How To Increase The Winning Probability Of Your Forex Trades

In this article I am going to teach you some powerful skills that aim to dramatically increase the winning probability of your forex trades. Pay close attention to these concepts and start practicing them in your trading.

In this article I am going to teach you some powerful skills that aim to dramatically increase the winning probability of your forex trades. Pay close attention to these concepts and start practicing them in your trading.

Price action trading strategies can be very potent ‘weapons’ to trade the markets with. We just have to learn to use them correctly and accurately. Most of us have a limited supply of bullets (money), so we have to make each bullet count and not waste them on low-probability targets (stupid trades).

So, how can we ‘fine tune’ our price action trading to make it into a high-probability trading ‘weapon’ so that we very rarely waste our bullets? This is your main mission as a price action trader; this mission is not an easy one and it’s going to take discipline, fortitude and the ability to pull the trigger only when your target is present. But, if you dig-deep and really want to be a profitable trader, you can make it happen.

So, without further delay, let’s get down to the business of getting your trading strategy ready to go to ‘war’ in the Forex markets:

Stop voluntarily decreasing the probability of your trading edge

Unlike lifting weights, where doing more typically makes you bigger and stronger, trading more will not make your trading account bigger or stronger. In fact, it will probably make your trading account a tiny little floundering wuss.

If you haven’t read any of my other articles on trading Forex with patience, go back and do that later. For now, I will briefly explain to you why trading less frequently will make you a better and stronger trader.

The reasons are pretty simple. First off, your trading edge is not always going to be present in the market, so you have to have the patience to wait to trade until it is. This typically means you will be out of the market more than you are in it, which is of course totally contrary to what most traders do. Most traders can’t stand to be out of the market, they feel an ‘itch’ to enter a trade that will not go away until they hit that buy or sell button. So they enter a trade not based on their edge, but based on emotion instead.

The point is this, most of the trades a losing trader makes are ones born out of emotion, or because they just feel like they want to trade. If we really stick to our predefined edge, price action trading in my case, we will naturally be waiting for our edge to form more than we will actually be trading. Any high-probability edge in the market is not going to be present all the time, we have to wait for a market to ‘show us its cards’ first, and it may only do that one or two or three times per week. So, the first and perhaps easiest thing you can do to increase the probability of your trades is to stop decreasing their probability by trading when your edge is not actually present! You can do this by employing the disciplined to ONLY trade when your edge is present…in other words, stop trading just because you ‘want’ to!

Confluence is like ‘steroids’ for a price action setup

Everyone knows I teach and trade price action. However, I know from emails that I get that a lot of people who follow me think that ‘price action trading’ means trading any old price action setup; they seem to totally ignore the market context that the setups occur in, which is actually just as important, if not more than the individual setup itself. Essentially, I am talking about confluence here, and trading price action setups at confluent points in the market is really the ‘core’ of my trading philosophy. I talk a lot about trading Forex like a sniper and not a machine gunner; well, waiting for price action setups to form at confluent points in the market is HOW you trade like a sniper. Traders who just enter any PA setup they see, without considering the context it’s occurring within, are machine gunners, not snipers.

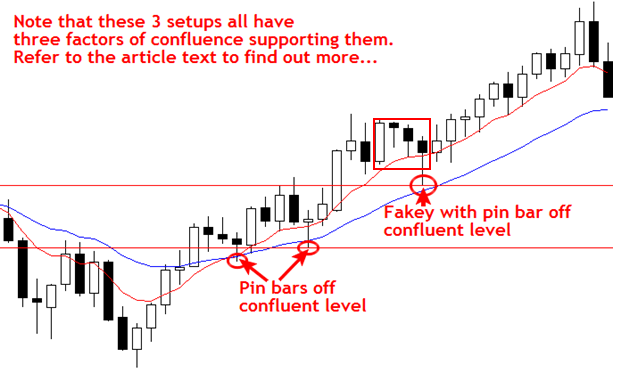

There are many different ‘factors of confluence’ that I teach to my members, but for today’s lesson we will just stick with horizontal and dynamic support and resistance levels in order to illustrate the point. I use the 8 and 21 daily EMAs for dynamic support / resistance, and horizontal support / resistance levels are simply your classic technical analysis support and resistance levels that connect highs to highs and lows to lows.

To trade with confluence, we want to first scan the markets for an obvious, or well-defined, price action setup. If we find a setup that meets our criteria, we then look to see if it has any supporting factors of confluence.

In the chart below, we can see 3 price action setups that each has three supporting factors of confluence. All three of these setups had confluence with the near-term bullish momentum / trend, dynamic support from the 8 and 21 day EMA layer, and support from a horizontal (static) price level. This is one example of trading price action setups from confluent levels in the market.

To contrast, here’s an example of two price action setups that were well-defined but didn’t have any obvious supporting factors of confluence…

In the chart below, we can see two very good looking bullish pin bar setups. Now, the obvious problem with these pin bars is that they are against the near-term trend, which was clearly down at the time. However, on top of that, they also did not have any supporting factors of confluence such as a key horizontal support level, dynamic EMA support, a 50% retrace, or any other factor. It’s setups like THESE that I get emails from traders about asking “Nial, I traded a well-defined pin bar the other day, why did the market go against me”?

The answer is two-fold: First, it’s important to remember that not every setup works out, even a perfect looking setup with 5 factors of confluence can and will fail sometimes. Thus, we need to always practice proper forex money management. Next, in order to use our ‘bullets’ as effectively and efficiently as possible, we need to always make sure we take high-probability price action setups, meaning setups that are well-defined AND that are in agreement with the overall market context they’ve formed in, AKA they have confluence.

The point to take away from the above two charts, and the main point of this article, is that trading price action setups from confluent points in the market is the best thing you can do to improve the probability of your trades. Too often, traders simply aren’t patient and picky enough in regards to their trading, and they thus end up throwing their money away in the markets. Just remember that every time you find a potential trade setup it’s YOUR HARD-EARNED MONEY you are about to lay on the line, so ask yourself if the setup has enough supporting factors of confluence to be worth trading.

Think before you ‘shoot’…not after

Most beginning and losing Forex traders seem to behave as if they are best able to navigate the markets after entering. This is akin to an army general thinking that his army has the best chance of winning a war if they just dive into war first and ask the questions later. Fortunately, in (most) wars, governments usually plan and ask the tough questions first, so that they know what they are doing when they are on the battlefield.

In trading, most traders seem to do the opposite; they try to plan, think and strategize in the heat of the moment, when their money is on the line and they are the most emotional.

I’m not going to get into a long drawn-out discussion about the importance of trading plans and trading journals, because I talk about them extensively in other articles, follow the links if you want to learn more. But, I will say that we need to do our analysis and most of our thinking about the markets BEFORE we enter, this gives us the highest-probability of succeeding as traders. As soon as traders enter a trade and THEN start thinking about it and over-analyzing it, they almost always lower their overall probability of profiting over the long-term.

I’m not going to get into a long drawn-out discussion about the importance of trading plans and trading journals, because I talk about them extensively in other articles, follow the links if you want to learn more. But, I will say that we need to do our analysis and most of our thinking about the markets BEFORE we enter, this gives us the highest-probability of succeeding as traders. As soon as traders enter a trade and THEN start thinking about it and over-analyzing it, they almost always lower their overall probability of profiting over the long-term.

There’s nothing wrong with checking on your trade every 4 or 8 hours or so, but you should not be thinking about it much, if at all, in between. The best thing to do is to pre-plan all your potential interactions with the market, and then follow that plan to the T, this way you deny the possibility of emotion coming in and destroying your trading account.

Trade higher time frames

As I discussed thoroughly in a recent article on trading daily chart time frames, you can significantly improve your trading by ignoring time frames under the 1 hour chart all together. I actually NEVER look at a time frame under the 1 hour. There is simply no reason too, they are messy, full of random market noise and will tempt you to enter a trade that you know you shouldn’t. In short, if you want to improve your accuracy and the probability of your price action trade setups, focus on the higher time frame charts.

Money matters

If you want to give yourself the best chance at taking the highest probability trades and avoiding low-probability / emotional trades you’ll need to make sure you are not A) trading with money you need for other things in your life and B) not risking more than you are comfortable with losing on any one trade.

When you are only trading with disposable income and never risking more than you are OK with losing per trade, you will be much calmer and more objective. This will obviously work to help you to only take high-probability trade setups. Traders who are strung-out and frazzled because they are overly worried about the money they have at risk in the markets are naturally going to take low-probability trades because they simply are not thinking clearly.

Remember, you never know for ‘sure’ what’s going to happen

As traders, it helps to always expect a random outcome from our trades, even though we may have mastered a high-probability trading edge like price action. Even if we have say a 60% or 70% win rate, it is a randomly scattered win rate, meaning we never know which trades are going to win and which will lose. For instance, if you have a 60% win rate, you could theoretically lose 40 trades in a row out of 100 before you hit 60 winners. So, knowing this, we have to approach each trade as just another execution of our trading edge, while doing everything we can to put the odds in our favor.

As traders, it helps to always expect a random outcome from our trades, even though we may have mastered a high-probability trading edge like price action. Even if we have say a 60% or 70% win rate, it is a randomly scattered win rate, meaning we never know which trades are going to win and which will lose. For instance, if you have a 60% win rate, you could theoretically lose 40 trades in a row out of 100 before you hit 60 winners. So, knowing this, we have to approach each trade as just another execution of our trading edge, while doing everything we can to put the odds in our favor.

Everyone knows that I don’t sugar-coat anything, so I’ll tell you that there is no ‘perfect’ trading signal, and that goes for ALL trading strategies and systems. Even if we have multiple factors of supporting confluence, a perfect trend, and a perfect price action setup, the trade can still lose. Thus, it’s important to trade with these facts in mind while simultaneously making sure you do everything you can to only take the highest-probability trade setups. If you want to learn more about confluence, price action trading, and how to combine the two for a high-probability Forex trading strategy, check out my Forex trading course and members’ community.

Merge is force! Thanks for article

Thanks Nial for such an eye opening article ..

Great article. Some of the basic trading habits that a trader should have. The most important advise is to think before you shoot. Having a plan before entering a trade is the most important thing in trading.

Thank you so much.Each article which you teach traders in clude me it will help to improve my trading skill.

Thank you so much which your shared.

Hi Niall: As many others have said – a great article once again. I trust you & yours have a happy & prosperous New Year – Cheers Oldie

Nial —

You have a genuine gift of stating and showing patterns and information in a much more straightforward, clear way. This is truly the ‘edge’ of ‘learntotradethemarket.’ Truly, thank you for your sharing.

Columba

Thank Master, nice article :D

Nial, once again, a GREAT article!!! THANK YOU!

Great article per usual Nial. Thanks!

OK Nial.Thanks!

Nicely put again Nial, simple and easy to follow price action seems to always be the best. There was a really good price action breakout of range trade on the top image as well when it broke top support…

Your articles reveal the hidden secret techniques of trading Forex. THANKS.

Nial,

I will say this to all aspiring member that with Nial’s course on price action you stand the chance of being successful in the market. When you lose one be sure of getting back a winning trade.

Best Regards,

Owonikoko

Hi Nial

A well written article indeed. It is so amazing how much one can learn from your articles. Keep up the good work.

Kind Regards

Thanks Nial Your articles are always straight to the point. I have enjoyed and learnt from every one I have read. You are truly selfless.

Thanks once again

Trend is your friend, so is Nial.

Awesome !!!

Thanks Nial… a lot of good stuff in this article…Solid!

Hi Nial,

Thank you very much.

Great stuff as usuall. I have improved my trading greatly ever since I got to know you. Thank you very much sir.!

I know something for sure. You’re the man, Nial. You do a great job but do we?

hi nial, thanks a lot for this great lesson about pa. please let me ask 1 question. if you trade in 1hr or 4hr timeframes how big is your sl??

best regards, t.s

I love this bit: Remember, you never know for ‘sure’ what’s going to happen

Great article Nial, thank you.

thanks nial read and watched all and most of videos just taken training wheels off last week on demo. trialing sniper 4hr daily and 1 hr worked in very well can see the trend now .tried other things that blew my account im working on getting rid of junkie trading and gambling thanks will take course soon lee

nice one as always.

a great well thought out and very informative article

thank you for another brilliant share!

Very reinforcing Nial, backed up by my trading journal. All thanks to you.

Your grateful student Peter

Nials, good wisdom as always.

W

Thanks again Nial, great article!

thanks be bless Amen

This is another phenomenal article! I’ve dramatically improved my trading success by becoming much more patient and unemotional. Thank you Nial for the wonderful articles! You are an invaluable mentor to my trading technique.

Nial, I read many of your articles that you post, and all i can say is after each one i always learn something new. I cant wait to become a member of your community and learn as much as i can. Great work!

Nail,

You have done it again! There is sincerety in your lessons.You really want your readers to succeed.Thanks.

Nial thanks for such a nice supporting article. when i first purchase ur course, i read, put MA’s and Tl on my chart and then as usual, deviated from rules until recently that I understood the importance of ur trading course.now I’m following ur advice and reaping the fruits. u are really beacon of light on dark paths.

kind regards

Another niece piece. Nial you have a way of making the complex really simple. Keep up the good work

More of the time we are focused in other details but the main the confluence is the key to get more winner than lossers.

Like always great

Another great lesson Nial. Thanks..

Genius, as allways! You really don´t “sugar-coat anything”, but that´s what makes us learn. Thank you Nial!

I actually said I was never gonna take any other fx trading course again cos I have spent a lot of money on these sham guys. Now I am seriously considering taking your couse. After seeing your website and going through your article, I realized you don’t sugar coat anything and trading is not as easy as other people paint it to be just so they can part with your money. I like the fact that you don;t use any systems which i have been a victim of in the past.

Thanks Nial

Thanks for another wonderful article Nial!

Even though I am a member, I read everything you write. Its all good.

In a nutshell…. the trend is your friend… trying to counter trade a daily chart is very brave but probably not healthy..

Thanks Nial

Great spot…

Cheers

Simple and easy to remember! ;)

Regards from Sweden

very interesting and valuable lesson to improve our trading

results

thanks

aleem

Great article Nial! Thanks

Just Brilliant, Thanks Nial

Hey Nial,

Great insight, but more importantly, great of you to share this… two thumbs up to ya.

Cheers,

Tonye

Hello,

Thank´s for your site, it´s very helpful .

I start trade 8 months ago ,lost money at first, but since I follow your directions have been successful.

I still can not master the placement of the target price and how to move my stop loss over the trend.

I continue to learn ….. to make more consistent profits.

Sorry if my writing is not quite correct, I can read and speak well but have little practice writing in English.

Thanks for your teachings.

Vasco Fernandes

Sintra – Portugal.

Brilliant article as ever Nial…

Looking back over my loosing trades I have noticed a startling pattern where their was very little to no confluence. This is where patience really needs to come in and wait for the setups that offer decent confluence and solid price action at the same time. When I have done this my account recovers and grows. Pretty straight forward really.

Thanks for sharing Nial !!

Always awesome articles

great

danilo

italy

GREAT lesson. I hope you will someday do a similar lesson on trading a high probability reversal pattern. In the 2nd example of this lesson, near the far right of the chart, I see an ema cross up, inside bar, followed by a bull bar with a SMALL tail, but at a support point. So even though it is not a pin bar, it did have some momentum upward to start a reversal. How far would you expect it to go? To the “shelf” at the left side of the chart? I want to learn more about this.

Hi,

Actually even weight lifting does not exactly fallow “more makes more”.

Look up what Peter Ragnar has to say about strength and how to build muscle.

Tam tam

Outstanding A++++++

Nial oh Nial….You brought out the big guns on this one! Thanks for sharing again…I hope one day i can afford your paid membership!

Thanks Nial, you are the only mentor that has ever given decent support to its members. Very much appreciated. Your system and teachings are invaluable

Regards Peter