The Ultimate Forex Trade Entry ‘Trick’ You Need To Master

If you’re a regular follower of my blog, you know I’ve written articles discussing “sniper” and “crocodile” trading and the benefits of this trading style. In today’s lesson, I am going to help you understand what this trading style is all about, and I’m going to show you exactly what it means to wait patiently like a crocodile for the ‘perfect’ trade entry to come to you. This trading approach is really the keystone that holds together my entire trading philosophy, and if you master it you will be one giant step closer to becoming a successful trader. Let’s get started…

If you’re a regular follower of my blog, you know I’ve written articles discussing “sniper” and “crocodile” trading and the benefits of this trading style. In today’s lesson, I am going to help you understand what this trading style is all about, and I’m going to show you exactly what it means to wait patiently like a crocodile for the ‘perfect’ trade entry to come to you. This trading approach is really the keystone that holds together my entire trading philosophy, and if you master it you will be one giant step closer to becoming a successful trader. Let’s get started…

So, what is this trade entry ‘trick’ Nial and why should I use it?

Glad you asked. The main idea of this trick is that when you see a price action trade signal or a trend, you don’t just jump in right away at market price, instead you do what most of the other traders are not doing, you wait for a pullback, retrace or a rest in the market. What exactly does this do and how can it help you improve your trading results?

There are essentially three very significant ways that this trade entry trick can significantly improve your trading results:

1) By waiting for a better entry, it allows you to get a tighter stop loss on a trade which in turn allows you to potentially make more profit on a trade by increasing your risk reward. This means you can trade a bigger position size (more contracts or lots) without risking more money.

2) By waiting for a more optimal, or conservative entry on a trade, we can decrease the probability of getting stopped out for a loss because our stop loss is placed in a safer location , thereby giving the trade more room to breathe. Now, instead of a losing trade you potentially have a winning trade, and instead of losing 1R you’ve profited 2 or 3R or even more…that’s a major difference in your trading account value.

3) This trade entry trick also allows you to wait for a better entry on those trades that you are just not 100% confident in and would maybe prefer to risk less on. It can allow you to get a better stop placement as we talked about above, and if you just really want to be more conservative and let the market come to you on a trade, the trick gives you this option. By waiting for a better entry and getting a safer stop loss placement on a trade you are essentially reducing the risk of a stop out and thus reducing the risk in general on the trade, and on a trade you aren’t totally sure about this can often be the best option.

Note: This trading trick of waiting for an optimal entry on a trade might mean that you miss a trade sometimes, but this should not worry you because that is what sniper trading is all about; we are waiting patiently for the ‘easy’ targets to simply ‘walk into our sights’, rather than shooting at everything that moves. Over time, this approach should increase your win rate and will build your confidence in your ability to not only trade profitably but to remain patient and disciplined as well, and that is truly something to be proud of considering lack of discipline and patience is most traders’ downfall.

Also, before we get into the chart examples, I’d like to make a point of noting that this trading ‘trick’ is really more about focusing on an ideal entry point on a trade, rather than on tighter stops. Most of the time, a normal stop loss distance should be used as the market needs room to breathe. Tighter stops should only be used on setups you feel very confident about and ideally after you’ve gained some solid screen time and trading experience.

The trade entry ‘trick’ in action

- Waiting for the optimum entry point on a trade we are 100% confident in

When you have a strong view on a particular price action trade setup and you would like to get the best entry possible so that you can increase the potential profit on a trade, the trade entry trick is your most potent weapon. Remember, to ensure optimum entries you have to be fine with potentially missing out on a trade from time to time, you have to accept this as part of being a highly-skilled price action trading ‘sniper’.

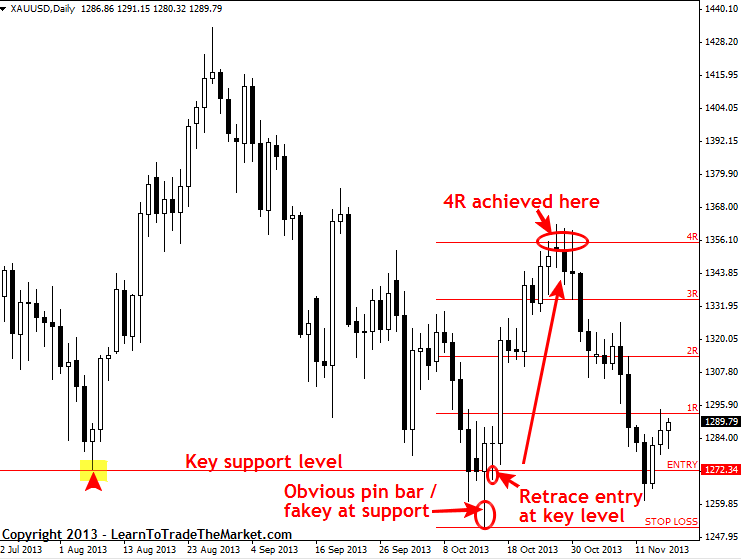

In the chart example below, we can see how the trade entry trick can increase the risk reward on a trade by allowing you to get a tighter stop loss and thus trade a larger position size. In the daily spot Gold chart below, we can see an obvious fakey with pin bar combo setup formed on October 15th. The ‘trick’ entry would have been at the key support level through 1272.75 which is also very close to the 50% level of the pin bar. Note that waiting for this retrace entry at the key support level would have allowed you to get a tighter stop loss on the trade and a 4R profit as a result. A ‘normal’ entry on this trade setup, near the pin bar high with stop loss near the pin bar low would have netted you no more than 2R profit. So you can see by waiting for the more optimal entry on this setup we could have at least doubled our profit on this trade…

- Using the trade entry trick to avoid getting stopped out prematurely

Another excellent way to take advantage of the trade entry trick is using it to help you avoid getting stopped out on a trade before it moves in your favor. By waiting for a more conservative entry (a better entry), we are being less aggressive because we are being more patient and using more discipline in waiting for an optimal entry. The net effect of this patience is allowing us to have more breathing room on a trade by shifting our stop loss further away. This use of the trick is not about reducing your stop loss distance, indeed you will keep the same stop loss distance as a ‘normal’ market entry, instead, you’re getting a SAFER stop loss placement and getting more breathing room on your trade, thereby increasing the probability of being on-board when the market moves in your favor.

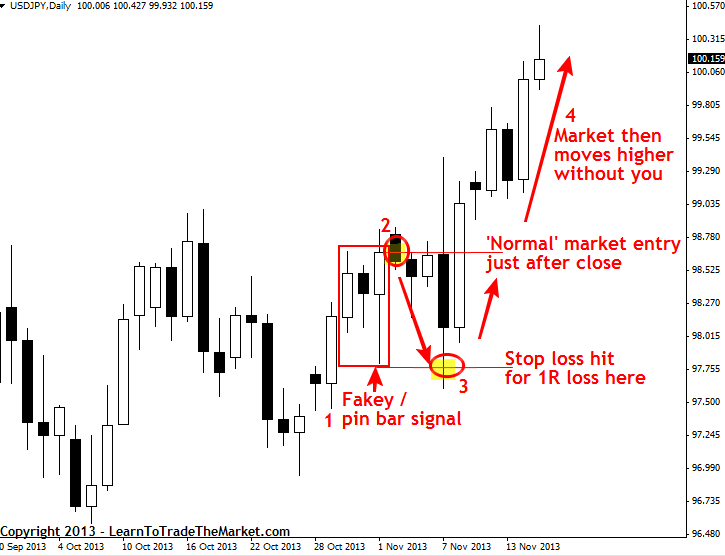

In the chart example below, we can see another fakey / pin bar combo setup that formed recently, this time in the daily USDJPY chart. Note in the first chart, if you had entered at market with a ‘normal’ (impatient) entry, you’d definitely have gotten stopped out for a loss if you had your stop just below the pin bar low…

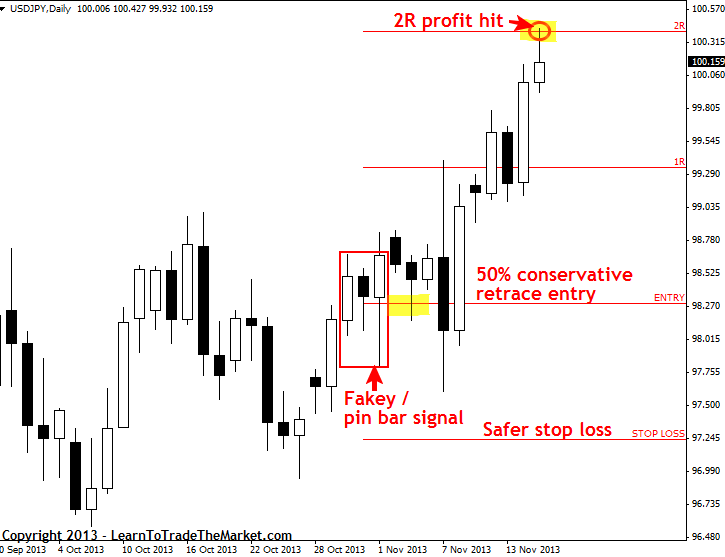

Now, let’s compare what happens when you use the trade trick entry to the normal entry in the chart above. In the chart below, we can see by waiting for an entry near the 50% retrace level of the pin bar and keeping our stop distance the same, we actually avoided the losing trade and turned it into a nice 2R winner:

Here’s another example from a pin bar signal that stopped many traders out in the Gold market back in early August of this year. Note that the market moved slightly below the pin bar low before rocketing up into what could have been a nice 3R or more winner for you if you had just waited for the more conservative retrace entry and kept your stop loss distance the same…

As you can see from the examples above, the idea with this trade entry ‘trick’ is that we are reading the price action in a market and when we find a trade setup and have a view on the market, we can then fine-tune our entry and this then gives us options for stop loss placement and targets. This is much different than just jumping in right away on our first observation of a price action signal or market bias. This is called pin-point accuracy sniper-trading and it’s the most powerful way to trade the market in my opinion.

- Using the trade entry trick when your belief in a trade is not 100%.

Sometimes, you will come across price action setups that you just aren’t 100% confident in but that still meet your trading plan criteria. For these types of setups you may elect to use the trade entry trick to play the trade more conservatively by waiting for an optimal entry. By doing so, you can give the trade more room to breathe by getting a better stop loss placement as we discussed above, and you will be letting the trade ‘come to you’ rather than entering too aggressively on a trade you don’t feel totally confident in.

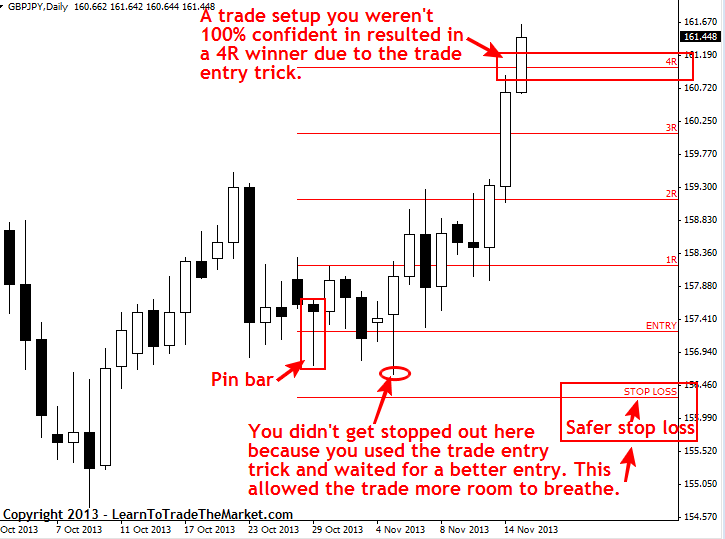

In the example chart below, we can see a recent pin bar in the GBPJPY on the daily chart time frame. Note that this was not exactly the best pin bar signal because it was a bit small and its tail didn’t really protrude out from the surrounding price action. Still, the underlying bias was bullish in this market and certainly longer-term there was a clear up trend. Thus, this may have been a signal you were less than 100% confident on, so you could have used the trade entry trick to wait for a better entry which allowed you to shift down your stop loss and avoid market volatility more. The result was that if you had taken a normal entry near the pin bar close or high, with stop just below the low, you probably would have lost money on it, instead, using the trade entry trick the trade could have netted you a huge 4R winner, quite a difference:

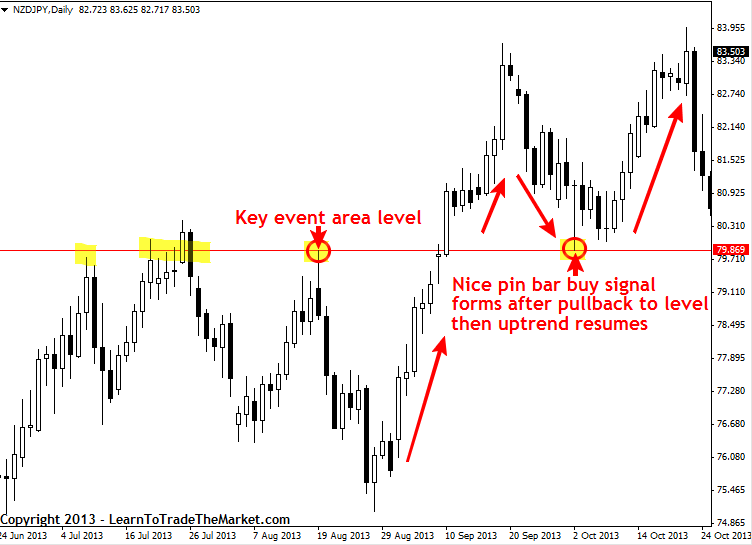

- Using the trade entry trick to get better entries in trends

In a trending market, traders see the market moving aggressively up or down and often want to jump in a trade without waiting for a retrace. It is usually this not waiting for a pullback to enter that often results in traders buying near the high or selling near the low. Markets ebb and flow as they trend, so it only makes sense to look for an entry as the market retraces back to value, as it’s at that point that the market is most likely to resume the trend. If you enter when the market is extended, which is usually when most traders “feel good” about entering since the market looks “safe”, it’s at this point that the market has a higher-probability of retracing and stopping you out for a loss because you didn’t wait for the retrace.

Let’s look at an example of waiting for a retrace to a key ‘event area’ level (I discuss event areas more in my trading course) before entering an uptrend in the NZDJPY recently:

Conclusion…

It is important to understand that every trader is different and different traders have their own motives for using different entry types. Some traders will use the trade entry trick because they refuse to take entries that are not “ideal”, they may miss some trades but they are emotionally OK with that because they understand the importance of getting the best entry and how it can lessen the chance of a premature stop out. Still, other traders might want to use the trade entry trick to get tighter stop losses so they can trade more contracts or lots per trade, note that does not mean they are risking more money per trade, it means they are trading a bigger position size with smaller stop loss distance, checkout this article on position sizing for more.

The main reason to use the trade entry trick I’ve discussed in today’s lesson is to get a better entry and to get better / safer stop loss placement, this allows you to avoid market volatility more and gives your trades the best possible chance at working out.

Also, it’s important to mention that a trader doesn’t always have to be uncertain or conservative in their view of a trade to enter on a retrace or pullback, this is just how some traders always trade and it’s part of their trading plan. It’s a tool to add to your trading toolbox, and a very effective one at that.

Keep in mind that the way we trade at Learn To Trade The Market is unique and we must apply discretion to each signal, because trading can’t be mechanical if you want to stand the test of time. You might choose to use the trade entry trick with a normal stop loss size or a tighter one, and you might elect to risk the normal $ amount or less, it’s up to you and discretion must be applied.

Over time, after learning the approach and screen time, a trader will start to develop their own unique style and entry methodologies to extract as much profit from the market whilst risking the least amount possible. These tweaked entries allow us to significantly improve our strike rate and overall risk reward, which ultimately should put more $ in our trading account. It’s not going to work for you if you don’t have plenty of knowledge on price action signals, reading charts and reading markets. My trading strategies are powerful, but you still need to know how to use them and how to manage your stops and targets. Your goal as one of my students is to put it all together and experiment and play different scenarios, it’s the only way you can truly learn this stuff, again it’s not mechanical and it’s not a perfect approach, every price action signal is unique and every entry, stop and target placement is unique. If you want to learn more about how I use price action to find optimal entries in the market, checkout my price action trading education course for more information.

Good trading, Nial Fuller

I WOULD LOVE TO HEAR YOUR THOUGHTS, PLEASE LEAVE A COMMENT BELOW :)

Any questions or feedback? Contact me here.

Hi Nial

This is one of the best articles I have got .Thank you

This is excellent stuff..

The way it’s presented is easily understood..

Thanks Nial.

Dear Sir,

Thanks a lot of & I pray long live in The World to give a power full Trading Strategy

To help weak Forex Trader.

Thanks again

Monirul

Nice and conservative.

Hi Nial,

I have a question with these trick entries, Do you wait for the price to break the pin bar and then retrace or you take it before it breaks if it touch your entry anyway?

Seb

Thanks Nial for these educational tips. you explain it easily. So much to learn. Cheers.

Nial,

Your truly awesome! You teach with authority and knowledge. I wish I could have a double portion of your Forex Trading Knowledge. God bless and keep up the good works.

God bless you more.

Best Regards,

John

Just so GOOD!

Very informative and eye ???? opening . I just love it ????

Hi Nial

This is one of the best articles I have got .Thank you

Hi Nial

This is one of the best articles I have got .Thank you

Thanks,good lesson.I come back after a year and lern

Very impressive and extended technique, Nial!

Thank’s a lot for giving that knoweldge.

Will add this to my trading plan.

I’m proud to be your student.

Regards

Dmitriy

Good article that goes hand in hand with the limit entry(Oder) you don’t necessarily have to wait you just set your 50% limit entry and forget

Thanks Mr Nial ????

powerful speech my brother…Keep it up

Great article Nial.

Am I correct in saying that the conservative stop loss is equal to the R dropped down 50% of either the pin bar or mother bar? Thus, it will protrude also by 50% below either bars.

Powerful will certainly add this to my trading toolkit. Than you. Powerful.

This is very informative. Yet another life-changing article.

Thank you so much Nial.

Hi Nial,

Impatience to get into a trade is my archilies heel. This could help me there.

Thank you

it happen to me. instead of a home run. i was stopped by a pull back.

Thanks for article!

Thanks a lot Nail that was a great article there only enter the markets when the correct strategy is present like a sniper only fire when you target is truly and positively identified.

Hi, Nial. Thanks. Article helped in real trade. Your articles very contribute to the study of strategy.

Thank You so much Nial! Again, I retain that this unique and powerfull way to trade must be apply with discretion. I really appreciate your writting!

Thank you for another thought provoking and honest article. It’s refreshing how you reiterate that trading is subjective and all these tools and entry signals have to be considered within in that market condition. In your pin bar article you mention placing entry at the break of a pin bar then the stop one pip below the tail- this technique has saved me several times as my order has not been hit. My question when using this tecnique do you place the order the wrong side of the market?, for example above current price if selling? I understand it can potentiall give a better R/R but adds another element of risk? This makes me think I would have to be more confident in the candle / confluence area as dont have that extra confirmation / saftey of price travelling through my entry in the desired direction. Really appreciate your articals, I am now only trading daily charts as you suggest which is changing the game for the better.

I enjoyed the read but after reading about pin bar. It must be extremely difficult to wait 2-3 days after you see a pin bar just to see if price will retrace down 50%. gbpjpy daily example it would be extremely hard in my opinion to wait for 2 days for entry. Overall extremely great concept and I get the idea

Hi Jordan, I think we are also wasting time if we entry too earlier when after that price retracing, and we also loss opportunity to have lower risk.

Exactly!

I think this entry super tuning technique is the deepest part of pa. Thanks a lot for article.

Hi Nial,

What a great article! So how do we place our orders at 50% conservative retrace, do we use pending orders or we wait for the market to retrace to that level? Please advice.

Hi Nial

Your course has lots of free treasures all over the place and this entry tick is one such. I like the approach but it would need emotional balance to wait for better entry. And I would like to know how can we control our emotion. Do you have any article on emotion control or psychology?

Thanks

your new student

Yes, see here – https://www.learntotradethemarket.com/forex-articles/profitable-forex-trading-mindset-psychology

Thanks so much for the article! Always learning….I want to know what you’re meaning when you refer to a normal stop loss in the 2nd XAUUSD chart? You said others traders would have gotten stopped out at the small pin bar. How would you determine to place your stop loss further our?

Hi, read here: https://www.learntotradethemarket.com/forex-trading-strategies/how-to-place-stop-losses-like-a-pro-trader

Its a wonderful article – Thanks lot Sir

Insightful teaching, thanks a lot.

Wonderful Niall I bought ur course quite a while ago, it is an amazing insightful course. Thank u.

Thank you my mentor. Salute

Hello Nial,

I’ve learned so much with your website, it helped me to be patient for the best Setup.

Thank you from Venezuela

Ricardo M.

TRICK ENTRY is great helps as a confirmation or maybe a reinforcement… Thanks Coach!!!

Thank you Sir

Good article thank you

Hey Nial

Thank you for sharing your expertise so unselfish…as I am still very..very novice I am starting to study the candle sticks at the moment. But I am 57yrs old and the brain isn’t that sharp anymore (well dont know if it ever was actually hahaha…my own joke) and I was never good in mathematics at school either, so I believe that there are approximately over a hundred candle sticks to learn. Can you please give me your comment on this..

Regards Willie

You don’t need to learn all of the candle patterns, just a few work consistently and those are the ones we trade with here.

you are wonderful. thank you for helping us.

Very enlightening and helpul. Thanks a lot for everything, Niall.

Dear !

You are the best !

ALLAH Bless you always

I don’t know what to say at how it seems you can read the minds of newbies in trading. Your articles just solve our problems in detail. I have been struggling with entering my trades, with my stoploss being hit now and again and the market continuing in the direction of my trade. without me of course. This article seems to be the solution to that problem. THANKS NIAL. Keep up the good work.

Hi Niel, Your articles continues to put into perspective my scrabbled knowledge of trading. I am becoming refined trader with clearer objectives. I now understand the market activity better than before. Thanks

Manas Manyaka

Thank you Nial. You inspire us a great deal. Trading would not be this fun without your lessons. Thank you and God bless.

Hi Nial

This is great technique, but I have a doubt: if the price doesn’t touch the limit entry at 50% retracement, when I should close the limit order? Or I should let it open until it is hit? Or maybe when the price touches my target I should consider the trade finished without being opened.

Thank you :)

Hi Nial

I love the trick entry lesson makes 100% sense only thing i am not certain is how to determine a safe stop loss please help Nial.

Thank you so much

Kind regards

Fred

Great article prof. Thanks a lot for this eye open trick.

Blessings.

Hello, Nial.

Great article Nial, I’m really enjoying being part of this trading site. You’re a great mentor. With each of your article, I’m a successful professional trader.

Thank you very much.

Hey Nial, Ialready know for that trick. :)

I prefer and focus only on ˝trick˝ entrys. R`s are at least 4, often much more. It is worth to be extremely patient, picky, disciplined, calm,…and emotional ok (cool) :)

Nial, I love this, you are a great mentor, keep it up.

You are simply awesome – GOD bless you for freely sharing your knowledge and imparting skill to us.

ABM

Hi Nial

It’s GREAT GREAT GREAT. You always great.

My HAPPY NEW YEAR best wishes to you & everyone.

i like your straight-to-the-point-and-not-beating-about-the-bush approach in your P.A. lessons.

THIS HAS BEEN VERY INSIGHTFUL AND I LOOK FORWARD TO THE NEW YEAR WITH DETERMINATION BE A SNIPER AS PART OF MY STRATEGY

the great strategi thanks

Great lessons Thanks so much sir,

Thanks Nial that’s brilliant

A precious article, very lucky to be a member in LTTTM, I get a continuous learning forex from You Nial, You are a Great Forex Coach, Thankyou So Much

A precious article, very lucky to be a member in LLTTM, I get a continuous learning forex from You Nial, You are a Great Forex Coach, Thankyou So Much

Happy Christmas, many thanks for as always an interesting article!

A masterpiece

U are grate man

Thanks a lot

What’s even more wonderful is that you don’t have to guess a stop. Is calculatable with a high accuracy.

Hi Nial! Thanks for the lesson, it really is eye opening. I’m looking forward to implementing it to boost my trading.

Eddie.

Thanks for another insight into Forex trading, I even recently experienced losses by keeping normal stop placement just a few pips under pin bar low/high, If I would aware and placed trick entry method would have turned to nice profit, thus dramatically increasing my trading account…. Will be following and practicing this method when the PA allows in the future. Making consistent profit each month( some X times R). something which I see in your approach and also the one need to achieve………

Let me wish YOU a merry X’mas and a very happy new year 2014 that realize all of your potential life goals.!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Great tips….. Risk n reward with entry trick are powerful combination …..thanks sifu….

thanks Nial!!!

Excellent article. Thanks very much !

Nial you are great tutor in forex land. keep it up and God bless you

Nail, this is a very educating article, a complete trading system on it own. Thanks

Great! A real milestone. Thank you so much. Greetings from Germany! Best wishes for Christmas an the New Year!

I always learn from your lessons.

Thanks Nial! This idea of waiting for retracing at 50% level while setting the stoploss size as the pin bar signal is new to me. It certainly can help to avoid getting stopped out comparing just putting the stoploss at pinbar low.

Will be implementing this!

Roger

I do gain a lot whenever I read your forex lessons.

Fantastic work, something I had been wondering about. I appreciate your thoughts and teaching, Gye

Hi Nial, great insight aricle you wrote here, it is well explained and useful, thanks so much.

After all patience will be rewarded, that is the biggest lesson i’am learning when i read your aricles.

Hi Nial,

That’s neat.

At first I didn’t get what you are saying so couldn’t see how you managed to stay in some of the trades using the same stop loss position. Only when I realised that you are saying to use the same number of pips between entry and stop such that both entry and stop levels move by the same amount did I understand it.

Thanks for sharing.

thanks sir I now understand more of price action trading signals through ur works and articles.

Bravo!!! I dove my hat for you(nial) as always. As at today , Gbpusd formed an inside bar pin bar combo..I placed my entry exactly at 50% fib . The trade resulted to a 2R profit..I have back tested the trick entry ever since and it is exactly what a trader needs. You nailed it when you warned that trades will be missed. I love you nial as a mentor . You have taught me all I know in forex. I thank you

Boss.

Really great lesson, Nial. After reading your article I had a look at my trading journal. If I had known your ‘trick’ at the beginning of this year I would have turned two losses into 2R. That are 6R in total! That makes a great difference.

I enjoyed the article Nial, thank you very much.

But, I don’t get how you determine the stop loss that’s below the pin-bar.

Thanks Prof. for the great article.

Hello Nial.

This was most important lesson to me. I mostly lose money due to bad entry .

Thank you coach

Niall, your blogs get better and better!

Here’s wishing you a very happy Christmas and a great New Year

You are indeed a great mentor

Thanks for this article. Quite an effort to write that much detail. May I add that this sort of pullback entry often comes after a signal was triggered during the asian session where liquidity is lower. Then we can entry set order at mid point of the signal during the European or US session.

Great Stuff Nial, Hunter’s precision … stops placed away from fakey swing low really makes sense especially when market makers are hunting for stops…

K. I .S .S . ……..

thanks.

As simple as that! You are the man! Thank you for this priceless lesson!

Nial, can this article help me turn-around my trading results? It may :-)

I am too often stopped out at a pinbar high/low.

When I use limit orders to get in at the pinbar 50% retracement, often the market takes me on the way to my stop.

Now based on your trick, I will backtest and then try this: limit entry at 50% retracement (or other logical level), and a wider stop (around like I would have if traded on pinbar close).

Let’s see where this takes me :-) Thanks a lot.

Nial, you’ve written many fantastic articles. This one by far resonates with me the most as it’s where I am currently at with my trading development.

This was my AHHA moment when you spent a lot of time to explain this concept in detail at the Melbourne seminar.

Many thanks and appreciation.

this article is an eye opener. Thanks Nial.

Thanks Nial

I have had to manage my patience in waiting for the correct/right entry and I am slowly getting there. The one other Challenge I am getting is to determine when to come out of the market and when not to. Once again thanks very much for your dedication and guidance.

Hi Nial thanks for your article. My interpretation of what your saying is that the stop loss order needs to placed at a key level in the market that if violated by price would invalidate the market “direction” implied by the signal. By being patient and “timing” entry on a market to pull back you can still in effect achieve the same risk reward ratio as placing a market order and placing the stop below the price action formation. its all about the key levels. I like your use of the gap (technical level) in the USDJPY trade nice one.

Great lessons! Thank you Nial.

My entries are usually conservative (entry on break of PB high/low with SL placed a few pips under PB low/high).

After this lesson I’m going to think about your “trick” and once I feel confident I may add it to may plan.

you are like a crocodile, you are adaptable and your brain is is very high. nice