Trading 50% Retracements with Price Action Confirmation

This is one of the most powerful price action trading strategies you will ever learn, it’s one of my favorite patterns. You need to learn this, and apply it.

This is one of the most powerful price action trading strategies you will ever learn, it’s one of my favorite patterns. You need to learn this, and apply it.

Enjoy the lesson…

In this price action trading lesson, I am going to explain how to use the 50% Fibonacci retrace in conjunction with a price action reversal ‘confirmation’ signal, ideally a pin bar setup or fakey bar reversal setup.

It is a widely accepted fact among chart technicians that most major moves, and many minor ones, will eventually retrace to around the 50% level of the move. There are many reasons why these 50% retracements are so prevalent in the market, but we aren’t going to speculate on those today, because in the end it doesn’t really matter, what matters is that the 50% retrace is a very real and very useful event to be aware in the market.

I am only a fan of trading the 50% retrace off a swing low or high as long as there is a price action signal to confirm its validity; meaning, I don’t “blindly” enter only because the market has retraced to a 50% level. My trading is all about confluence and finding evidence to support the price signals on the charts.

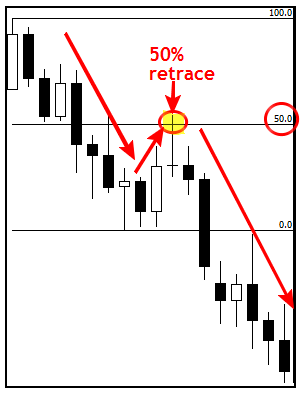

How to find the 50% level of a move

Before we talk about trading price action signals from 50% retrace levels, we need to be clear on how exactly to draw in the 50% levels because I know from some of the emails that come in on the support line that some traders don’t really understand how to properly draw use the Fibonacci drawing tool on their Meta Trader 4 trading platform.

Quick note: I don’t use all the other Fibonacci extension levels because there are just too many of them and I don’t see the point of having so many different levels all over your charts. The 50% phenomenon has been proven across hundreds of years of technical analysis whilst the other Fib levels are much more haphazard and self-fulfilling in the sense that if you put enough lines all over your charts, some of them are going to get hit regardless of whether or not there is any significance behind them or not. I primarily only use the 50% level, but for me it is an ‘approximate’ 50% retrace and that means if a valid signal forms near the 50% level, say anywhere from a 45% retrace to a 60% retrace, I will also count that as a valid retrace and treat it the same I would as a signal exactly at the 50% level.

It really is quite simple to draw in the 50% levels, but it’s important that you understand where a move begins and where it ends, because I know some traders get confused about that. Where the move started should be an exact high or low of the move, or very close to it, this is where you first place the Fib tool, then you click and drag the other end of the Fib tool to the other end of the move; where the move terminated. Where the move started you should see the “100.0” in the top right of the Fib tool and you should see the “0.0” in the bottom right of the Fib tool. This might seem confusing at first to have the 100 % level at the start of the move, but it makes perfect sense if you think about it like this: You are looking for a retracement of a move, so by the time the move is finished and the market starts retracing, it is moving back toward the origin of the move and if it were to retrace back up or down on the whole move, it would then have retraced 100% of the move. See the chart below for more help:

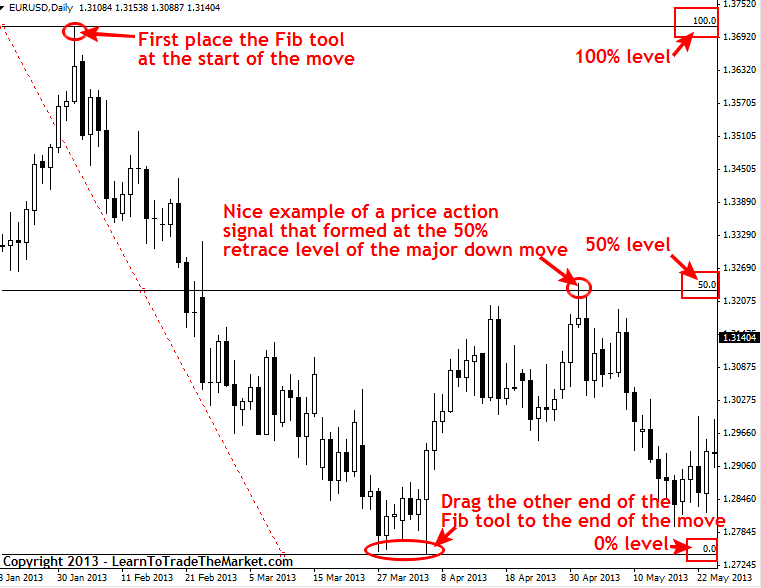

In the example below, we are looking how to properly apply the Fibonacci tool to find the 50% retrace level of a major down move in the EURUSD pair:

How to trade price action signals from 50% retrace levels

When you have a price action signal present on the daily chart, you then match up the fib 50% retracement level if there is one present (see chart example below), if the price action candlestick signal matches up with the 50% swing retracement level then you’re good to go and potentially have a valid trade. If you can also find a relevant horizontal level to match up here, its a ‘double whammy’ of confluence (a reason to get excited).

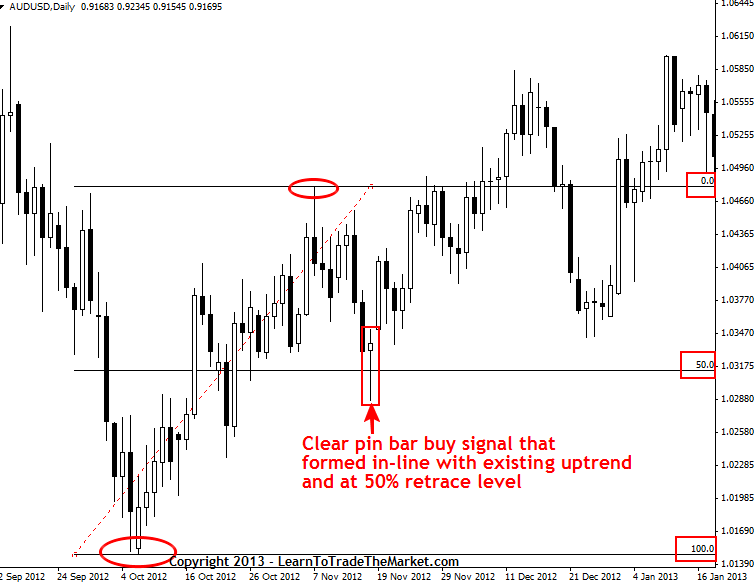

The process of trading the 50% retrace is simple, below is one example of a recent trade on the AUDUSD pair:

After finding the potential trade signal, decide to enter at market prices, or wait for a pull back to get your stop loss tighter to reduce overall risk. In the chart example above, given the ‘perfection’ of the setup, as prices started to move up in the correct direction, a long entry could have been taken, momentum in the correct direction is always a good sign.

These obvious and ‘perfect’ price action setups at a 50% retrace level can lead to huge moves on daily chart time frames and learning how to identify and trade them can give you a very potent trading tool for your price action trading toolbox.

I personally feel that when a trader looks for the price action signal first, then matches up the supporting factors (confluence) they tend to make better trades. What I am saying here is this…if you see a giant signal on the daily chart, find out what other factors are backing it up and showing supportive evidence; we won’t always be able to trade a signal, mainly because we prefer not to fight the natural trend of the market, and many times we see signals forming against the trend.

In the next chart example below, the 50% swing retrace line and price action signal both came together at one common point and showed us a nice setup here, but what you should really take away from this example is that it was in line with the general thrust of the market, notice that prior to the pull back, we saw a nice rally up, and the pull back did not exceed the 50% area , rather it rejected it strongly and has now bounced aggressively higher to the new recent highs.

In this example we can see a 50% retrace in the EURJPY and a price action buy signal that formed showing rejection of it:

I hope this article clears some confusion about Fibonacci levels. Personally, I only get a handful of these setups every month on the daily charts, but when you see these swing retracements inside a general trend movement, its wise to mark them on your charts and then look for a price action confirmation entry signal. These setups typically lead to some very significant, and potentially very profitable moves, for more information on trading price action signals from 50% retracements levels, checkout my price action course and members area.

you are fantastic master

Thankyou Nial Fuller.

Informative lesson. Thanks

I just found thos out last week on the chart and I saw it gob ng more profits and I started searching more about it and I saw your article. You just confirmed it to me that this strategy works out perfectly. Thank you

thanks sir

I love this article as it deeply explains the in dept work of Fibonacci

You don’t cease to Amaze me!!

All I have got to say to my PROFESSOR COACH

BRILLIANT!!

Thanks Nial you the best.

Thank Nial for the lesson i hope this article can help me in trade strategy.

Thanks Nial …a good article with nice charts using 50% retrace as confluence level.

wah! great Sir.Thank you very much.

Thanks Nial, this was very informative. I understand now!

good luck in trading John.

Hi Nial Thanks for explaining the subject of Fibonacci levels clear and understandable in relation to trading forex.

Hey Nail…

First of all, I would like to thanks a tonne for you nice articles which will boost and increase our confidence levels with Forex Trading…..

I almost completed all your articles and found a very little information about “fibonacci” and only in this “Trading 50% Retracements with Price Action Confirmation article”. I have heard most of the traders use “fibonacci” levels for their trade setups. Do you personally recommend this. If yes, can you please let us know more about this “fibonacci” levels.

Thanks

Venkat

nice strategy

will be trying it out (thou i still lack discipline)

Mister Nial Fuller, I only just became familiar with your work a couple weeks ago. This past weekend I read this article, and then yesterday three lovely setups appeared on the daily charts at the same time. I took all three and increased my account by over 41 percent. All of my money is off the table for these trades, but it will be interesting to see how much further they go. Thank you so very much!

Thanks Nial for these lovely simple examples

Dear Prof, You have given another good angle of elevation to our trading career. thanks again.

Respected sir

it boost up my confident.

Thank you sir

Thanks Nial that clears a lot of things up for me.I am a newbie, I forget to do the 50% fib. Great lesson

Hi thank you for the education I trade retracement too just as you said it’s a good set-up in a month it gives me over n300% profit though I lost half of it the following month because of lack of money management. so thank you this just confirm that the system is good.

Thanks again

Thanks,Nial,you have said it all concerning the 50% fibo retracement which has greatly made my day.

Hi Nial,

Great combo! pinbar on a 50% or 61% fibo retracement gives me an edge rather than to wait for the next candle to close, thank alot….

Dear Nial,

Your explanations are very refreshing and easy to understand. Your style only reinforces the idea that trading should be kept simple. Thanks again

Simple, effective & profitable – like it!

Hi Nial,

I have been reading our articles they are clear simple & easy to understand. Thanks

Thanks for this artical.

HI Nial

Its a great article and website.

I’ve been reading your articles over and over again just to understand what you’re saying and so that I don’t miss out anything.

For this type of 50% retracement setup, when do you start putting your order? right after the day of pin bar appear?

Thank you for your time.

Hi Lucan, please email me for details on this.

Please is pin bar only the price action signal one have to expect on the daily chart in confluence of 50% fib level?

You are good thank you for making good me too GOD BLESS YOU.

Great stuff Nial !!

Every article I read has tons of new info.

Great, Nial. Thanks a lot.

great piece….. wud incorporate it to my trading tools.. Thanks a lot

Wow! Another arrow in my quiver. I wonder if this is brought out better on the daily chart or does 4 and 1 hour charts display 50% retracements equally so in the handful that occur throughout the month?

Nial, I have just found your website and cannot wait to get stuck into all this free trading advice you have on your website. I love price action trading and have only recently realised how nice it is to trade without indicators.

Keep up the great work.

best to found your wedsite,good strategy for us to use,thanks.

Thanks for posting this technique. I hope will let you know how my trading goes..Shane

God rewards you for helping others. Nice article as usuals-thanks

This is a great looking setup to minimize risk while increasing the probability that the trade will work out! Glad I found you Nial! :-)

nial, you’re a great guy, i’m just receiving the mail thanks a lot it a nice one.

Hey Coach as always you keep showing great potential setup.

I will now start using this one into my trading plan.

Keep the good work mate.

Cheers !

Hi Nial,

Thanks a lot for sharing this another clear strategy, you’re a great help for us newbies here.

Carlos Pinon

This is so good.. just had to come back and read again.. It shouldnt be here for free..just got a cracker tday off a 4 hr mther candle..SPOT ON ..fr 75 points.

This is a very special set up for me nial.. i use quite often on big 4 hr candles and look for rite candles with increase vol..

Very well explained.

THANKS NAIL ARTICLE! Am really improving in this business industry through the knowledge I get from you.”You are God sent to new traders” Thanks again!.

Thank you for price action candles,it is very interesting and now I am practicing it.It is very clear to me.

Thank you

Thanks, this is a powerful strategy. How come I have never noticed it at all? Well done, I deeply grateful for this eye opener strategy

thanks for this article about fibs retracement.. It is always easy to make things simple like what you did.. because before i am confused about this retracement levels.. More poweR!!!!

Signal with the TREND, Fifty percent retrace, Horizontal Support,PRICE ACTION – Pips Conquered – Thanks for the Advance Course Material – Conquering pips have become secondary to me after I read your course, Now, Whole scope is, Enjoying the trading with STRESS FREE method, Few pure Price action Trades and having more time for my self. Once again Thanks for the Advance course.

certainly focuses some credence to this timeframe, one needs to respect it.

Thanks for this setup Nial. Yes you are right 50% fib is the best setup to use period as the major players always use the 50% fib and out of all the fib numbers has the highest probability of price reacting there. Good to know someone is thinking like the big players.

Nice & simple, price action, Not a reproduction of Jackson Pollocks”Blue poles” painting, Good one, Niall, Thank you:-)

Fantastic Nial. Never thought of just the 50% fib your right a lot of traders look at this on the daily charts.Pretty much center point of the sell and buy zones also.

Nial:

I enjoyed this tutorial. It was explained clearly and concisely so I can understand it and use going forward.

Well Done

Thanks Nial for showing current examples.Keep them coming, so we can improve our trading.

Larry

Hi Nial

I’m really knuckling down to practicing and trading the way you instruct on the 4H and daily time frames, I going to be moving away from the lower time frames. Less pressure, less time consuming and easy to understand, that’s how trading should be.

Always look forward to your teaching lessons and web updates.

Best regards

Tom

Hi Nial

Thanx for this example. Nicely explained. Well done.

Great Nial,

This is really good stuff!

DR

I am fascinated by the way price action works. I need a good instructor. I need to have some success in my trading career……………Jim

Dear Neal, Thank you very much!

Dear Nial,

Hi,

Yes I have got 166pips on AUDJPY with that retrenchment 50%.

it was very nice signal.

What do you think, does this pairs (AudJPY and AUDUSD)get 138.2 level of Fib?

Hope to get such signal in near future.

thanks

Hello nail

Thank you for all this stof you have the most of the time small text but i tell us much to much thanks for every thing.

And the videos are great .

thanks again.

Greet you ,

Yoenes from the netherlands

i like this trade setups because it carries a high probability. in addition, i have noticed that such reversals occur after price bangs to round numbers( 50 and 00 endings as in 1.0050 and 1.0000 or quarter numbers( eg 25 and 75 endings as in 1.0025 or 1.0075).

thanks nial for the post because you are one of the few that teach how to trade the right way.

Dear Nial,

Thanks a lot for this explanation – I had noticed the pin bar on the AUD/JPY that you highlighted on your Trade Setups Blog…I had had the support marked through the 79 region as one area of confluence, but I hadn’t realised that it was a 50% retracement zone as well (a second area of confluence) – I need to pay more attention obviously! ;-)

Very useful tips here Nial and the explanation is crystal! You are helping me to see the markets in such a simple way – Thanks again !

Nial,

Super example…appreciate your continued efforts helping the Forex trading public…

Thanks much.

This trade is very well laid and easy to understand. Thank you!

Nial – you always do a good job putting things in a nutshell. Thanks for this great article.