two months and it’s been a nightmare. It’s clear…the gambler within is my greatest enemy.

Great artical for highlighting two traits of successful traders.

1. Act logically.

2. Act Rationally.

Keep it up mate!

Well written Nial. I feel like you took a whole page out of my dairy. F.E.A.R = FALSE EVIDENCE APPEARING REAL

A timely article, I’ve been trading for nearly 3 years and the road has been bumpy. Spent thousands on courses and still I experience loses. I know for sure that controlling your emotions and being discipline is key to future success, I am yet to blow my account, lost no more than 20% of my account. After all the strategies I have learn there is only one that I use and that is trading price action.

I have literally spent hours and sleepless nights staring at charts and sleepless nights searching for the holy grail; I thought the more you stare at the charts and trade, the more money you made. I have spent thousands of pounds on training programmes and systems but I finally learnt the hard way after stumbling on this website and reading all the articles that the reason why I was losing money was simply because I was over-trading.

I’m so glad I took Nial’s course as I now only take a maximum of 5 trades a month and trade of the daily chart. 3 of my 4 trades were profitable in the month of August.

I’d recommend taking Niall’s course esp for struggling traders as he teaches the truth and tells you like it is

Thanks Niall

Thank you nial master !!

Great Nial, thank you so much!!!

I´m probably at stage 6 now, only that I didn´t blew out my account, but I´m not making consistant profits either! I´m impatient and I don´t stick to my plan, thats the problem right now and you are completly right with your advice to take some time off. Thank you so much, it´s allways encouraging and helpfull to read your articles!

sonja

A thorough analysis of a trader’s journey in this business.

The key is to be couragous,maintain your motivation and be determined to succeed.

Great article as usual sir Nial..Thanks for this.

Another masterpiece !! Real goog stuff .

This is really a true life story as re-told by the “professor”. Thank you dear Nial for your GREAT contributions to our trading career. Words cannot be enough to describe what impact your lessons have contributed to ‘our’/my trading life. The truth is that your lessons has resurrected or inspired a new hope in most of us who could have dropped by the Forex way side. This new hope and life has the potential and intensity of moving me farther than I thought I would have gone.

I am really grateful.

I want to thank you because you really keep me in the right path. I think with small steps forward day by day, I will become a Trader.

Best Regards

Nikos P

Athens Greece.

Thanks Nial! I gotta say that this article is most definiately dedicated to me.

Nice article…Thanks Nial

bright and clear drops of an honest mindset….

thanks a lot ….

( sorry for my funny english ..lol…)

Hi Nial,

Again, a great article!

while doing so what you mentioned above, my account is still growing.

Not with spectacular ups and downs, but consistently.

what helps me not to be too greedy, after setting my s/l and t/p, i mask the profit/losses (displayed in Euro’s) with ordinary tape on my screen. therefore i will only watch the charts, nothing more.

Regards,

Paul

Am eye opener Mr. Nial considering av been stage 1-3…all i can do is laugh at my self and learn from my mistakes.haaaha!!

thank you once again.keep up the splendid work ur doing.

deja vu

Atlast I understood the real cause of my blown out losses.

Infact, I have gone through all the stages that you have described here.

My causes of lossess………..

* Not planning the trade

* Rushing in for the trade

* Over position sizing

* Over trading

* Not having relaxed and confident state during trading

You are truly my trading Guru

Thanks a lot Sir.

Real talk: great article as ever. Nial you tell it like it is. Respect.

Great the story of 90% of traders success stories are good reading but being forewarned of failure or obsticals is a much better way of entering Forex trading and demo trade till you can know a entry or exit point by just glancing at the chart practice makes perfect.

Very Sober News Nial

Trading has been like training for an Olympic event for me. The discipline and burning desire to be a successful trader has to put all those mistakes and trading loses into a mental framework of learning and training for the big event.

In my view this can only be achieved with a coach.

To work through all these steps by myself would have been emotionally destroying.

I am still learning from the Members Forum.

Thank’s Nial and all the LTTTM Team.

Steve

just blown my account.. and will take break for a month or two and will study systems..

thanks for that help

Great work Nial, this is what most traders go through when they learn that trading is about knowledge, discipline and good habits and not compulsion and second guessing. Many would feel that they are alone in this learning curve but your sharing just gave them hope….

Hello Nial,again a very true article…blowing up an trading account seems to happen often for beginners ( including myself).So your help is very appreciated :)))

But problem with a Demo-Account might be that it mostly offers more “money for playing” than people have and it does not hurt really to loose…good for the start to see how markets work..but finally its too easy..

Wouldn’t it be better after some time “Demo” to start with a small account with, hm, maybe 20$ to learn trading real money ??? Every penny one wins, might be only one penny, but I think at least the percentage of winning or loosing ist important..also this needs patience:)

Many greetings from Germany, Sabine

Really superb article, and very much to recognize about one self.

“Been there, done that” but now hopefully near the goal of consistency.

Cheers Tomson

..i think i must be somewhere around stage 4 or 5…especially after this $#%$king week..!!

Thanks Nial, a good article.

Great article Nial, a year into my demo account and i feel like i am about 70% ready to get into trading forex.

I hope the patience pays off , well done with helping everybody with common sense articles.

If you blow a demo too easily don`t fool yourself that you will make a living using your hard earned, you`ll just blow it quicker.

Great article Nial, I just went live after 6-7 months of demo trading and I’m just using simple price action as you teach. I think it is important to set realistic goals/targets for becoming a full time trader (if that is what people want to do), as you say it is not a get rich quick game and if people have that mentality they will soon blow their accounts.

My goal is 2 years until I can take a full time income from trading, luckily for me I’m already free of the rat race thanks to other online businesses.