5 Common Mistakes When Trading The Pin Bar Strategy

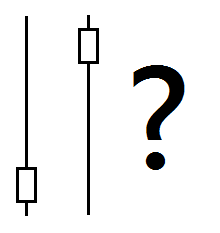

The pin bar is perhaps the most powerful price action signal that has ever existed. If I could pick only one price action pattern to trade with for the rest of my life, I would probably pick the pin bar. However, despite its simple structure, the pin bar can be very tricky to trade if you don’t know how to distinguish a good pin bar from a bad one.

The pin bar is perhaps the most powerful price action signal that has ever existed. If I could pick only one price action pattern to trade with for the rest of my life, I would probably pick the pin bar. However, despite its simple structure, the pin bar can be very tricky to trade if you don’t know how to distinguish a good pin bar from a bad one.

I see many traders making the same mistakes over and over with pin bars; they trade every pin they see, they give no consideration to the market context the pin bar formed within, they constantly try trading counter-trend pin bars and many other mistakes.

The fact of the matter, is that there are many subtleties to trading pin bars that you must understand if you ever hope to trade them successfully. So, without further ado, let’s some of the biggest mistakes traders make with pin bars…

1. Not learning to trade pin bars in trending markets first

The first thing I tell my students to do in regards to pin bar trading, is to learn how to trade pin bars in trending markets. The simple reason for this, is that any price action setup or signal is going to have a better chance of working out with the power and momentum of a market trend behind it.

There are numerous reasons why markets trend, but the exact reasons don’t really matter. All we care about is that a market is (or isn’t) trending and whether or not we can jump aboard that trend to take advantage of the power of it. To ignore the power and ‘weight’ behind a trend and think that you will begin making money trading pin bars against the trend before you’ve learned to trade with the trend, is simply ignorant. To this day, I still look for pin bars with the trend first, and those are the pin bar signals that I prefer as option number one.

2. Not learning to trade pin bars on the daily charts first

If you can’t trade pin bars successfully on the daily chart time frames, you won’t be able to trade them successfully on any lower time frame either. For reasons you can read here, the daily chart is simply the best time frame to trade, and I don’t believe that to be a subjective view point either, I see it is a fact of trading.

Generally speaking, the lower in time frame you go, the lesser chance any given price action signal (or other signal) has of working out. This is due to market noise or random price fluctuations that simply mean nothing, and within this market noise there inevitably arises pin bar setups that may look good to the untrained eye, but in reality they are meaningless.

Thus, a pin bar on the daily chart time frame has a much better chance of being meaningful, simply because it’s on the daily chart where there’s less random market fluctuations. The daily chart shows the most pertinent view of a market, including what has happened in it, what is happening and what might happen next. As you go down in time frame, this view becomes hazier and less meaningful, as does any price action signal.

3. Not trading pin bars with confluence – market context.

A pin bar is a very powerful price action signal, but only if it occurs at the right place on the chart and at the right time. As I teach my students in my trading courses, the best pin bar signals typically occur at a confluent level or area on the chart. Essentially, there are many pin bars that you might spot on any given price chart, but they are not all equal, and it’s the type and amount of confluence that makes one pin bar better (or worse) than another.

I like to tell my students that a good pin bar signal should “make sense” in the context of the current market conditions that are occurring on the daily chart. That goes for a 1 hour or 4 hour pin bar too; if it doesn’t “make sense” with either the trend, key chart levels or both, on the daily chart time frame, it’s probably not a good pin bar to trade.

4. Putting your stop loss too close to entry

Another big mistake I see traders making with the pin bar reversal strategy, is putting their stop losses too close to their entry. As I discussed in a recent article, good trades often take longer to play out than we expect, and with that comes the fact that markets fluctuate across time, often meaninglessly, and so you don’t want to get stopped out of a good pin bar trade prematurely just because your stop loss was too close.

What you want to do, is find the most logical point on the chart that will invalidate your pin bar trade if price moves beyond it. Often, this point or level is further away than most people want it to be or think it should be. The difficult thing about having wider stop losses, is that if you want to manage risk properly, it means you have to reduce your position size down as your stop loss distance grows. This isn’t something you should view as ‘slowing’ your trading progress or as a ‘hindrance’, because in the long-run it will lead to more gains / profits because you will be trading properly and building proper trading habits.

Check out this lesson for insight into how to achieve safe stop losses on pin bar trades.

5. You’re not actually trading a pin bar.

Many times traders think they are trading a pin bar setup and it’s actually not even a pin bar. This is a mistake that people make typically from not being properly trained on how to trade pin bars or exactly what makes a good pin bar, and it’s something that’s easy to fix. Through proper pin bar trading education and training you will quickly learn what a high-quality pin bar setup actually looks like, how to identify them and how to trade them properly.

I trust from this lesson you’ve learned about some of the most common mistakes traders make when trading pin bars and some steps to make sure you avoid them. If you want to learn about all the subtleties of pin bar trading, check out my price action trading course for more information.

and let me tell you number 6, join the market too early before Pin bar is closed then they regret why they entered … it was my experience … “”in trading markets being late works better than being early””

i never knew there could a guy who talks facts like this in FX.. keep up the good wrks shaa wakaipa wakaipa.. wakuseri sedamba

Thanks Nial…As usual, an EXCELLENT article. Ever since I started trading the pinbar, I think the best confluence of them all is “Trend”. It works great in a trending market. Thanks once Again. You the Guru

Hello always try to won on that but mosly lost but nice article .

Pinbar strategy is excellent and i am glad to have you as a coach.From your articles, I learned about trading from you and now i finally designed a great method for controlling emotions and now i am not committing any emotional mistakes.Thank you sir.

Thank you for ‘re-enforcing this facts.. I trade only pin bars on daily and 4hr and the results is awesome.. You are indeed A KING in the forex jungle. Godspeed.

Nial, You come up with real gems!!

Thanks a lot.

Very useful article thanks a lot. May your wisdom

never run dry. Thank you so much .

Excellent article about my favorite price action setup

Thanks for the head up message. Pin Bar (rejection candle) is a very (most) powerful single candle setup i’ve ever come across in forex business when traded with the trend or a pretested S/R area. Your previous message on it has improved my performance drastically. Amen!

very good lesson. It will be more clearly said when you can combine the lesson wih charts examples.

million dollar article

Excellent article Nial – very timely and informative as usual ! As a relative Newbie, I am still working on keeping focused and less impulsive with your trading “methods” in order obtain the best “setups”. Your reinforcement of your materials go a very long way for me.

Thanks again !

Thank you Nial. It is true what you say. Since I stopped trading charts lower than the daily, I have become profitable consistently. And it took me so long to ditch those intraday charts. I was so stubborn! I should have done it a year or two ago! Thanks again for the great training.

Good article – and setting the stop loss as far as is reasonable is very good advice.

Appreciate Nial

Most informative

Thank you so much Nial for your quality time to write such precious words for us. Every things is explained very well but it could more easy & informative if you add some snaps with them.

Thank Nial, I see that trading with confluence on any given signal would increase the chances of good trade.

This is very insightful. May your wisdom never run dry Nial. Well said.

Thanks Nial…

Very useful and timely reminder…

Very good info specially trade pin bar with trend

Very useful article thanks a lot.