K.I.S.S. – ‘Keep it Simple Stupid Forex Trading Method’

The acronym K.I.S.S. stands for Keep It Simple Stupid. This acronym is as applicable to the field of Forex trading as it is to any. ‘Keeping it simple’ in regards to your Forex trading means keeping all aspects of your Forex trading simple, from the way you think about price movement to the way you execute your trades.

The acronym K.I.S.S. stands for Keep It Simple Stupid. This acronym is as applicable to the field of Forex trading as it is to any. ‘Keeping it simple’ in regards to your Forex trading means keeping all aspects of your Forex trading simple, from the way you think about price movement to the way you execute your trades.

Simplicity is the most often and easily overlooked ingredient to profiting long-term in any financial market. I’m sure you have probably tried using complicated and (or) expensive trading methods at some point and subsequently realized that they weren’t working how you had thought. This article will help you understand why people tend to over-complicate Forex trading and how you can use the power of simplicity to your advantage.

The truth about Forex trading

So you’re excited about the latest and greatest programmed indicator that has been getting a lot of attention in the trading forums you visit regularly. You just know that this one will work because the returns that its creators have posted look absolutely brilliant, and you can’t wait to try it out. That last indicator-based method didn’t work as you expected it to, but this new one seems like it makes a lot more sense and all the testimonials you’ve read just can’t be wrong…

Many traders have had similar experiences to the one above; they think that by trying enough trading systems and forex indicators, eventually they will hit upon that one that is their automatic ticket to consistently profiting in the markets. This belief is exactly what causes many traders to blow out their accounts time and time again only to find themselves full of frustration and confusion. Simply put, there is no ‘free lunch’ in trading, still, many traders think by finding that one great trading system or indicator they can sit back and watch the money roll on. The truth is that nothing that is fully systematic will ever be a truly effective way to trade the forex market because the market is not a static entity that can be tamed through black box mechanical systems. It is a volatile beast that is driven from human emotion, and human beings vary in their emotional reactivity to specific events, especially when their money is on the line.

The fact is, that while almost all traders would say they want to make trading a simple process, they are going about it in the totally wrong manner. Trading can only become simple once you forget about the idea of finding a perfect indicator-based trading system that will work in all market conditions. Markets are just too volatile and complex to ever be dominated by a piece of software code or a mechanical set of trading rules.

How do you “Keep It Simple”?

How does one keep their Forex trading simple? Well, no pun intended…it’s actually pretty simple; STOP looking for the next “perfect” Holy-Grail trading system and START looking at the price bars on your charts. By learning to read price action on a raw, “naked” price chart, you are learning an art and a skill at the same time. The “art” part of the trading equation is what allows some traders to make a full time living in the markets while the masses who are struggling to find the next best indicator system continue to lose money by trying to fit a square peg into a round hole, so to speak.

Learning the art and skill of price pattern recognition will provide you with a perspective and not a system. This market perspective is what would be considered a trading “method”; many people use the terms “method” and “system” synonymously when referring to trading techniques, however, they are really two entirely different things. A trading method provides you with a way to make sense of daily market movement, whether the market is trending or consolidating, where as a trading system is a strict set of rules that allow for little to no degree of human discretion.

How did famous traders like George Soros, Jesse Livermore, and Warren Buffet make their millions (and billions) in the markets? Not through complicated trading software or lagging indicator based trading methods, but through a discretionary market perspective that was developed through an awareness of price dynamics and market conditions in the various markets they traded.

Clean vs Messy

The purpose of this article is to help you understand that you can use simple price action setups to successfully trade the forex market. Professional Forex traders all have one thing in common; they keep their trading as simple as possible because they know that they need a calm and clear mindset to make money in the market. However, most beginning traders, and many experienced but unsuccessful traders, take the complete opposite approach to trading the markets; they make it as complicated as possible.

The K.I.S.S method, as it relates to Forex trading, is built upon an understanding that the best way to navigate the market is by learning to interpret and trade the raw price action signals that form naturally in the market. By trying to force a set of strict indicator based trading rules around the unbounded arena of financial markets, many traders unknowingly make trading infinitely more complicated and difficult than it ever needs to be.

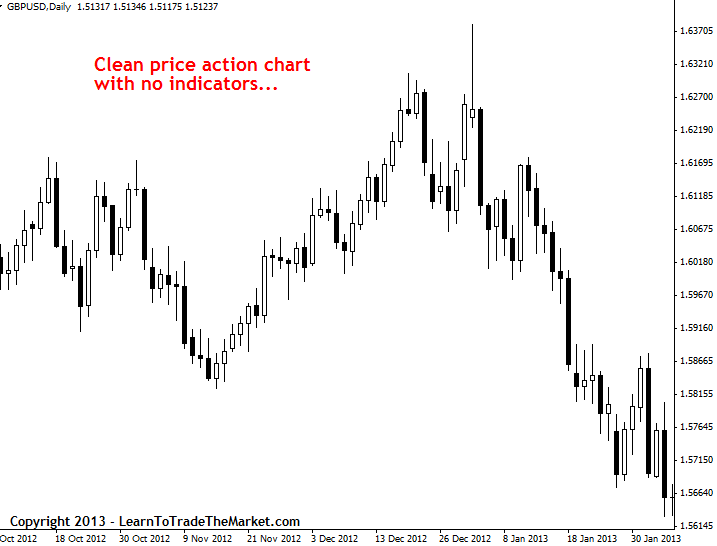

In the example chart below, we can see a clean and simple price action chart with no indicators.

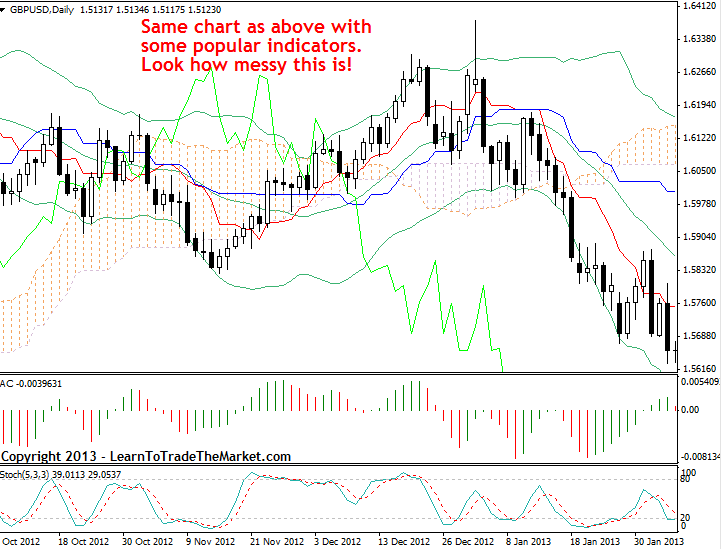

In the example chart below, we can see the chart is very cluttered and messy with many indicators that will confuse you and distract you from the price action below…

If the power of simplicity in Forex trading was not clear to you yet, analyzing the charts above should make it more than obvious to you. I have seen many beginning and struggling traders try to trade with charts that look like the second one above with all the indicators on it. To be honest, I’ve seen traders trying to trade on charts that actually have more indicators than the example above…believe it or not.

As humans, we seem to have an almost innate tendency to make the easiest part of trading (chart analysis and finding trades) a lot more difficult and complicated than it needs to be. Once you accept the fact that chart analysis does not have to be difficult, it will help you to focus more clearly on the more difficult aspects of trading like remaining disciplined and managing your risk properly. Don’t be like the legions of other traders out there who waste a massive amount of time and money trying to figure out what a mess of different indicators and trading robots are trying to tell them. Learn to analyze the raw price action that the market naturally provides you with and you will be much further along the path to trading success than people trying to trade on charts like the one above.

Conclusion:

Now that you have a basic understanding of the why and the how of the KISS method, you can begin to work on practicing its implementation. Practice trading specific price action strategies combined with support and resistance levels for at least 3 months on a demo account, or until you are consistently profitable, before attempting any of this on a real money account. Keep in mind that trading is inherently risky and this information is for educational purposes only and it is not met as a recommendation to buy or sell any financial instrument. That being said, if you are dead set on becoming a profitable and consistent forex trader, stick with the KISS forex trading method and master the concepts outlined in this article and in my Forex trading course, and you will begin to see that profitable trading does not need to be complicated.

To be honest and sincere your explanation is very simple and easy going. thanks you so much. God bless you.

I dont know how to thank u..nial…your article is really great for me…

Was! This article is one of a kind. Though a newbie but the excitment is building up. And I will be part of this community proper. Keep the flag up Nial.

This is informative for me as a novis sir. Thanx

I will follow your lessons as I opted to subscribe and loooking forward to a better future as a begginer.

Thanks

Thanks for the KISS lesson you simplified the trading method and approach for me and agree with the practice on demo account until you guild a confidence level about trading. I will follow your lessons as I opted to subscribe.

Thanks

hi NIAL

i am one of many of your student that I read your article and commentary everyday, and I appriciate it.This year I will be consistent profitable and successful trader.and all is because of you.Thank you 1000 times. May God bless you and your whole families.

Good advice,you have alot of goodies.Will take your course.Have been on forex for a decade now and i know how not to win but the pain of loosing is always on my shoulders.

Thanks

Thanks Niall,

I’ve been trading for real for 3.5 months after Demo trading for about 6 months. My real win rate is at 60%, but I find your site/articles ring really true and this is a step-up from Baby Pips to a slightly higher level (for me) of knowledge and experience. I have hitherto traded H4, H1, using some indicators to confirm my trades, and using Weekly and Daily charts for major trends (this improved my win rate significantly) and using M5 and M1 to find entry points. I’m still working through your articles etc, and will probably do an online course with you when I have finished all of this. It’s a very big change for me to now focus on Daily charts only. So, thank you for your advice, expertise and I hope to give you some good news soon! Kind regards David

Thanks for the article. You always hit the nail on its head Nial. You are the Guru.

i really like to focus on price action first for me. I’m so glad you kindly share this information in internet.

That was rly more than amazing..thank you!

Thanks for such a wonderful post. This is so so much insipring

nice rule and simple . seems logical. why is there so many losers if its this simple. i am having a go . and i am taking your advise .

Nial,

I appreciate that you kept it simple and legit, I totally agree with you that, learning to read the charts is the best thing you can do to become a better trader.

Hi nial,

I like your resource.Your price action method really awesome.Thanks for helping.

Clean and clear charts makes you Healthy, Wealthy and Wise—- Subhan Azhar—

Am blesses thanks….

Nice and educative. I’m a novice in forex but you’ve so simplified it using KISS and it’s seriously appealing and attractive now. I really wish to delve into the reality of forex training and trading like yesterday. I will send you a private e-mail. Please be ready to tutor and help me to succeed. Many thanks sir.

Thank you Nial Fuller for your teaching made simple..

Nice article NIal. In aesthetics we say,”Simlpe is beautiful”. and in forex trading now we will say,”Simple is successful”. Thanks Nial that you educate us, all.

Thanks a lot

Hi Nial So appreciate your kiss trading method. Also learned a lot from your crocodile teaching.

I was just about to give up on Forex – fed up with all the lies and scammers – so it was refreshing

to know that an Aussie is teaching and keeping it simple. As you say I have seen some charts

looking like spaghetti I am so glad a friend sent me your information. thanks for making it

simple to understand

I used to love seeing my 2 flashy moving averages 25 and 50 emas on my chart and trade pullbacks on those trends but now i only use 2 indicators on my chart which is candlesticks and fractals just for trailing profits. I do a lot better with just these 2, priceaction trading is the best!

Thanks Nial…

Price Action is the greatest. Learn to read candles and you will never be broke.

Thanks for your work, Nial.

Great , thanks a lot mentor Nial…

great article.

It is excellent article

NIAL,

u are d man, u change my life

Nial,

re:

Ampurira Grace said,

April 8, 2011 @ 7:07 pm

Tthere is none like you Nial Fuller in Trade knowledge, i have made 10 trades and so far, i have made minimal losses in 2 and mega profits in 8. Guys this strategy real works.

I will forever be grateful, and will sure tell everyone willing to listen about you

Thank you Nial

Grace

”

– Question: what is the Strategy that this chap Grace is referring to?

Thanks mate,

Matt

“

Very nice article. After reading your article I realized that I am so focused on support and resistance that I am missing the signals occuring within a strong trend. This site is the best! I just pulled in my first 1 to 2 risk reward trade ever!

The lesson is fantastic. Thanks very much. We are expecting more.

Nial,

Your price action strategy is really very simple and it works! Thank you for all your support and articles..

amen to all the above! I had so many indicators at one stage i truly did not know where to look and got soooo confused did not know when and where to put my bid on! On the other hand Nial is soooo correct when he talks about human emotions and humans driving markets. I personaly noticed when the “cowboys” = USA traders come onto the market the whole hell gets lose and gods help you if you are sitting on a trade when they decide to move every currency in the opposite direction to yours!…hahaha…and charts and templates and systems be damn….well – that has been my experience up to date…so YES…KISS is wonderful plus to remember to stay away in those “crazy” times..:-))

hi,nail,I m very grateful,thank u very much,GOD bless you in Jesus name,concerning your course,I need to get myself ready,thanks nail.

I’ve been successful in my trading for the past weeks. Tnx Nial!

hi, nial..

i’m so free now to trade the market. i ‘ve been 1 year to finding a good indicators and system.

your articles and videos are very simple.

Thanks a lot.

Trading must be art, kiss :*

Thanks for the Lesson, am a new trader still on my virtual account but catching up through this lessons.

Hi Nial,

You are a breath of fresh air to Forex traders. Can’t wait to join your (and the community’s)ranks later this month. Really like the emphasis you place on simplicity, money management as well as one’s disipline…Larry

Thanks for the help. I’m turned off to the webinares if the charts are all cluttered. I’ll continue to study the clear, simple charts.

Thanks Nial!

I totally agreed that price action setup is a very simple technic to use. However, I must say that the trader must be patient to wait for the signals to appear. KISS is important. Thanks for the tips!

Tthere is none like you Nial Fuller in Trade knowledge, i have made 10 trades and so far, i have made minimal losses in 2 and mega profits in 8. Guys this strategy real works.

I will forever be grateful, and will sure tell everyone willing to listen about you

Thank you Nial

Grace

thank you very much i will work with you, i am a victim of indicator overdose.

Price action can “set and relax”. thank you Nial,

Thanks for this post Nial. Great job showing us how “simple” is the best way.

Thank You

Jay

Hello Nial,

Einstein quote for the day: “Any intelligent fool can make things bigger and more complex… It takes a touch of genius – and a lot of courage to move in the opposite direction.”

Your in good company with your trading principles.

Thanks for the insights you give.

Paul

Hello Mr. Fuller

I browsed through this article simply because “Price Action” is where it is at. K.I.S.S.

Hi Nial,

Thanks a lot for this info. Keep ’em coming.

G’day ;-)

Hi Nial

Thank you so much for this information. It makes perfect sense.Thank you.

Don

Hi Nial,

Thank you very much. It is so nice you give us excellent Method. Thank you for your hard working for us.

Nial,

According to contemporary poet, David Whyte,the greatest suicide note ever written was the following “I simply could not simplify my life”.

Hi Nial, To be honest, i do really feels that your articles are making me very much exuberant, in the trading field. Hats of to your guidance, and seriously will recommend others to view it. Cheers Mate..!!!!

Hello Nial,

Thanks for your lesson(s). This article has given me more time to do things other than watching the screen all day.

Faye

Hey Nial, thanks for all your exhaustive efforts to help educate new and/or struggling traders (myself being one). I am a member of the community and must say it’s the best thing I’ve done for my trading. To complicate it with more indicators and “tekky” software would be destructive. Learning price action is truly an art and skill. I have learned much about myself through this course. Why would anyone not want to simplify ? The Beast is beautiful and uncaring. But it can provide you with a wonderful lifestyle. Thanks again

Yes, I must agree with k.i.s.s.. not only does it allow you to have more time to analyze the market, it also makes forex a more pleasant profession to deal with.

I have never won 30pips until I adapted to your method.

Thanks a lot Nial!

thanks for your lessons so far it has realy helped me develope my trading systm;nail still have a problem because i use instante execution;plz yteach me how to use pending other with sl and tp.cous i have tried it in my demo but it cuoldent worke out for me.thanks i remain greatful

Hello Nial, I wrote a comment a few weeks ago but can’t find it, so I don’t know if you commented. Anyway, good information. One question, to what time do you adjust your charts and do you think it makes a difference. Local time, NY time, etc. Thanks

you need a broker that has 5 daily price bars per week and combines Sunday with Monday, You see for the real world, Sunday is not a real trading day because it is in effect Monday in New Zealand when the markets open, so it makes no sense to have 6 bars on the chart for a market which is truly 5 days not 6. You would need a broker which offers a new york close for the time server feed for the data. Not many do. Contact me via ‘contact us’ menu above for more details.

Nial, yes, thanks also for the email linking to this article. There were two sentences that stuck a chord with me. If i may quote you:

“Markets are just too volatile and complex to ever be dominated by a piece of software code.”

“Not through complicated trading software or lagging indicator based trading methods…”

It has only been about 1 month since i “ditched” all my technical analysis indicators on my demo account. Prahaps i can not use the TA tools properly.. maybe? I did double a demo account using pivot points, but soon lost it all again!

Now, i would dread having all of that “scribble” all over my charts. (I have worked out a “tweak” to physically remove TA indicators from the MT4 platform :)

The interesting point is that the lower chart (with indicators & oscillators etc) actually hides most of the definative pin bars. The first pin bar that you highlighted is *virtually hidden* by the grid background. Amazing, so all the technical analysis guys wont even see these kinds of setups. Thats fine by me!

What a joy it is to actually feel like i am understanding the chart and the price action. Keep up your good work Nial… all the best, Max, near London, England.

Thanks for your feedback, make sure you pay it forward and tell the world about me and the site, the aim is to help those that need it, cheers.

thanks for a great article, timming is excelent !!! and I certainly agree, KISS.

you know Nial, it is funny that i do not even look at the moving averages anymore. My trading is definitely on the up swing. Simple is the rule. thnks

no doubt about it Nial, if I only knew about this 3 years ago when I had some capital to play with.

Nial,

I won’t go spouting off like many people do and say I have it all figured out now, and the markets are a breeze. I will say this, my trading has improved greatly since a friend set me up with your articles and youtube videos. I’ve been studying and happily trading price action ever since. My guilty pleasure is one Simple Moving Average…. Otherwise I’m clean.

Hello Man,

this article is the bomb.

I work with the price action too and i like your site that i consult every morning.

i work with price action in the daily chart for big operation – minimum 100 pips each – and also intrady with the 15m time frame for multi small 20 pips each – .

I see that the 15m, 1h eand daily tf in forex market have good results.

I’d like if u will answer to my post and keep in touch.

Bye man and… Keep it real simple!

Arduino from Italy

Glad you sent this link to me. The article itself is nothing but KISS. You have put forth the concept so clearly and lucidly that even a layman like me can understand and learn something.

Thanks