Why Ignoring the News Can Save Your Trading Account

With all the recent news surrounding Greece’s debt crisis and the virtual cascade of economic reports and other market-moving news events that happen each day, it can seem overwhelming to try and keep up with them all. What’s a trader to do?

With all the recent news surrounding Greece’s debt crisis and the virtual cascade of economic reports and other market-moving news events that happen each day, it can seem overwhelming to try and keep up with them all. What’s a trader to do?

My solution is simple and extremely effective; I ignore all of it. I tune it all out and it’s the most freeing and stress-free way you can possibly trade, not to mention it’s much better for your trading results and might even be the key to saving your trading account…

Trade the now, not the future

Have you ever noticed that a Forex currency pair will often move the opposite direction of what you thought after a particular economic news report comes out?

There’s a reason for this, it’s because people are the main driving force behind the markets and people trade the market based on their beliefs or expectations of the future. So much so, that once the news event or economic report comes out that they were anticipating, the price move based on it has already taken place. This is where the old saying “Buy the rumour, sell the fact” comes from.

Price action is a reflection of what is happening in a market right now, and it gives us clues as to what might happen in the future, real, actionable clues. Knowing that people tend to trade their expectations of future events in the market right now, logic dictates that by the time that future event approaches, it is not going to affect the market the way we might think it will. The point is this; there’s simply no point in trying to trade based on how a news event might affect the market in the future, when it is affecting a market mostly before it occurs (now) and we can see its effect on a market via price action.

Thus, we want to trade the ‘now’ of the market, instead of trying to guess about how a particular news event might influence the market in the future. By the time the future gets here, the news event will already have influenced price and there will be a new one the horizon that people are trading on. If you try trading news events as they occur, you’ll be late to the party and always chasing your tail. Stick to the price action as it reflects everything that is currently happening in a market.

One caveat here, that you might be wondering about; what about ‘random’ news events like surprise interest rate hikes or natural disasters, etc.? Good question, but, as we obviously have no previous knowledge to these events, we can’t think about how they might affect a market in the future, thus, all we have is the price action that they leave behind on the chart after they occur. Again, price action ‘wins’ and trading it in the ‘now’ makes the most senes. In these scenarios, you can wait for the event to unfold and then watch the charts for price action signals in the volatility that follows.

How attachment to news can kill your trading account

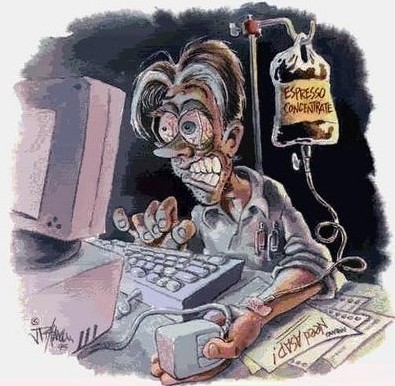

Traders literally become obsessed with news events and watching economic news calendars. They get sucked into a ‘black hole’ of staring at economic news calendars from their broker or elsewhere and trying to ‘figure out’ what might happen as a result of them, this is a horrible place to be mentally and it’s very bad for your trading.

Traders literally become obsessed with news events and watching economic news calendars. They get sucked into a ‘black hole’ of staring at economic news calendars from their broker or elsewhere and trying to ‘figure out’ what might happen as a result of them, this is a horrible place to be mentally and it’s very bad for your trading.

Once you convince yourself that XYZ is ‘going to happen’ based on a certain upcoming news announcement, you have set yourself up for the destruction of your trading account. All logic and objectivity goes out the window when you think you know ‘for sure’ what the market is going to do at some point in the future.

The main key to trading success, is remembering that trading is a game of probabilities, not certainties, and trading in-line with that knowledge. When you trade this way, you will naturally manage your risk properly and stick to your trading plan, because you are remembering that any one trade can be a loser and that you never know what will happen ‘for sure’ at any point in the future.

Conversely, when you trade with the belief that you ‘know’ what is going to happen based on some news event, there’s nothing stopping you from jacking up your risk to unsafe levels. This is the main reason why ignoring the news can save your trading account. Ignoring the news removes a lot of the potential for you to convince yourself that you know something ‘for sure’ about the future of the market. It also removes a lot of second-guessing and confusion, and significantly simplifies the trading process.

The more we focus only on price action, risk management and trading psychology, the closer we get to operating from an ideal trading mindset. Often, the biggest obstacle to a trader’s success, is simply flushing out and then ignoring all the information they are exposed to each day. You want to trade from a ‘pure’ mindset and trying to analyse news and figure out how it may or may not affect a market is like a futile game of whack-a-mole that will ultimately result in you blowing out your trading account.

To get started on the path of ‘pure’ trading, focused only on price action, risk management and trading psychology, check out my Price Action Trading Mastery Course.

Always on point!!

Nial is simply amazing.As characteristic of him,simple and direct to the point.I am beginning to be persuaded that after trusting in God,listening to the chart is the way to trade consistently successful.If you do your analysis top-down;at least from the daily perspective for a day trader and then identify the supporting pattern and setup in your 1 hr or lower time frame you should be fine;taking proper care of risk management and trading psychology.

This has been a great improvement in my trading. I think price action has to become your master and you must follow it all the time. That’s simple.

Very good article and points made here, although news don’t equal fundamentals, fundamentals instead are very very important and do make the difference in most trading strategies.

Thanks Nail the article came at the right time since there is a lot of news these days about Greece thanks so much

Great post nial. My trading results turned around positively after applying price action techniques. Now am a profitable trader all tanks to ur ingenuity. Tanks nial

Once again you hit it on the head. Thanks for reminding me again. Price action, risk management, and trader psychology.

Thank you nial..i used to be a die hard news trader until i learned price action from your site. Most times if there is a high impact news coming up, price action forms and shows you the direction the market will go. It doesnt happen all the time but when it happens and you follow price action, the reward can make ur account. Price action is the best way to trade the market using the daily time frame just as my mentor nial always preach.

Hi Nial!

I agree that to trade the news is bad, risky idea. I trade using a trend system and ignore the news. I believe that all the expected news is already incorporated in the price.

Hi Nial, I have been studying your price action philosophy as well as all the other methods out there and I can honestly say that yours makes complete sense. I plan to start trading this October. Thanks for all your Free knowledge. Best Regards

Chris Uk

Hello Nial

Thanks for the article. Great, simple advice that keeps trading stress-free and enjoyable.

Hi Nial

Having read Nicholas Davas book many years ago he says that he was successful by only watching price action as you advocate. He moved to Wall Street and started watching the news and then his trading fell apart. He then realized he had to ‘stop listening to the news’ to get his trading back on track. Which he did. Other successful traders still factor in the news into their knowledge base to figure out the overall direction of which way they should be trading – but don’t just “trade the news” – they use a combination of factors – one of which includes “the news”. Many successful traders trade in all different types of ways. Different trading styles suit different people. Different time frames. Different entry filters. Different instruments Stocks, currencies, commodities or indicies.

Regards

Fritz

Hi Nail.

You are the best, I have grown in my trading journey by just reading your articles. I wish I knew you couple of years ago. Thank you for making this so simple……

Thank You for yet another great article, Nial! I am a newbie and all I focus on is price action. All the news are too confusing for me (and there are soo many!) and I have no idea what kind of impact they might have on the market. Thank goodness-and You- I don’t have to bother with them any more! Can just go back to drinking coffee and watching candlesticks ;)

Right on, Nial. Another gem from the master. Keep them coming. Thank you.

Thank nail for your lesson.I hope this knowledge always in my mind when i trade the market.Sometime i lost my pation when market again me. Thank for your lesson.

Hi Nial,

Great article. I have been researching, contemplating, & adjusting my process & thinking for the past week. I noticed almost incidentally that I was spending too much time looking at the news event calendar & actually had a screen almost completely dedicated to it. I’ve made only a few trades directly due to a news report but I discovered it definitely taints my thought process! I will continue to get reminders for things like the NFP but will remove the news calendar from the process.

Thanks!

Stan

Perfectly timed post. I hate all the hype on news events by get rich quick trading schemes! Thank you for keeping it real.

All true. I learnt this lesson the hard way- when the NO camp won the UK Referendum. I bought the pound a few hours after the results. Soon it came down rolling against me. Markets were simply obeying price action- and it was all in the charts.

Dear Nial

I love reading your posts ‘ it really alert me to always respect the basic of you rules in trading . Thank you for sharing your years of experience with your students.

Whack-a-mole, lol! You called that one perfect. It’s very easy for me to entertain the idea of making an opportunity to make money. I appreciate you keeping it real.

Hi Neil,

Many thanks for sharing your knowledge with us.

I have to admit that my best investment was the moment

I bought your course. The way you write and explain makes

everything easy and enjoyable.

You really put a lot of energy and will power to teach us.

Thank you again.

Alf.

Nice post!