How To Remove Your Fear Of Losing Money When You Place Trades

If you’re going to be a trader, you’re going to lose money at some point, and in case you are still in the phase of trying to avoid all losing trades and searching for a “Holy-grail” trading system with a 75% strike rate, you should forget about all that right now. As cliché as it may sound, losing really is part of winning as a trader; the two are inseparable. If you don’t learn how to lose properly you will never make consistent money as a trader.

If you’re going to be a trader, you’re going to lose money at some point, and in case you are still in the phase of trying to avoid all losing trades and searching for a “Holy-grail” trading system with a 75% strike rate, you should forget about all that right now. As cliché as it may sound, losing really is part of winning as a trader; the two are inseparable. If you don’t learn how to lose properly you will never make consistent money as a trader.

Reality check…ALL pro traders lose money, and they understand that it’s just part of the “game”. Sadly, for many traders, every trade is accompanied by a tremendous FEAR of losing money and sometimes intense emotional attachment.

Some of the key reasons why traders become fearful about losing their money include the following:

1. They don’t understand that mathematically, over a series of trades, a trader can lose a majority of their trades and still be widely profitable, simple math proves this.

2. They are simply fearful of losing money in general.

3. They are trading positions that are too big (risking more than they really should be), causing fear, sleepless nights and huge emotional swings.

In the rest of this lesson I’m going to provide you with some insight into the fear of losing money in the markets and how to conquer it. This is some pretty powerful stuff so make sure you actually read the whole article and re-read it if you have to. What you learn here should give you the power to eliminate your fear of losing money in the markets and will help you develop into a confident and emotionally collected trader.

Fear of losing money can be a good, natural emotion, but we need to transform its focus.

Fear of losing money is a good emotion to have in many areas of life, if we did not have it there would be even more chaos in the world and in the markets. Humans are protective of their acquired wealth and property, and rightly so; they worked hard for it.

However, in trading, this natural energy to be defensive and emotional with money needs to be transformed and refocused into a different mental state…

Instead of being fearful of losing your money when trading, embrace the control you have on each trade; a trader has complete control over the risk management of every trade via stop losses and position sizing, [and for more advanced traders, derivatives and hedging mechanisms (not discussed here)]. These risk management tools are your way of being in control of your money/funds, and instead of being “fearful” about losing money, you should feel empowered and confident because you can predetermine how much you are comfortable with potentially losing BEFORE you enter a trade by using these tools.

However, just using these tools to control your risk per trade is not quite enough to totally remove the fear of losing.

Ask yourself some serious questions

If you feel fear or any emotion at all when you place a trade, you need to “slap” yourself in the face and ask yourself 3 big questions (and answer honestly):

1. Do I really have the knowledge and confidence to be trading with real money in the first place?

If you’re trading your hard-earned money in the markets but you don’t know what your trading edge is and you don’t have 100% confidence in your ability to analyze and trade the markets…you probably should not be trading. One of the biggest reasons traders become afraid to lose their money is because they aren’t confident in their own ability to trade! It seems silly I know, but it’s very true; many traders simply don’t have a trading strategy mastered, they don’t have a trading plan, trading journal, etc…they simply aren’t prepared to risk real money in the markets yet…thus they feel fear when they trade.

2. Am I trading a position size that’s too large for my personal risk profile / per-trade risk tolerance?

If you don’t know what your per-trade risk tolerance is, then you need to figure that out first. It’s basically just the dollar amount that you feel like you are 100% comfortable with potentially losing on any trade; because you CAN lose on any trade…remember that. You have to take into account your overall financial situation and then determine how much money you should realistically and honestly have at risk in the market on any one trade…be honest with yourself here. You’ve got to think of yourself as a risk manager and as someone who is managing funds, rather than just a small-time guy trying to get lucky; your trading mindset will directly influence your trading results.

3. Do I truly understand the math’s behind trading?

When I say the “maths behind trading” I am mainly referring to risk reward and how it relates to your overall winning percentage. For example, on a series of 20 trades, you are likely to lose at least 35 to 45% of the trades, and most traders who are successful lose anywhere from 40 to 50% of the time, some even up to 60% of the time. But, through the power of risk reward you can lose more than you win and still come out very profitable. We will expand on this below.

Embrace the belief that losing is OK

Losing is good if you’re cutting your losses quickly and understand that by doing so you’re simply preserving capital and that your winning trades will pay for your losing trades with profit left over. This is the power of your average risk reward ratio over a series of trades coming into play; we will see this in action below…

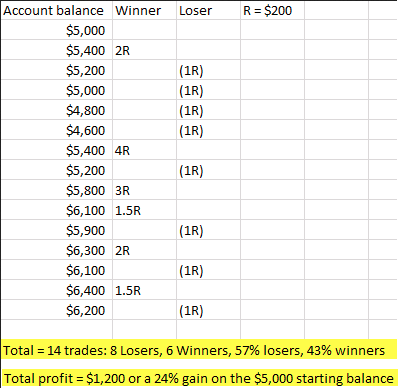

Even very profitable traders typically lose more than they win, to prove this point let’s take a look at a case study showing 14 trades with a just a 43% win rate. To be clear, that means you are losing 57% of the time and winning just 43% of the time. It can be hard to associate “losing” the majority of your trades with making money, but as I discussed in one of my recent articles, you don’t have to be right to make money trading.

This image shows us that profitable traders can lose more trades than they win and still come out very profitable over a series of trades. Thus, losing money on any one trade should not concern you:

Trust your strategy and Trust the maths

As we can see in the hypothetical track record above, the math shows us that even while losing 57% of our trades, if we let our winners run to around 2 to 1 or better and cut our losses at -1R or less, the profits will take care of themselves. It’s worth noting we included a couple of 1.5R winners, because sometimes it will make more sense to take a reward of slightly less than 2R, depending on market conditions. The average risk reward in this example was 1:1.75, and if you can aim for an average risk reward of around 1:1.5 or 1:2, over the long run you should come out ahead. The “secret” is keeping ALL your losers at 1R or less and ONLY trading when our price action trading edge is truly present.

If you follow an actual plan, losing is easier to accept, because at least you had a plan and a roadmap as to what you were trying to do; the brain then sees it as more logical and thus you’re less likely to experience apprehension or fear. The set and forget concept I always talk about will assist with training your brain into accepting losses. You will also avoid interfering with a lot of your trades which can produce unnecessary losses.

The “Sleepless night test”

Everything we said above is accurate and important, but there really is one simple “fear test” that I have found to be very effective for most traders. That test is simply to gauge how you feel at night before you go to bed while you have a trade on. If you find that you can’t stop thinking about your trade(s) or you are glued to your computer screen while you should be sleeping, you are still experiencing fear of losing. So here’s a very simple test for you:

One simple rule…if you can’t go to sleep at night feeling comfortable and at ease with the trade(s) you have on…

1) You’re either trading too big of a position size / risking too much at your stop level

2) Or, you have no idea what you’re doing and lack confidence in your trades

Conclusion:

The fear of losing money or of losing a trade can be crippling to a trader, causing them to miss out on high-probability trade setups, second-guess themselves constantly and it can even cause them to be unable to sleep. Clearly, if we are to succeed at trading we have to conquer this fear. Conquering the fear of losing money and trades starts with acceptance; we have to first accept that we are going to lose money and have losing trades, even if we try to avoid them. Thus, there is no sense in “trying” to avoid losing trades, instead we have to learn to roll with them and contain them. We do this by following through with the concepts we discussed above, so let’s sum them up briefly:

The fear of losing money or of losing a trade can be crippling to a trader, causing them to miss out on high-probability trade setups, second-guess themselves constantly and it can even cause them to be unable to sleep. Clearly, if we are to succeed at trading we have to conquer this fear. Conquering the fear of losing money and trades starts with acceptance; we have to first accept that we are going to lose money and have losing trades, even if we try to avoid them. Thus, there is no sense in “trying” to avoid losing trades, instead we have to learn to roll with them and contain them. We do this by following through with the concepts we discussed above, so let’s sum them up briefly:

• Mastering our price action trading strategy and “trusting” it: master it, own it and believe in it.

• Manage your money and employ solid risk management; this means cutting losses at 1R or less and aiming for a decent risk reward of about 1:2 on each trade. We also need to try and let some winners run to get larger risk rewards like 1:3, 1:4 or more.

• Trust the math: remember the example track record above and that even a 40% win rate can make very good money with an average risk reward ratio of approximately 1:1.5 or more.

To learn more about the above concepts and to get on the track to conquering your fear of losing money in the markets, checkout my Forex trading course and members’ community.

Good trading, Nial Fuller

thank you.

The best lesson. Thanks

Thanks Mr. Nial! for your help, excellent article!

Thanks for this wonderful article. Everyday when the market starts i would sit there with fear and hopelessness and utter pessimism. One wonderful point you made has drilled itself deep inside my brain. I would like to repeat your words here

“Instead of being fearful of losing your money when trading, embrace the control you have on each trade; a trader has complete control over the risk management of every trade via stop losses and position sizing, [and for more advanced traders, derivatives and hedging mechanisms (not discussed here)]. These risk management tools are your way of being in control of your money/funds, and instead of being “fearful” about losing money, you should feel empowered and confident because you can predetermine how much you are comfortable with potentially losing BEFORE you enter a trade by using these tools.”

This thought has changed my mindset, thanks a lot for this eye opening article. I am feeling very much better now.

thank you……..

thank you so much coach.

Thanksfor ur great lesson it is mind changing lesson more grease to ur elbow

Nial, In your trade table above how did you arrive at an Overall risk reward = 1:175 ?

Everything you said is so true!!!

Hi

Price action is the only real and pure way to trade the market, the price action leads the indicators and indicators don’t lead the market. Price action is a very interesting strategy once you learn it.

Regards,

Nadeem

Great writing,Good way to start the year.Keep it up

Great article; you JUST have to insure yourself (every trade) with good acceptable stop loss. All this NECESSARY “administration”, what are automatical calculation of all things in excel sheet keeps me away from emotions, that mean I am more objective and without fear.

Prof. Nail,This is a glorious post.I wish you more success.Regards.

Another great one Nial,always appreciated your risk reward education…….

Great article….

I’m so glad I found this website. Niall provides such insightful info. Its really helped my trading. I have seen less losses and greater wins since ditching complicated charts and indicators which I hardly understood.

Dear Nial, thanks for your posts and your great lessons ..sometimes when you trade “in real money” it’s not so easy to see a winning position turn in a losing position .. so it’s not easy to let your trade run till 2 or 3 risk reward …even if you split your trade and close one part at the first profit, when you see a retracement in a winning trade ..fear is there, and sometimes it makes you close your trade before .. have a wonderful 2013

This is really a good and profiting advice to those who do poorly is risk management.please kindly explain HEDGE MECHANISM STUFF.

GOD Bless YOUR HEART

Martinmary

Hedging could achieved through a variety of mechanisms

the most obvious is buying an option (call or put) to hedge your risk on a directional position.

Email me on the support line for more assistance

Nial

awesome thanks

THUMBS UP!

THIS IS WONDERFUL, KEEP IT UP.

Thank you Nail.

thanks master………

Hi thanks again look forward to next weeks pearl. cheers and thanks

The TRUTH sets free, chains are broken and captivities are loosed. I am free! Thank you Nial. God bless you.

Real wisdom. Enjoy this article

because there is gold in Nials advice. Literally.

Hi Nail

It’s realy good.Every traders must be know this article.

Realy great one.

Regards

Uthayakumar

Great lesson Nial!!! Having a trading plan makes loses easier to accept… wow… what a great reason to have a trading plan, as opposed to so many other people who never really give good, logical reasons to have a trading plan. They only say that you need to have one. Thanks for the simplicity and logic.

Excellent article there Nial.

Thanks for such nice information you provided.

Good article Nial, thanks a lot

Another motivated post from our master Nial, kudos sir! :)

thanks sir

Great article Nial – This was something I really needed to hear at the moment – thanks!

THANK YOU FOR THIS LESSON REALLY THIS TYPE’S OF LESSON I NEED IT

Perfect, AGAIN!

well for me as part time trader, some time I do catch some of pin bars, and they are good for me. happy with is even though am trading a small amount om money just to take out my fear from my sule :.

good luck traders.

Excellent article Nial! Armed with a powerful trading strategy like the Price Action plus a Trading Plan(inclusive of an appropriate risk & money management strategy) plus a Trading Journal you really should have nothing to fear. Thanks for a great article once again! You are a star!

this is the best trading article i have read, thank you

I am learning a lot from your articles Nail.God bless you.

Carlos

Hello Nial,

Happy New year.You are in fact my mentor.God Bless you abundantly and more grease to your elbow.Thanks in a million for your wonderful job you are doing by educating,encouraging,enlightening and motivating us.

I say Thank you Thank you and A very Big Thank You.

Please i want you to help me in Gold Trading.I want to know if price action strategy is actually working in Gold chart.

please keep me on track on the best set up for Gold trading.

Thanks and bye my dear.

thanks nial, i have always admire your truthfulness

If you have a strategy and have mastered it and it is a winning stretegy, you can become bold. Boldness eliminates fear simple. Thanks Nail.

Good tips, thanks.

What a terrific “fresh start” lesson for 2013. I personally had no idea of the HUGE value of joining ltttm several years ago. All the best as always, Nial….r

Great article, Nial. Before I learn a great method such as Price Action Trading. I experienced many losses but took my stop losses 100% of the time. I don’t lose all the time but because of past experience, I am scarred. Now when I enter trades, fear always linger and until I experience positive equity curve, the fear of losing will remain.

Power of Risk : Reward , a tough thing to execute but once success it is the key !!

Outstanding article as usual Nial. I would expect nothing less, as your articles are all excellent. This is a great one to start 2013, and certaintly relevant for me.

Your excellent example of showing your loss rate can be greater than your win rate, and yet you can still make money highlights something very important for me, and that is the trading axiom, “Cut your losses short, and let your profits run”.

It seems with fear of losing money, when you do find yourself in a winning trade, I know I often have the urge to take profits prematurely (ie, the market might take it away).

It dawned on me, when I see your examples of 3R win or 4R wins, and I wonder why I don’t get those? Simple, because I don’t allow them to happen!

Hence, your set and forget article!!Set your target and get out of the way!

I must say Nial, you certainly make it difficult for any of us reading your articles to blame anyone or anything except the person staring back at us in the mirror.

All your articles have explained pretty clearly what it is we need to do to be successful in trading.

Thank you very much, and happy new year to everyone,and best of success in 2013.

Thanks for opening my eyes Nial, I didn’t know that you can be successful even with a low wining rate. Its about moving on consistently with your trading at all times. I am grateful.

Thanks Nial, it’s a great article. I treat losing as a way of preserving capital!

´Great post, thank you

If your edge works less than it should, then you lose confidence. This is the origin of fear.

You start to think: If your method gives you a winning possibilty of less than %50, then why don’t you flip coins before trades? You will win 45 to 50 trades from 100 in any case. This is the iron truth.

Karl. You don’t flip coins to make trading decisions that is a very silly idea. You have forgotten that the trading edge (trading strategy) is what creates the high risk/reward on your winners.

I’m learning a lot from your articles!

Thanks Nial!

Thanks nial, that such a great article.. i absolutely love ur method n articles ;)

Nice

Great article thanks Nial. I’ve just opened a live account and about to trade my own money. Interesting how the fear has crept in! Your article will help me to get stuck into trading again!

Very Nice post Nial

Of course i liked the concept of slapping, I really did slap myself after reading this article coz I really traded in the market without the knowledge of those 3 aspects which you have mentioned in today’s article, i was trading in the market so blindly, this article has really opened my eyes and hope it will benefit others too,

A great ariticle at the beginning of the year has brought some enthsiasm in me to conquer FEAR.

thnx for the good information

Nice post.

Thanks Nail, I just got started on trades and it makes sense already. complements of the new year…

thanks, man! good one as always.

Great Nial, really.

It happened many times that you wrote an article about that point where I am just struggling. (and I am realising that I am strungling there)

So thanks for that yours sixth sense :D

very good article, but there is still another aspect greed especially when you losed some trades and you won them has quickly restored, maybe that’s not greed but impatience. I have hit my first combo. Thanks Nial

i beleive 0.05 lot is okay for 500 account.

Thanks Nial,

Even if my statistic (and account) shows that with my latest trades I am winning, still I can feel the fear. Maybe it takes some more trades in the same manner before I can handle the fear better. A little help for me is that I have smaller goals also, not only the latest 20 shall be good, but 5 trades at time shall show that I am profitable I get quicker feedback to have those smaller goals also and this makes me more confident.

Anyway, thanks a lot.

/Tomson

Great piece Nial – It’s so true about managing risk correctly, and trade sizing. I look back at my journal for December, and out of 8 trades I got four right, and made 4.75% profit. Thats it in a nutshell!

Welldone, and have a great Year

Regards

Tim

Hello Nial!

Sorry for my bad English in advance)

Do u use other risk management than SL in your trade, e.g. hedging mechanisms?

Thank u.

Roman, I may use a put or call option to hedge from time to time, yes.

Right on the money again Nial.Anyone that really worries themselves sleepless should go back to Demo account trading probably till they can show consistant profits.

Awesome, It makes perfect sence. Your articles are eye opening….I’m learning a lot from them. Thank you so much !

Good one. I remember times before I started using your method Nial… there was fear and all the things you mention in this article.

God bless you

Thanks Nial

Pillars to success.

Cheers

Thank you again Nial for a lot of common sense and realism.

Awesome post man!!!

Thank you nial…

Wonderful Post!

Great article Niall, however in your trade table the risk is 4% per trade which in my opinion is way too high and causes fear. Everything else you said is spot on thanks.

WHAT A WONDERFUL ARTICLE TO START THE YEAR WITH, THANK YOU DEAR ‘Prof’.

good day Nial,

ur whole approach to trading is so logical and simple.

i have learned a lot from reading ur posts.

many tks

Tony

Amazing post Nial!!! The one i needed right now! Thanks a lot all your efforts!

thank you! – great post