4 Tips for Trading Sideways Markets

A simple truth of trading is that markets are often moving sideways, neither trending up or down. It’s in these sideways market conditions that traders do the most damage to themselves. I’m sure you’ve experienced the infuriating feeling that comes with giving back all your profits on a recent winner because you continued to trade as the market stopped trending and started chopping sideways.

A simple truth of trading is that markets are often moving sideways, neither trending up or down. It’s in these sideways market conditions that traders do the most damage to themselves. I’m sure you’ve experienced the infuriating feeling that comes with giving back all your profits on a recent winner because you continued to trade as the market stopped trending and started chopping sideways.

Not all sideways market conditions are the same however; some are worth trading and some simply are not. Today’s lesson, if you read it all and implement it into your trading, will provide you with an understanding of what types of sideways markets you should look to trade and which you should stay far away from. Hopefully, this will provide you with the knowledge you need to make the best decisions for your trading account when the market inevitably changes from a trending / easily-tradeable condition to less favourable sideways conditions…

1. Determine if the market is worth trading, or not.

Sideways markets can be worth trading IF they are range-bound, meaning they are trading / oscillating between well-defined horizontal levels of support and resistance that have good distance between them.

To determine if a market is worth trading, first, zoom out and get the bigger picture on the daily chart time frame. Is the market trending clearly either up or down? If not, than it’s sideways.

If it is sideways, then you need to determine if it’s in a trading range or just chopping sideways.

Sideways markets that are range-bound and thus worth trading, look like this…

Notice in the chart above, there is a fair amount of distance in between the support and resistance of the range and that the support and resistance (boundaries) of the range are fairly well-defined. This provides us with good levels to enter at or look for signals at and a good risk / reward potential with the expectation that price will move to the other end of the range or at least close back to it.

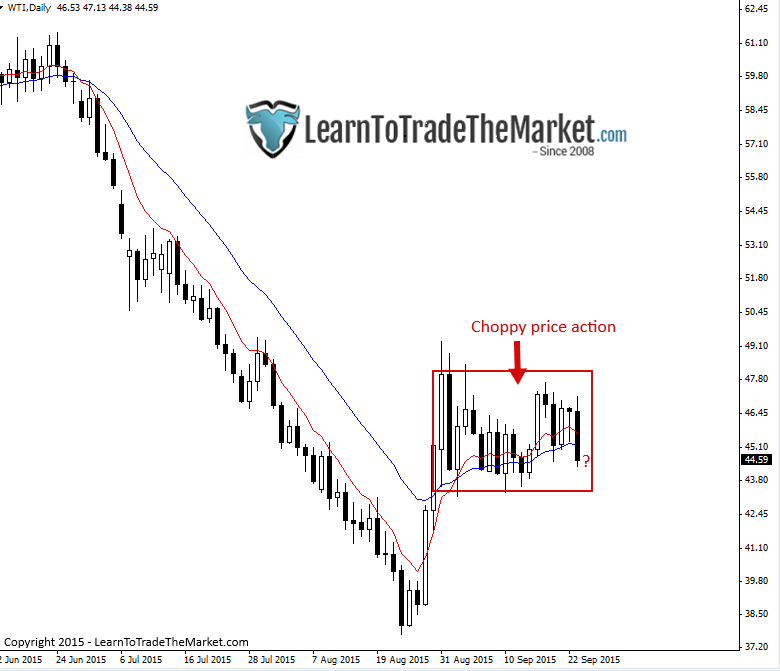

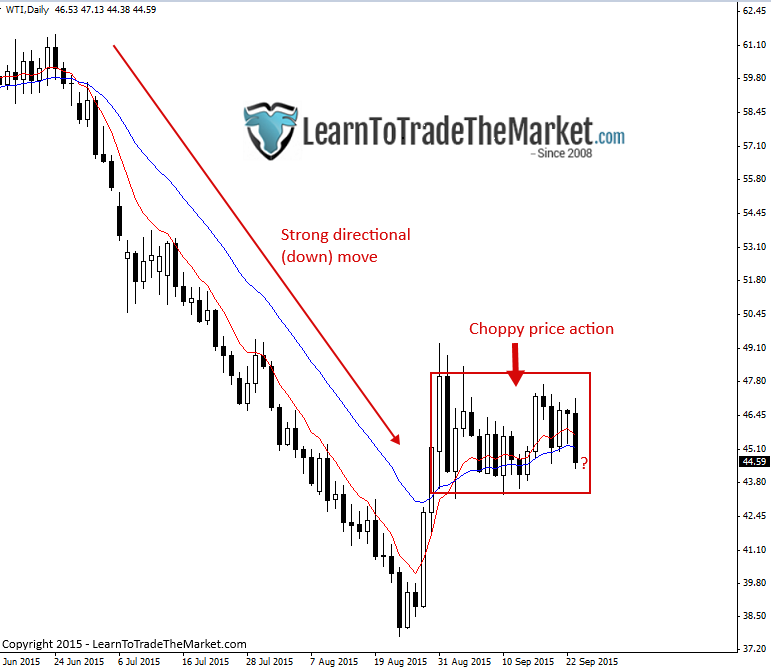

2. If the market is ‘choppy’, it is not worth trading.

A choppy market is one that is consolidating very tightly. It is not worth trading because the distance the market is moving between reversals is not big enough to allow for a good risk reward ratio.

The best way to determine if a market is choppy is just zooming out on the daily chart and taking in the bigger picture as I discussed above. After some training, screen time and experience, you will easily be able to identify if a market is range-bound or choppy. Here’s a good example of a choppy chart that is not worth-trading…

Notice in the chart above, the price action in the highlighted area is very choppy and it’s moving sideways in a very small / tight range. Notice also the 8 / 21 day EMAs (the red and blue lines) are sideways and close together, all of these things are signs of a choppy market that you should stay away from.

If a market is ‘choppy’, in my opinion, it’s not worth trading. In my experience, aspiring traders tend to give back their profits shortly after big winners because markets often consolidate after making big moves. Many traders however, keep trying to trade as the market moves into this choppy / sideways period, giving back their profits and usually then some.

Here’s an example of this…Notice how there was a powerful directional (down) move followed by a period of choppy price action or very tight consolidation / back and filling (all mean the same thing)…

If you attempt to trade chop, you are gambling and in my opinion, you have worse than a random chance of profiting because the market will move a little bit in your favour and then reverse against you, no matter if you’re trading long or short. This type of price action is very difficult to handle emotionally, and you can easily get into a game of “this time it’s going to move / breakout”, only to get sucked out of your position as the market once again consolidates against you.

3. What to do if a sideways market IS worth trading…

When we find clear range-bound conditions in a market, we can watch for price action buy and sell signals at the support and resistance of the ranges…

Perhaps the best way to trade range-bound markets is the false break trading strategy. By waiting for the market to make a false-break of a trading range, you significantly increase your chances of profiting. In almost every trading range, there is at least one false-break, and they often create powerful moves in the other direction, back toward the other end of the range.

To get more insight into why breakouts often fail, leading to false-breaks, check out my recent article on why breakouts often lead to losing trades. The important thing about failed breakouts or false-breaks of trading ranges, is that they are excellent trading opportunities to take advantage of.

Most people will try to trade the breakout of a range and lose a lot of money doing so, you can take advantage of this ‘herd’ mentality by taking a contrarian approach and trading the range by looking for false breaks of the range. When a breakout is legit, price will close outside of the range for several days and often re-test the level it broke out from, and if that re-test holds, meaning the level holds, then it’s pretty safe to assume the breakout was legit. But, there is no point in trying to ‘predict’ breakouts before they happen, as most traders do. What you should do instead, is wait patiently for a false-break to occur and then jump on it like ‘white on rice’.

Here is an example of false break trading strategies in a sideways / range-bound market. These false-breaks provide great risk reward ratios and are very reliable trades…

Notice in the chart above, there were two very obvious pin bar sell signals at the trading range resistance that lead to significant moves lower into the trading range support.

It’s nice to get a pin bar or another price action signal at the boundary of trading ranges for extra ‘confirmation’ of a trade, but because the boundaries of a trading range are so solid, we can also consider taking ‘blind entries’ at them as price hits them, e.g. take a sell entry at a resistance level of a trading range as price comes back up to the key resistance level, even if there is no price action signal there. This is a more advanced entry technique that I get into more in-depth in my trading course and members area and should only be tried by traders who are experienced and educated on my trading method.

4. Don’t ‘chop up’ your trading account…

Finally, if the market is choppy and not in an obvious trading range, then just don’t trade. Sitting on the sidelines and preserving your trading capital is always a better option than over-trading and losing money just because you can’t fight the urge to be in the market.

If your favourite pair or market is in a choppy / not-worth-trading state, go look at some other charts perhaps, and see if there is a nice trend or a good trading-range in one of those markets. However, don’t force the issue, if there is no trade then there’s no trade. Don’t go looking at a bunch of exotic currency pairs that you don’t normally trade just because you can’t fight the urge to be in the market.

Often, the best position is no position.

To learn more about how I trade (or don’t trade) sideways markets, check out my price action trading course for further instruction.

Thanks alot Nial bro

You are the master Nial

Hi Nial,

I want to get into equity trading and have been on various courses and tried various programs but I am hesitant to the point of inaction because of a market moving sideways. Can you help me please.

There’s no sure shot way to predict the sideways market. But you can follow the support and resistance levels, two moving average and see if they’re close to each other or intertwined. If yes, then that’s a sign of sideways market.

And as Nial said that you can take advantage of fake breakouts which give you an edge by providing you with a good risk to reward.

excellent article Mr. Nial! thanks for your works

Thanks alot bro!

Just what i needed to hear, thanks alot

Great Nial… I am keen on reading your articles.

Regards,

Hi Nial,

Great article and advice!!!

Thanks for the reawakening

Trade the sideways market is really frustrating unless you know how to deal with it. Anyway great article.

Hi Nial

I have been following your web site for a while and reading your articles and trade setups and i think i am starting to see some things I wasn’t a year or 2 ago so i am making a progress. i guess and i hope. Your articles show the way I should trade but was not and blow up my last account. Now try to preserve capital, take profits before the change into losing position and take obvious setups.

Thanks and waiting for next one.

Greetings from Poland!

Truism! Capital preservation is necessary 4 long term success. Great article Nial.

good one. your articles are always on point.

Save your money for a good trade. Simple but true. Should be obvious to us but thank you Nial for reinforcing that trueism. I call these lessons Nialism’s. Thanks again.

This teaching is an eye opener, thanks a lot,

Super article, thank you !!!

Another awesome article Nial. Price action at support/resistance combined with lots & lots of patience. Simple!!!!!!!! Cheers!

Hello Nial,

Very insightful article, thanks for all your efforts in making we your proteges become a better, disciplined and profitable trader.

Regards, Kayode

Just what I needed to hear.

Thanks agin Nial for this capital preserving article.

Thxs for all your artikel. They are very helpfull

It’s true Nial that sideways markets are difficult to trade and trading such markets require simplification.

Amazing demonstration ! …

Thank you Nial ! …

Thanks, Nial. I think you have touched a very sensitive issue concerning the ‘choppy price action’ market. Now, you have given us the ‘green’ light on how to go about it. I am most grateful for this advice. Regards.

Thanks Nial for sharing your experience and making us grow as a better trader.

Thank you. Great article.

Hi Nial!

You are absolutely right…

Take Care,

Thanks so much Nial this was a very good article thanks so much

Amazing article Nial ..the right time to the right place I like to say …

Thank you Nial ..Always forever your trading strategy is the best .

I preserve my capital this time after a profitable trading month !!

Have a good day

Best regards Adriana