Is Mobile Trading Bad For You ?

You can do almost anything on a smartphone these days, including placing and managing trades. Having this 24-hour finger-tip access to the market brings with it some significant advantages and disadvantages.

You can do almost anything on a smartphone these days, including placing and managing trades. Having this 24-hour finger-tip access to the market brings with it some significant advantages and disadvantages.

Whilst I’m all for smartphones and the conveniences of checking email on-the-go and having access to what is for the most part, life-enhancing technology, there is definitely a danger for traders having 24-hour instant access to the market. Having market access essentially glued to your body around the clock via a smartphone can very easily create an addiction. Even if you don’t feel like it’s an addiction…being able to satisfy your urge to check the market whenever and wherever you want is something that entices many traders to over-trade.

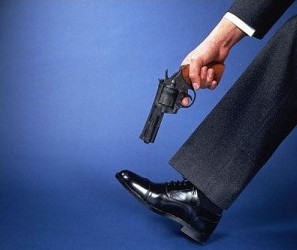

Aside from obvious health risks like trying to place a trade while driving down the freeway or while trying to mow your lawn (joking, although I’m sure some people do this), mobile trading brings with it a whole set of other more serious issues, mainly emotional ones, which traders didn’t have to deal with in the past.

In today’s lesson, we are talking about the emotional implications of mobile trading. We are not dissing mobile trading apps, in fact, you should use them and take advantage of the technology, but anything in excess is bad for you, and sadly, most traders who use mobile trading apps abuse them or use them to excess.

An addiction in disguise

For many traders, downloading a mobile app from their broker seems like an obvious thing to do. For example, a guy (or girl) gets an iPhone, goes to the app store and gets his broker’s trading app. Now he thinks, “Yay! cool, I can take this to the barbecue and show my mates, even take it the toilet if I have to…I’ll never miss a trading opportunity now!” However, little does he know he’s in for a wild ride. Just like a gambler at a casino he will probably give his money to the market without really being aware of what he’s getting sucked into: flashing numbers and indirect emotional manipulation. For those who wake up quickly, this is avoidable, for many of you it might already be too late. But you can break the addiction if you try.

For many traders, having a mobile trading app is like gluing a cigarette to their hand or like having their hand glued to a slot machine; because it’s right in front of their face and so easy to access…it takes more self-control than most people have to ignore the temptation.

Reasons people are drawn to mobile trading

People are drawn to mobile trading for a multitude of reasons. I am of the belief that most retail traders abuse mobile trading apps and don’t use them right. Having a mobile trading app on your phone is like walking around with a wad of cash in your pocket all the time; eventually you’re going to spend some money on something you otherwise probably wouldn’t have had you not had that cash in your pocket.

Some of the more common reasons that traders get drawn to mobile trading apps are the following:

• It’s cool to think you’re “trading like pro” with a mobile trading platform – In fact, most pro traders place little to no trades from their mobile apps. Pro traders know that if they are too busy to sit down in their usual trading office or work from their usual trading computer, they probably don’t have the correct trading mindset to fully focus on trading. Thus, it’s better not to trade if you are too busy to be fully focused on the market. Pro traders use mobile trading apps as more of a monitoring tool than anything else. They know that there is too much at stake to lose money simply because they were rushed and didn’t properly analyze the charts from their most effective state of mind.

• It’s cool to show your friends your fancy trading app and say “Hey look I’m a trader” – You might think it looks cool to be trading on your smartphone while waiting in-line somewhere to get food or while out with your friends. However, most people think it’s a little rude to be glued to your phone all the time at a social outing or other event. Who cares about looking cool anyways? Making money in trading is what matters, not how you look while doing it.

• It’s cool to take your phone to bed like Gordon Gecko and lay there checking the charts – Losing sleep because you can’t stop looking at or thinking about the markets is a classic hallmark of an over-trader and a trading addict. The smartphone has offered a very easy way for traders to lie in bed looking at charts or analyzing other trading variables. When you go to sleep…go to sleep! Losing sleep is only going to hurt your overall trading performance as well as other areas of your life.

Ease of access is not always a good thing

Here’s a reality check: mobile trading is great for a certain breed of professional, but for the everyday retail trader it can do more harm than good. Essentially, when you trade from a mobile phone you are starting to enter the same world that the online casinos lure people into, which is addiction created by the easy availability of the markets on the run. Since it’s there in front of you at your fingertips or in your pocket…a smartphone tempts and encourages you to watch the market any free minute you get.

Here’s a reality check: mobile trading is great for a certain breed of professional, but for the everyday retail trader it can do more harm than good. Essentially, when you trade from a mobile phone you are starting to enter the same world that the online casinos lure people into, which is addiction created by the easy availability of the markets on the run. Since it’s there in front of you at your fingertips or in your pocket…a smartphone tempts and encourages you to watch the market any free minute you get.

I’ve got news for you: traders controlling millions or billions of dollars aren’t trading hundreds of times a day or week on their mobile phones. At most, they are checking the market if they are traveling or otherwise don’t have access to their regular trading computer.

A lot of traders have a false-sense of what a mobile trading app should be used for: it’s there for a monitoring tool, it’s not there to engage a lot of trading activity. You DON’T HAVE TO DO ANYTHING with it…just use it to monitor. Remember, that the LTTTM method is not a high-frequency model of day-trading, therefore, the lure of being able to trade from your phone all day could interfere because you’ll be watching the live prices tick up and down from work, airport, or even the bathroom and you’ll be panicking on every red and green flash.

Use mobile trading apps as the tool they were designed for but be aware of the emotional pitfalls and subconscious manipulation that occurs when you have a cell phone with a mobile trading app attached to you all day.

How to use your mobile trading app properly

Mobile trading apps are a great tool if used correctly. Here are some of the uses that mobile trading apps are good for:

• Exiting a position – Occasionally, you might see a valid reason to exit a trade while monitoring with your mobile trading app. You have to be really careful with this though, and it’s not something you should try doing until you’re already experienced and know what you’re looking for. But, a mobile trading app can give you the ability to exit a trade at a better price since you have more access to the market, just be sure you don’t abuse it by exiting for an emotional reason rather than a logic-based one.

• Monitoring a trade that you’re in several times for the day but not to excess…Doing basic quote checking.

• If you are traveling and don’t have access to your ultra-book or laptop, a mobile trading app certainly could play a role in your analysis, but if you are traveling it’s probably best not to trade because you’re focus is not as sharp.

In essence, a mobile trading app is good for monitoring trades and possibly exiting them, but that’s really about it. You have to be very careful in entering a trade from a mobile trading app. Most of the time, it’s not the best idea because you will either be entering in a rushed state of mind or you will just be over-trading. Take time and relax and only enter a trade when you’re in the right mindset and you have time to determine with confidence whether or not a worth-while trade setup is truly present.

In closing…

Other than the radiation risks of carrying a cellphone in your pocket (joking), mobile trading apps are cool to use and cool to look at…but they can also be a highway to addiction and emotional trading decisions. It’s easy to become drawn to these apps, almost like an obsession, but you really need to learn to keep them in-check if you want to benefit from them rather than getting hurt by them.

Other than the radiation risks of carrying a cellphone in your pocket (joking), mobile trading apps are cool to use and cool to look at…but they can also be a highway to addiction and emotional trading decisions. It’s easy to become drawn to these apps, almost like an obsession, but you really need to learn to keep them in-check if you want to benefit from them rather than getting hurt by them.

Mobile trading apps should be thought of as more of a supplement than a primary trading device. Meaning, if you have a trade on and you have to be away from your normal laptop or trading office for a day or two, then it makes sense to use your mobile trading app to monitor your trade and possibly adjust stops or exit according to what the price action is showing you. However, for most traders entering trades via their smartphone mobile trading app is a bad idea and is something they should avoid. The whole idea behind the method I teach in my trading course and members’ community is to not watch the market all day and to not over-trade, but to trade like a sniper instead. If you feel like you’re having trouble controlling yourself with your mobile trading app, then maybe try going without it for a while and see if you’re trading improves, then later on you can start using it again … but try only using it to occasionally monitor open positions or manage a trade as necessary.

Thank you for this, I noticed I was over trading and always checking my mobile trading app even on the weekend to look at the charts. I also see that you’re right about being a trading addict when we allow ourselves to access the mobile trading app 24/7. I’ve taken a decision to delete my mobile trading app and only take trades from my laptop which I believe will take my trading to the next level. Being a professional in trading is a strong desire for me.

Thanks a bunch Sir????

I have been trading with my phone which I think it’s the reason of my over trading.

But from today I quit trading with my mobile phone.

Yeah that’s true, the main important thing is to control our emotion and also be discipline and planning our trade.

Great post..Nial

All boils down to the word “Discipline”

Personally I don’t like mobile trading because of mobile screen, it is small so i didn’t enjoy…

Thanks for your personal marvelous posting!

I actually enjoyed reading it, you are a great author.

I will be sure to bookmark your blog and definitely will

come back sometime soon. I want to encourage you to

ultimately continue your great posts, have a nice afternoon!

very nice article, I almost lost my account due to mobile trading, I was monitoring my trade on the smart phone when I had an urgent reason to put the phone in my pocket hoping that my screen lock will shut down the application, when next I opened the mt4 apps I found out it had taken a trade with the default lots size which was too large for my account size and the trade taken was against the trend. it was a painful experience, i still use the smart phone to monitor trade (not often)but on a demo account. I deleted my live account from the phone. I now monitor on demo, go to my lap top if I ever need to make adjustment. If I had read this article earlier it would have saved me some good cash and also the urge to monitor trade while driving is no more. Thanks

i think mobile tradding app will be important in terms of recieving alerts, don’t you think?

This is another excellent article pls keep it up

Many times I have been noted that charts from mobile are looks a little bit different then from PC. No, quotes the same but sense or perception is different. Agree, the best way for mobile app’s is only monitoring, especially during the trade off day like first Friday.

I’ve been dabbling with trading for 2 years now and realy starting to find my feet. I am mainly doing end of day trading due to having to work normally. I work shifts, 2 days, 2 nights. So come those night shifts I have difficulty accessing my account to monitor and place trades. I have the MT4 app on my smart phone, mainly for the reason of being able to monitor or cancel pending orders. Not to trade intraday. Although I do trade intraday on my days off, I would never consider doing it via a smart phone. I believe you need to get into the ‘zone’ to be able to trade effectively and without distractions. I see your point about constantly monitoring trades and you really should stick to your rules. If you’ve placed a trade correct by the rules then you know that its either going to hit SL or Take profit point.

GOOD ARTICLE

you have just summarized my thoughts on mobile apps uses.

once again thanks

Great topic :-)

I would be more definitive…

We have to DELETE Fx app !

Human are naturally curious and we want always to know, that’s why this kind of app cultivates our bad habits

Hi Nial!

I have been reading and studying from this website on and off for about 2 years now, and this is the first time I saw fit to comment.

Trading through a smartphone should not be portrayed as bad as you have put it.

I have been trading only through my smartphone from the start, and it has been working well for me so far.

I see no difference between trading through a smartphone and a laptop.

The psychological issues are there either way, equivillantly.

I also have to admit smartphones are getting closer to computers with each generation when it comes to speed, graphics and more.

Either way much of my success is thanks to your trading methods, therefore I’d like to finish with gratitude and continue writing and staying active in this international community.

Good trading, Yuval.

Mobile trade it is bad, was influenced, turn into a norkaman, removed him. I learn to trade on day charts, is enough to look once a day on closing of day. Thanks Mr. Nial! Excellent article!

Nicely written.

Hi Nials, R the joys of technology.

Cheers W

The “Looking Cool” comments about mobile trading made me laugh! Thanks!

First thing I thought of when I saw my broker’s app on my phone was glad I’m a “LTTTM”-type trader nowadays.

Remember when we used to look both ways before crossing a street rather than looking for new texts on “smart” phones?

Excellent, excellent wisdom, Nial!

I think Nial said it all, and to add id say and mobile app in the hands of a rookie trader is like a novice driver trying a super car when he cant even drive a family one. On the other hand if a Pro knows his method well, has his psyco in the right place, have a plan and discipline to stick to it, then yes no problem, a mobile app would the same as his trading desk, laptop, ipad etc…

God bless ya all

Sergio

I do not have a smart phone so I am good, I was going to get one NOW i will give it a miss.

for you to be a good trader,is all about making mistakes.

What a complete ledge!

Agreed that this mobile trading is good for monitoring and exiting trades. Thanks Nial!

This is a great article although can you make the font slightly larger as I am having trouble seeing it clearly on my iPhone.

Well said. I really respect all your perspectives.

I think that being DISCIPLINE trader, mobile platform is neutral and can be such great tool like your laptop or regular desktop. For emotional trading it can be like having gambling machine in your pocket. So when you’re addicted it doesn’t matter if you use laptop, phone or mobile. Maybe you’ll demolish your account faster.

Hi Nial,

I am glad that I got to read this article before I own a smart phone. I currently have a normal old fashioned phone with no internet and now that I know what you wrote about on the above article,I will be ready to use a smart phone wisely when it comes to trading that is if I ever buy one.

Thanks for a great article.

Interesting article, I use the mobile app a bit because I’m regularly away from my home office days at a time and think it’s a great convenience. In saying that trading is trading no matter where you are or what you use; discipline is key and technology won’t change the fundamentals behind an effective trading strategy

Well, deleting the app is not the best solution, i think. Another way of dealing with the problem could be removing the shortcut from you screen in order to prevent looking at it every time you use your phone.

Hi nial, well its good for beginners also without time to sit infront of conputer. But as u said with limits. In life everything gets bad if u cross the limit. In starting just a beginner on a demo account on MT4 and yes use the app to place a trade and forget. Your price action strategy is that set & forget. But yea technogy can be dangerous and harmfull when u get addicted. Thanks for your articles :)

Nial,

You are one guru of trading and you hit a 10RR on this subject. Even though I do not log into with the real account. I find myself waking up and looking at what happened overnight at the first place!

A nasty habit..

Very Interesting Article, Nial. What you said is damn true. I’m experiencing this problem. BTW I enjoyed the jokes from the article. It gave me a smile on my face.

I could not agree more.

Nice one Nial! I have ruined few demo accounts on my mobile platform because of overtrading. But… i have followed one of your advises and am watching for obvious signals to trade. Also im not messin up with my trades and remain disciplined until reaching the targets or hitting my stop losses…

Discipline is the key to success

True, I agree with what you’ve said,I’m also a victim of this mobile trading of a thing, It makes it easy for one to break one’s rule and over trade. Nice article as always, Nial :-)

Thanks Nial, it is a great reminder!

thanks so so much Nial.i personally dont log in with my real accout on smartphone because its so close to me.i just check what market has been doing so far on it.thanks once again

Good for alerts?

Hi Nial

I quite agree, I do have mobile trading aps, but I only use them when I am away from my usual trading lap top to check if any price action has occurred on the daily time-frame, at my pre – identified SR levels

I do this at (or around) the New York close, once a day! If a trade ‘trigger’ candle has printed, I will place an order on my trading ap, but I never enter ‘at market’ either on my lap top or my iPhone)

If I am in a trade, I will monitor via my aps, only once every 4 hour bar has closed until the trade has achieved my 1xrisk profit level, when I use the ap to move my stop up to break-even.

That’s it

So, if I don’t have a trade open (or my open trades all have stops to break even or better), its only the daily check for me

Hi Nial,

Very nice article,

Mainly for the youth like us who are always busy with our iphone

In reality we should never open trades on mobile and this is my true experience, coz the numbers hypnotize us soon on the small screen and we tend to make wrong decisions.

This is an eye opening article,

thnx

Rajiv

Nice post Nial, it makes a lot of sense. Thanks for the good work. God bless you.

I use mobile mt4 only to check my trades, not to trade.

Is Mobile Trading bad for you?

For me it isn’t. I know this for sure because I do it on a regular basis and do quite well from it. Tho to be fair I don’t do it while I’m driving my car on a silly phone! I use my laptop from say a hotel room and have even traded from oil platfroms! Different Strokes for Different Folks. Forex rules shouls not be written in stone! Each trader should work out what works best for him/her!

I noted your comments on radiation risks of carrying a cellphone in your pocket people ( Joke ) many a true thing said in jest people do not realize that radiation risks are real, men prostate cancer, ears increased cancers in the inner ear don’t take my word for it ENT surgeons have noticed an increase during the last ten years, is it coincidence that it corresponds to the rise in cell phone use ? your phone your body you make the choice.

Any way back to Nials article he is wright on the money here well done.

Hi great only use my phone to call.

Thanks look forward every week to your

pearls. Cheers

Hey Nial, again this article is so correct. Thing getting easier to access always brought to over-doing. U know what, I think u are public enemy to forex brokers out there.

I’m on a mac as my primary computer, and learning your price action strategy mainly. Perhaps I can gain the necessary trading edge via this mobile platform.

Completely agree that mobile trading does more bad than good and the main logic is that it entices people to trade more and more….while at work or while living a personal life. It will not only harm trading but other aspects like job since it creates a ton distraction.

Surely, one can argue that no one is forcing us to use but still its just like an any other addiction like alcohol / smoking that increases with more availability

Mobile trading will pose more SERIOUS challenges in observing discipline.

Guilty as charged! Been doing this for quite a while now and it’s not doing me any good. I’m thinking of deleting my metatrade app from my phone. LOL.

Thanks for this eye-opening post Nial. Looking forward to reading more great articles from you.

Brilliant article as usual Niall. I first began demo trading and can fully agree with the effects if it being addictive. The pshycological aspect of knowing i could trade anytime i wanted led to over trading. It is definitely something to be wary of in regards to its overall impact on trading results.

Nice article thank Nial.

I only use mobile apps to check the markets updates And to check for perfect 1hr and 4hour trading setups. But generally mobile apps can cause problem to traders who are not strongly discipline.