How To Stop Missing Winning Trades You Convinced Yourself Not To Enter

Have you ever not taken a trade and then looked back in hindsight and wanted to kick yourself? Ever entered a great trade and exited too early due to low confidence or over-thinking it, only to see the trade go on to be a huge winner? How often do you find yourself in these situations or similar?

Have you ever not taken a trade and then looked back in hindsight and wanted to kick yourself? Ever entered a great trade and exited too early due to low confidence or over-thinking it, only to see the trade go on to be a huge winner? How often do you find yourself in these situations or similar?

Truthfully, these situations are unavoidable sometimes, but if you’re finding that you are in a constant state of frustration and regret with your trading decisions you need to do something about it.

What if there was a way to reduce these trading errors and the mental pain that comes from them? What if you could start getting onboard these big trades that you talked yourself out of entering? What if I could help you cure this mental condition and finally set you free?

I have good news and perhaps bad news (depending on how you look at it). The good news is: This article is going to help you understand what is causing these problems and hopefully give you confidence to rectify the issue and start nailing some of these trades you keep letting get away. No more living in hindsight saying “I was going to take that trade, but…” or “I was going to let that trade run, but…”. The “bad news” is that I can’t do the work for you, I can show you the proverbial “door” to success, but it’s up to you to walk through it.

So, if you’re tired of standing in the same spot, getting nowhere fast, here is the path, all you have to do is start walking down it…..

1. Learn what recency bias really means and how to stop it

Humans tend to make decisions about the future by looking at the past and for good reason; this is usually a very helpful behavior that can prevent us from repeating the same mistakes over and over. However, although this evolutionary instinct has helped us move forward over the centuries, in trading, it tends to work against us. We call ourselves “optimists” when we learn from the past, and indeed that is typically a very optimistic thing to do, but in trading, in an environment with so many random outcomes, it can make us “pessimists” very quickly.

Allow me to explain with an example….

We tend to think that what happened recently in the past will impact what is about to happen next, and in MOST situations that would be true. However, in trading, there is a random distribution of winners and losers for any given trading edge. So, this means you never know for sure which trade will win and which lose, even if your edge is say 80% profitable over time. Even in a very small sample size of 3 winning signals and 2 losing signals on a random section of a chart, a trader could take 1 of the losing trades in that series and get mentally “shaken out”, meaning they freeze like a deer in headlights and skip the next perfectly good signal purely due to the recency bias in trading. In other words, they are being overly-influenced by the past / recent trade’s results when in reality, those outcomes have little to nothing to do with the next trade’s outcome.

An example of recency bias in action:

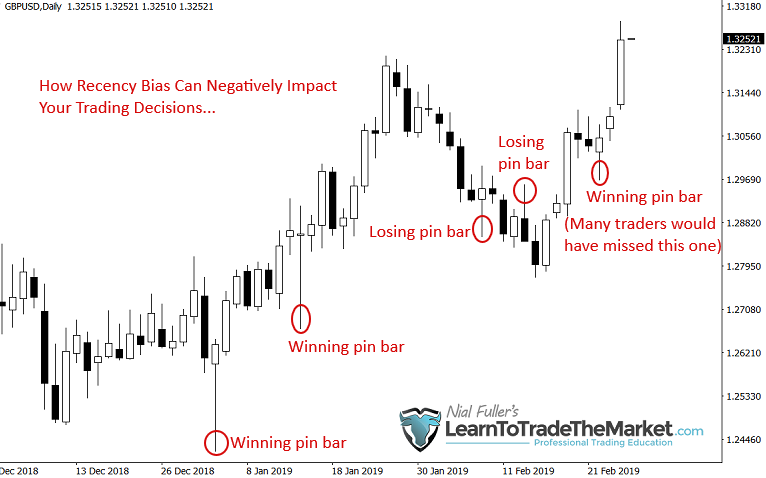

Now, let’s look at a recent real-world example of how recency bias can negatively impact your trading:

If your primary trading edge was pin bars on the daily chart time frame, you would have been taking the first two signals labeled “winning pin bars” on the chart below. These were long tailed pin bars, one of my favorite types. You could have profited from both of those or at worst, gotten out at breakeven, OK, no harm no foul.

Now, things get a little more interesting…

We can then see there were back-to-back pin bars that ended up losing. So, had you taken these two pin bars, if you let recency bias “get you”, there was a VERY slim chance you were taking the last pin bar to the right on the chart; which has ended up working quite nicely as of this writing. This is proof of why you need to continue taking trades that meet your trading plan criteria, despite recent trade failures or outcomes that you didn’t like. You (nor I) can see into the future, so to try and “predict” the outcome of your next trade based only on the last, is not only futile, but stupid.

- I will be honest with you, we discussed the two “losing” pin bars you see in the chart above in our daily members newsletter, when they formed. They failed, as trades sometimes do. But, we then also suggested traders consider buying the most recent pin bar buy signal on the far right of the chart, which you can see is working out quite nicely, DESPITE the previous two pin bars not working out. This, my friends, is called TRADING WITH DISCIPLINE. If you let that recency bias get you, you would have sat out, fearing another loss, then you’d be riddled with regret seeing the last pin bar working out without you on board. Regret, is very, very dangerous, this can lead to you jumping back into the market and making a ‘revenge’ trade (over-trading) and this of course results in more losing.

- Again, the concept I am trying to press home is believing in your edge and sticking to it. You must understand that the outcome of each trade is somewhat random and winners and losers are randomly distributed over the chart, as mentioned above. That doesn’t mean we will be taking every trade because we will filter our signals using the TLS confluence filtering model that I teach my students, but as we can see with this real-world and recent example on GBPUSD, when you see these signals, they very often lead to giant moves and we have to try to be on board a large proportion of them for our winners to out-gain our losers.

2. Don’t let fear of loss mentally disable you

The fear of loss, of losing again, is a very powerful catalyst for missing out on perfectly good trades. I am not denying that it’s difficult to take a trade after a losing streak, but you need to get to a point where it isn’t. As we mentioned above, it’s silly to keep thinking you will continue losing just because the last trade was a loser.

- To avoid this fear, or to extinguish it, you need to truly treat each trade as it’s own event and as an unique experience, because that’s exactly what it is. You definitely need to NOT over-commit to any one trade, meaning, don’t risk too much money! You need to protect your bankroll (trading capital) so that you can always feel confident and positive, so that you know you can lose a trade or several in a row and keep going and be just fine. Remember, your trading capital is your “oxygen” in the market, so make sure you always have plenty so that you can keep “breathing” properly.

Many traders often associate negative experiences or events in their personal lives with their trading. These “bad things” in our personal lives can manifest in our trading or finances (think about the addicted gambler losing all his money at the casino).

- This can become pretty complex, psychologically speaking, but just know that you need to be able to “compartmentalize” your personal life and negative things going on with it, from your trading. If that means you don’t trade for a week or two until a negative experience is not affecting you anymore, then that’s what it means. But, you need to protect your trading mindset and bankroll at all costs.

3. Don’t let overconfidence lead to a lack of confidence

We all start out optimistic and confident but the market typically shatters that quickly. We can set ourselves up for years of pain if we go out and try trading without the right study and practice.

We start out excited and motivated, read a few books, watch a few videos, do a course, and we go out and risk a giant chunk of our hard earned money. This can destroy even a great trader in the making, some of the best traders don’t make it because they simply didn’t wait their turn and respect the market and the process. One giant blow to finances can cost them the next decade mentally and financially. One series of losing trades can mentally disable even the most talented and smartest traders.

- You need to use your head in the beginning of your career and truly for the duration of your career. Sure be confident, but first protect capital, study those charts daily and stick to that routine daily, grind it out week in week out and commit. Practice your craft, master your craft. Be at one with the charts.

4. Develop your intuition and gut feel

Broken traders lack gut feel and intuition, they have stopped trusting themselves. We need to get you back up on the horse and get that 6th sense (gut trading feel) activated again. Jesse Livermore, in his book Reminiscences of a stock operator, often talked about “feeling the market” and “knowing what was about to happen by a hunch or feeling”, to quote him:

A man must believe in himself and his judgment if he expects to make a living at this game. That’s why I don’t believe in tips. – Jesse Livermore

- If you identify and fix the three issues we discussed above, then your gut feel and intuition will develop slowly but surely, like an athlete’s stamina. Once this happens, when you go to take a trade you will begin to automatically “paint” a mental map into the future from the bars on the chart to the right and your gut feel intuition will serve you well in building the confidence to enter the trade. For a price action trader like you and I, this starts with learning to read the footprint of the market left behind by the price movement / price action.

- Another thing you can do to help develop your gut trading feel or intuition is put together a list of daily trading mantras that you read to yourself, like the following:

I am confident in my trading edge and my ability to trade it.

I will respect my filtering rules and pull the trigger on valid trades.

I will not hide behind my filtering rules to excuse me from pulling the trigger.

I trust my intuition and gut feel.

I will not overthink this next trade.

I do not care about the outcome of my last trade, it’s irrelevant to my next trade.

5. Understand that the stats don’t lie

Many times, traders miss winning trades because they simply think themselves right out of them as a result of not trusting or understanding the actual facts and statistics of trading. Let me explain…

As I touched upon earlier in this lesson, there IS a random distribution of wins and losses for any given trading edge. What this means is that, despite your trading edge having XYZ win percentage, you still do not ever know “for sure” WHICH trade will be a winner and which will be a loser, the consequences of this trading fact are three-fold:

- There is no point in changing your risk considerably between trades, because you do not know if the next setup will win or lose, despite “how good” it looks.

- You cannot avoid losing trades, all you can do is learn to lose properly. When traders try to avoid losses by doing things like thinking they can “filter” out losers or any other similarly hair-brained idea, they put themselves in a position to blow out their trading account because they are now trying to predict that which is unpredictable which leads to a whole host of other trading mistakes.

- Any one trade is simply insignificant in the grand scheme of your trading career, or at least IT SHOULD BE. If you are making any one trade overly-significant by risking too much money on it and become overly-mentally attached to it, you are setting yourself up for certain “death” in the trading world.

Conclusion

Trading is not about never missing a trade or never having a losing trade, not at all. However, if you find that you are chronically missing trades and in a state of regret about your trading, then you do need to make some changes.

As traders, our number one “enemy” and “competitor” in the market is ourselves. How long it takes you to realize that, accept it and do something about, will determine how long it takes you to start making money in the market. Today’s lesson has diagnosed and offered multiple solutions to one aspect of trading that typically causes people to “shoot themselves in the foot”, so to speak; missing out on winning trades.

Your mission as a trader is to totally overcome and eliminate all of the various self-defeating behaviors that every trader must conquer to reach a level where you are giving yourself the best possible chance at making money in the market. This is what I constantly try to teach students via my professional trading courses and it is my hope that by following me and learning from me you will eventually get out of your own way and be able to take advantage of the powerful price moves the market offers up every so often.

Please Leave A Comment Below With Your Thoughts On This Lesson…

If You Have Any Questions, Please Contact Me Here.

so helpful thanks

You are a gifted communicator. Everything is so well explained and documented. Thankyou.

Avery great article indeed reminding us that the market one has to concur the mind first thank you Fuller.

Thanks

very helpful

Excellent lesson!

Thank you Nial so much! Your articles very very powerful!

Nice lecture

so helpful Nail thanks

Dear Nail,

Thanks a lot for your very valuable and detailed lesson, and so for your course.

Really enjoyed the article- thanks Nial

Thanks Nial. so insightful

Thanks

I appreciate so much and something interesting for me here is to know that the first competitor and enemy is myself, this will move me to change in many areas of my life

Big up Nial, a brilliant and educative article ever! thanks a lot, you have pushed my trading a milestone ahead.

Thank you Nial, I am inspired by your analysis. I started watching your videos on YouTube last week. And they opened my eyes.

Spot on…thanks

Thanks Nial, I needed that, Gye ????

The detail is excellent. The message is in the detail. The information is invaluable. There is nowhere else and no other person providing the ongoing support that keeps me in the world of forex. Thanks Nial.

Spot on another great article just so many good point to learn from. One would think to be able to give this insight Nial you had made many of these mistakes yourself!!

Great lesson Nial

I definitely need to gain more confidence in myself, study more, to become the type of successful trader that I want to be.

Very useful article!

Great article indeed at the right time, thanks Nail.

Nial…are you telepathic? How did you know I needed this right now?

Excellent article after excellent article. These are an education in themselves. Thanks.

Do not know how you do it Nial , but you seem to post the right article at the right time. Always good to have somebody step you back in line.

Cheers and keep up the good work .

Brilliant article Nial. Thank you. Really wish you would do YouTube videos again.

Very profound! It’s like it was directed to me specifically.

Great stuff!

I should read this post before every trade I plan :)

Great article Nial. Thank you for sharing with us.

Great article Nial

Mixed emotions/beliefs over the last few months

Good refresher for my mindset and feel a boost of confidence already

I’ve left some cracking good trades go by recently

Believe and commit

Kind regards

annton

Thank you so much we do not have any control of outcome but a can control outselvrs????????????

Controlling our emotions is most difficult part of trading!

Superb nial

I Am trading 7 years. Still making stupid trades where are no valid trades. I feel and trust that im ready to be a succesfull trader but imy inner demons makes opposite decisions again and again. I think not mantras (try it) but hypnotic ways must change my mind. Im not frustrated but about it only i feel very stupidly.

Hello, Nial!

Thanks a lot for your article! Sometimes I start believing that providence through you helps me. Your publications come out just in the right moment and for the right theme. It really helps, especially when there is nobody to talk about trading.

Thanks

Thanks for opening my mind on this one

Thanks, Nial, I really needed this article. I am struggling with 1) trades I don’t take but I see were good after the move happened and 2) trade I take that I think they’re good but later I can see clearly that they aren’t. It’s a nightmare sometimes, specially at low volatility.

Great article.

Just what i needed. Thanks Nial for this article

very useful information in terms of trading strategy and trading psychology in the market

Great lesson….thanks Nial.

Really a very good article.

Ilove your articles Nail!

Regards from Nigeria

Thanks Nial you have built a confident within me. I start by analysing the market myself before i check your weekly analysis. The winning pin bar you refer to i saw it without reading your weekly analysis but i am guided by your lessons

Your articles are constractive and full of wisdom.May God bless you and your whole family.