How Simple Maths Can Increase Your Average Profit Per Trade 10-Fold

You’ve probably read trading articles that talk about how your “winners need to be greater than your losers”, it’s used so much that it’s become cliché. It is NOT as simple as having a series of trades and just keeping your risk at 1r and your average profit objective of 2r, that is never going to be the case in real world trading. There are several situations where maths is applied to trades I personally take that can dramatically increase the risk-reward, which increases the overall risk-reward across a large sample of trades.

You’ve probably read trading articles that talk about how your “winners need to be greater than your losers”, it’s used so much that it’s become cliché. It is NOT as simple as having a series of trades and just keeping your risk at 1r and your average profit objective of 2r, that is never going to be the case in real world trading. There are several situations where maths is applied to trades I personally take that can dramatically increase the risk-reward, which increases the overall risk-reward across a large sample of trades.

I am going to present three ideas on money management involving simple maths that you can apply to your trades right now. After reading today’s lesson, you’re going to walk away with three concepts (One of which you might know and two you probably don’t), that most people rarely talk about or execute in their own trading plan.

Here are the concepts in no particular order: 1. Understanding the risk vs reward profit ratio in your trading. 2. Using winning streaks to ‘reverse martingale or pyramid across trades. 3. Using pyramiding in a single trade position to magnify gains.

This article won’t discuss trade setups in any detail, rather it’s focus is on how simple maths can be applied to your money management. If you don’t have the patience to read and understand this lesson, you certainly are not ready to learn the price action patterns I trade with. Do the work and understand the capital management and position sizing concepts before you start looking for the ‘holy grail trade entry strategy’.

1. The Money Management Cliché We Need to Actually Understand…

Winners need to be bigger than losers.

Sorry to repeat what you already know, but it’s an unavoidable fact that to make money over the long-run, your average winning trade needs to be bigger than your average loser.

In a nutshell, the only way to achieve this is having your risk be small on each trade and your profit objective being larger than your risk, usually two to three times or more. Over time, you will average around 1.5 to 1 and 2 to 1 across a large sample of trades if you’re doing well.

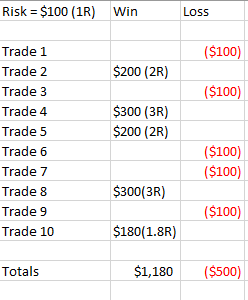

Here is a table that presents 10 hypothetical trades, each with a constant risk of 1r and various targets.

Some trades lost and some trades won, the end result shows the average winner at approx. 2 times the average risk.

Easy as an example but in the real world harder to do obviously. For greater understanding, check out the following articles:

Risk reward and money management in trading

A case study of random entry and risk reward

2. Pyramiding in a single trade

The power of snowballing position size inside a single trade..

Pyramiding a trade allows you to ‘snowball’ it into potentially a huge winner by adding to a winning position at predefined intervals. We can turn an initial 1R risk into potentially a huge R profit by adding a new position onto the trade as it moves in our favour, which essentially allows us to trade with the markets money since we are not taking on any new risk. The result is a snowball effect which builds a small trade into a much larger winner if the trade continues in your favour.

For a greater understanding of this, check out this article on pyramiding trades for big profits.

3. Winning trade streaks using ‘reverse martingale’ (something most people never talk about)

Compounding profits across multiple trades…

If you’re in the market long enough you will know when you’re on a winning streak and when a market is ripe for the picking. Yes, that statement is arbitrary to the technical minded and gut feel is definitely applied to this concept.

I am going to discuss this concept at the most basic level to demonstrate the power of applying some fancy yet simple money management maths during winning streaks…

The idea is similar to adding to a winning trade in a single position (as discussed in point 2 above), but in this case, we are doubling and thus compounding our risk per trade across multiple trades. Before I discuss this concept, let me clarify that this is not martingale strategy whereby a trader doubles up on losses, it is in fact, reverse martingale, where a trader uses profits from one trade and re-invests them in the next trade, essentially doubling the position size on the subsequent trade. Basically, we are using the markets money since you are not risking anything over your 1R investment on the first trade.

The idea is simple; we are doing the opposite of standard ‘martingale’ in which a trader would simply continue to double his risk per trade until he wins. Instead, the reverse martingale is a method we apply when we anticipate a streak of wins in optimal market conditions and we then double up our position across multiple trades only if we win the previous trade. This method can supercharge an account, and remember, we are trading with the markets money, not our own!

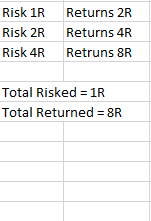

To demonstrate the maths in this concept, we will place three example trades, all with a risk reward profit objective of 2r, however, the risk will be increased on each trade as the streak plays out, as explained below…

Trade #1:

1R risk, to return 2R profit. Trade wins and you earn 2R.

Now you’re in a positive mindset about a trending period in the market and the recent signal that has paid off, so you’re anticipating a streak. You will now do the following…

Trade #2:

Re-invest the previous win (2R) on the next trade. Trade wins, you earn 4R.

Now you retain the same view as the prior trade, you’re in a trending period and the signals are working well, you are prepared to roll all of the previous profits (4R) into the 3rd and final trade of the streak…

Trade #3:

Risk 4R trade wins, you earn 8R.

Total result of streak

————————

Most risked at any time = 1R

Total return = 8R

8 to 1 total risk / reward)

Here’s table showing our example trades and how the returns double each time we re-invest the previous trade’s winnings:

The above example shows us a brilliant case of using the market’s money and simple maths to trade a small initial risk into a huge return.

Now, I am sure some of you are thinking “How do I know when the streak will occur?” and so on. You don’t know for certain but there are indeed market periods and conditions where the trader with experience knows the likely hood of streaks are higher. Even with a random walk, where you randomly apply this concept of re-investing / compounding profits, you are bound to have some decent wins. This will only improve as your confidence and trading abilities improve over time through proper trading education and experience.

The maths above is incredibly simple, but it’s essential to understand and if understood can literally take your trading results from mediocre to outstanding, very quickly.

In closing…

These are the very same position sizing and money management techniques that I personally apply to each price action trade setup I execute. These are also the same money management techniques that I teach my students to apply to the price action strategies, all of which is contained within my advanced price action trading course.

Trial the ideas on a demo trading account or if your already trading live, trial the ideas on smaller positions until you perfect the concepts.

Good trading, Nial

thank you

i real real like this ideas…..thank u brother

Good idea, Nial But, why in trade 3 we not reinvest total returns from trade 1 + trade 2? so trade 3 will be: risk 6R, returns 12R and next total returns : 2R +4R +12R = 18R

Awesome money management techniques from Nial.

Thank you Nial

Very valuable information. Thank you Nial.

Great article nial, yeah there are times that an obvious trade signal to reap such profit comes but only experienced trader can see that opportunity .

Wow! Mine is to congratulate u upon the winning of the cool $1m!

This is incredible.

Thanks.

Great article. At the end of the streak, it seems to me that the result is 2 + 4 + 8 = 14 if all three trades win, rather than 8 as written in the article. Each time, you risk your previous profit which is already yours and has to be added to its double of the next winner.

I replied earlier and realise i was wrong (quite normal for me!)

You risk 1 on your first trade and win 2, you risk the 2 on your second trade and win 4.

You are now ahead 2+4=6 from your first two trades, you risk the 6 on your third trade and win 12. When you add the risk, the 6 (winnings from your first 2 trades), then your total gain over the the three trades is 12+6=18.

The only risk to your initial account from these three trades is the 1 you risk in your first trade, the second and third trades are risk free to your initial account.

This ‘simple maths’ is like trading – simple yet difficult!

Thanks you very much

Thanks so much Nial for the great article.This only can make one aim for just one very obvious trade in a month and be fine.

does your ‘reverse matingale ‘ example not in fact reward 12R to your origional 1R as you can include the 4R from the first two trades – i also use something similar – winning two trades in a row is very common – 1:3 R:R earns a 12R profit (and, very occasionally, 1:4 rewards 20R profit) over two trades (or a combination depending on actual market conditions) – thank you for all your advice and information – i have been trading for a number of years but always learn new things (and/or reminded of forgotten things!) reading your articles – your material is easily the most helpful i’v seen out there!

Shouldn’t it be 12 returned instead of 8 when you include the original 3rd trade investment?

example:

Trade 1 = Inv $100, win $200

Trade 2 = Inv $200, win $400

Trade 3 = Inv $400, win $800

Total = $1,200

Thank you, Nial! :D

hi nail,

it is a really good concept to grow account.

but I am confused in “Winning trade streaks using ‘reverse martingale’ (something most people never talk about)”

what will be the scene if one win first trade, loss second ? than how he/she can go for third trade?

and moreover did u want to say that when u got first trade hit 2r and than take exit of that trade and than enter with 2r risk another trade? if that is the case than one losing trade can wipe out all you earned

thanks

Ashesh, article is designed to provoke un conventional thoughts on money management, there is no exact process for determining when a streak will happen, however when an experienced trader is in the zone, streaks become easier to anticipate.

Also the term “market money”. I remember we should not consider profits as market money but our own money, because one can easily start to gamble with money that he/she do not consider own. Anyways interesting idea.

The professional trader will look to add to winning positions, not add to losing positions. This is as you have said ‘using the markets money’.

Thanks for the great insight coach

This is a very powerful insight! from the great forex giant/professor. I love that reverse martingale concept. Thanks alot

Excellent article Nial. ThAnks for the insight. You are the best!

thanks Nial its a very useful lesson

Hi wery nice article just a quastion have i close R2 before put in 4 R THENKS.

Hi Nial – great article esp the “reverse Martingale” idea. My question is, in any trade, when do you decide to take a profit. At 2R? Some technical signal? Instinct? I struggle with the exit much more than entering a trade. Any insight you can offer?

well written. Even your commentary is always on point Mr Nial. joining your team is really a must. great weekend to you&your fam.

Thanks again for a most valuable lesson, no one else offers what you do for use newbie traders. I am so grateful to have found you and your wonderful website.

Best regards

Peter miller