Best Price Action Forex Trading Strategies

In this Forex trading strategies lesson, I am going to share with you guys three of my all-time favorite price action trading strategies. Trading the Forex markets does not need to be technically complicated, by making use of simple price action patterns like the ones discusses below, we can trade from a clean price chart as well as a clean mindset. Most traders end up over-complicating their trading approach, don’t be one of them, be different, trading with simplicity and clarity, trade with price action.

Pin Bar Entry

The pin bar is a price bar which has rejected higher or lower prices. Price will open and move in one direction, and then “reverse” during the session to near or past the open.

The pin bar formation is easy to spot because it has a long “tail” or wick. It is a common reversal signal which typically needs to occur near a support or resistance area. Some traders use them in conjunction with Fibonacci retraces as well as moving averages or horizontal support and resistance levels.

In a nutshell, pin bars are the ultimate strategy for picking up major swings in prices. In my experience, the Forex market is most responsive to this entry signal, due to the number of traders in Forex, the pattern becomes self-fulfilling and it also shows you when a change in price direction is imminent, whatever the reason may be.

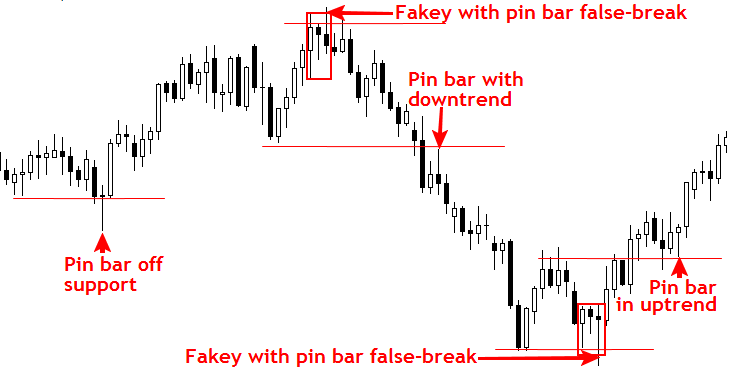

In the chart below, we see multiple examples of what good pin bar setups look like. We also see some fakey setups that had a pin bar as the ‘false-break’ bar, you will read more about the fakey later in this lesson.

Inside Bar Entry

An inside bar is a bar or series of bars which is/are completely within the range of the preceding bar, i.e. it has a higher low and lower high than the bar immediately before it (some traders use a more lenient definition of inside bars to include equal bars). On a smaller time frame it will look like a triangle.

An inside bar indicates a time of indecision or consolidation. Inside bars often occur at tops and bottoms, in continuation flags, and at key decision points like major support/resistance levels and consolidation breakouts.

They often provide a low-risk place to enter a trade or a logical exit point.

The most logical time to use an inside bar is when a strong trend is in progress. If we play the break out, our stop loss can be defined by placing it below the half way point of the outside bar or mother candle.

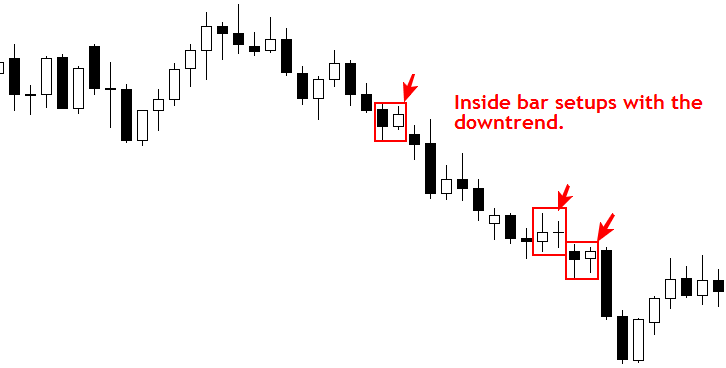

In the chart below, we can see three different inside bar setups that occurred within the course of a down-trending market. Note the large risk reward opportunities that were available from these inside bar setups due to the small stop loss distance and the breakouts that occurred. Inside bar setups often lead to significant breakouts like this because markets tend to contract and consolidate before they make large directional moves.

The ‘Fakey’ Entry (Inside Bar “false break pattern”)

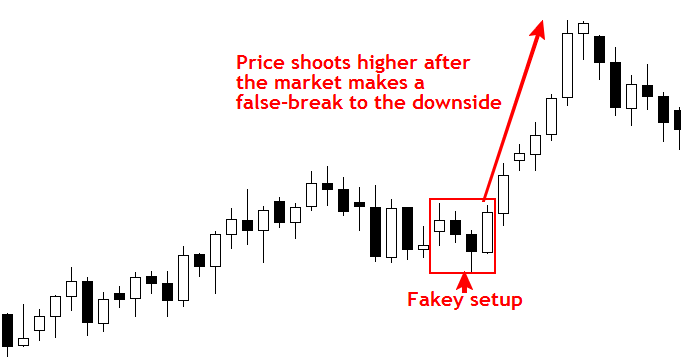

The fakey pattern is the result of a false break of an inside bar setup. Instead of the market going with the initial break of the inside bar pattern, the market “fakes out” and reverses back past the other side of the inside bar. This often initiates a solid burst of momentum which can last one day or more. As we can see in the chart below, a false break of an inside bar pattern occurred and the next day price broke up above the inside bar high and shot higher for the next 6 consecutive days. Now, not all fakey’s will result in such a strong move, but when trading with the existing trend like this they are usually a very high-probability price action trading setup.

If you would like more information on the price action strategies discussed here, and how to develop them into a complete Forex trading strategy, check out my Forex price action traders’ course and members’ community here.

Thank You For This Nial… Appreciate It Very Much

G88888888 Job Boss….

IN ONE WORDS SUPER…..

KEEP IT UP……

CHEERSSSS……….

Very useful stuff.. Thanks.

Good trading syatem. I ‘ve tried it and may trading consistent now.

This is very cool!! Though new to the market but keeping it simple is a strategy I will like to put into my demo and finally commit real money. Keep it up

these three patterns, I use for my intraday trading and are very effective.

just minting money.

thanks Guru Nial

Fantastic explanations. This week I did not read anything, just your articles. Closed fx and watched all the videos of yours and I learned so many important things. I read lots of complicated books and loose lots of money for my budget. And today I earned serious money with your simple price actions. Thanks man. You are a big guy.

Brilliant work! Glad to see there are really true mentors out there. I’m a newbie. I do understand what you are explaining…… being trading 1 minute candle stick but just keep loosing money on my real account….is this pin bar applicable to all different time formations of candle stick.

So Nial, it there anything else to Price Action than pin bars and inner bars?

Great stuff as usual though.

Peace

DR

Nial your a genius. Great teacher. You’ve changed the way I see the markets. I can actually SEE now.

I see another false continuation on that cable daily chart, before the up legs, there is a double inside, looks like it broke support slightly and then shot up for 7 days. Would of been a nice 1000 point pop.

I just want to thank you, you’ve changed the way I trade. I’ve always used S+R and played breaks and reversals, but the PA techniques and the way you explain them, are so clear to me. It’s like I can see now. I don’t need anything but S+R & PA. I also use Fibs. I’ve never used a .55 level before either, I look forward to experimenting it. I can’t thank you enough.

Anyways I’m up 500 points today, just on the GBP/JPY and the Cable.

Great work bro! Glad to see there are some true mentors out there.

Thank you for the explanations. Price action has always alluded me and I tend to get into bad trades, often(still Demo phew :)… I look forward to see how these setups will help my win/loss risk/reward ratios.

Thanks

Thanks for the explanaions but being a newbie, I’d rather you gave a clearer example with a possible trade setting, say, ‘supposing you want to go long at…, you could enter using the inside bar strategy’etc.

That would make it more real for a newbie.

Thanks

Good stuff, thanks.

Hi Nial,

Very good explanations of the inside bar and Pinbar set-ups . I just made a trade yesterday Friday October 10 on the EUR/JPY using a pinbar set-up in the direction of the major trend ( seems right now is this environment most short trades are ” Golden ” ) and made 116 PIPS.

Thanks for your trade mentoring . I will definitely be purchasing your trading course.

Best in Life ,

John Wade ( EZTrades )