Why You Should Take the Profits and Run!

This article is for those traders (new or experienced) who have trouble booking profits. Do you often see large profits evaporate as the market reverses against you, leaving you feeling powerless and confused? If so, you know how frustrating it can be and you know exactly what I’m talking about.

This article is for those traders (new or experienced) who have trouble booking profits. Do you often see large profits evaporate as the market reverses against you, leaving you feeling powerless and confused? If so, you know how frustrating it can be and you know exactly what I’m talking about.

Poor target placement, lack of experience, greed, arrogance and stubbornness are all issues that can cause traders to not take profits off the table.

I appreciate this article may conflict with some of my core beliefs and teachings on taking profits since typically I encourage people to aim for a 2 to 1 risk reward or greater and to set and forget stops and targets. In theory this makes sense, but in the real world as you likely already know, there are still a great number of trades that almost hit your profit target or where a trade has moved quickly in the right direction and your staring at a giant profit… and then the next day or week, the market goes the other way and your once giant profit has become a much smaller profit or even a loss.

In today’s article, I am going to go over protecting open profits, and how to know when to take the money and run and trust your gut, and several other tips that will help you start booking profits and building your trading account as a result.

Should you take the money and run?

How many times have you gotten up a huge profit in a short space of time because the market popped in your favor right away? Well, it happens, but not as often as you (or I) would like. Yet, I find that traders almost always do the exact wrong thing in these scenarios…

If you know a fast and big move in your favor is relatively rare (usually trades take longer to play out in the market) then it goes to reason you should try to protect most or all of that profit when you have it. The way you do that is by trailing your stop loss close to the current market price, after the big move in your favor. This way, you secure most of the profit but you still give the market a chance to keep running in your favor. The alternative here, is watching price reverse and melt-away all your open profits.

Now, I know what some of you are thinking already: “But Nial shouldn’t I just set and forget like you teach?” Well, there is a time for set and forget trading and a time for actively booking profit, and that is the point of this lesson. We are all trying to make money from trading, so when you get up a big profit fast, it’s time to start thinking about booking it. Set and forget is more of a default trade-management strategy that you should consider your baseline management technique. In other words, set and forget your trades unless there is reason not to (like a huge fast move in your favor). Here’s an example…

Here’s another common scenario: there is no clear breakout (beyond a level) or trend in place, but the market moves a lot in a short space of time. In this scenario, you should also consider booking profits when they’re there. Here’s an example:

This chart was in a trading range and we see a pin bar buy signal formed near the bottom of the range. Now, in this scenario, it’s obvious you would look to book profit near the resistance of the range, but you would be surprised how many traders don’t. Instead, they will watch that profit evaporate because they ‘feel’ like the trading range will breakout and they’ll make even larger profits. This is greed at its ‘finest’. You can see what would have happened had you kept holding that trade, you would have probably lost money or at least made a lot less. Don’t try to predict breakouts before they happen; if you’re up a good amount of profit in a trading range, BOOK IT!

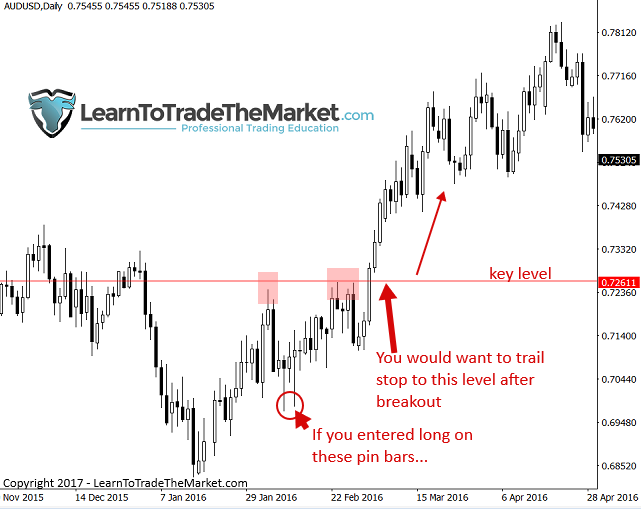

Now, if there is a strong trend and a clear breakout within that trend, you can look to trail your stop loss below or above a logical key or near-term level. You don’t want to hold onto the trade if the market comes crashing back through a level it just broke out from, this could end up being a false breakout, leading to a loss. In the example below, we can see price broke above a key level in the AUDUSD, so if you were already long from the pin bars marked on the chart, you would definitely want to trail your stop up from the pin lows to that key level or just below it. When you see an obvious breakout of an obvious level, view that as a good level to trail your stop to, because if price comes back through that level it shows the market dynamics have changed dramatically and your trade idea is likely invalidated.

Getting emotionally attached to your positions…

When you’re trade is up 2R or 3R and you don’t take the profit because you are only thinking about the profit you MIGHT miss out on if you close it out here, you are being greedy and illogical. Remember, the market is probably going to retrace soon (because markets don’t move in straight lines for very long), so better to book the profit while it’s there and then you can always wait and enter later, after the retrace. You’re in a better position if you take the profit because you have the money in the bank and you can still re-enter should the market pull back and give you a second chance entry opportunity, which happens often. It is not fun to watch a previously large profit evaporate…

The culprit is getting emotionally attached to your positions, you feel like if you close it out for a profit you’re somehow cutting your potential to make money. But this is silly! You can always enter again! However, once that profit is gone, it may never come back! Especially in the situations like those mentioned above, you need to book the profit when it’s there.

Ideally, before you enter the trade you will have some idea of your profit-taking strategy.

- If you are trading a volatile market that’s making large swings in either direction, be looking to book profits after big moves, don’t wait for the opposing swing to happen again and wipe you out.

- If it’s a strong trend, then you may elect to let the trade run for a while and trail your stop below or above obvious levels, etc. If there are no obvious levels then you can always trail your stop below or above the previous day’s high or low.

- If the chart is in a trading range and you buy near support, look to exit before or near the resistance, vice versa if you sell at resistance (look to exit near or before support is hit) – don’t hold on this scenario, book it!

The points above are examples of things you may include under your profit taking section in your trading plan. Don’t make strict / rigid rules you must adhere to, because this is futile, instead, write down some common scenarios and plan what the best course of action is for these scenarios and why, then when you are in that scenario for real, you just follow your plan, you don’t panic.

Conclusion

The psychology of profit taking is both fascinating and frustrating. More than anything, you should take way from this article the point that booking profits is almost never the wrong move. Obviously, most of the time you want to try and take profits that are 2 times your risk or greater, but there are times when holding out for a certain profit target is not the best move. You must be flexible and able to adapt to various market conditions to take profits successfully, and thus to trade successfully.

I would suggest you take the time to write out a profit-taking plan, and include various scenarios like the ones mentioned in his article and others you’ve found yourself in, and plan what you will do in those situations again. Markets tend to behave in the same general conditions; trending, consolidating, range-bound or meandering with no direction. Make a plan of how you will trade and take profit for each condition and you will be light years ahead of most traders already.

I WOULD LIKE TO HEAR YOUR STORY :) PLEASE POST A COMMENT BELOW

QUESTIONS ? – CONTACT ME HERE

This change my mindset and thanks for who write the words out, i use to struggle with taking profit i always think i will made more if i hold the trade but later get stop out or breakeven

Very good and improtant Article Nial, thank you. In my opinion this topic its crusial from psychological point of view. Never regret when you will close your position on +. Always is next day and next trade. Never count your paper profit before closing position and like you wrote every trader should wrote down few scenario how to close trade on +. Im with you very long time, and Im very greatfull for everything what you did for my trading. Happy 2022 !!???? thanks Nial !! You are my legend !!

Cheers Mariusz

Thank you for the reminder that we need to always plan ahead to confirm the saying if you do not plan you are in other ways you are planning to fail.

A great article here to be read by all the traders to sharpen the exit and entry in the markets thankyou Nila for all always contributing greatly in the fx world.

Thank you sir, for these highly informative and insightful articles. This, I must really say, is immensely helpful to millions of people, both beginners and experienced traders alike. What you teach here is completely transforming and eye opening, and I must really confess, I have gained immeasurably from it. I lack the right words to express my deepest gratitude. All I can say is: Thank you for teaching us what we never knew, and what we probably wouldn’t have known had you not taught us. Thank you once more for helping to make the world a better place. God reward you abundantly. Ozone D great.

Thank you, Nial, for spelling the myth, that is so awesomely helpful.

Very helpful

very nicely written. But to execute and catch the pinbars YOU must be attach as umbilical cord to your computer during trading hours, that is time consuming. How to trade them…..

This is exceptionally great. I will read it over and over and over again until it sticks with my being

My eye is opened. I always have my stop loss every tight and all trades end on a loss or very low profit. May i remember this lesson each time i nter the market. Thank you Mr Nial.

It will easy when you enter from support(buy entry) and from resistance(sell entry) with inside bar and pinbar

Nice post sire. However, i wish there are rules for identification and validation of these highs and lows… i hate subjectivity without rules. With rules, repeatability happens with exactness till it becomes involuntary to we newbies. Is there any way you could incorporate rules into identification of highs and lows? Are there any rules to validate highs and lows?

This is an article that need to be reread as many times upto the point it is engrained the sub- conscious mind thankyou again for the great article.

Thanks for this write up.

Hi Mr Nial, you are doing the great job, you are the one of best FX trader in the world what I feel. Thanks you for sharing such a great session.

Toufeeq

This is an eye opener. I have been leaving my trades for long until I lose the profit I made. Thank you Nial.

Always out with a winner post A teacher to cherish Thanks many thanks over

Hi Nial,

I enjoy reading your wisdom-filled articles on trading the financial markets. I have been trading for some years now, picking up useful trading nuggets along the way. Your latest article is, as usual, content packed.

Thanks Nial for your awesome trading insights.

Essien.

Nial, you are the godfather of the Forex trading.

You are too much sir. By this you have solved most of my problems.

Thanks for all the vital information on retracement trading- entry signals, stop loss placing and profit taking. You sure opened my mind to new idea.

You tha God sent!

Pls support me to explain more about ” Event area ” in the line ” Retrace Entry Back to an Event Area or Prior PA signal.

Thank you

THANG

Super Nial bro…..

Hi, i am a brazilian guy who trades for years. I pause my trades during some years, and i came back about 2 months ago. I’ve been trying a strategy with short take, and it has given to me a lot of profits. I am trying to make my mind strong to ignore the market’s movement after i book profit. You have said a very right thing here: the market always makes a retraction.

This article was very good, thanks. Keep it that way. God bless you.

Thank you for this article.

Very nice Boos.ok go forawd.

Great always to hear you big brooother Nail. God bless you. timely article for me. love

Nice and very interesting. This article answer the questions why i always close trades with losses while actually I have been profitting during the trading session.

ive bee reading your lessons im impressed

Interesting article. This happen everytime. The idea of wanting to wait a little more time may cause us to lose what is supposed to be a profit instead.

reading such artecles really opens my mind.Thanks Nail

This happened to me recently on Eurgbp. Up 200 pips and thought it’d go higher. Next day market came down and I booked only 40pips!

I learn a big lesson.

ok, its been almost 2 years since I start to learn how the market move. I can say most of your articles give me a vision about how to, what to do and don’t. It’s cool because I start move to learn draw some major snr, I got stuck on making it, but your articles show me some clever way to draw “a key level” and some short term. I’ll try my best to practice it everyday !!!

Thanks Nial, You’re Awesome !

U ar really a genus.sir u teached me that i should take a risk than to lose the chance **#great things come to those who hustle (lovely)$$$$$

Hi Nial,

Thanks for the lesson. This has been my problem for some time. Greed. Always waiting to take more with a small investment. My profits evaporate and majority of times end in a loss.

In the last 6 weeks I have been taking the small profits. 100 – 200 points instead of trying to get 500-1000 points. seems to be working ok. Thanks again

That’s a good trading guide. Thanks nial.

Keep it up Mentor. God bless you more!

This is exactly what was missing from my trading. Realistic exit plans. Thank you Nial.

thank you sir for your well prepared article. Im a victim of this very situation , i’ve almost hit my profit target then i said i should let the profit run but to my very face , the profits were evaporating until i closed the trade .

Thanks Nial, booking profits on-time is right, cos too much emotional traits is involved when one realized that the trade is going to retrace unexpectedly.

Thank you, Nial.

Thanks Nial, way to go. You keep writing evolving lessons like these, Ill always have something to learn. And again an opportune time to write this particular article, I think you are the Yoda of trading:)

Thanks Nial, that’s an eye opener to me, I have that problem of letting profits run into losses, thank you very much for the article.

Thank you Nial, well explained and organized article. Definitively help me to prepare my Profit plan. Regards

Thank you

Thanks Nial. I really got immense knowledge about booking profits.

Amazing,am definitely going to include all this point in my trading plan. Though am still on demo, but what have learned from this article in very key to a successful trading.

Thanks a lot Mr.Nail Fuller.

This happened to me last week. Was up 700 proffit and closed with 700 loss because i had such an attachment to what i thought was a fullproof longterm move in one direction so i wanted to ride the waves but it looks like it wasnt the long term move in that direction i thouht it was.

Hi, Dear Nial Fuller, , excellent, well-explained with reality and experience. Thank, cheer

Excellent article,Thanks Nail

Nice….this has been my bane in trading. Not booking profit….

Thanks Nial. My mentor.

Remain blessed.

Thanks Nial.. great advise. Am looking forward to not closing or closing when the trade goes against you but hasn’t hit your stop loss…

Thanks so much Neil as always, great article!, mm please i have a question, what about the case that all the other trading books and gurus says about let profits run until at least 1:2 Risk reward ratio? , because they say if i close before that 1:2 im cutting my profits and that can damage me in the long run! , but in the real life im bored to wait sometimes for a 1:2 and when im at 90% to achieve that profit target the markets turns down eliminating all my profits and making a loss for me, but when i book the profits i see my account growing, what you can reccomend me about that?.

Before reading the whole article, I’m writing this! Just the header alone struck the cord. Toy, Nial, are a mind reading mentor! I’m at that stage in my trading where my edge is consistently delivering profits! But, yes, most times, these profits evaporate. Alot is happening around the political and business world and price is fluctuating between these events. Yes, price still does was it’ll do, but the whipsawing is alarming! I can’t say enough how soothing this article is to me because I make sizeable % of my Acct only to watch some diminish or disappear, even into losers.

Thank you for this article.

Amen

Thanks Nial #Legendary

I am one of those loosers who do not book much profits on the trades, because I’m setting

way too large TPs. Thanks for the posting!

Thank you very much

Amazing thank you Nail

Your articles just keep getting better and better, Nial! Great stuff! Thank you very much.

Powerful thank you sir

Good Teaching As Always.

Thank you For Sharing Your

Heart With Us.