How to Stop Being Your Own Worst Trading Enemy

How many times have you just wanted to kick yourself because you exited a trade for a loss before it hit your stop loss, only to see it take off in your favor without you on board? Or, how many times have you felt the extreme frustration that comes with giving back your recent trading profits to a trade that you knew was ‘stupid’ before you entered it?

How many times have you just wanted to kick yourself because you exited a trade for a loss before it hit your stop loss, only to see it take off in your favor without you on board? Or, how many times have you felt the extreme frustration that comes with giving back your recent trading profits to a trade that you knew was ‘stupid’ before you entered it?

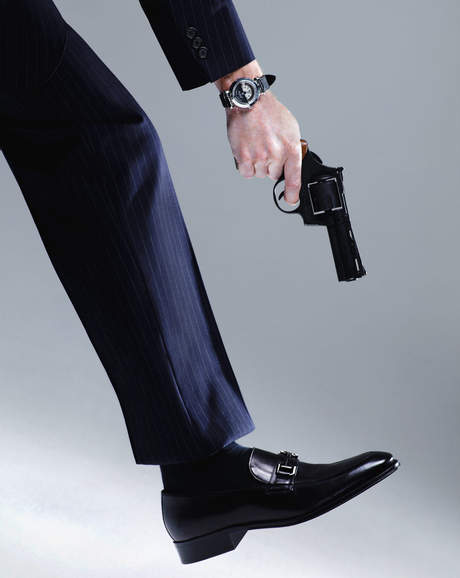

Trading can be thee most frustrating profession in the world, if you let it. The less ‘unforced errors’ you make in trading, the better you do, just like tennis. The worst way to lose money in the market is by doing something that you know you shouldn’t do, but do anyways. We are all guilty of them sometimes, the key is to limit these unforced errors as much as possible so that you are doing everything you can to put the odds of trading success in your favor, instead of shooting yourself in the proverbial foot.

‘Unforced Errors’ Can Destroy Your Trading Account

If you’ve ever played a game of tennis against a competitive friend, you know how maddeningly frustrating unforced errors can be. Essentially, an unforced error means that you ‘gave away’ the game to your opponent because of ‘stupid’ mistakes that you made, which were easily preventable.

Now, unless you’re Rafael Nadal or Novak Djokovic, you probably don’t have a lot of money on the line if you’re into recreational tennis, yet you still know the frustration of unforced errors. In trading, ‘unforced errors’ basically means making stupid trades / over-trading / over-leveraging your account. Except, when your real, hard-earned money is on the line, and becomes the direct ‘victim’ of these unforced trading errors, it can literally make you feel like you want to jump out of your own skin. I’m sure you know what I’m talking about!

Unforced errors in tennis, whilst still preventable, might actually be a little harder to control than unforced trading errors, because in tennis you are trying to control your entire body, and hitting the ball just a little too hard can send it flying out of bounds (unforced error), for example. In trading, unforced errors are entirely preventable because they are simply the result of a lack of discipline and logic. You can change the way you think about trading by making a conscious effort to do so and you can work on controlling yourself in the market better, so as to totally eliminate unforced errors from your trading. But you will have to work at it.

Trading is hard enough as it is, you don’t need to do ‘stupid things’ in the market that you know you shouldn’t do, you will have enough losing trades without doing these things. So, don’t make it any harder on yourself than it needs to be!

Here’s a list of concrete / logical ways to help eliminate ‘unforced trading errors’ and put the odds of trading success back in your favor…

How to Eliminate ‘Unforced Trading Errors’

It’s going to take a conscious effort to have the focus and discipline required, but if you want to become profitable in the market, you have to eliminate the unforced trading errors that plague most traders. Here are some things to focus on that will help you reduce and eventually eliminate unforced trading errors…

- Stop closing trades out manually unless there’s a REALLY obvious reason to do so. Closing trades out manually before they hit your pre-determined stop loss is almost always a bad idea. Let the trade play out, if you don’t, you’re voluntarily eliminating the chance of profit and simultaneously implying that you know ‘for sure’ what the market will do next. This is both arrogance and ignorance! You have a trading edge (your trading strategy, e.g. price action), so if you enter on a valid price action trade setup, then you need to let that trade play out to have a chance to work in your favor. Otherwise, you’re cutting down its overall profitability / ability to make you money.

- Stick with your initial trade idea and gut call. Don’t waffle and close out perfectly good trades soon after entering them just because the market moves against you a little bit. Stick with your gut feeling and trust yourself and your trading method! If you cannot do this consistently over time, you stand no chance of making money in the market because you will not have a trading edge, you will have nothing but a bunch of randomness and pointless actions in the market, i.e. gambling.

- Stop jacking up your risk! Risking too much per trade is probably the quickest way to become your own worst trading enemy and is a very dangerous ‘unforced trading error’ to make. Trading too much (when your edge isn’t present) and risking too much per trade are the two biggest mistakes traders make and are the two most preventable trading errors. If you can simply eliminate these two unforced trading errors, you will probably start seeing profits build up in your trading account, over time.

- Stop focusing on rewards and profits. What you should be focusing on is learning to trade properly and becoming a good all-around trader, because that is how you make money. Most traders get ahead of themselves and begin focusing way too much on profits and reward and day-dream about quitting their jobs or telling their boss to ‘shove it’, etc. This is really not constructive or conducive to becoming a successful trader because it simply diverts your focus from what really matters. Focus your attention on managing risk, preserving your trading capital, and becoming a master of your trading strategy, and you’ll find that the profits begin to take care of themselves.

- Stop looking at lower time frame charts. Unless this is your first day reading my blog, you know I preach the power and effectiveness of higher time frame trading. There is just no need to analyze any time frame under the 1 hour chart. These low time frames are also low-probability and do not give you a significant perspective / view on the market, and they are just too ‘noisy’ and unpredictable. Remember…don’t make trading harder than it already is! Trading very short time frames, like those under the 1 hour chart, is doing exactly that!

- Stop over-analyzing unnecessary variables. Traders typically spend way too much time analyzing the charts and looking at unnecessary variables. Trying to trade the news is perhaps the single biggest waste of time and over-analysis mistake made by traders. People have different views on news trading and some don’t agree with me on my views, but the fact that the price action reflects all variables that affect a market, is simply a fact and is indisputable.

- Make a conscious effort to remind yourself of what your trading strategy is, stick to it and track it. This means having a trading plan and actually following it, as well as having a trading journal to record your trades. A trading plan can simply be a checklist of what you’re looking for in the market and maybe even trading affirmations / reminders to stay disciplined and to not deviate from your risk management plan or your trading strategy. All of the things that you know you should do in trading, should be included in your trading plan and they will act as a reminder of what you need to do to succeed. Eventually, these things will become habit, but to build that habit, you need to follow the trading plan.

Conclusion

The primary reason most people fail at trading is due to ‘unforced trading errors’. If you simply get out of your own way, and let your trading strategy and the market ‘do the work’, you will stand a far greater chance of making money in the forex market.

Unfortunately, as humans, we seem to be ‘hard-wired’ to make the ‘unforced trading errors’ discussed in today’s lesson, and the only sure-fire way to overcome them is to make a conscious effort to do so. The tips discussed above are an excellent starting point. Of course, to ‘get out of your own way’ and let your trading strategy do the ‘work’, you first have to know exactly what your trading strategy is and have it ‘mastered’. You can learn my simple price action trading strategy by taking my trading course and joining my members’ area, this will be a good first step in formulating a plan of action to put the odds of trading success in your favor, instead of continuing to be your own worst trading enemy.

the master at his best again!

nial,

Absolutely spot on Nial.

It is truly infurating to pick

a good trade then pull out too

early. Lack of Moral Fibre

my father would have called it.

Great info as usual. We tend to forget with all the day to day life of jobs, family and business.

Really appreciate the pep reminders.

Never can have too many. Thankyou

Good Article Nial ..

This article should be stuck on or next to our trading desk and read each day before we trade.

Thank you my Mentor.I can not have enough of your lessons,very educative.

Another great and inspiring lesson.Thanks a lot Nial.

The seven points are so true. great wisdom. thanks

Great piece, Coach! Your articles keep shaping us up to become better traders. Keep up the good work.

Thank you Nial.

Thanks Nial great lesson!

another excellent article Nial, I liked this one as it was unfortunately relevant,

do you reckon those behaviors are unconscious? do you have suggestions around that?

cheers

I have been following your lessons ever since i joined the Demo account. After using your notes am now building to $1500 and enjoying every moment.It’s so lovely but wonder whether the same is with Live account.

Thank you Nial, great article.

Oh boy, am I battling with discipline! Last night I entered a trade I shouldn’t to “make up for my loser” it went in my favour but I felt anxious all evening. For the last two months I’ve hovered around break even, my money management is consistent but I guess I’m hovering at BE for all the other reasons in this article! I’ve decided to start looking at trading as a business so I shall hear from you soon when I sign up for your course!

Thanks for the blog.

THANKS A LOT GRT ONE !!!

Thanks a lot Nial,

In deed this a very good lesson for those battling for discipline on their trading carrier, I recommend that people should read this over and over again.

great wisdom. if attention is paid to the above, then we have a successful trading community.

thanks nial.

hello

i hv been in th fx for over a yea but i hv lost a lost hw can hel me

Great as always Nial,thank you.