There’s More Money In Your Trading Account Than You Think

How much do you value your time? I’m willing to bet quite a lot, in fact most of us value ‘free time’ more than anything else in the world, because as we all know, our time is limited to one relatively short lifetime on this planet. But if we value time so much, why is it that so many traders are seemingly unaware of the power and value of time in regards to how it can significantly affect their trading performance?

How much do you value your time? I’m willing to bet quite a lot, in fact most of us value ‘free time’ more than anything else in the world, because as we all know, our time is limited to one relatively short lifetime on this planet. But if we value time so much, why is it that so many traders are seemingly unaware of the power and value of time in regards to how it can significantly affect their trading performance?

In today’s article, I am going to discuss the importance of time in trading and how utilizing it properly is often the difference between success and failure in the market. The power and monetary value of simply not trading, is vastly underestimated by most traders and until you understand why you should think of time as an extremely valuable commodity, you will continue to struggle in the market.

Time = Money. Literally.

I want you to start thinking of time as a ‘currency’ that is part of your trading account balance. The more time you have the more value you have, we can all agree on that. In trading, it is literally true that time is equal to money, if you utilize your time properly. Let me explain…

First off, the only way you can lose money in the market is by having a losing trade (“brilliant point Nial” you’re thinking, read on it gets better, I promise). Think about it like this, when you are sitting on the sidelines in the market (not trading), you can’t lose money can you? Avoiding losing trades, as well as not giving back profits you made on winning trades are the two main ways that time spent not trading can help you grow your trading account faster.

It’s counter-intuitive for many of us, because as humans we tend to think ‘more time’ is better in anything; our job, school, sports, you name it…more time spent doing something is almost always a part of the path to success. However, trading is a different beast all together because spending more time in and out of trades is typically not what equals success. Trading success is found by picking your entries very carefully and waiting patiently for the most obvious trade setups to ‘come to you’, which typically involves much larger stretches of time spent not trading in between trades than what most traders are used to.

Most traders fail, everyone knows that, we’ve all heard the 90% failure rate thing, and sadly it’s probably pretty accurate. Are most traders patient and disciplined? No. Thus, if most traders are not patient or disciplined and most traders are failing in the market, then the logical inference to make is that you need to be more patient and disciplined as you trade. This basically means you need to trade less frequently and give more value to the time you spend not trading than you currently are.

The approximate 10% of traders who become very successful in the market have the SAME amount of hours in their day as you do in yours. However, what they have learned is that by sitting out on low-probability trades and mastering their trading strategy to the point where they know when to trade and when not to, they are able to use time to their advantage in the market.

The day-trader vs. the time-savvy swing trader

The mindsets of a day trader and a patient swing trader are going to vary quite drastically. The day trader is almost constantly competing with time because he or she feels compelled to always be in the market. This compulsion to trade naturally means the day trader will have more losing trades eating into his profitable ones; he essentially is not using time to pick and choose his entries as discreetly as the time-savvy swing trader is. The end result of day trading is usually a full-blown trading addiction where time spent not trading literally creates a panic and intense cognitive dissonance as the trader eventually figures out that they are spending too much time in the market but cannot seem to stop trading. It’s pretty hard to consistently take high-probability trades when you’re always in the market.

The mindsets of a day trader and a patient swing trader are going to vary quite drastically. The day trader is almost constantly competing with time because he or she feels compelled to always be in the market. This compulsion to trade naturally means the day trader will have more losing trades eating into his profitable ones; he essentially is not using time to pick and choose his entries as discreetly as the time-savvy swing trader is. The end result of day trading is usually a full-blown trading addiction where time spent not trading literally creates a panic and intense cognitive dissonance as the trader eventually figures out that they are spending too much time in the market but cannot seem to stop trading. It’s pretty hard to consistently take high-probability trades when you’re always in the market.

A trading ‘edge’ means you have some type of high-probability entry method that literally gives you an ‘edge’ over a purely random entry, but when a trader spends too much time trading they naturally negate their edge since the edge is obviously not present as often as they are trading. The very nature of a good trading edge / trading strategy is that it won’t be present very frequently…you have to become a master of learning when it is and is not present, that is how you become a skilled trader and separate yourself from the legions of losers.

The skilled, time-savvy swing trader, knows that the more they trade the more their money is at risk in the market. They know that a trader’s first goal is to minimize risk and the second goal is to maximize reward, this is opposite to how losing traders behave, which is that they focus far more on potential rewards and profits than they do on managing risk properly. The successful trader essentially practices good ‘defense’ because he knows a good defense will lead to the ‘offense’ taking care of itself, so to speak. In other words, if you manage your risk capital properly and use time to your advantage by waiting patiently for high-probability trade setups, the profits will start to accumulate in your trading account.

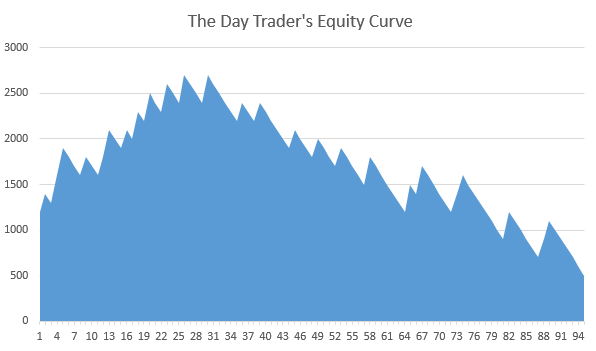

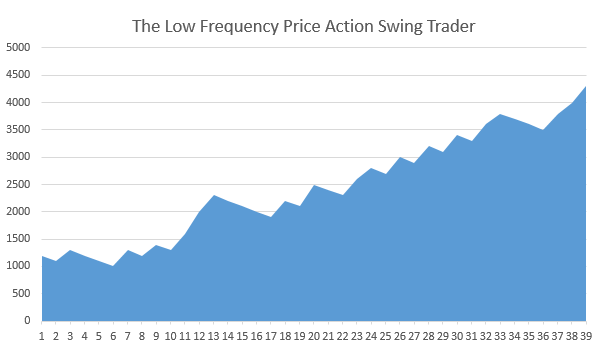

Let’s look at a hypothetical example of the equity curves of a day-trader / scalper and a low-frequency time-savvy swing trader:

The day trader’s equity curve below shows an increase at first, but then slowly but surely as time goes by the curve begins to decrease. Low-probability trades (over-trading) and losing profits made on winning trades (over-trading) eventually flattens out the equity curve and ultimately causes either a fast or slow depletion of trading account funds.

The time-savvy, skilled swing trader takes a much calmer and lower-frequency trading approach. This approach is evident in the slow but consistent increase in his equity curve. Note that he still has losing trades, but because he is using time to his advantage by picking his trades very carefully, he always has another winner around the corner that makes up for his losers. He is also not giving back profits that he made on his winners, which is a huge reason his equity curve has a nice consistent upward trend to it while the day trader’s does not.

Don’t marginalize the significance of time to your trading success

As I bring today’s lesson to a close, I want to first make it clear that you should not think you can avoid having losing trades, that is not the point I am conveying in this lesson. Even a patient, time-savvy swing trader will have losing trades, and the best traders out there still lose around 50% of the time. There are two different types of losses, there are losses that are a natural part of any trading strategy and that are unavoidable, and then there are losses that are avoidable, these are the losses that result from spending too much time in trades / over-trading.

Thus, if you take away only one thing from today’s lesson, let it be this: Being able to pick and choose your trade entries in a patient manner is how you can make the most out of your time in the market. If you want to know how to pick and choose your entries properly, you can start by learning the high-probability price action trading methods I teach in my Price Action Trading Course. Once you have the knowledge and skill to find high-probability trade setups in the market, you only need to remind yourself that the time you are spending being patient and waiting for the most obvious setups is literally helping you grow your trading account because you’re not giving back your profits or losing money on ‘stupid’ trades.

magnificent article! thanks!

Hello, Nial.

I’m really enjoying being part of this trading site. With each of your article, I’m a successful professional trader.

Thank you very much.

My Dear Mentor. But for you,I wouldn’t have acquired the knowledge I have now

As regard forex trading profession,and to know that you are there for me for life!

I can not thank you enough Nial ! God bless you.

Hi Nial,

Thanks again for sharing your knowledge.

You are the Bom!

I always see reflections of myself in the losing trader, so I appreciate the kick in the pants, so to speak.

I need it, as I want to be in the 10% category of winners.

You always pull me back in line Nial.

Kind Regards

Alan

My mentor Nial

Thanks for the lesson its quite an eye opener, enjoyed it very much looking forward for more inspiring articles from you..

Thanks

Thanks Nial ..a good article on how to make a solid profitable equity curve by being very selective in our trades only when there’s edge and not giving the profit back to market by not trading until our edge shows up again in market.

Nail, You’re guru. Your tips applies well on Indian market as well. God Bless.

Thank you for the article, as a new comer to trading, I welcome any insight. Though I do not feel that those graphs are showing the complete picture. The swing trader graph is taken only over a period of 39 days/trades, yet the day trader is over a period of 94 days / trades. If both graphs were on the same scale, namely 94 days/trades, how would they then compare.

Kevin, the idea is that the swing trader is taking LESS trades over the same period, therefore less trades are shown in the example.

Thank you for your reply. That makes it completely clear now.

This amazing formulated article with important and relevant information! Many thanks for your work!

Time is like Sword, if you didn’t cut it, then it will cut You My Mates.

Thanks coach for the inspiring article, keep the good work.

Thanks Nial, great article again. I had been doing well last couple of months and got to cocky and started to over trade and started to see my account pretty much stand still. This backs up what i have been thinking and what great timing to post it now. Thanks for all your hard work, cheers.

Thank you Prof Nial for your valuable lessons. It took me 8 years of wandering in the forex market to discover you. Unfortunately, I have lost valuable investment to lagging indicators and unprofitable forex software.

The most important thing about trading or wanting to be a trader is believing in your strategy. Nial is my mentor and has been for many years now. Time and patience to learn and master price action is a must. The process is slow and can see why many give up. But if you’re serious about doing this then you have to give 110% because this journey is life changing as for me it has and continue’s redefine me in what is ultimately for the better. And that’s just the beginning and anything worth doing will bring failure to test you but wil teach you how commitment and persistence will reward you. If it was easy everyone would be doing it. Thanks Nial great as always and appreciate today’s lesson.

Fantastic article

TO MY MENTOR,

HI Mr Fuller thank you very much for the way you have shown many the right path. Thank God that this is my first trading site that i want to live with it for life. Am a beginner at forex and was introduced by a friend who unfortunately has given up. AND THE REASON BEHIND IT IS THAT all he has been doing is trading the indicators. It was scary to me since what i thought there were no other strategy for trading especially price action strategy. on looking at money management while surfing that how i came to learn about you. now an willing to show my friend something new. THE ONLY REQUEST I HAVE IS FOR YOU TO BECOME MY MENTOR

yours,

CHARLES NGUGI

Thank you for that great article, that is definitely one of my short falls! my account goes up and down all the time and I never really see a profitable change in the long run. I need help discovering or learning how to find profitable set ups and let them come to me, then be patient and not jump out too soon.

Great article, for me I trade with a 1:4 RR Ratio on every trade. This means I only need to be winning 21% of all my trades to make good money. Its stress free and I find it more difficult to loose money then to make money over a series of trades… Every one will have different ideas on the best money management strategy but I think one thing that all successful traders will agree on is that money management is everything.

Thanks Nial