How I Find, Enter & Manage My Forex trades

Today’s lesson is going to be a complete walk-through of exactly how I find, enter, and manage my Forex trades. I am going to use the GBPUSD pin bar setup from last Friday that I traded as an example to illustrate my analysis and thought process behind taking a trade. Today’s lesson will provide you with a “window” into my mind as I trade the market so that you can better understand how to successfully trade simple price action setups on the daily charts.

Today’s lesson is going to be a complete walk-through of exactly how I find, enter, and manage my Forex trades. I am going to use the GBPUSD pin bar setup from last Friday that I traded as an example to illustrate my analysis and thought process behind taking a trade. Today’s lesson will provide you with a “window” into my mind as I trade the market so that you can better understand how to successfully trade simple price action setups on the daily charts.

How I find an entry signal

The first step to finding an entry signal involves scanning your charts. You need to decide the best Forex pairs to trade and then scan the daily charts first; you should do this around the same time each day. The best time to analyze your daily charts is between the New York close and the European open. This is when the market action dies down from the previous day and the new day begins in Asia, which is typically not as active as the NY or euro sessions.

As I scan through the markets I am looking mainly for the following things: trends, levels, and price action. I will first determine if the market is trending or not, this is not an exact science, but for me I like to see patterns of higher highs and higher lows or low highs and low lows and I also look at the direction of the 8 and 21 daily EMAs.

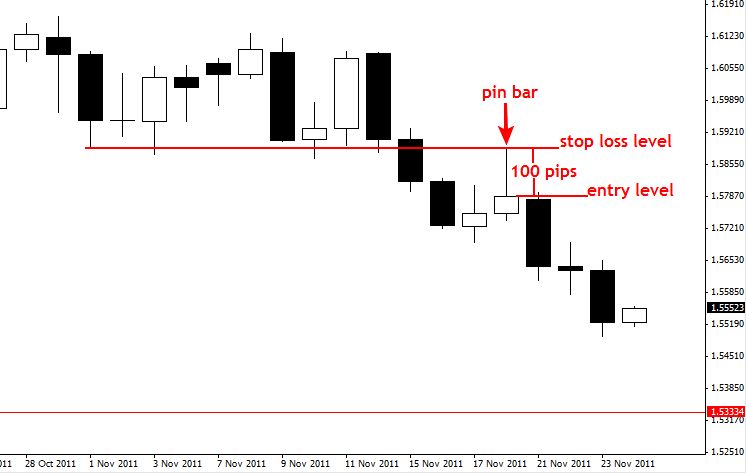

I then mark any core levels that I see on the chart, this is important because simple horizontal levels and price action is a very powerful combination. Now, I don’t go crazy with drawing levels, I only draw in the “core” obvious support and resistance levels that I see on the chart, you will get better at this with enough screen time. For now, check out my example below of the GBPUSD daily chart:

Note the pin bar setup in the chart above. After I’ve determined whether the market is trending or consolidating and drawn in the core horizontal levels, I will look for obvious price action signals forming within the structure of the market. I like to trade with the trend as much as possible, and from points of “value” (support or resistance) within the trend. But, sometimes the market is not trending, and at these times we can look for price action setups near core support and resistance levels in order to trade a range-bound market or for counter-trend setups.

In the case of the GBPUSD pin bar setup above, we can see the market was just starting to trend lower which was made evident by the 8 / 21 daily EMAs crossing lower and price recently breaking down out of an obvious sideways trading range. The pin bar that formed was in-line with the recent downward momentum, clearly rejecting the old support / new resistance near 1.5900 and was well-defined and obvious. So, since this pin bar met all the parameters in my forex trading plan, I decided it was a good signal to trade.

How to place a stop loss

Determining proper stop placement is also not an exact science, but there are some general rules of thumb that you can operate by:

First, you want to try and place your stop at the most logical level possible. So, on the pin bar setup below, I put my stop just above the high of the tail of the pin bar, because this represented the point at which the signal would be invalid for me. Note, you always want to enter your stop loss at the same time you enter your entry order, never expose yourself to the market without a stop loss in place.

We can see in the chart below that I had a stop loss distance of 100 pips; stop at 1.5887 and entry at 1.5787, this is important to know when figuring out our target, which we will discuss next.

How to find a target

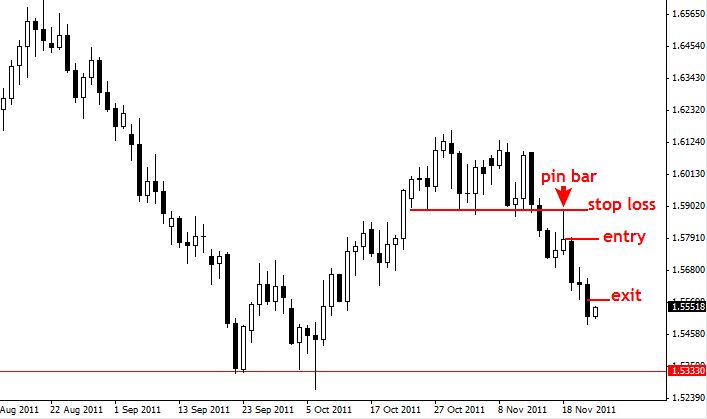

When I set my target I am looking to get a risk reward of at least 1 to 2 or more. In the case of the GBPUSD pin bar trade below, my risk was 100 pips, so I am looking for a 200 pip reward distance or more. Note, I am only using ‘pips’ here to measure distance, not risk, read about my Forex money management strategies here.

I check to make sure there are no ‘core’ support or resistance levels in the way of my desired target placement. If there is no major level in the way I will place the target, if there is a core level that comes before two times risk, I will then use discretion to decide whether or not to take the trade. Sometimes I will take a reward of 1.5 times risk if I feel the setup is sound but there is a core level coming in just before 2 times risk.

Exiting trades is probably the most discretionary part of trading and it’s something you get better at over time. The biggest problem most traders make in regards to exits is not exiting in hope of bigger profits. Don’t be a greedy trader; take your profit of 1:2 or greater if it’s there. If you have pre-defined that you will trail your stop in hopes of a larger profit based on your analysis of current market conditions, that’s OK too, just don’t get into a game of setting your target and then moving it further away once price gets near it, or always thinking the market is going to run in your favor forever.

Placing the trade in your trading platform

I can’t go into too much detail about actually placing the trade with your broker since we are not all using the same trading platform or broker. But, there are a few general comments about this that I would like to make:

Be sure that all your parameters are correct; your stop, entry and target. Double check everything before you hit the button to send the order. There is nothing worse than losing money because you entered your trade incorrectly or too quickly. It’s best to slow down and take a little extra time to make sure you have entered everything correctly.

Managing the trade

After you’ve entered the trade the “real” work begins. For most traders Forex trade management is where they mess everything all up. You don’t really need to do much after you’ve entered the trade besides maybe check on it once a day. After I entered the GBPUSD pin bar setup above I literally did not look at it for 24 hours. When I came back the next day I noticed I was up over 1 times risk, I didn’t do anything at that point but set and forget for another day.

I then came back the next day (Wednesday of this week) and decided to exit the trade for a profit of approximately 2.5 times risk. Some of you will remember that I mentioned in the GBPUSD thread in the members’ forum that I was going to let this trade run into the 1.5445 area. Whilst I had pre-defined my strategy as letting this trade run for a bit, I decided to exit earlier once I was up 2.5 times risk. There’s nothing at all wrong with using discretion to exit a profitable position, just make sure you aren’t acting out of greed by NOT exiting a profitable trade or at least locking in some profit if you are up over 2 times risk.

Handling the emotions of the trade

Perhaps the best way to make sure you do not trade emotionally is to not risk too much money on any one trade. I get many emails from traders telling me they are losing money and that they are up all night staring at their trades or that they can’t stop thinking about them. The only reason traders do these things is because they are risking too much money or over-trading. You need to risk an amount that you are TRULY ok with losing, because you COULD lose it on ANY trade. Yes, price action trading is a high – probability trading strategy when used with discretion, but you still never know for sure which trades will win and which will lose, so you MUST manage your risk effectively on every single trade you take.

The reason why traders risk too much and over-trade is because they have unreal expectations about the market. You need to seriously consider that fact that you aren’t going to get rich quick in Forex. You should aim for slow but consistent profits, and then over time you will build your trading account up. But, most traders don’t seem to have the patience for this, thus they end up getting caught in a perpetual cycle of emotional trading.

After the trade

After you have exited a trade for a profit or a loss you need to record exactly what happened in your Forex trading journal. It’s important to have a trading journal so that you can develop a track record and so you have a tangible piece of evidence reflecting your discipline or lack thereof.

As you can see, there is nothing complicated to the way that I trade the markets. Just simple logic combined with discipline and my discretionary trading skill. You can learn the same price action strategies that I use by taking my trading course and joining my members’ community. After you practice them for a while you will develop your own discretionary trading skill that will help you to only take obvious and confluent trade setups like the GBPUSD pin bar signal discussed in today’s lesson.

Hope I’m not dreaming. Nial , your strategy supersede all

Thanks for this wonderful article on forex. I call it forex at a glance. While some of my friends call it forex at finger tips.

This is the best information that I have ever gotten, regarding forex trading. Thank you very much sir.

Nice one Mr

Thank you Sir!My mentor!

I have found this lecture so rewarding that your trading strategy on price action is so precise.Tony from Nigeria!

Mr nail fuller very good article can i trade 4 hour or 1 hour chart with your trading method

Interesting, thanks a lot for the insightful article. But I still do not understand how to find an entry. Please if you can give it a treat, I’ll appreciate. Thanks

Thanks Nial ..a good article on how to make a good mindset for trading

Your lessons always inspires me a lot. My mindset is being developed positively each time I read your article. Thanks

Rally nice for me. Have a nice day…..

Really fascinating, thanks Mr.

u style like my style… when i see pin bar then i will convert to H1 timeframe then wait pin bar or bearish engulfing at 50% daily from opening to high.. then i will put sell..

Hi, I want to become a Forex trader, I bought myself a computer because I made some research on Forex Trade I also want to market, and I also want to know if it possible for me to use my smart phone to trade? Where do I start and how do I start???

Thank u

I m really happy to see the way u describe but needs a lot of practice. Thanks

wow..great job for that sir..looks so easy to you yet so hard to me to read that signal..

Do i have to enter trade in the next bar open after the pin bar?

Once again simple and makes sense. Thanks Nial. K :)

I was in this trade as well 1:2 Thanks to you Nial, You are a fabulous teacher. Best wishes to you

An excellent lesson, Nial, and still very relevant for all of us. Great to refer to every now and again to keep on the right track. If we want to do what you do, we have to do what you do, and now you’ve shown us what you do. Thank you.

ok

Once you decide to start trading, don’t expect to learn everything about it in an instant. You will surely need to learn for some time, and you need to exert a lot of effort. Practice makes perfect, and forex trading requires a lot of it.

Before using real money, you can practice through simulated forex trading software and do a paper trade. Here you can incorporate all your trading techniques and see if they actually work.

Don’t be a scared to lose a certain amount of money, because any trade involves risk. But this doesn’t mean that you should not limit your losses, you can make use of stop orders. And most importantly, you should learn from your past losses. Forex trading is serious business but it is fun and profitable.

A good trader by day should be disciplined. Make discipline a habit in order to make sound decisions, and act in accord with trading systems/strategies. This way, you can do your trade in a consistent and reliable manner. Certain situations require an individual to make decisions based on their pre-set criteria and parameters.

You should make it a point to habitually follow your forex trading system plan; this way you can effectively evaluate the results of your plan. If your expectations are not met, perhaps its time that you make certain adjustments and fine tuning, so that your plan will still be of good use in the future.

Cheers Nial

this was a top lesson

regards

Bob

Dear ‘Prof’ Nial, you are really an ANGEL sent by God Himself to help every responsible trader. Thank you.

Njal,

Thank u for the excellent and superb articles.

rgds

Rikus

Dear Nial,

One of the best ways to put a stop-loss is to track Maximum adverse excursion of your several trades.

You haven’t mentioned anything about whether you enter trades using market or limit order. Anyways,as always the lessons are great.

Sudhir

thanks a lot for this great piece of article. came in handing when i need it.

Hi Nial, the point jonas makes about a 50% entry I have seen

in some of the past trades you take. When do you consider this to be a good idea, as I have also tried to get my stop tighter and missed my entry. Great article and I look forward to becoming a member.

Excellent example. I unfortunately missed that trade as I had set my entry at the 50% retracement of the pin which it didnt reach. Nice to see your method of entry.

It’s good to know what process you take Nial. Useful info as ever!

Cheers

Jim

Best stuff , Master , Mr Nial. Thanks

Thanks for the artical, and information. I have been following you for a while now, and feel that I am ready to take price action to the next level.

Got 1 to 2 on the same setup Nial. Noticed that the eur/usd also formed a pin the same day but the confluence on the gbp/usd was much stronger so that was the trade I took. Great lesson. Thanks again!

Thank you! This is exactly the kind of detail I’m looking for.You said it simply and completely. A true poet!

Hi Nial,

That good article, what a great guide for a newbie like me. I trying to get a profitable strategy in forex, but I couldn’t. With information like this you help people like me who are starting in this steep road of forex. Keep going.

Thanks and Regards

Cesar

Hi Nial,

I have been trading with the demo account for 6 months & used all the major indicators and maintaining a healthy profit of more than 200,000 USD .I’m a great fan of the fibo levels and now with your price action techniques .Anyone following your entry/exit ,stop loss techniques will never lose money.I’m a voracious reader and look forward to your posts.

This is the lesson you should post every now and then to remind you followers !!!!!

Hello Nial,

Excellent setup strategy!

I was wondering after the 2-hour pinbar was made in the downtrending market, was your order to enter the market placed as a limit order (activated when the maket rose back up to the target entry price) or did you wait for the next 2-hour session to trade above your entry price and use a stop order to enter your trade in the downward direction of the trend?

Thank you for your awesome trading website and helping current and aspiring traders to succeed.

Sincerely,

Mark

Hi Nial,

Hope you are well. Thank you for another terrific and fantastic lesson, your suberb logic and insight are truly amazing.

Thank you for all your help

Thanks and Regards

Gurpal

great lesson nial,really helpful.

Thanks Nial,

your articles are really the best but this one is the best of the best. These days are so much confusing political announcements here in Europe, that trading on lower time frames then 1Day is very hard and the only successfull way how to trade is PA.

Great lesson. I have also managed to trade this same setup on GBPUSD last week. Everyday I am getting better and better; thanks to your teaching and I am grateful of being part of your members.

Regards,

Maitha

Great article. Very informative. Please have more of them.

Thanks.

You always go an extra mile! Wish I wrote this lesson. Many thanks!

Thanks very much Nial,I am very grateful, with your lesson now I think I will do better in the forex trading.thanks Nial.

No words Nail, This is awesome…

many many thanks

kind regards

Nial, Spot on….this is the best time to use pin bar with moving average, it sure is yummy taking all those pips

cheers…

Again another very good article from you Nial. Is it possible for you to do an article with real time examples showing stop loss, entry and exit with engulfing candles and inside bars?

Great as always… Thank you.

very attractive article i never see before,it is not only good for beginner but als for exprienced.

Thanks Nial for another tangible info about the fx market. I must say that since I discovered your site,my perception of the market has changed for the better,keep up the good work.

Patience is the key to succeeding in Nial’s stragtegies …. Only I know how much i need it.

THE SECRET OF TRADING IS REVEALED

No words. Thanks for such a amazing artical.

Many2 thanks for your excellent article Nial. As always you’re authentic Price Action Guru. I did try to take the GBPUSD trade. I placed limit order for entry at 50% of the pin bar range for 1 to 3 risk to reward but didn’t get filled. Then I took the 4 hourly pin bar at Nov 22 at market. I closed the trade the next day for a tiny profit because I thought the market didn’t close low enough and formed a doji. I thought the market could reverse at anytime and I couldn’t move my stop to break-even because it’s still too close to my entry so I decided to closed the trade. The market continued lower into the European session. So I know my discretionary is still lousy and need further development. Many2 thanks again for your excellent work and please keep enlighten us.

Great article! i come up with a plan before i enter a trade, my discretion, my method and strategy are applied at that point. once i enter the trade, i stick to the plan and that is

how i have conquered my emotion. i trade to win but i always remember the market can go eithier way, my preparation is based on that.

i expect a pinbar at the next support of this GBPUSD.

Thank you so much Nial, can’t thank you enough, joined about 2 months ago, your technique and teaching made forex trading possible for me, and this article is an answer to a lot of my questions,and above all, the continous training shows your love for what you do and your desire to see others succeed. please keep up the good work.

Thanks Nial. Your articles continue to encourage and inspire my approach with trading. The education you bring I have test and tried over and over again and it works. Todays lesson is my favourite!

Nial

Crystal clear explanation! Happy Thanksgiving from Miami, FL , been following you for quite sometime now, and I am thankful I have you as a trading mentor. All the best this holiday season!

Hi Nial,

I have been reading many articles re forex lately and most are quite irritating, as they put so many drawings and indicators, it is hard to see the real chart. Your method is just so clear and simple. A great lesson; the step by step commentary helped to confirm the correct understanding of your trading method. It gave me more confidence, as I executed the same trade in the same way.

I hope you won’t get tired sending us these lectures,

i started short time ago following your articles, videos ect., and keep doing it because what you explain is very simple and logical.

thanks

donato

Thanks once again Nial & everybody who post the threads in the live trading.I am a newbie only 2 months or more.I go away to sea on the ships so I cant trade as much as everybody.Talk about rushing sometimes on the ship we pick up the internet. When we do I tend to rush the trades. & fail. When I am home its differant more relaxed. 4 winners 2 losers. So now I will just have to be a bit more patient while at sea. I am happy with my progrese so fare.I started with $2000- went down to $1550 now back up to $1912.Hopefully I will start to head in the wright direction.Thanks every body

Hi Nial

My trading account has been about break even after 4 months trading. I have had 5 wins and 10 losses. I have a journal and screen shots of all my trades. I am so close to trading myself into profit.

Today’s lesson has just highlighted a couple of small mistakes I have been making with my Trade Management. OH how those mistakes can damage my account!!!!

I am finding that each lesson with a lot of screen time in between is a process of incremental learning.

For your dedication to your members/students.

Thanks Nial

You are so incredibly generous with your lessons and mentorship. Thank you.

Thanks Nial, excellent lesson. I always enjoy reading your articles

Hi Nial,

Many thanks for this article, I’ve being trying to trade your system for sometime but was also trying to trade other system as well for 3 years before now, even though I got your system last year 2010, I have being reading most of your articles and now started using your system again but I was having problems with my stop lose, I really now realise how simple this system is, this article as really being a great help, A Big Thanks Nial.

Best Regards

Hi Nial,

about your entry, when do you open position? When the pin bar’s closed or you wait for a little retracement or the break of the nose?

Thank you, I’m very interested in your lessons.

could I ask about the daily bars? Different brokers have different time to define their daily bars, will this make difference?

thanks

Nial, This is great it as answered a lot for me all in this one lesson.

This was an excellent explanation on the mechanics of a trade and then the emotions involved. And it is the first one I have ever seen in nearly 4 years. The Yanks all they do is market, market, market, then sell, sell, sell some revolutionary proprietary software. No education at all. They would sell air conditioning to an Eskimo if there was a buck to be made.

Thank you Nial for this first rate piece of trading education.

thank you so much for the lesson, and all the previous “bits of gold” you have given us. after absorbing the info you have shared, i am finally putting it to profitable action. only 3 trades in the last 9 trading days and several hundred pips are mine. now i know what real,high quality trades look like!

with regards to the discretion you speak of. how do you have that written in your trading plan? i understand the need for flexibility in trading. but how do you combine that with the rules of a trading plan?

thank you again!

Solid Stuff!!! K.I.S.S is a so relevant in Forex Trading!!

Thanks Nial!!

Great lesson and hooray, I actually managed to get a trade right! However, I closed 2/3 of the position at 2x risk level and since the MA’s are still pointing down, I thought I’d leave the trade running with a trailing stop. I think that your lessons are probably the most informative around, keep it up.

Hi Nial,

Great post… letting traders hear your “thinking process” is the most important element in helping people become “self reliant” in any skill or task. You did a great job! If you can do a few with Fakey set ups also, I think we all would get a lot out of that also.

Thanks for the time you put into this.

dear sir.

i always give full attention for your lessons…

but i usually feel that i fail what you are trying to teach me

thats fact that there is always big distance between teacher and the student like me.

i really appreciate your work and your good thinking for new traders like me

thanks alot

i have been following for several months and have been taking very similar trades. my main problem seems to be with stop loss. i generally move to break even when the trade moves 1:1 then i set a trailing stop at the amount of risk (about 100 pips in this case). do you have a preferred method? i shorted the eur/yen and eur/usd on the 4 hr inside bars on very similar trigger that you saw. both trades were profitable but my eur/usd ended up being just over 1:1 when it could have been 2:1 . i really enjoy your site, i really enjoy how you take your critisism standing up and give honest clear answers.

A great guide…Nial, how many trades do you enter in a year and how many trades would this involve..approx. Hope this request is not too personal. michael

Thank you so much Nial for this lesson.

I actually made some paper money on that trade as I am demo-trading at the moment.

I alwyas look forward to hearing and learning from you! Thank you and keep the good work up!

Priceless information. Excellent…

Excellent and valueable lesson.Your explaination is superb.Looking forward to be your student soon.

Thank You Nial

Simple but NICE, thanks Nials.

Great article Nial!

I was wondering about your entry. I usually wait for the break of the nose of the pin bar. Still though, it’s nice to see that I’m seeing the same setups as you do when it comes to my trading and that in itself is priceless! :-)

THANKS AGAIN NIAL YOU NAILED IT ON THE HEAD.

Nice trade explanation Nial.

Thanks!

Thanks for amazing articles.. thanks for sharing..appreciate it much. i have learned a lot from you.

Excellent lesson – makes it look so easy! Looking forward to getting full course next year. One question – would you moveyour stop to b/e once you are at 1:1 (or any other time)? Thanks. Lee

Very simple trade clearly explained thank you for sharing.

Dear Nial,

First of all I thank you for all information that you have given me from the 17.01.2011 that I have became your member.

I have started with 2000 USD, and I practiced with it according what ever I got from you, but I did not obey all your rolls, so for 9 months many times I got about 400USD and lost it again and again.then I check most of my trades,the problems were:

1.greed 2.quick entry before closing the candle and quick closing 3. sitting the front of my PC and most of the time changing the SL and TP or closing the order before getting TP which was the worst act in my order and lost a lot because of it.

But from 9 of September,I have obeyed all your rolls and I have got about 600USD with much lower orders, about each week one order. Now I am very glad and I have written on all my charts SNIPER+PATIENCE= TP

From GBPUSD I had also order like you and I got 280pipes (risk: 1=2.8)

profit trade 14 and loss trades 4 .

thanks nial…richy

thank you so much.

:)

This is what I mean by monkey see monkey do, it works for me every time, simple concise instruction,one level at a time, this is what newbies and othe confused traders need,more please

Hi Nial

What a wonderful article with the actual charts. Brilliant

and must be preserved by any trader. The same question Karl

asked came to my mind too. Are you ignoring the resistance

level at 1.5688.

Many Thx

Keep up the good work.

Yog

there is always going to be levels nearby.. you can’t ignore a good trade setup just because there is a level of support nearby

the trade setup was in a nice trending market, and a logical entry was taken,

the market needed to break down below that level to trigger further momentum, and we saw that happen quite easily

Great! Learned a lot from your strategies

Hi Nial

Here is a quote from the very article this comment is for:

“I check to make sure there are no ‘core’ support or resistance levels in the way of my desired target placement. If there is no major level in the way I will place the target, if there is a core level that comes before two times risk, I will then use discretion to decide whether or not to take the trade. Sometimes I will take a reward of 1.5 times risk if I feel the setup is sound but there is a core level coming in just before 2 times risk.”

You had resistance at 1.5885 and a support marked by you on the chart at 1.5688. You entered in the middle so your RR was 1:1. I would not say anything if you entered the trade after the price moved below the support level. Just my thought.

Marek .. please see this line from the article

” If there is no major level in the way I will place the target, if there is a core level that comes before two times risk, I will then use discretion to decide whether or not to take the trade. “

Marek

The support level was not far away, and was not a major level… The real major level is 1.5325 area

the market was in a down trend, i was trading with the trend and the price only needed to break lower to help the trade run into further profit.

it was a solid trade and there was no reason not to trade it.

Hi Nial

I been a member for some time and I have constantly been falling back into the old gunslinger short time frame trading that has been blowing my account over so many years.

I finally decided to stick to the dailies and your Price Action method and guess what happened this week I traded the AUDUSD the GBPUSD short and the CADUSD long all off Pin Bars with excellent confluence Net gain was 645 Pips.You are an expert trader you talk common sense and your method works.

Many thanks Nial I now feel that after 10 very frustrating and expensive years I have a fighting chance of achieving my goals as a forex trader.

Nial

This article is very informative and a great lesson for me. KISS – I just need to work on it now!

Thank you

Di

Hi Nial,

nice presentation. For Europe was to early (monday) to take entry on 1.5787, I chose to go in (according 1h graf) on 1.5735 (SL 1.5770) but my exit was on 1.5634 (end of day)

Cheers

Wow, how come you make it look so easy!! great insight for a low in confidence newbie like me.

great work, many thanks

Nice work. You make it look easy!

Thanks again.

The best price action analyst ever. Go Nial!

Great article and trade Nial – you are right – trade management when in the trade is the hardest thing when leaning to trade the market. This may be your best article.

Cheers

Ezzywave

Hi Nial! You had a risk reward of 1 to 1. There was a strong S/R level at 1.5688, see your first chart. But 1:1 is ok.

Karl

my risk reward was 2 to 1 or greater

just because there is a support level just under my entry.. does not change anything

the market needed to break down under that level to trigger the momentum and trend shift lower.

I said in the article –

” If there is no major level in the way I will place the target, if there is a core level that comes before two times risk, I will then use discretion to decide whether or not to take the trade. ”

Thanks Nial for another Nugget of gold,

Filopastry

Amazing lesson Nial!!! Thank you for sharing!

As a paid member of LTTTM one of the best things about it is the Daily Commentary – Every day Nial and another coach post up around 4/5 charts for the day – this is a great tool to help you develop your own chart reading skills – I could recommend LTTTM to anyone – but remember trading is a skill that takes time and discipline to master – Oh yes, I am a profitable trader and have been a member of LTTTM for over 1 year…

Hi, Nial. Very nice trade. I wonder if you moved SL to BE after 1R profit or not. Thank you.

P

Peter.s , I had moved to break even, but I did not move the stop any lower than this.

Thank you Nail.

You just opened the window of my mind – for trading.

Yes you have put it very lucidly and clearly.

Nice article Nial. The simplest and most profitable trading strategy that I’ve ever found. Doesn’t get any easier than this folks.

Cheers.

Guys, Nial is onto something big here. I have been following his lessons for over a year now and have consistent monthly profits since March (I can prove this). I happened to trade this exact setup for 1:2 profit. Stick with it and don’t give up.

Nial

I’m intrigued about your Entry level, why there and not below the pinbar?

Nick H, feel free to join the community to learn the different ways to enter pin bars within the trend.

Thank you again for your consistent efforts in sharing with us selflessly your real trading experience. Your method is simple and effective. We need to simplify forex trade.

It’s amazing how clear and concise your thought process is.

Super stuff!

That my friend is the best article, among some excellent articles, I’ve read from you and the answers to possibly the hardest questions. Exactly where and when?

Thank you.

Beautiful Lesson Nial – Maybe the best ever. THANKS