To Trade or Not to Trade, That is the Question

You’re sitting at your laptop, staring at the charts, you spotted a potential setup but you’re not totally sure if you should trade it. You sit there a little more; finally you’ve convinced yourself you should trade this setup. You set the trade up, pull the trigger, and then about 5 minutes later you change your mind, realizing the trade was not as good of a setup as you thought. Does this scenario sound familiar to you? If so, you’re not alone, I know it’s happened to me before and many other traders, but eventually I reached a point where I never have any doubts about the trades I take. In today’s lesson, I’m going to help you get closer to achieving that sort of confidence in your own trading too, because there’s nothing worse than constantly regretting your trading decisions.

You’re sitting at your laptop, staring at the charts, you spotted a potential setup but you’re not totally sure if you should trade it. You sit there a little more; finally you’ve convinced yourself you should trade this setup. You set the trade up, pull the trigger, and then about 5 minutes later you change your mind, realizing the trade was not as good of a setup as you thought. Does this scenario sound familiar to you? If so, you’re not alone, I know it’s happened to me before and many other traders, but eventually I reached a point where I never have any doubts about the trades I take. In today’s lesson, I’m going to help you get closer to achieving that sort of confidence in your own trading too, because there’s nothing worse than constantly regretting your trading decisions.

How can you know to trade or not to trade?

What goes through a professional trader’s mind as he or she is analyzing the market and deciding whether or not to take a trade? Whilst every trader is different, whether or not a pro trader takes a trade basically boils down to two main things:

1) Is my trading edge present?

And

2) Can I get a good risk reward ratio on the trade?

The “perfect setup”

First off, let’s discuss what constitutes the “perfect setup”. When I say “perfect setup”, I put it in quotes because there actually is no “perfect setup”…because the word perfect implies something without flaws or that cannot fail. As I have written about many times before, any setup can fail…even a “perfect” looking one, so try to get the idea that a setup “cannot fail” out of your mind right now. That said, certainly we can say that a perfect setup is one that represents a valid instance of your trading edge, to the point where you have no doubt that the setup is worth trading.

I get a lot of emails from traders who say things like “Nial, can you please look at this trade, it looked perfect but it didn’t work out, did I do something wrong, why didn’t the trade work for me?” Many traders try to over-complicate the trading process by assuming there is some way they can avoid having losing trades or that they should be winning 90% of the time. I answer these types of email questions the same way; by saying that even “perfect” looking price action trading strategies can and will fail from time to time; it’s just part of the game. I’m going to “burst your bubbles” right now: There is NO holy-grail trading system, and you WILL lose trades…even if you become a professional trader. In fact, most professional traders still lose somewhere around 40 to 50% of their trades…it’s the power of risk reward that allows them to make a good living even while losing so much. So, that said…let’s move on and discuss what a “perfect” price action trade setup might look like…

Now, when I am browsing the markets looking for a price action setup, I know what I am looking for; I don’t have any doubts. My trading edge is either present, or it’s not. There is not really any “in between” for me anymore, I have reached a point where I can just browse my favorite markets for about 10 minutes at any given time and very quickly know if there’s something worth trading or not.

Some of the things I am looking for include the following:

• What condition is the market in? Trending, consolidating, calm, volatile?

• Is there an obvious price action trading strategy that’s sticking out like a sore thumb?

• If there is an obvious price action setup, did it form at a confluent level? What is the surrounding market context the setup has formed in?

• Can I realistically and logically achieve somewhere around a 1:2 risk reward (or better) on this trade given the surrounding market structure and conditions?

These are the main things I am looking for, and depending on the answers to these questions, I will either trade or not trade…at this point, for me, there is no more “question”. It really isn’t very hard to reach this point either, you just need some solid Forex trading training and the patience and discipline to wait for your trading edge to appear, along with screen time / practice.

Examples:

Let’s look at an example of what I consider to be a “perfect” looking price action setup. Remember, just because it looks “perfect” doesn’t mean it will for sure be a winning trade, it just means the probability is higher. Always try to think in probabilities while analyzing the markets…weigh the pros and cons of each setup you take according to your simple trading filter or checklist (see the bullet points above). After you get the hang of this you should have no problem determining whether or not a potential trade setup is a higher probability setup or a lower probability setup…we trade the probabilities…not certainties. Over time, if we focus on high-probability trade setups and effective forex money management, we should be profitable…that is how you make money in trading…not by gambling and trying to “get rich quick”.

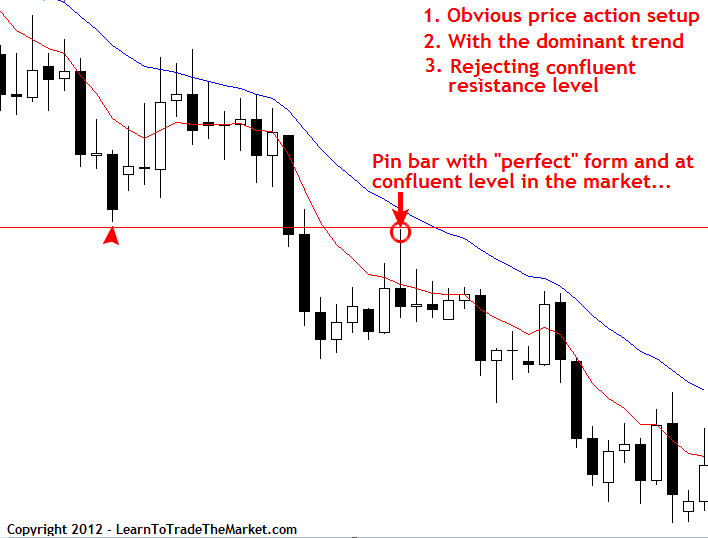

Now, back to our example (sorry for that little rant)…Look at the chart below:

From looking at the chart below, a few things are worth noting. The pin bar I highlighted had very good definition; long upper tail and a bearish close and it was with the overall downtrend of the market. The pin bar was showing rejection of an obvious horizontal resistance level as well as the 8 and 21 day EMA resistance layer; so it formed at a confluent level in the market. Overall, this was a very obvious setup and these are the types of setups that stick out like a “sore thumb” to me when I am scanning the markets. To me, this is a “no brainer” setup.

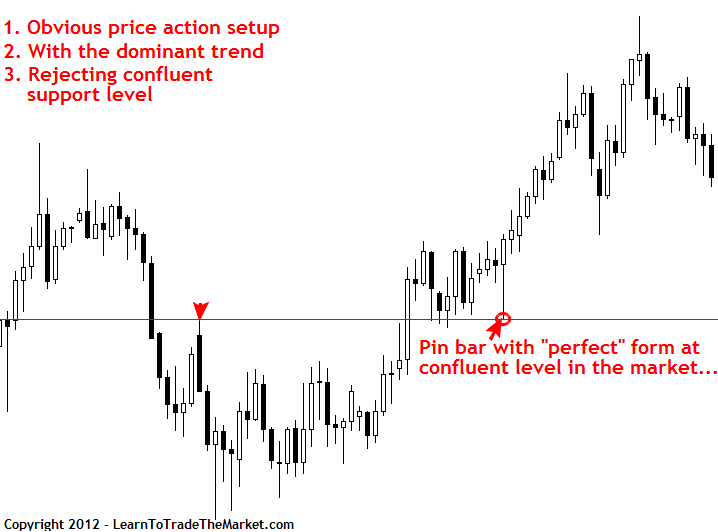

Let’s look at another example of what I would consider an ideal or “perfect” price action trading setup:

In the chart below, we can see a very obvious and well-formed bullish pin bar strategy that formed in the context of a market that was moving higher and had fresh bullish momentum behind it. Now, if by looking at the chart below you don’t understand why this market had just recently started trending higher before the highlighted pin bar formed, then you should read my article on how to trade with trends for more information. So, this market had trend momentum behind it, it was a very obvious setup with good definition as we mentioned, and it was also showing rejection of a key support level. Note, I didn’t put the 8 and 21 day EMAs on this chart, I want to show you guys that you don’t “need” the EMAs…you can trade with 100% pure price action, which is mostly how I trade these days, the EMAs are really just an optional “guide” and are especially good for beginners.

So, to sum up the two above examples, we are really looking for confluent and clean setups when we look for a “perfect” price action setup. We need to always keep in mind that even a “perfect” setup can fail and will fail from time to time. But, we CAN put the odds in our favor by knowing what a “perfect” instance of our trading edge looks like and only taking those setups as if we are trading like a sniper.

Stop loss placement and risk reward

The other primary factor that determines whether or not I take a trade is if the setup I’ve spotted has a realistic chance at making me a decent risk reward. This involves first determining the best stop placement considering the current market structure and condition. For those of you unfamiliar with determining the risk reward of a trading setup, the first thing you want to do is determine the best stop loss placement. Then you decide if there’s a realistic chance of getting approximately a 1:2 risk reward or better on the trade, and if so, you can go ahead with the trade while making sure you’ve adjust your position size to a level that doesn’t exceed your per-trade risk tolerance. We always decide our stop placement before we determine our position size…you never adjusted your stop loss based off the position size you want to trade, this is greed. If you don’t know much about position sizing and risk reward yet, then I suggest you read this article on risk reward and money management.

Since stop placement is such a critical part of trading and determining a trade’s potential risk reward, let’s look at a couple of examples of “ideal” and logical stop loss placement.

Essentially, what we are looking for when placing our stop loss is the most logical point in the market that is the closest level the market would have to hit to invalidate our trade setup. That might be a bit of a loaded sentence if you’re a newbie, so let’s look at a couple of chart examples to explain it more thoroughly.

Examples:

In the chart below we are looking at a pin bar setup that formed showing rejection of a key support level. Coincidentally, I would also consider this a “perfect” price action setup like we discussed above. But, the point of this picture is to show that the most logical place for the stop loss was just below the pin bar low and the key support level. Now, it won’t always be the case that the pin bar low or high coincides with a key level like this, and in such cases you can sometimes place your stop loss further up the pin bar tail, around the 50% level of the pin bar. But, in a case like the example below, where you have a key level close by, it’s most logical to place the stop loss just beyond the level and the pin bar low…even if it means you have to reduce your position down a little to accommodate for the bigger stop distance.

In the next example, we can see a bearish pin bar setup which formed rejecting a resistance level. Thus, the most obvious place to put our stop loss would have been just above the pin bar high and just beyond the resistance level, which were basically the same level. The point, once again, is to show that when you have a price action setup and an obvious level nearby, it’s best to place the stop loss just beyond both levels, rather than just the closest one, that way you give the trade the best chance of working out and give your edge a fair chance of playing out in your favor. Many traders get into a game of placing their stop losses too close to their entry just because it allows them to trade a bigger position size. I can promise you that if you start doing this it will only be a matter of time before you blow out your account.

Miscellaneous factors

Perhaps the best way to know if you should trade or not trade is just to be fully prepared before you start trading. Many traders jump into the market with little or no training, no high-probability trading edge that they’ve mastered, no trading plan, journal or any real clue as to what they are doing. It all seems very easy on the surface, but trading is won by those traders who take the time to develop the correct trading habits and who know exactly what they are looking for every time they open their charts.

Another aspect of knowing whether or not to trade is trusting your “gut feel” for the markets which is something that you’ll develop from screen time. Over time, you will solidify your gut feel trading skill and your confidence will grow, then you will begin to trust yourself more and the second-guessing that you might be fighting with now will gradually die off.

Finally, one very low-probability time to trade, mentally speaking, is right after you close out a trade, winner or loser. Traders are the most emotional right after a trade closes out, even if they are very disciplined and patient traders. In my article on high frequency vs. low frequency trading, I discuss how it’s a proven fact that people become less risk adverse after a winning trade and more risk averse after a losing trade, even though the potential risk per trade has not changed.

If you have any questions about this lesson or anything else … you can email me here. To learn more about my price action trading course and forex traders community click here. Please remember to leave a comment below and click the ‘like button.

Good trading, Nial Fuller

excellent article! what is necessary for me. Thanks Mr. Nial for your articles!

Very good, simple and clear trading checklist. Thanks, Nial.

Great article for beginners like me… Thanks Nail

thank you, thank you, thank you, thank you, thank you for everything, specially, becouse every time I read some of your articles, they are remembrering me that there is no other way to trade profitable, with rules, with confidence,…Problem is only my consistent,maintaining this performance, becose it start to be boring and than I try to trade some other market, or timeframe or methot or setups, and than you probably know what happen,…

you are the best of all!

Great lesson Nial. Thanks a lot

Brilliant article Nial.

Thank you

Excellent article nial as usual.

After reading your articles, I have changed my trading habits tremendously.

– Shifted to higher time frame

– Trading junkie to confident trader

– Fixed SL Amount and position sizing

– Booking profits at 2R instead of 1R earlier.

Great Nail..very very important facts.. explain in simple manner..great job bro..

Thank you Nial for this timely article because following

the basic is key to success.

great article

THANKS NIAL

Thanks Nail, I appreciate the article. You have address one of my key areas in price action set up.

thanks again for the article.i did not know about confluence

So good article. thank a lot.

many thanks for your kind help. this is well worth. learned lot. once again many thanks.

Thank you soooo much NAIL,GOD bless you and your NOBLE FAMILY, YOU are doing a great service to TRADERS COMMUNITY.The article is full of SUBSTANCE, Please keep up your valuable efforts.

WITH REGARDS, AMIN MALIK from PAKISTAN

Yes, trading is won by those who take the time to develop the correct trading habits:)

Another amazing article. I’ve had to come down from complicated to simple. It was like coming down from a drug or something. Simple (what you are teaching) is much better and adds peace of mind once you get to know the setups. Thanks, Nial.

Who, that was a lesson

Thanks Nial. The journey and process of trading is complex because we choose to make it more difficult than what it really is. Today’s lesson is a reminder of how emotion does not need to be involved if your trading edge is present and can find “the perfect trade”.

Great article nial.

Many thanks

Grant

Very good thanks a gain. Cheers

another important lesson, thanks a lot.

God bless you!

daalu

Good “stuff”…..(really good “stuff!)

Thanks Nial appreciate your articles real helpful and deep meanings and real

thanks again

dev

Thank you Nial for the time you take to present your most informative articles

Always a student

Galen

Hi Nial,

This is one of those invaluable, practical,logical and common sense articles that you will rarely find in most market journals or courses.

I have been reading your weekly write ups and have been impressed with the depth, clarity and substance.

Many thanks.

Nial, thanks for the great article again!

Gracias!

Un Perfecto!

Thank you for the brilliant reminder.

Thanks Nial, very useful for me.

Thanks Nial.

Very imformative.

Cheers

I can honestly say that your course and weekly lessons are sinking in. This article reminded me again to stick with the basics…levels and price action. Thx, Nial!

thanks for keeping on drumming it into our heads till we get it.

Reinforcement…Reinforcement!

I have been reading your stuff for a couple of weeks now Nial. It has produced a few lightbulb moments for me and I find it all very useful.I trade Indices -mostly FTSE and DAX-but obviously most of the information is valid.

Keep up the good work!

This article is awesome. I will definitely be purchasing your program.

Thanks again

Hi Nial, fantastic article, just what I needed, thanks!

Well, this is another great article, but this info has been already covered in other articles (entries, SL placing) but what is quite missing is trade management, profit taking. I think, this is the most important thing and some articles about this would be helpful. Of course there are some advices about 1:2 RRR etc. but we don’t know how far our trade will go, if it hit 1:2 and this is the time when something missing come out to play. On the other hand, it’s really very subjective but I and probably many others would appreciate some kind of article about it. Thank you, keep up good work Nial.

Thanks Nial,

Having a good and tested strategy is vital to know when to trade or not to trade

Well said Nail! Clear and easy to understand.

Very insightful and real facts of losers or winners.

Thanks

Nial.

Ahmed.

thanks Nial,Enjoyed the article key points of confluents having an edge with no bullshit indicaters just using your brain

Confluent levels make for great setups. I never understand why anyone would be willing to take the other side of those trades. Must be institutional order flow, or people trading out of excitement…

Nice article very usefull thanks

That’s how we hit them

thanks Nial, useful for me.

thanks again

Dear Nial,

Nice Article. I have understood your trading plan and strategy. Keep Posting.

Regards,

Nadeem