Why Serious Traders Need ‘New York Close’ Forex Charts

This is an extremely important lesson about why you need to be using New York Close Forex Charts to effectively trade the price action strategies I teach my students. If you’re truly serious about your trading, you should pay close attention to what I am going to discuss here… it will make a huge difference in your trading.

This is an extremely important lesson about why you need to be using New York Close Forex Charts to effectively trade the price action strategies I teach my students. If you’re truly serious about your trading, you should pay close attention to what I am going to discuss here… it will make a huge difference in your trading.

Let me explain why New York Close Forex Charts Are So Important…

In a nutshell, traders need to be aware that the normal Forex charts offered by popular forex brokers out there are NOT suitable for professional price action trading or any form of technical analysis in my opinion. If you’re a serious trader you need to ensure that you have forex charts which open and close in true alignment with the New York trading session close (this is the real forex market daily closing time). These charts also need to have 5 daily bars per week instead of 6. This will ensure you are seeing the correct price data and you will then be able to analyze the exact same price action signals that myself and all of my members see.

I am going to get into much more detail on this subject below, however if you don’t want to read this entire lesson you can just download our preferred New York Close Forex Charting Platform Here.

Most forex brokers simple do not offer the most relevant or effective charts for you to make your trading decisions from. For many beginning traders, the fact that they might be looking at charts that aren’t accurate does not even occur to them. Let me assure you this is something that you NEED to seriously consider before trading live, and you probably won’t read about it on other Forex trading education websites.

Proof That You Need New York Close 5-day Charts

The daily close of the Forex market takes place at 4:59:59 pm NY time and signals the end of the current Forex trading day and the start of the new one which occurs at 5pm NY time as New Zealand / Australia and Asia trading gets underway. The New York close also reflects the close of the 2nd heaviest Forex trading session which is the New York session.

Closing prices are the most important in any market because they reflect who won the battle between the bulls and bears for that session. Also, as a price action trader focusing on the daily chart, we need to see the price action setup close out on the daily chart before we can correctly identify it as a price action signal, and it’s at the daily chart close that many significant price action setups form.

Due to the fact that daily chart trading strategies are critical for all traders to learn, we all need to see the most accurate and relevant daily chart closing price. Traders who are planning on being members of my trading community need to have the correct NY close 5-day charts since my price action strategies are focused around the daily charts and all my members use the correct NY close charting platform.

Not all MT4 (Metatrader4) Platforms are the same, in fact, most MT4 providers are on GMT time and show 6 daily price bars which is very WRONG and will sometimes show “false signals” and this can lead to very big problems. You WILL NOT be able to follow my trading patterns or ideas if you’re not using the correct charts.

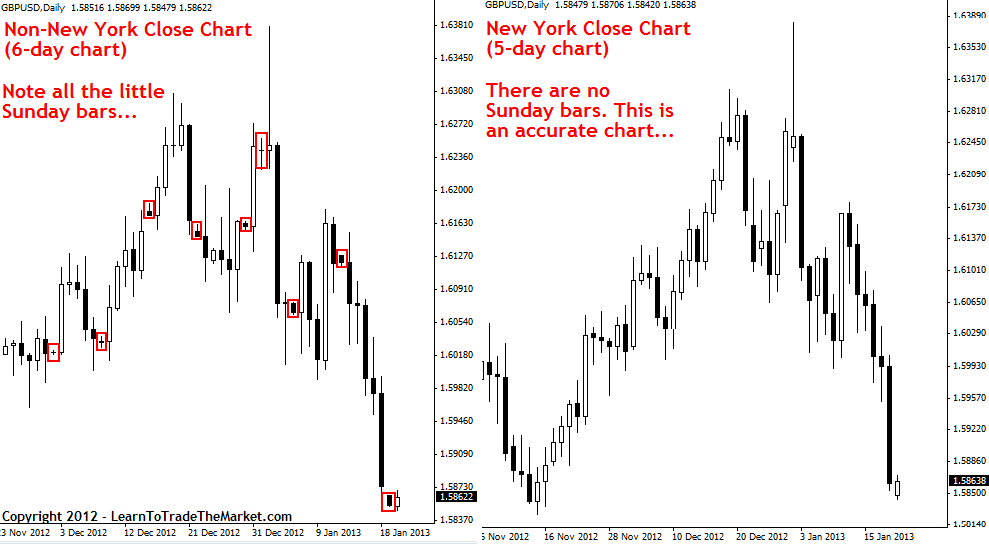

Example of a Non-New York Close 6-day Chart vs. a New York Close 5-day Chart

Note all the little Sunday bars on the non-New York close chart on the left. These Sunday bars should not be there and they are not relevant; they just take up space and add unnecessary variables to the chart which will confuse you and many times generate false signals. There are only 5 trading days per week in each major currency trading center around the world, but due to the 24hr nature of Forex, some platforms show a “Sunday” bar, this is incorrect and unnecessary…

New York close 5-day charts provide more accurate price action trading signals

If you want the SAME charts and price action bar/candle formations to show up on your charts that my members and I use, you should use ‘New York Close Charts on Meta Trader‘ with the correct data feed.

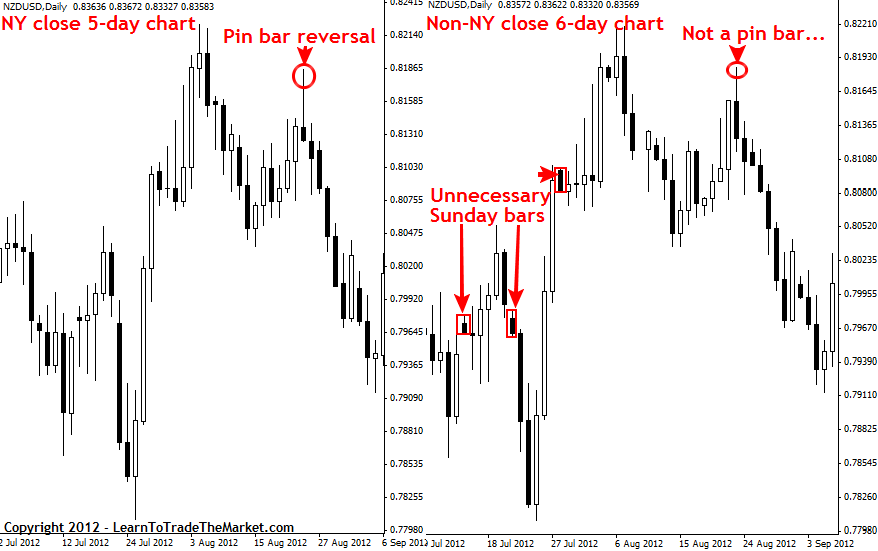

Most of my members and myself included would have missed the approximate 200 pip move that resulted from the pin bar reversal setup on the NY close chart on the left had we been looking at a Non-New York close chart like the one on the right…

Only a handful of brokers offer a true ’5 Day Chart’ with the correct open and close shape of the daily price bar. My members and I use a 5-day chart with a New York close MT4 data sever to generate my Price Action Trading Signals. If You are not using New York Close Forex Charts, you won’t see the same trading setups/signals.

Some traders email me asking if they can “adjust” the platform time on their trading platform, and the answer is that you cannot adjust it. The time at which your daily bars close out is set by the broker offering the platform and a broker either offers NY close 5-day charts, or they don’t…

So You Need To Find a Good Broker Who Offers the Correct Charts. See Below For Details of Suggested Brokers & Charts.

WHAT BROKER Has The Correct New York Close Charts ? (Who Can you trust to trade with?)

We work with a broker who offers the correct NY close 5-day charts and they are in my experience, reputable and reliable. My recommended broker offers direct access to interbank prices and they have run a genuine operation for 15+ years. They have the correct charts on both desktop and mobile platform and offer a wide variety of other markets including CFD’s, Commodities and Indices. Click Here To Get a Demo Of Our Preferred Forex Broker Platform

Related Trading Tutorials:

How To Correctly Set Up MetaTrader Forex Charts

How To Place Different Trade Entry Types Using MetaTrader Platform

How To Set Up Price Alerts In MetaTrader 4 & 5

Beginners Introduction To Japanese Candlestick Charts

Why Serious Traders Need ‘New York Close’ Forex Charts

Please Share This With Other Traders, Click The Like & Share Buttons Below.

Please Leave A Comment Below With Your Thoughts On This Lesson…

If You Have Any Questions, Please Contact Me Here.

Good trading, Nial Fuller

Thanks this is the most valuable information 🤠

Thank you so much for this eye opener, I think, I make in my trading before now . Then I was disappointed, but I want to start all over alright. Thank you for helping me as a beginner.

Thank you sir

just from reading your introduction concepts you open my eyes to so much concerning forex trading and most importantly I now understand how to mark the support and resistance levels correctly S/R.more blessings to you mr Nail

Thank you Nial…

Tôi dùng biểu đồ 5 ngày/tuần.

Thank you sir, you just open my eyes.

Thank you sir

Thank you so much Mrs Nial Fuller

God bless you, help you as your

helping people

Hello dear,

I’m a new member. Thanks for all this valuable information. I need some clarification. If I trade cross currency pairs (The currency pairs that do not involve USD), such as GBP/JPY. Should I need to use London or Japan close chart? Otherwise, Do I need to use NYC close chart on all symbols?

Thank you

I like this

Cheers!

Very interesting reading for me as a newbie and clearly explained to.

I’m in the UK.

Can you recommend some UK brokers that are offer 5 day charts

thank you sir for that knowledge i will try it

Thanks for all this valuable information. I did not know anything about 6-day charts. My broker offers 5-day charts, but I am not sure about the adaptation of opening and closing time of bars with the New York clock.

I’m happy for helping. who help the people, be successful himself. thanks a lot.

Hi Mr Nial, am very much thankful for you supporting us and making sure we use correct platforms in trading, may God bless you abundantly throughout your life and have a prolonged life #Denish Kenya

Thanks for the great job, your tutorial lesson is one of the best one can find as regards forex trading for newbies

You are really doing a great job Mr Niall. You’ve really improved my trading strategies. Thank you so much

Thanks mr neal.. thanks a lot for information..good job.

Great job Sir ????

I’m in the US, will this brokerage account work for me?

I would love to know this as well. Finding a U.S. broker that offers NY close charts seems to be very difficult. I’m a LTTM member, and I’m itching to put this stuff to work!

You can email us via the support line and we will direct you to a USA broker with new york close forex charts.

Am a Nigerian, I followed you for a while now, can I use the New York close charts, as a Nigerian??

hi

Thank you for all your efforts

Hy Mr Nial I’ve been following your articles and I find them very informative, which broker do you personally recommend for PA trading ??

FX Broker to consider is – https://www.learntotradethemarket.com/forex-trading-tools/new-york-close-charts-forex-broker-platform

Hi Nial,

Is there a template for MT4/Metatrader for LTTTM members can load? I want to make sure my charts look like yours.

I have been unable to find in the forum.

Here is a tutorial on setting up forex charts in meta trader – https://www.learntotradethemarket.com/forex-university/how-to-set-up-meta-trader-forex-trading-charting-platform

Hello Nail,

I have just opened a demo account with the broker you mentioned in the article, but what they offer as a start deposit (50,000) don’t you think is way too much for a novice trader. Because i have read it somewhere that what ever amount you are planning to start with (live account), you should practice the same amount in demo as well.

Need your guidance,

Regards

you can request they change the demo account balance or choose a smaller amount when opening the demo via the MetaTrader platform

Hi Nail.

Am new here but so excited reading and learning important trading informations I’ve never had.

Blessed

your role keeps us moving forward please don’t give up on us

Thanks alot sir for your guidance

Hello sir. Is the new York close platform can be used as replacement to my existing mt4 provided by my broker?

Thank you very much sir.

I have been following your articule sir and i have seen that i have not been misleaded in anyway

And now i totally come across the solution of one if my answer that is which broker iffers the best and precise price chart fluctuation and with this infor mation i know i am on a good footing

But how can i chose a good 5 day chart forex broker from Africa…………….

Or is it better to use the new york 5 day broker?

Thanks for the insite Nial

Good information, thank you Nial

Dear Nial,

I am a novice forex trader from India.(GMT + 5:30). Here I used to trade USDINR and EURINR( euro vs Indian rupee) . But New York close is almost 3:30 am in the morning, where all the brokers are closed. Tradable hours is restricted to 9:30 am to 5 :00 pm in Indian. Standard time. So when should i observe the market? Just before Indian market is closing or in the morning 3:30 am ?

Any forex broker will allow trading 24/5, there is no closing time during business hours in the forex market. You are not using the correct broker.

In India, the forex trading is different from rest of the world. We are missing out on the real deal due to restrictions.

Thank you very much sir

Thanks Neal…

After I lose in trade use broker now I start learn the correct way.

Good Morning and thanks champ and your team.

Hola,

I have been learning and practising on a demo account from a UK broker, and want to open a live account now.

What broker would you recommend and are they subject to the new leverage caps imposed by ESMA?

Thanks a mill in advance

To avoid ESMA low leverage of 33 to 1, you can sign up with Australian broker at 100 to 1 leverage or higher. We use this broker platform here – https://www.learntotradethemarket.com/forex-trading-tools/new-york-close-charts-forex-broker-platform

GREAT ARTICLE!!

A marv job

its a learning curve for me thanks Fuller

Nail Fuller is such a unmatch price action Authority.

great lessons sir

You’re such an unfound man

Can’t thank you enough!!!..!!!!

Much thanks, Nial! I have found your articles really useful for newbies

Found tutorial a great help Thanks Nial

Thanks a lot sir

BOSS GREAT JOB. WELL DONE BOSS. THANKS

great advice for a newbie like me. look forward to learning much more from you Niall

tq mr niall

Thanks Nial for guiding of all us regarding correct chart

Sir i read your every article every day.I follow your trading setup information and price action study more than 3 year now i am your online student.So thank you very much.

Hi Nial i am so glad i come across your excellent website. I now see trading in a totally different way. And am now signing up to 1 of your recommended broker’s as the one I was with don’t offer the five day charts.

I’m excellent on this article.Thank you

Cheer!!

Thanks Nial really appreciate the information

Thanks Nial. Very informative article.

Cheers fella, nice article.

Thanks Nial….Just downloaded the appropriate platform and I could see a good pricing difference between my current broker and this new one….You are always spot on….Good work….Thank You.

Excellent thinking, Nial. You are dead on, in my view. Finding accurate charts can be a problem for sure. Please keep up the good work, and Thank You! Del Hagan Oct 30, 2013

I’m surprised nobody has commented on this excellent article. Thanks Nial!