The Anatomy Of How I Enter Price Action Forex Trades

What goes on inside the mind of a successful Forex price action trader as they enter a trade? What is the process they use to succeed?

What goes on inside the mind of a successful Forex price action trader as they enter a trade? What is the process they use to succeed?

This article will demonstrate five trades that were valid price action trading setups over the last two months. I will walk you through them one by one and explain to you the reasons for taking them, what the proper entry and exit parameters would have been, and why. You should use this article as a reference tool and also to learn how an experienced price action trader thinks about and trades the Forex market…

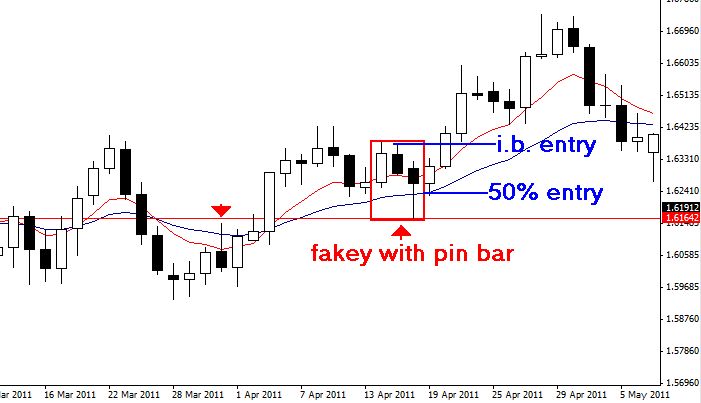

GBPUSD – Fakey with Pin Bar Setup – 18th April 2011:

This price action trading setup was a fakey with a pin bar. We can see the momentum was higher, as evidence from the 8 and 21 day EMA’s suggests. Price showed clear rejection of the horizontal level near 1.6150 on the day the pin bar formed. So, we had confluence with the existing bullish momentum, the horizontal level rejection, and a very well-defined fakey with pin bar trading strategy.

This setup had two potential entries. The first entry would have been a limit buy entry near the 50% retrace level of the pin bar. This 50% entry is an option on fakey’s with long-tailed pin bars like the one in the example below. The other entry option would have been a break of the high if the inside bar. Since the inside bar and mother bar high were so close in this example, you could have entered at the inside bar high. Normally the fakey is not triggered until the mother bar high breaks though. Stop placement would have been below the low of the pin bar if you had entered at the 50% retrace. If you had entered on a break of the inside bar high you could have placed your stop near the 50% level of the pin bar.

Achievable rewards on this setup were at least a 3 times risk winner if you entered at the 50% retrace, and at least a 2 times risk winner if you entered near the inside bar high breakout. We can see after giving us a 2 or 3 times risk win potential the market reversed sharply, this is an example of why it’s good to take a profit of 2 or 3 times risk when it presents itself, or at least lock it in by trailing your stop loss up.

This was a solid price action setup that had multiple factors of confluence supporting it, and it was very obvious; there was no guessing or hoping with this setup. We clearly identify our edge and trade it. If there is a lot of doubt or confusion, there is probably no setup worth risking your money on.

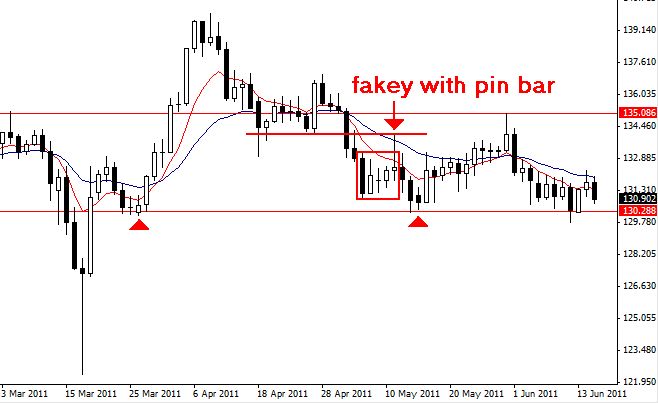

GBPJPY – Fakey with Pin Bar Setup – 11th May 2011:

On May 11th a large pin bar / false break occurred in the GBPJPY. Three inside bars preceded this false break, and the momentum was clearly lower as the 8 and 21 day EMA’s show us in the chart below. Furthermore, the pin bar showed clear rejection of the horizontal resistance near 134.00. So, we had confluence with the bearish momentum, the rejection of resistance, and an obvious price action setup.

This setup could have been entered near the 50% retrace of the pin bar, just like the setup discussed above. It also could have been sold on a break of the inside bars as price came back the other way, or the mother bar.

Now, the obvious problem with this setup was the significant support level near 130.00, which price would need to break through for this trade to have any chance at providing a decent risk reward potential. However, in the previous trade example above, the GBPUSD was facing stiff resistance near 1.6400 as well, and that trade worked out nicely. The point here is that we never really know for sure which trades will work and which will not, and while we generally do not want to sell into support or buy into resistance, sometimes if there is a very obvious price action setup with the trend, you have to take a stab since your edge is present.

Now, let’s assume this trade was a loss of 1 times risk because as we can see the market did not follow through to the downside; we are still ahead because in the GBPUSD trade above we made 2 or 3 times or risk. This is an example of risk reward in Forex trading.

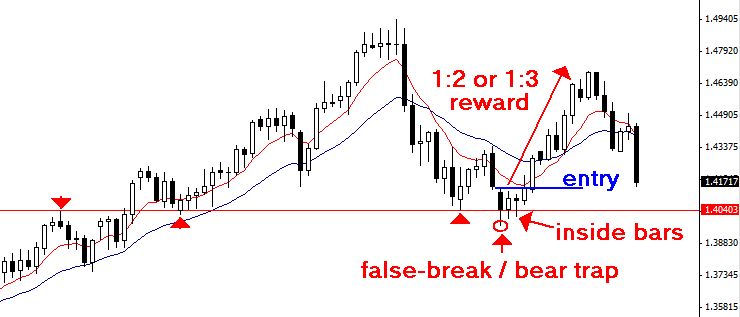

EURUSD – Inside bars after false break – 24th / 25th May 2011:

On May 23rd the EURUSD created a false break “bear trap” at support near 1.4000. Over the next two days the market consolidated and formed consecutive inside bars just above this support.

We can see in the chart below that the market then exploded higher as price broke above the mother bar high on May 26th. Now, this setup was definitely more advanced because it was against the recent bearish momentum, however, given the obvious false break and the consecutive inside bars that followed, forming above support, it was a valid price action setup worth taking. There was a strong potential for a rotation higher back into value. As we can see price shot significantly higher, moving past the 8 and 21 EMA’s before stalling just below 1.4700.

This trade gave us the potential for at least a 1:2 or 1:3 winner. The stop loss would be placed just below the mother bar low and entry would need to be the high of the mother bar. This is the typical stop loss and entry placement for the inside bar setup. Once again, this trade is another find example of why taking 1:2 or 1:3 winners as they present themselves is usually the best thing to do, or at least lock in that profit; look how sharply the market reversed after offering you 1:3.

NZDUSD – Pin Bar / Inside Bar Combo Setup – 25th May 2011:

On May 25th the NZDUSD formed an inside pin bar combo setup. This is one of my favorite setups to trade as it is generally very accurate and can allow for a tight stop and large reward potential.

This particular inside pin bar came after price had rejected a strong weekly support level near 0.7750 and the 8 and 21 day EMA’s had recently crossed higher; indicating more bullish momentum was possible.

We can see as price broke up through the mother bar high it had a lot of momentum behind it which propelled it substantially higher before consolidating for a few days and then forming another pin bar before re-testing the highs near 0.8250.

This setup provided a reward of at least 2 times risk. We can see a very significant resistance level that came in near 0.8200 – 0.8250. If you zoom out and look at the monthly chart you can see this level was clearly significant, and so if you were long from the inside pin bar on May 25th, you would have considered taking your 1:2 profit near this resistance.

GBPUSD – Pin Bar Setup – 3rd June 2011:

On June 3rd a bullish pin bar setup formed in the GBPUSD that showed rejection of a significant support through 1.6300 and was in-line with the recently crossed higher 8 and 21 day EMA’s.

While this setup seemed pretty solid due to its rejection of support and confluence with the ascending EMA’s, it formed in the midst of a market that had just failed to make a new high. We can see the market failed to re-test the high at 1.6750; this indicated momentum may be transitioning from bullish to bearish or from bullish to sideways.

So, whilst this pin bar setup did have enough definition and confluence to consider taking it long, it lacked the support of a clear / directional market. Setups like these sometimes work and sometimes do not, its part of the game. As long as you are taking valid setups with supporting reasons of confluence and effectively managing your risk, you are executing your edge and should not become emotional as a result of losing a trade.

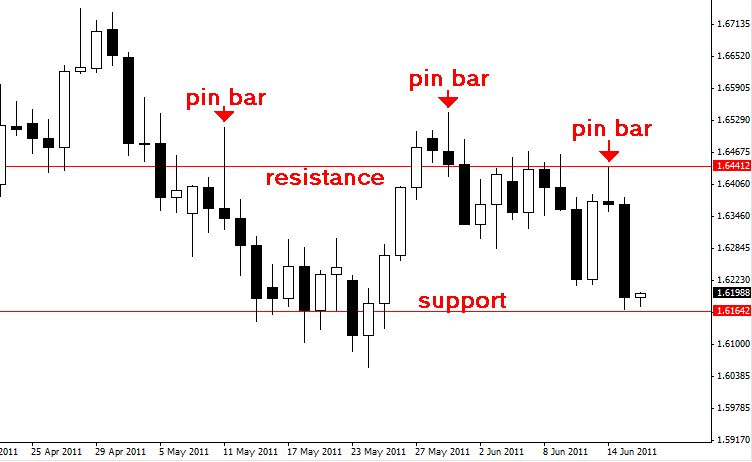

GBPUSD – Pin Bar Setup – 14th June 2011:

Finally, the last setup we will look at was a bearish pin bar that formed on Tuesday of this week (June 14th). This is a great example of how pin bars from key levels can be very high-probability trading strategies.

Note the two previous pin bars that had worked out nicely which formed at the same approximate resistance level around 1.6500 – 1.6450. This meant when the third pin bar formed we had a very high-probability setup because it formed off a previous event area and had confluence with a very significant resistance level. Even though this market is ranging and not really in a trending state, we can still use significant levels combined with well-defined price action setups to trade with. This is part of the beauty of trading with price action; it works in all market conditions.

Due to the smaller size of this pin bar you had the potential for a quick profit of 2 to 3 times risk since the stop loss required was relatively small. The support near 1.6200 made an obvious target area.

Conclusion:

All of these trades above are examples of valid price action setups that I would have traded, and I did actually trade and profit off of some of these setups. The point here is that as long as you are executing your edge flawlessly, you are doing nothing wrong.

Now, flawless execution of your edge means you have mastered price action trading, you have a concrete and practical Forex trading plan, you are tracking your progress in your Forex trading journal, and you effectively manage your risk on every single trade you take. The examples above include losing trades that were pretty decent setups. This goes to show you that even good price action setups will lose sometimes. Because you never know WHICH particular setup will be a loser, you HAVE to manage your risk diligently on EVERY single trade you enter. Even the best looking price action setup can fail, so don’t bet the farm just because you convince yourself you are “right”. To learn more about how I trade with simple price action setups check out my price action trading course.

To get there to do something good in life, you have to touch the best. Good traders exist a lot, what’s more Nial is the talent and approach of people of all levels.

Excellent article!

Since reading your lessons, I now understand why and how I should trade forex. Please keep that good work, you’re really changing ourlives.

Thank you…

Sir you are reaaly great in what you do.i really thank God that i was told about you by a friend of mine.i also hope to keep reading more of your work and practice more untill i get the money to subscribe into your trading course.I live in South Africa and i have been telling my friends to read about your work as well as they are into forex trading just like me.

thnks so much am gonna put more emphasis on risk reward management

Great article.

outstanding article, thanks Nial

Thanks Nial for the best lesson learned. Risk reward management is the key in whatever setup is so perfect. I like your phrase not to bet the farm eventhough we are very confident.

THANK YOU NIAL GREAT TRADER .

Thank you Nial, great article

Thanks a lot for this article nial!

I love the clarity and the simplicity of your lessons. Outstanding!

Thanks very much Nial for equiping us to be the best traders and follow your footsteps.

May the Grace of God be with you and your family

Thanks Nial, very clear explanation with the charts attached. Easily understood. Its definitely a course covered for free. I really appreciate it. Thanks.

thank you Nail.

Thanks Nial. Your articles are really helpful. Your course is also very well priced.

yvan is touched the same way I`ve been touched. Thanks Nial

Thanks so much Forex professor Nial. These are pricely set ups! I wish to meet you some day and thank you in person.

Really helpful article. Just makes K.I.S.S. all the more understandable.Keep them coming!

nice one

Thamk you!

Very beautiful and useful post. Compliments! You have the ability to touch the raw nerve of trading and show us how we can get better trader. thanks.

hi Nial, Ben here in South Africa, thanks for everything, all the great articles you keep sharing to us and price action lessons, you have changed me to something I don’t understand, owh Nial, what have you done to me? profit all the way and loss not that much since I am following you, thanks my Mentor, God bless you….

Nial …a very good article explaining how to think for a valid trade setup

Thanks Nial, you are building more of confidence using these price action strategies “pin bar, Inside bar and others”

Thanks Nial for the great job you’re doing by empowering traders

Step by Step I am REALLY convinced Nial’s method will be succesful for me too… The first method in 2 years of trading I found which is so conceive, very clear… all in 1 with exactly all the trading facets.

Hi Nial,

May I know which 2 MA that you used on the charts?

i’m very very grateful

Nial, you should be called the Messiah of forex trading!! Your articles are GOLD!! My trading has improved tremendously thanks to your them. I just can’t believe you give all that for FREE!! You are Forever in my debts, the name Nial Fuller will forever be remembered by people like myself, you are certainly and without shadow of a doubt THE authority in the field! God bless you!

sounds pretty technical…but great work as always..what you are doing is amazing..cheers

Great explanation,simple,clearly with high profit potency

One word for you nial . Superb !!!

a true masterpiece!

thanks GOD…..this is the first time i found a real profesional and real guy in a forex trading….thanks a million NIAL……ur words really motivate me after i loose so much money….

thanks..

slivester

Great article Nial,straight up explanations of trades,It’s great!!!

Top dog!!! Now I understand why I blew my trading account. I now ooze confidence as I have been following your blog since April 2010. Great articles mate! Keep up the good work.

great article nial very easy to understand.

Nial, your lesson really helps me to improve my trading skills. I appreciate articles like this one and your way how you explain trading . Thaks a lot.

Thank you for this article. The point you drive about well formed setups losing being normal (along with the demonstration above) is very encouraging.

Excellent lesson!!

Nial you are the Grand Master of Forex trading. Numero uno.

One mo time! Thanks for these meaty goodies. Larry

hi, this is cool stuff. cheers andrew

Nial.

Thank u for giving us the unending educative info

n may god bless u always.

rgds

rikus

I am speechless! :)

Don’t stop coaching/tutor us in the lively LTTTM forum!

We can’t walk the trade w/o you!

Hey Nial,

Could you possible create a monthly price action article like this one showing the set ups we may or may not have entered,I found this article very helpfull,….thanks so very much for your commitment and professionalism.

Nail, I have never been so confident like this before. This post is a big eye openner. Thanks a billion times

Hey Nial,

This article is simply brilliant!This is Price Action trading at its best,with clear and concise explanations on how to trade Price Action.You are a great mentor,thank you for sharing this valuable article with us,we are greatly indebted to you,thank you for making us better and more confident traders.God bless.

Great article Nial. Looking forward to more vids and articles like these. Keep up the great work!

Thank you for the clear explanation and charts. Well Done!!

To kong! In our dialect – this is amazing!

Hi Nial

This type of article is brilliant for me. Helps to refine my trading plan and see the master at work. I learn a great deal from this type of analysis.

Namaste

Geoff

Nial, these are wonderful examples and you’ve done a splendid job explaining the rationale for entry etc. God bless you.

Great Article! Thanks Nial for your sharing. From these case studies, I have reinforced my knowledge on price action and also to check on my own thinking/analysis with yours before entering into the trade.

hey nial great article, many thanks for your efforts, just got a job with a proprietary trading firm and i’m currently using most of the things I learnt from you, did alot of backtesting just to get the confidence and discipline for my myself, really appreciate everything, stay blessed

great work nial, so honest in your work recommended read.

thanks Nial. this is now a part of my trading tool kit as I find this valuable with keeping my charts simple.

You continue being a valuable mentor to me. great great article. highly appreciated

Hi Nial, I have been with you just a few weeks now and have been picking out potential trades but not always trading. I had spotted all but the GBP/JPY. This has given me the confidence that I am on the right track. The advice on the entry points I have found invaluable. Thanks a million

Phil.

Are these setups on Daily or 4hr charts?

daily charts

I couldn’t agree more ~ you never know

Many many many thanks to you Nial, This article is a real treasure, a real diamond. You have my highest appreciation. This is just what I need, an explanation on not just the setups but the way to take the setups and the mindset behind them, with real trade examples and detailed explanations. Your sharing really brings enlightenment for all of us and me especially. Please, keep enlighten us. Wish you all the best!

Nyoman

Thanks again for the good advice. Someday maybe I’ll be able to aply it all to my trading.

Thanks!

thanks Nial, i dont need to say more,you are amazing. may the good LORD bless you real good

Thank you Nial, this article solidifies a lot of things for me, you are a blessing to the trading community.

Nial,

Great Great Great info man!

Thanks a lot for all your teachings and the time you

dedicate to share this information!

Gracias!

Rudy

This is an absolute must read for any forex trader!! Great article Nial!!

Absolutely clear, thanks for sharing your knowledge

Regards

Nial, thanks for showing real life examples of the set ups. This is so helpful especially for the newbies.

Hi there Nial, I’m normally very lazy at filling up my details to leave a comment at a blog post, but I could not but take the ‘stress’ to fill my details to fill this just to tell you that THIS ARTICLE IS GOLD!

Believe me when I say that this is one of your best fx tutorial write up. I was about bombarding you with mails, as usual :-), to try to ‘pick your brain’ so as to know they xteristics of the kind of set-ups you take. Nice one mate, I’m grateful for this!

One question though: DOES IT MEAN YOU HAVE TAKEN ONLY 5 TRADES FOR THE PAST 2 MONTHS? I mean I’m just curious to know if I’ve been over-trading by taking averagely 12 trades a month. Perhaps there are other high probability setups you trade off the intra-day charts as well?

Thanks for this golden write-up man. I have just downloaded it to my PC and liked the article on Facebook. You ROCK!!

HI MATE

As usual I can depend on you for clarity and honesty. This info is hard to come by . Your lessons are easy read and detail oriented . You always give us the whole scoop.

THANKS!

Nice article Master !!

It again and again prove that we should be patient enough and wait for the perfect setup to present in the market.

Things are becoming clearer. Thank you Nial.

This article has provided great insight into correct PA trading.

I need to learn how to take in what the chart is telling me.

This article is from the top shelf .

Thanks again for your hard work and constant encouragement,

Filopastry

Nial, always thank you from my heart!

Thanks Nial, other institutions would have charged a kings ransom for this kind of information and lesson. You are indeed a good friend and warm human being and a great teacher.

Peter

Your style of trading is great. Since I began to obey your advice, my trading has significantly improved. This article is especially valuable. It can be compared to live trading session due to detailed explanation of entries, SLs and TPs. Thanks Nial.

Hi Nial,

Hope you are well. Just one word to describe this is ”fantastic”.

Thank you for all your help

Thanks and Regards

Gurpal

Thank you for your numerous lesson. infact this is a time bomb for me because i took one of the loss trade but still made profit at the end of the week.

i am a die hard fan of your article keep up the good work.

cheers

Hi Nial,

Another great article, as usually.

Thanks for being so helpful and patience with newbies.

Cheers,

Ricardo

Practically very helpful and educative. Article guides trainee to how the market is watched by a professional and for getting an idea about how close you did it comparing to a professional. Thank you Nial.

Great post.

Hey Nial

Reading this article, along with others, makes me feel confidence in my trade. Thank you my friend. You’re the best!

King

dear nial

thanks alot you been a great hepful to me thanks again.

jamaljber

amman/jordan

Great article and great trade.

Thanks Guru, full confident on your methode.

Hope you are in good health .

Cheers

Absoultley ” BRIALLANT “..this is way too good to be given as a FREE !!

but just shows NIALL as an outstanding HumanBeing and teacher..

i commend you …and thanks NIALL

kumar

Hi Nial. I don’t know if this is just coincidence that you posted this GREAT LESSON after our emails but either way thanks so much as usual…great stuff. Your faithful student and loyal Member…richy