The Most Profitable Markets I Trade & Why

I get a lot of emails from traders asking me whether or not my strategies work on certain markets that may not be discussed often on my site. The answer is basically, yes. The proprietary price action trading method I use is applicable to many different global markets, not just Forex.

However, with Forex trading becoming so widespread and easily accessible in recent years, many traders think I just look at the Forex market, but this couldn’t be further from the truth.

For us price action traders, learning to read the footprint of money on the chart means we can trade and return a profit on virtually any market we want. However, I’m not saying go out and apply my strategies to every price chart in the world, not even close! In fact, I recommend and teach my students to become “specialists” in a select handful of markets. This lesson discusses some of the important details and price action tendencies of my favorite markets so that you can get a feel for them and understand why I trade them.

Don’t Limit Your Trading Options

Opportunities exist globally and I trade a plethora of markets to take advantage of those opportunities, from indices to commodities to Forex and sometimes even equities. You don’t want to limit yourself to just one asset class because doing so also limits your chances of long-term success in the markets.

Limiting yourself to just Forex, for example, means that you are not going to do well when the major Forex pairs are consolidating, and many times they all consolidate at once. Expanding your focus to other markets and opportunities increases potential opportunities and potential returns. For many good reasons, hedge fund traders look to a diversified portfolio of instruments and as private retail traders we should do the same!

In addition, for those of you solely focused on Forex, the fact is that volatility is not always present in the major FX pairs we look at. So, it stands to reason that you should look outside of the Forex market regularly so that you are not without opportunities to profit. If there’s very low volatility there are going to be very few trading opportunities. In short, you have to trade what’s MOVING to make any money as a trader!

Understanding MetaTrader Product Specifications

OTC, CFD, Spot, Futures, Forex, Commodities, Indices, to the beginning trader all these different products and acronyms can seem very confusing and somewhat bewildering. Let’s simplify all of it here and now….

Spot Markets – The “spot price” of a market is quoted by central banks and brokers all around the world, for example, the current price of the EURUSD Forex pair is quoted as the “spot price”. OTC markets (this means over the counter markets) have no central exchange and trading is done electronically, directly between two parties (such as a broker and a retail trader like you) and this trading is based on the spot price of the underlying market. Contract sizes and the price per point value can differ from one broker to the next.

CFD – This stands for Contracts For Difference. It is a product offered by institutions or brokers which mirrors the underlying financial product. So, when you’re trading a CFD you are not dealing directly with the underlying market, you’re trading a ‘mirror’ market and this is how retail traders commonly access it. These mirror markets are created ‘on top’ of a futures or spot market. So, you can trade a Gold CFD for example, which mirrors the Gold futures market (called a futures cfd) or you can trade a Gold CFD that mirrors the spot Gold market (called a cash cfd).

- Gold (and some other markets) is traded as both a spot market and futures market and with MetaTrader you can trade a cash CFD which is based on the spot market, over the counter the market. The actual futures product is on a regulated exchange typically in Chicago, New York or London. Different contract sizes and different price per point value are common between brokers.

- Forex is only a spot market, however, there are currency futures traded on major exchanges but we don’t trade those.

- Commodities and Indices can be offered on a spot market or a futures market but where you want to trade spot they turn into a cash CFD and where you want to trade futures it’s a futures CFD.

Note – To trade the same markets I discuss in this article, you can access them via the MetaTrader platform I use here.

The Primary Markets that I Trade Are…

I regularly look at and follow the major Forex pairs, S&P500, SPI200 (and other major stock indices), Crude Oil and Gold are my favorite commodities. These are the bulk of the markets I like to actively watch and trade but I do look at others from time to time. In recent years, these markets have contributed substantially to my trading profits and I also traded them in the recent trading competition that I won.

EURUSD – Euro/Dollar Forex currency pair

The EURUSD, also known as the Euro/dollar is offered as a spot FX (forex) product on the Metatrader platform that I use. The spot price of the EURUSD at any given time reflects the current exchange rate between the Euro and the U.S. dollar. For example, if the rate is 1.1700, that means 1 euro is worth 1.1700 U.S. dollars, in other words, the euro is stronger than the dollar (as it is now).

- Market behavior & price action tendencies

The EURUSD tends to be the most heavily traded currency pair. As a result, in can get somewhat choppy more so than the GBPUSD or AUDUSD for example. That said, price action signals, especially on the 4-hour and daily chart time frame tend to pay off quite often in this pair. It tends to respect support and resistance levels quite nicely and is marked by sustained trending periods followed by somewhat lengthy durations of sideways movement especially within large trading ranges. The EURUSD is a favorite market of mine mainly because so many people trade it that many of the obvious signals tend to be “self-fulfilling”

GBPUSD – Sterling/Dollar Forex currency pair

The GBPUSD, also known as the Sterling/dollar or Pound/dollar is offered as a spot FX (forex) product on the Metatrader platform that I use. The spot price of the GBPUSD at any given time is showing the current exchange rate between the British pound and the U.S. dollar. For example, if the rate is 1.3100, that means 1 British pound is going to get you 1.3100 U.S. dollars, in other words, the pound is stronger than the dollar (as it is now).

- Market behavior & price action tendencies

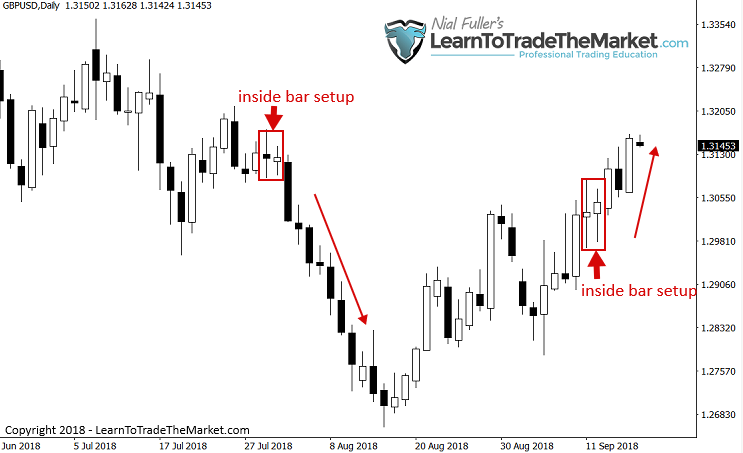

The GBPUSD tends to have higher volatility than the EURUSD, for example. This means it tends to make bigger moves, bigger breakouts, bigger trends, etc. The price action signals are typically larger / more pronounced in this pair than other FX pairs. Overall, I really enjoy trading the GBPUSD and because it’s not quite as popular as the EURUSD and has higher volatility, it tends to move more and consolidate a bit less, which translates into more potential winning trades for a skilled price action trader.

USDJPY – Dollar/Yen Forex currency pair

The USDJPY, also known as the Dollar/Yen is offered as a spot FX (forex) product on the Metatrader platform that I use. The spot price of the USDJPY at any given time is showing the current exchange rate between the U.S. dollar and Japanese Yen. For example, if the rate is 110.00, that means 1 U.S. dollar will net you 110.00 Yen, in other words, the dollar is stronger than the Yen (as it is now).

- USDJPY market behavior and price action tendencies

I will be the first to admit the USDJPY can be a choppy market to trade. It can make some erratic moves even on the higher time frames. That said, it does get into some sustained and very predictable trends sometimes, and price action signals tend to work well in this pair. It is also a very technical market, meaning, it tends to respect key levels very predictably and accurately. Just watch out for the “chop”.

AUDUSD – Aussie/dollar Forex Currency Pair

The AUDUSD, also known as the Aussie/Dollar is offered as a spot FX (forex) product on the Metatrader platform that I use. The spot price of the AUDUSD at any given time is showing the current exchange rate between the Australian dollar and U.S. Dollar. For example, if the rate is 0.7200, that means 1 Australian dollar will net you .72 cents of a U.S. dollar, in other words, the USD is stronger than the Aussie dollar (as it is now).

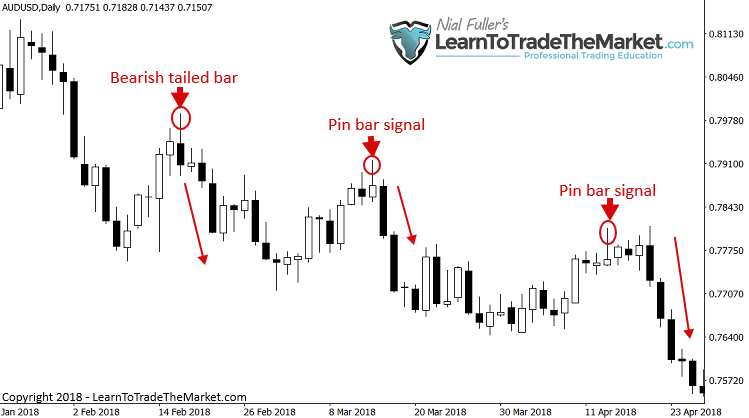

- AUDUSD market behavior and price action tendencies

Being from Australia, the AUDUSD is probably my overall favorite currency pair to trade. As I wrote in my article on why you should have a favorite market, I suggest you pick one Forex pair that you really feel comfortable with (perhaps your native currency vs. another major) and really get “intimate” with that pair. As I said in the intro, becoming a specialist trader is how you make money. It’s not different than any other field, whether it’s medicine, sports, business or investing; the more of a specialist you become, the more money you’re going to make. The AUDUSD tends to be a bit lower in volatility than the GBPUSD and EURUSD but it’s a very technical market. When it trends it’s very nice to trade and it respects levels very well. Daily chart signals tend to come off very nicely. I love trading the AUDUSD.

NZDUSD – Kiwi/Dollar Forex Currency Pair

The NZUDUSD, also known as the Kiwi/Dollar is offered as a spot FX (forex) product on the Metatrader platform that I use. The spot price of the NZDUSD at any given time is showing the current exchange rate between the New Zealand0 dollar and U.S. Dollar. For example, if the rate is 0.6500, that means 1 kiwi dollar will net you .65 cents of a U.S. dollar, in other words, the USD is stronger than the kiwi dollar (as it is now).

- NZDUSD market behavior and price action tendencies

KIWI very similar to the AUDUSD. Obviously, New Zealand and Australia are next door neighbors so they tend to have similar catalysts for what moves their currencies, this is why the NZDUSD and AUDUSD charts often look quite similar. However, be mindful that the NZDUSD can have very choppy periods, this chart will move sideways about 50% of the time. For this reason, I prefer the AUDUSD over the NZDUSD in most situations, but the NZDUSD is still a very good major FX pair to look and trade when a signal presents itself.

Gold – Commodity (precious metal)

I trade spot Gold (XAUUSD) which is in fact a cash CFD. Gold is obviously the most popular precious metal in the world and is also the most widely traded.

- Gold market behavior and price action tendencies

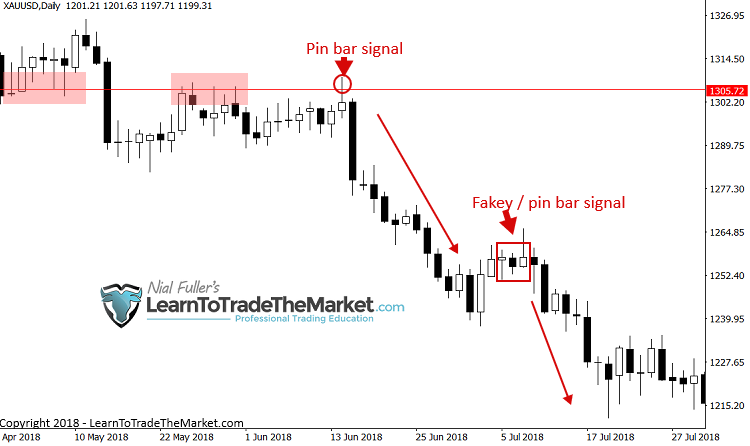

Gold tends to trend extremely well in between periods of consolidation. The consolidation can be very choppy and difficult to trade at times, however. Gold can be volatile and large directional moves are not uncommon, this means huge potential for profit, but also for loss if you are not skilled and well-prepared. Gold is one of my favorite commodities to trade.

Crude Oil – Commodity (energy)

Crude oil is offered as a cash CFD (spot symbol – USOIL) or a futures CFD (symbol – WTI.fs), either one is fine to trade just be aware that the prices are different. Crude Oil is the most popular energy commodity to trade and along with Gold is one of my top two favorite commodities.

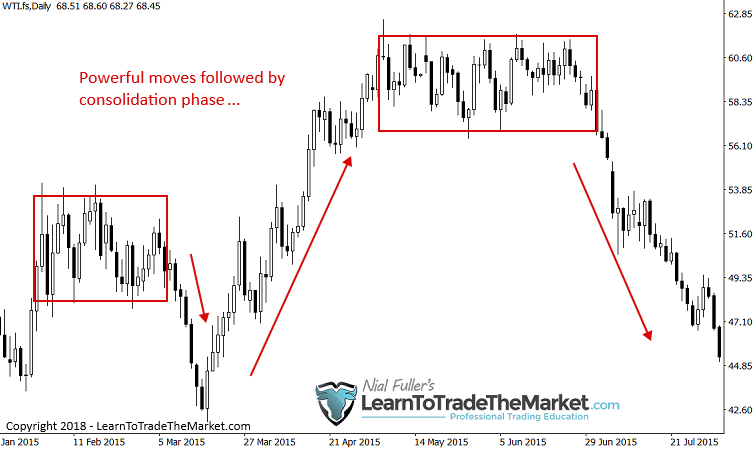

- Crude Oil market behavior and price action tendencies

Crude Oil is a market I trade quite frequently, probably even more so than Gold. I would say it’s my favorite commodity to trade, and for good reason. Crude tends to experience prolonged periods of strong trending / directional moves and it also respects key support and resistance levels very well, typically. Oil can be very volatile however, so it’s not for the amateur or inexperienced trader.

- Crude oil will often consolidate for weeks or months after a big move

S&P500 – U.S. Stock Index S&P500

The S&P500 is offered as a futures or cash CFD on the Metatrader platform I trade on. You will see the futures cfd symbol as S&P.fs and the cash CFD symbol is US500.

The S&P500 is comprised of 500 of the biggest and most important, predominantly U.S.-based companies and is considered to be the world’s leading benchmark for investors of all types. All stocks in the S&P 500 index are traded on the New York Stock Exchange and NASDAQ.

- S&P500 market behavior and price action tendencies

The S&P500 is another market that I trade quite often. It is a very good market to ‘buy and hold’ as U.S. stocks tend to want to trend higher. However, in times of recession or economic turmoil, this market can sell-off extremely quickly, wiping out gains fast. So, whilst it is a relatively ‘easy’ market to trade, it does take a solid understanding of price action and market dynamics to profit in it over the long-run.

SPI200 – Australian stock index

The SPI 200 Futures contract is the benchmark equity index futures contract in Australia, based on the S&P/ASX 200 Index. It provides all the traditional benefits of equity index derivatives. The SPI 200 is ranked in the top 10 equity index contracts in Asia in terms of traded volume.

The SPI200 is offered as a futures or cash CFD and you will see the futures CFD symbol as SPI200.fx and the cash CFD symbol is AUS200.

- SPI200 market behavior and price action tendencies

The SPI200 is a specialty of mine, so to speak. I have been following it and trading it for more than a decade. This market tends to rotate from key levels and so is one that we want to look to ‘fade’ often, in other words, when price makes a move into a key level, we look to trade the other direction or fade that level. This can throw many traders off because just as it’s starting to make a strong move it will often reverse strongly, the other direction. But for a well-versed price action trader, these strong movements from key chart levels are enough to make your mouth water.

DAX – German Stock Index

The DAX (German stock index)) is a blue chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange.

The DAX is offered as both a futures and cash CFD on Metatrader, and you will see the futures symbol as DAX30.fs and the cash CFD symbol is GER30.

- DAX market behavior and price action tendencies

The DAX trades similar to the S&P500 in that it will often trend upwards quite nicely and sometimes for a sustained period, then, seemingly out of nowhere the market will nose-dive 10 – 15% in a few days. Not for the faint of heart to be sure. However, this volatility is a blessing if you understand it and know how to read the price action and get in and then exit your trades properly.

Why I Don’t Look at EVERY MARKET…

One thing that is probably on your mind is why don’t I trade many different markets? After all, I could trade hundreds of products you’re thinking! Well, I narrow it down to the most liquid products and then I narrow it down further to the markets that I see the price actions signals producing more consistent outcomes in, so I know I have an edge.

Let’s look at a couple examples of why I choose the major market over the more ‘obscure’ or less-traded counter-part:

GBPUSD vs. EURGBP:

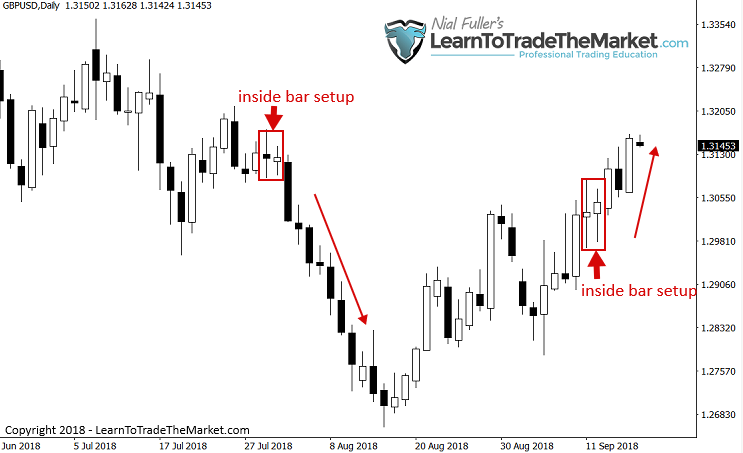

Below, we see a daily GBPUSD chart. Notice the powerful down and up moves and the inside bar signals that have worked out well so far. This is just the current daily chart view of the last few months and we can see it’s moving nicely and not very choppy at all.

Compare the GBPUS chart above to the EURGBP chart below, showing the same time period, and you can see it’s a much more confusing and barren chart to trade (not many good signals, if any). This chart looks ugly and if you were following this one everyday and trying to trade it, you’d probably lose.

Gold vs. Silver:

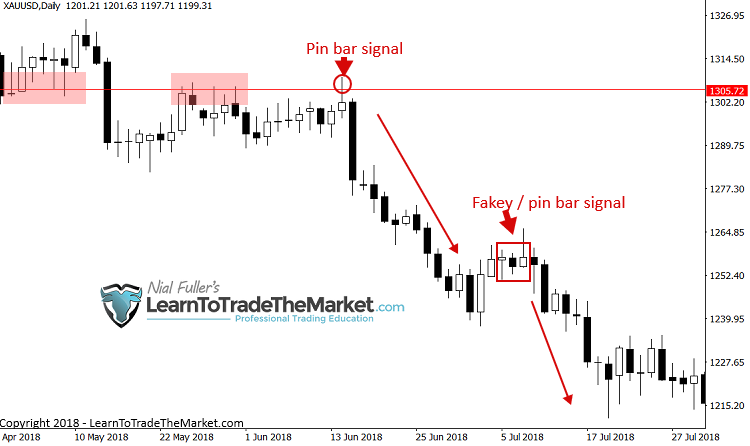

I prefer Gold over silver. It’s more liquid and widely followed and it moves better, and who wouldn’t want to trade Gold? It tends to swing a lot and trend a lot (good things for price action traders) and the signals that form tend to be quite pronounced.

In the daily Gold chart below, notice the nice trend and the clear signals that formed within that trend. Compare this to the Silver chart below it (showing the same time period) and you will see quite a difference.

This chart is messy and choppy, hence it’s much harder to trade this than the Gold chart above, it doesn’t take a rocket scientist to figure out why…

Conclusion

The proprietary price action trading method I work with is applicable to many different global markets, not just Forex, as you can see by the above examples. However, just because there are literally hundreds of different markets you can trade doesn’t mean you should trade them all. I have found that becoming a specialist on certain markets, you will significantly increase your chances of long-term trading success. You can trade every single precious metal out there, but why? I trade Gold, because it’s the biggest and the best precious metal market to trade and it’s price action signals produce the most consistent outcomes.

If you want my weekly and daily analysis on the above markets, I analyze their price action and discuss potential trade signals in my members daily trade setups newsletter. Also, all my course teachings and strategies can and should be used on indices, commodities and Forex, as discussed above, and can even be applied to major equities. As I mentioned above, when you learn to read and trade off the “footprints” left behind by the price action on a chart, the opportunities are near limit-less. However, not all opportunities are created equal and that is why you need to become a specialist!

Note – If you want to trade the same markets I have discussed in this article, you can access them via the MetaTrader platform I use here.

What did you think of this lesson? Please leave your comments & feedback below!

Very informative and hope to follow your footprints to success, thank you Mr. Fuller

Always nice work nial, thanks.

Hi Nial

Powerful information. Thank you.

Very encouraging & helpful. Excellent inspiration to kick start my trading career. THANKS LOTS

That is an article that needs to be achieved for referral.Thanks once again.

My Big Thanks Sir Ni

thank u

Very informative! Thanks for sharing.

great !

Your thoughts are very insightful, Inspiring and uplifting to all traders that read your article. thank you and keep the good job up.

Hi Nial, thank for amazing article. I have a question, in MT4 platform there are WTI and Brent crude oil. Why do you prefer to trade with WTI ? Thank you !

U are really helpful teacher. Eat well sleep well and trade well

Sincerely insightful, Thanks Fuller.

Great stuff bruh

Thank Sir for sharing this information.it is really encouraging and inspiring.Thank you very much Sir.

Very helpful article as always.

i was about to open eight exotic pairs, but not anymore!

Many thanks

very useful article but would suggest being extra vigilante when trading GBP. As Friday’s (21/09) price action confirmed Brexit negotiations make this currency very vulnerable to all nuances.

Dear Maestro Nial,

Thank you for your kindness.

Peace onto you & the whole LTTTM team.

Great advice, evidence based and well explained as always – it just makes sense.

Answers a lot of my unasked questions as to why you prefer the markets you prefer. This also makes the course of action, AFTER reading your weekly and daily market updares, clearer.

Thanks for the article.

Another excellent article, lots of advice given without padding, clear concise and easy to understand.

Thank you

Hi Nial

Sounds interesting. But which calculator are you using to work out your position sizing for Gold, Oil, DAX, SPI200 and S&P500?

A very informative article,I should have been part of the course.

Love it so much. thanks and be more blessed.

Thanks, very insightful.

Thank you Nial. God bless you!

Thanks Nial ! Very good article! Thanks!

Excellent. Worth its weight in Gold. (Rather than silver or crude oil…)

Hello Nial.

It took years of being a loser before I finally accepted your advice to limit my trading to the daily chart. What a difference it has made. I firmly believe the reason so many of us traders continue to day trade the small time frames is the same reason casino gamblers love to gamble even as they lose time and time again. They are addicted to the prospects of winning and cannot change the reality that they are doomed to be losers. Sadly, the facts on traders and casino gamblers bear this out.

Nial, your advice on how to manage the daily charts is what has made the difference in my trading career. I thank you, Mate.

Hello Dennis. I share that same experience. After a read Nial saying the daily chart is more accurate and more profitable, i took a while to change all my trading style. But when i did this, my entire career has change for the best.

I do believe that daily chart is the best to trade, because their signals are more correct and it gives far less false signals. But i also believe that the fact we spend less time watching price movements has a weigh on the results.

Very nice comment.

Fantastic article. Nial I am still struggling. But because of I will be successful trader.

May God bless you and your whole family.

Thank’s, Nial.