3 Simple Tricks To Improve Your Pin Bar Trading Results

The pin bar price action pattern is a very powerful trading signal and one of my personal favourites. However, if you are simply trying to ‘learn it by yourself’, you are probably experiencing ‘mixed results’, to say the least. There are many subtleties to trading pin bars and my other price action signals that you must understand and master before you can really become a successful price action trader.

The pin bar price action pattern is a very powerful trading signal and one of my personal favourites. However, if you are simply trying to ‘learn it by yourself’, you are probably experiencing ‘mixed results’, to say the least. There are many subtleties to trading pin bars and my other price action signals that you must understand and master before you can really become a successful price action trader.

My trading style is all about waiting for the best price action trade signals to form. I absolutely do not jump at every pin bar or every price action signal that I see in the market. One of the things that I teach my students in my trading courses, is how to filter out the lower-probability trade setups so that you are only taking what I consider ‘high-probability’ price action trades.

Whilst this is a skill and also an art that takes further education and experience to really get good at, in today’s lesson I am going to share with you three of my favourite ‘tricks’ for filtering out sub-par pin bar signals so that you have an increased chance of improving your pin bar trading results…

1. Focus on pin bars in trends first

I am reluctant to tell you to ‘only’ take pin bars in trending markets, because there are times that pin bars in range-bound markets or even counter-trend pin bars, can be worth trading. But, as a general rule of thumb, such pins are few and far between and they are more difficult to trade then pin bars in obviously trending markets.

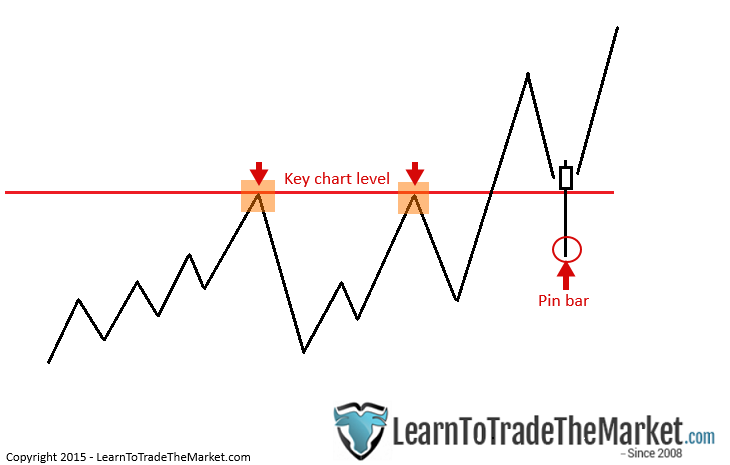

So, my first ‘trick’ for improving your pin bar trading results, is to focus only on pin bars in trending markets. This means, you will only look for trending markets or currency pairs, other (non-trending) charts you can just ignore for now. Focusing only on trending markets is especially important whilst you are learning how to trade pin bars. The first step to becoming a master pin bar trader, is learning to trade trending markets on the daily chart time frame and then the 4 hour chart time frame. However, make sure if you are trading the 4 hour chart, you take pin bars that are in-line with the daily chart trend direction. To learn more about how to trade trending markets, check out this tutorial on how to trade trending markets.

2. Next, focus on pin bars at key chart levels

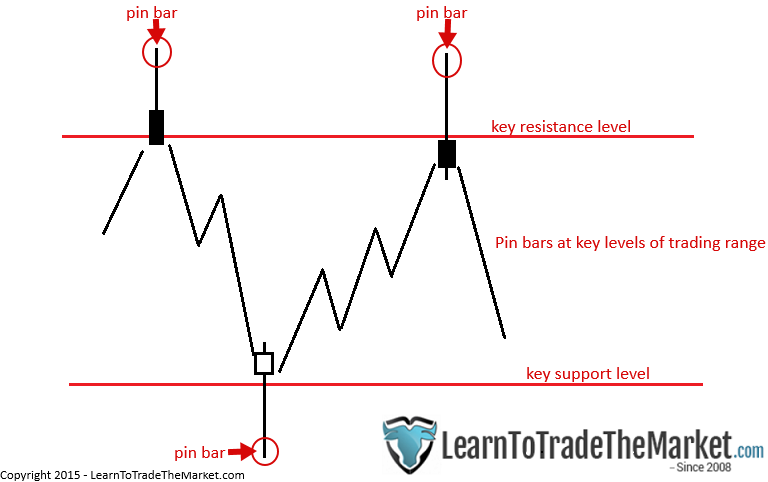

Often, markets aren’t in an obvious trend like in the example we saw above. Whilst I do recommend focusing only on pin bars in trending markets in the beginning, eventually you will want and need to know how to trade pin bars in other market conditions because markets don’t always trend.

After you have mastered pin bars in trending markets, you can look for pin bars that simply form at key levels of support or resistance in the market. Key chart levels add a powerful factor of confluence to a pin bar setup and you can look at key chart levels for pin bars in trends, range-bound markets or even for counter-trend pin bars.

The ‘key’ with these types of pin bars (no pun intended), is to look for them at key chart levels. Now, if you aren’t clear on what a key chart level is, check out this link on key chart levels and this one on how to draw support and resistance levels, those lessons should clear it up for you.

Here’s another example of pin bars at key chart levels of support or resistance, this time it’s an example of a trading range where price is oscillating back and forth between key resistance and support levels…

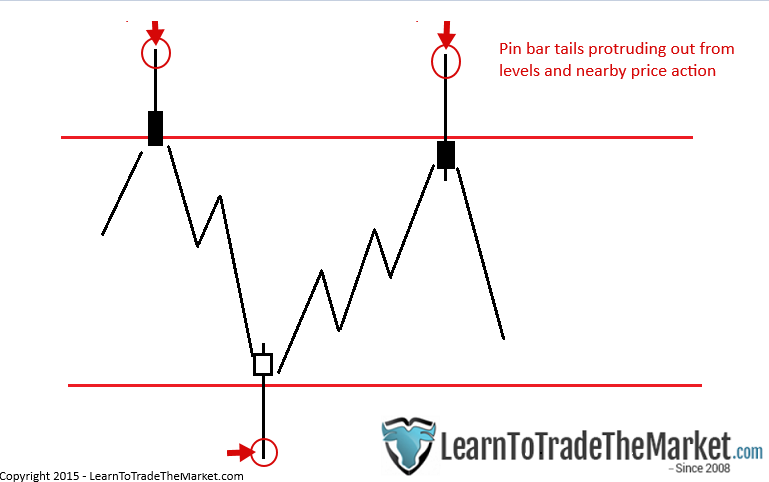

3. Look for protrusion of the pin bar’s tail

Protrusion of the pin bar’s tail means that the tail is obviously sticking out or ‘protruding’ out from the surrounding price action or through a key chart level forming a false break strategy of the level.

The pin bar at its core, is a reversal signal, and the more the tail is protruding out from the surrounding price action or through a level, the stronger the rejection and reversal at that price point is. The stronger the reversal, the higher-probability the pin bar has of working out, generally speaking.

I will admit, the issue of ‘is a pin bar protruding or is it not’, is very much discretionary and can vary slightly depending on the individual. But, there are those pin bars that are so clearly protruding out from the surrounding price action or through a level that it’s nearly impossible to argue with them, these are the pin bars I look for.

Conclusion

Pin bars are one of the most effective price action trade signals, but trading them successfully isn’t as easy as just spotting a pin bar on the chart. There are subtle differences in a good pin bar vs. one you should avoid, and this article has introduced you to some of them. If you’d like to get a more in-depth explanation of how I trade pin bar signals and everything I look for when trading them, get my price action trading course for further training.

Thanks Nial. Simple but strong strategy. Understood, every pin bar formation is not a price action signal. Excellent…..

Thanks for your nice article…unbelievable .

Thanks Nial, you are always fascinating.

I must admit that you are completely great at what you do.I am a novice trader but when I read your article centred on trading like a sniper and trading like a crocodile I was really impressed. Each time I read your articles I learn more and more about you and how great a trader you are.I have a couple of questions for you.I would to know how to accurately draw support and resistance lines from the scratch.I would be very pleased to hear your response pretty soon.Thank you.

thank,Nail for the lesson.

Thank you Nial Fuller, excellent lesson.

good day,i must commend that you are doing a great job,God bless you.please i want to understand the different between trend and moves,and again how long DOES IT TAKE A CURRENCY TO BE IN A PARTICULAR DIRECTION.Secondly the EURUSD currency,can one short it and later long it .In short is it advisable to trade a particular currency on both side or to dwell in the direction of the trend.

THANK YOU.

Thanks Nial

Thanks Nail

I like your teaching. It is simple and honest. It is all about knowledge and mastering your technique and not get rich quick. Thanks so much for sharing.

Especially tip #3 is very key.

Thanks

Thank you Nial.

Great article.

Execellent work thank you.

Hello Nial,

Thanks for your nice article and I will request you write similar on fakes and inside bar as I am finding some difficulties on those.

Regards,

Syed

Simple, crystal clear explanation and easy to understand about Pin Bars signal, I am waiting your simple tricks for “inside Bars” and “Fakeys” Signal, thankyou for your great effort Nial GBU

A very well laid out lesson. Nial Fullers forex course that I purchased a few years a go and the daily commentary that I receive as a member has really paid off handsomely. Thanks Nial for the great training I have received and still receiving. You’re tutorial skills are really awesome!

// Joe

Thanks Nial,

Very useful and easy to learn. I think no one could share with this kind of advice in the web.

God blesses You. Keep it up.

ur awesome Nail. bless ur soul

nice me teach you if kindly send more things about forex

Thanks for the lesson on pin bar trading. Powerful and straight to the point, especially looking to avoid low probability set ups.

Thank you, Nial!

Thanks for that, very good lesson.

As simple and clear as possible. Well done Nial and thank you

Thank you so much for these treasures from you soul.

You just kept on simplifying trading for us. Kudos. Any trader who is disciplined, following what you ‘open up to us’ will profit.

Get used to it. It’s always special when it’s Nial! It’s always honest and true.

Many thanks to Nial !!! Your articles are very useful and carry a lot of sense!

thanx my mentor

thanks

Good article. Confidence building one. Thanks.

thanks nial

Nice article, I use pin bars a lot in trading binary options and it works like charm for me.

Hi Nial

Thanks for your good blogs.

I have noticed that when a long pinbar forms, alot of the time, the price eventually ends up returning to the low point of the pin bar. Do you have any idea why this is?

Regards

Hi Tom,

You’re right, price does often retrace down (or up) the pin bar’s tail a certain degree. I have a lesson on how to deal with this situation, check it out here: https://www.learntotradethemarket.com/forex-trading-strategies/ultimate-forex-trade-entry-trick

Just excellent,Really you are a good teacher.

Thanks a lot sir.

Great.

Thanks a lot.