Profitable Traders Do Nothing 99% Of the Time

What is the single biggest reason why most traders end up losing money in the market? It’s simple: They do too much – they think too much, they look at charts too much, they trade too much, they risk too much and on and on.

What is the single biggest reason why most traders end up losing money in the market? It’s simple: They do too much – they think too much, they look at charts too much, they trade too much, they risk too much and on and on.

The most successful traders and investors of our time spend 99% of their time waiting for opportunities and studying the markets, rather than trading them. Approximately 1% of their trading effort is spent executing trades and managing positions. In other words, most of the time they are doing NOTHING. Can you say the same? Or, are you spending 99% of your time entering and managing trades and only 1% of your time waiting patiently?

If you have ever read my articles on What Crocodiles Can Teach us about Trading or The Sniper Trading Approach, it’s obvious that my trading style is a low-frequency, high-conviction approach. So, why should you adopt a similar approach with your trading? Read on to find out…

The ‘hunt’ involves A LOT of waiting.

Just as a Crocodile spends most of its time stalking its prey, a profitable trader spends most of his or her time stalking good trades. You want to trade like a predator, not the prey in the market, what I mean by that is, you want to be the trader who is waiting patiently in the ‘bushes’ for the ‘easy kills’. You do not want to be the masses of prey (amateur traders) who get ‘eaten’ by the professional traders every week.

How do you accomplish being the predator and not the prey? It’s simple really, waiting, waiting and more waiting.

I like to say I am in “hurry up and wait” mode for the right market conditions to present themselves. What this means is, I am actually excited to wait, because I know waiting means I am exercising self-control and being patient and disciplined, and I know this is how you make money in the markets. I have no problem waiting for the right setup to form with the perfect market confluence, sometimes for weeks or even months.

The reason is simple, because I know for a fact that trading with high frequency is how you lose money in the market and trading with low frequency is how you become a profitable trader. Every trader eventually learns this fact given enough time and experience in the market.

Warren Buffet is a master of doing ‘nothing’

My favorite concept and metaphor for teaching people how I trade is that of a sniper. The sniper trading approach as defined in my article on this topic, is basically that I wait patiently like a sniper for my predefined trade criteria to align, rather than trading or ‘shooting’ at everything like a machine-gunner.

Perhaps not surprisingly, this is also how the ‘greatest investor ever’ manages himself and his activity in the market. I’m talking about none other than the great Warren Buffet, of course. Think about how he manages billions of dollars – it isn’t by entering the market every day, that is for sure! All you need to do is read a book about him or watch the recent documentary on him, “Becoming Warren Buffet”, and you will see he is an extremely patient and precise investor.

Not only is Buffet patient and precise about the transactions he makes in the market, when he is ready he dives in, boots and all. Sometimes, he even buys the entire company! You would call Mr. Buffet a low-frequency and high-conviction investor. As traders, we can learn a great deal from Mr. Buffet. Whilst we are doing something a little different than long-term investing or ‘buy and hold’, we should indeed model our swing trading approach after Mr. Buffet.

Here is a good quote from commodity trading extraordinaire, Mr. Jim Rogers from The Market Wizards

I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. I do nothing in the meantime. Even people who lose money in the market say, “I just lost my money, now I have to do something to make it back.” No, you don’t. You should sit there until you find something.

You see? The point here is that most of the time, profitable investors and traders are doing ‘nothing’ and by nothing, I mean they are not entering trades or managing trades. They may indeed be studying or analyzing the market in the meantime, but this would count as ‘stalking’ their prey.

Change how you think about doing ‘nothing’

It is innate for us humans to want a ‘quick thrill’ in all that we do. Constantly checking social media on our phones has been proven to increase the amount of dopamine (the feel-good chemical) in our brain, for example. We are a society addicted to doing what feels good more often than doing what IS good. We are born with a gamblers or speculators brain, seeking instant rewards and thrills in life and with money.

When it comes to trading, the ramifications for such behavior can be severe.

It can lead to treating your trading account as if it is a slot machine. Many traders end up entering trades, one after another, as if they are pulling the arm of a slot machine over and over in a casino. Of course, the difference is, we typically expect to lose at a casino, so most of us don’t take money that we need. In trading, many people believe they will be profitable because of some ‘innate ability’ they have and so they often risk more than they should or trade with money they really can’t afford to lose. Of course, once they start trading and get the dopamine fix, it becomes an addiction that leads to blowing out their trading accounts.

How do you change this poisonous trading mentality?

One of the best rules anybody can learn about investing is to do nothing, absolutely nothing, unless there is something to do. Most people – not that I’m better than most people – always have to be playing; they always have to be doing something. They make a big play and say, “Boy, am I smart, I just tripled my money.” Then they rush out and have to do something else with that money. They can’t just sit there and wait for something new to develop. – Jim Rogers

The way that we circumnavigate our own flawed trading mindsets, is to simply understand, accept and then embrace the idea of doing nothing. Embrace what you consider ‘boring’ and mediate on it. Eventually, after a few big trading wins that resulted from you waiting patiently for highly confluent trades, you will start to re-align your thought processes and the dopamine rush you used to get from entering trades and messing around with them while they were live, will shift to the periods of time you are waiting and stalking the market. When you feel like you’re not doing enough, you’re in the right zone, you must master being able to do nothing and you can do this by finding something else to replace that ‘void’.

Once you realize that being patient and studying the market or simply not even looking at the market at all, will make you more money in the long-run than the opposite, your brain chemistry will begin to ‘flip’, and soon you’ll be looking forward to the ‘hunt’, even if it means waiting two weeks between trades.

Conclusion

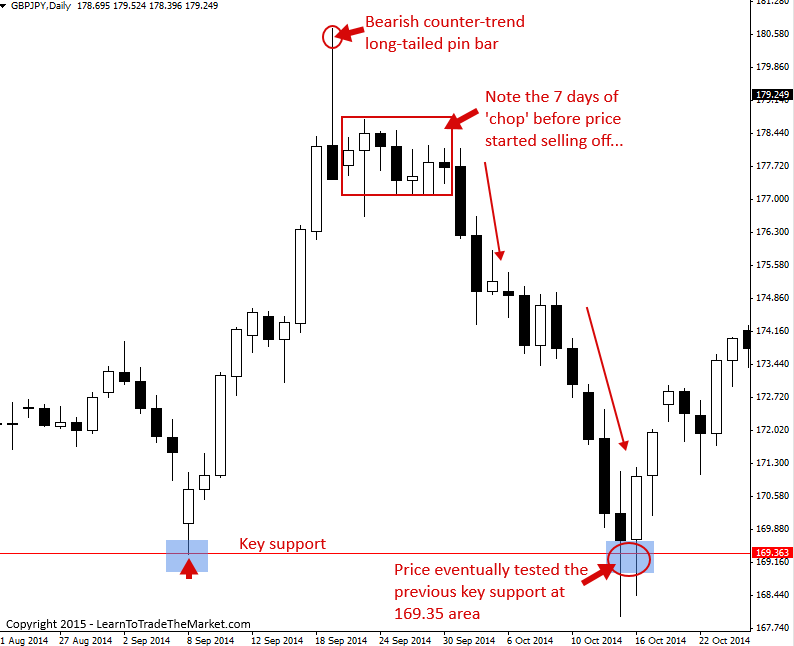

The Market is slower than we imagine, and trades can take a long time to play out. Take the chart below for example: It shows that patience is needed to grab the big moves, and we must ignore the short-term ‘shake outs’ that cause most traders to over-think and exit prematurely…

The price action setups that I trade don’t appear extremely often, and when we apply my TLS filtering rule and wait for that confluence, the trading opportunities are reduced even more. My trading courses can share my trading strategy but they can’t force you to be patient and wait it out for the right opportunity to arrive. It’s one thing to be confident in spotting trades, but are you confident in your ability to not over-trade even in the face of constant temptation by the charts? If you know this is your weakness (and I assume it is for most reading this), spend MORE time getting that aspect of your trading right, and I guarantee you that your account balance will thank you.

I WOULD LOVE TO HEAR YOUR THOUGHTS, PLEASE LEAVE A COMMENT BELOW :)

ANY QUESTIONS ? – CONTACT ME HERE

This the advice I need to become a successful trader. Thank you sir

If I read nothing else except your free articles I would still get a great trading education. Thanks, Nial. My problem is not the waiting….it’s talking myself out of a trade when the “time” really comes. Deer in the headlights perhaps…..an article on that would be great.

Super lesson!

nice one nial

May appear simple but this is sound and excellent advice! Thank you!

That was great wisdom all these lessons are clearly learnt from experience and I can perfectly relate to evrything you are saying but I’m not sure I would have liked this advice when I was new to markets ????

Very informative article, it is perfectly written, I think it it is worth re-reading what would not rust. Thanks

Best trading advice I’ve read in a long time!

As helpful as always Nial.

Good studies from you Nial. Thanks a lot

Exellent Article…..

thank you nial

Thank you for your useful advice.

thanks Nial, again excellent article

Patience is the true virtue.

Enough said.

I almost blew out my account today using the 4 hour time frame. But after reading this, I think I ought to consider being more patient than I am. Regardless of how old this post may be, I feel like it was written for me just a few hours ago hahaha. Thanks Nial for this insight.

you are the best forex teacher i have ever come across

Early on in my trading career, I learned the value of SOH. That is “Sitting on Hands.” When new traders asks me for advice on their rapid fire trading strategies, the first things I tell them is take their hands off the mouse and sit back in their chair. That being said, doing nothing can also be active. By setting price and indicator alerts, you can limit your screen time to only doing analysis and infrequently actually executing trades.

As I plan to start forex trading in 2018 In Shaa Allaah, this article will serve me great. Thank you Nial!

I want to believe that gradual but intense reading(eating up) of various charts will build this virtue in a consistent trader.

Thanks Nial, this is so powerful,

Your are grate Price Action Forex Trader and writer and cover everything regarding Forex trading please write some thing about fundamental trading also and how to trade mix both technical and fundamental analysis

I liked the sniper trading approach. But trading in Forex needs a lot of practice and training. Any resources that I could refer to?

excellent article. confirms what i felt to be true

Is this how hedge fund manager trade Mr Fuller?

Thank you

Excellent article#

I am tired of being a shotgunner, after shooting everywhere I end up exhausted and tired of the vibration of the gun, and without me noticing only one bullet from the market kills my account. Thanks Nial, I am working on being a sniper.

It’s a long process to become patient in the markets. One has to watch key levels. One also has to find something else to occupy the mind while waiting for a set up. I have been guilty of taking trades just to be in the market or fear of missing out.

+1

thank you!

Rather than waiting and doing nothing, why we don’t go through lower time frames that may give some opportunities to trading. Choppy in D1 means range bound in H4 or lower that we can trade them. Thanks.

i really familiar with this advice,trade in low time frames with significant volume size,just try to get below 4 pips…and then booom! price moves against your position,,we can’t never 100% sure where is the market gonna move, the sideway market with narrow range is the most dangerous area to trade and the perfect time for investor to lose their money!

Great article Nial! Patience finally pays.

True patients doe’s pay off, Thanks Nail.

Patience ,patience and patience only pays off

Oh, Great. I Just Wait For That, Thanks Sir. Again Waiting For Next>>>

thank you

Thanks Nail, I think keeping to this instruction of not overtrading will make me a better trader.

Yup! I concur! I am indeed learning why my trades are not giving me the returns I am aspiring for! My being impatient! Thanks Nial for these insights.Really, I have to have the virtue and discipline of patience..

Your every write up has been as “God -sent” to traders. You are influencing

and developing traders ‘free of charge’.

I will always say thanks a lot.

Wait for sit-up

Wonderful article thanks

Great man you are although you are giving knowldge of millions for free thanks a million, you change my ways of trading

What i liked most about your articles is emphasising trading like snaiper and taking 2-3 rewards they are changing something in my trading journey thanks fuller

Hi Nial

All you have said are right and true. %95 of traders( including me ) know this but arenot capable to use them. why?

what is/ are main reason that they can not use patient strategy? what are the steps to become a patient trainer?

Tanks

Mehdi

Everything is fun to write and read. But there are those who have already come there and we want to go there. I have to fight with myself because Im not patient because I see the signal and want to make money, sometimes I do not play and I see the price goes away without me, I know that all pipsow can not catch, only a lot of other portals that bother; See how much I earned ….. Regards

Unreal I’ve been trading 4.5 years and I still need to be reminded of this Thank you

Nial,

It’s like you looked inside my brain AND sat next to me at my desk. I wrote out this thought over a year ago and am still trying to change my mindset and behavior regarding it: “Trading is doing nothing most of the time”. Thank you VERY MUCH for writing this.

Sincerely,

Larry S.

LI, NY

Really helpful, thank you Nial

Thanks Nial, this is spot on. Lot of us see numerous opportunities but can’t help but to jump in.

Doing “Nothing” was the most difficult thing I had to learn, to become a profitable trader. I done it practicing patience by meditation. And studying the Markets.

wow. nice moves

Thank you for writing this Nial :)

AMEN!