My Thoughts On Recent Market Volatility & The Coronavirus Crisis

Dear Students & Readers,

Given the amount of inquiry I am receiving from our readers and students regarding the Coronavirus and the recent market volatility, I feel compelled to share my views on the situation, from a trading and investing perspective as well as a personal perspective.

I have produced this article in a question and answer format to best address the comments and concerns many of you have sent us over the past few weeks.

Q: Will the LTTTM business or service be interrupted by the Coronavirus situation?

A:

I am self-isolating at home with my family, avoiding any outside contact. The rest of the LTTTM team are also working from home. In the unlikely event I or a team member becomes ill, we have a contingency plan in place to continue the LTTTM service. The show will go on, as it has done since we started back in 2008.

Q: What do I think about the Coronavirus situation overall and what am I doing?

A:

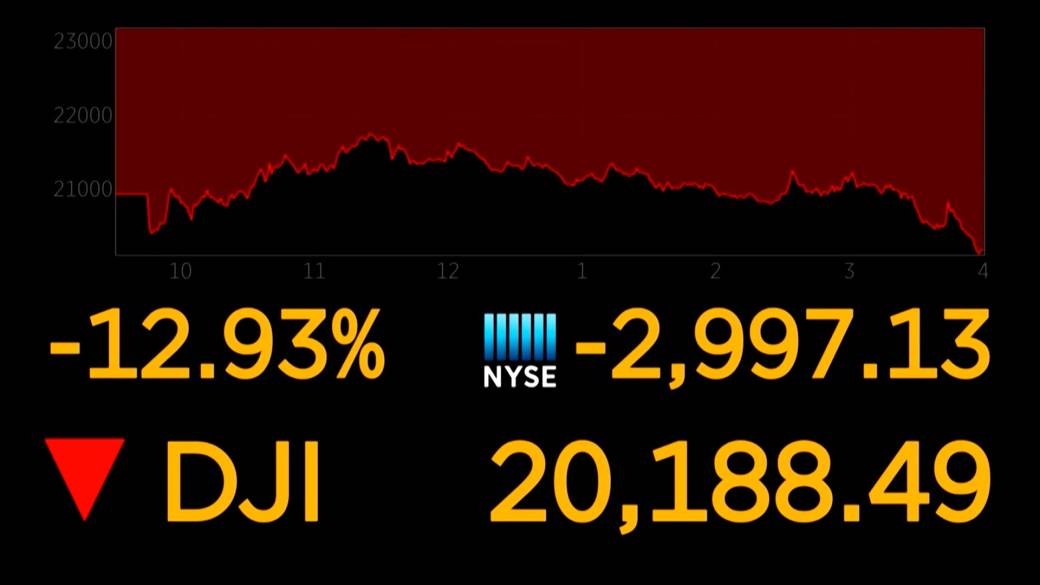

As I write the US equity markets just crashed circa 13% overnight, the worst drop since the crash of 1987. The market is now down circa 30% so far this year. This has been the most volatile price action I have ever witnessed in all my years of trading.

Whether you believe the virus pandemic is going to eventuate into what the experts are predicting, it has now become an almost self-fulfilling market collapse. Traders and investor’s confusion start to dictate these volatile moves rather than facts and evidence. Unfortunately, now that the markets have caused this level of technical damage, we may remain in this state of chaos for some time until we see the world starting to show clear signs of exiting this viral and economic crisis.

I have members in Italy, South Korea, China, and other seriously impacted regions who have shared concerning stories of just how serious this virus situation is. From all my discussions with well-connected individuals as well as my own in-depth research online (non-main stream media), it is clear that this virus is very serious and poses a risk to certain people in the community, especially the older generation and those people with existing health conditions. Despite the massive dangers to a large segment of the population, the very fact the world is now so aware of the danger of this virus and with everybody preparing and bracing for the worst, the worldwide pandemic may come to an end faster than we all expected, touch wood.

It’s definitely not a time to panic and run for the bomb shelters, but it’s a time to be vigilant, to have a plan, and to protect ourselves and our loved ones from possible infection (especially our older folks who are most at risk).

At this stage, I have taken personal precautions including self-isolating myself and family from the outside world. I have stockpiled food to last months if needed (as I speak, the local stores are restricting purchases and shelves continue to remain almost empty). I have also asked my parents and older friends to self-isolate from all people including their own family. I have also suggested they have food delivered instead of going out to stores and risking infection. Most of my attempts to help my family and friends prepare for a potential worst-case scenario has fallen on deaf ears, so this has me a little concerned. People tend to believe it’s never going to happen to them, and ultimately we can’t control others, we can only really control what we do ourselves.

Q: Why are the markets acting so crazy and is everything going to be ok?

A:

This is a true black swan.

The moves in the markets have been both extreme and unexpected. This is a true black swan (an unexpected and unpredictable event that was extremely difficult or impossible to predict), that is causing genuine chaos to the world’s financial markets and economies. The move has been exaggerated by people’s predictable panic and confusion, and like always, the computer algorithms (quants) are fueling the momentum behind many of these crazy daily movements in the markets.

The only thing to fear is ‘Fear’ itself

Most retail market participants actually believe the world is ending right now, the level of chaos in stocks and commodities especially is unprecedented. Due to the extreme price volatility, we know that typical trader and investor psychology will see many market participants panic and make decisions without even understanding what is truly happening. Some will inevitably be forced to sell due to margin calls or simply to raise capital to run their business during this slow economy.

The problem we have here is that panic and overreaction may indeed turn out to be the cause of another GFC as apposed to the Coronavirus crisis itself. Once you have the entire world fearful of owning financial assets and fearful of any form of travel or even leaving their house, you have a self-fulfilling crash in the global economy, regardless of the true cause. Fear and panic are the real danger to all of us here and not just virus pandemic itself.

Fed to the rescue ‘Again’

Just like we saw back in the 2008/2009 GFC, the US Federal Reserve has just announced ‘whatever it takes’ rescue measures to try and stem the bleeding in financial markets and credit markets. Countries around the world and central banks are all working together to try and stimulate their respective local economies and to help local businesses weather the current economic storm. Sadly these rescue tactics will not save every local business and certainly won’t save every listed company. There is going to be insolvency and bankruptcies as a result of the current crisis, and the global stock, credit, and currency markets are pricing this in already.

Capitalism will continue

History has shown that the Reserve banks and Governments won’t allow the markets or economy to collapse. They have rescued the world before and they will try to rescue it again, so we should remain optimistic. When the market finally wakes up to the idea that there is a rescue mission from the banks and government on the way, things will hopefully start to stabilize, just as they did back in 2008/2009 GFC and other crisis points in recent history.

It’s important we all understand that no matter what happens right now, this is not the ‘end of days’, this is not the ‘end of capitalism’ and things will continue normally right where they left off eventually. It’s important to stay optimistic because if you immerse yourself in negativity, you will 1. add to the problem and 2. miss the huge trading and investing opportunities upon us.

Q: Do I still think Trump will be re-elected in 2020?

A:

Every since I predicted Trump would win the 2016 election and made 500% + returns on that bet/trade, people have been asking me about my thoughts on Trump winning in 2020. My view is that the pandemic will hopefully be over by the November US presidential election. As a master of spinning any and all events in his favor, Trump will take credit for saving lives through his response teams effort and bringing the crisis to a close. He will take credit for the V-shaped stock market recovery that will ultimately occur after the pandemic subsides, his buddies at the US Federal Reserve will make sure it happens. His existing supporters and new silent supporters will emerge in massive numbers and Trump will claim victory in November 2020 convincingly. There may be opportunities to back Trump above even money odds in the coming weeks/months ahead, and that’s worth keeping an eye on. I might write a post on this later in the year.

Q: How am I trading the current market conditions?

A:

Look for opportunities in all places.

For myself and other experienced traders, there are amazing opportunities to trade the short term swings and trends across a range of markets. In recent weeks there have been a plethora of trade entry opportunities offering high risk-reward payoffs. We have seen amazing volatility in Gold, S&P 500, Crude Oil, and all Major FX Pairs, just to name a few.

The patient trader waits to trade the swings by watching for price action signals to identify the short term turning points OR they wait to trade the trends by watching for retracements to key levels and using price action signals to identify when the prevailing trend momentum will resume.

For investors, there are amazing opportunities to pick up long term investments in solid companies they have had on their investment shopping list. Professionals don’t panic in these situations, they are salivating at the opportunities to profit and they embrace these kinds of market conditions.

Give trades room to move, these are unusual times.

It’s important during this extreme volatility that traders give their trades room which means using a wider stop loss and an adjusted position size. As an example, whilst keeping the same $ at risk per trade, you may trade 1 lot instead of 2 lots. You may use a wider stop loss of 400 points instead of 200. Remember, wider stops don’t mean more risk if you reduce position size. Do the maths and watch your risk.

Use the crazy market conditions and newly found free time to learn and practice your craft.

If your like myself and intend to spend the next few weeks/months at home working or just laying low on weekends instead of going out to see friends and family, you should use this newly found free time to focus on your self-education, to study up on your trading approach and practicing your trading strategies in real-world conditions. There has never been a better time to immerse yourself in the markets, it’s an exciting time to learn and an exciting time to trade.

Closing thoughts:

Like it or not, the privileged elite few control this world, and they have controlled it for a very long time. The financial markets are one mechanism they use to transfer wealth and to control the wealth. They won’t let the game won’t stop, the world will continue and companies and people will return to normal in the not too distant future. It has always been this way for the past few centuries since capitalism began and it’s not going to change any time soon. So stay optimistic and things will eventually return to normal and life will go on. In the meantime, try to make yourself some money and capitalize on the plentiful trading and investing opportunities upon us.

What do you think is really going on out there in the world and in the markets right now? What have you been trading or looking at trading? How are you planning for the next few weeks and months ahead? Talk to me by leaving your comments below and I will reply to every comment.

Stay safe and good trading,

Nial Fuller

Gold Coast, Australia

March 17th, 2020

thanks for sharing best information about the market .

Hello Nial.

I’ve just read through this interesting article written in March 2020. Great article!!!

Thanks for the superb write up.

Thank You Nial

Nice

i agree with every thing you have put down on your write up ….. honestly in my part of the world here in Africa, Nigeria to be specific i feel the current situation on the world as really affected the economic activities here with the the currency being more devalued and the inflation is on a high, the exchange rate aren’t so funny for importation and also doing business is so good at the moment but i agree with you that is all about how we are able to take in all of this and look at the positive side to things, well i majorly trade the currency market and i actually do wider stop losses now given that it isn’t actually risking more but actually giving your trade more room to breath. i only take my entries on H4 and H1 for now so i can be in the market longer make a little return on my investment and focus on trading right and not often. they are a lot of opportunities as you have said and i believe that one most take time to be patient enough to see and listen before making any decisions, lastly i really have no comment on the trump president issues but i just want to say that who ever comes in should be able to hand situation wisely because what ever happens in USA doesn’t just affect the USA only but Africa as well, i am really optimistic that the world would go back to normal soon but until then we lay low and keep learning and improving ourselves.

thank you so much for the write up you are a great teacher.

What a great article. It’s now a few months on and still a great read. Nailed it Nial.

Thanks Mentor Nail.

I trust your insightful posts, to bring more illumination into these global chaotic financial periods. May More grace, strength and understanding follow you Sir.

God bless.

There was a lot of bad stuff happening at the time of this post. But people who didn’t panic actually saw their portfolios grow in the weeks after. Personally I’m glad I stuck with it.

A sober, realistic and optimistic view of this insanity. Thank you Nial.

Very well said! Appreciate the insightful, thoughtful blog post.

Hi nial am so blessed reading your blog all day I practise what you teach on risk management and stop loss ,trading plan and price action I must confess it s an eye opener. I just started reading your blog just today morning and I have being for the past 10 hrs the value you put is awesome thank you

I am from China, your course is very good, thanks

I wish everyone good health

hello dear sir how are you i follow many year ago with you website

i tell you from bangladesh so i want to buy you course i am not speak english you course have bangla language tutorial

Thank you for your usual good-hearted posts. The almighty God will keep you, your team and family as well as us-your followers all over the world.

I don’t joke with your posts, I chew them hungrily everytime.

I’m Bamidele from Lagos, Nigeria.

Hey Nail,

What do you think about crude oil?

There is no reason why it can’t keep falling, maybe even to $10 to $12

Hello Nial. I’m interested in your opinion. Don’t you think that it just a matter of time when oil price will go up. And if it fall to 10-15 USD it is good opportunity to buy? If we count that the lowest price could be 1USD (hypothetically). We can count the risk and enter market with long position? Or you think that oil price could go even to negative price?

Thank you for your replay.

Long term investing in commodities costs money, on cash or futures contracts, so if your holding long periods keep that in mind – you will need to talk to your broker about these costs of carry not me :). There is strong long term support at $10 to $15, the risk-reward does look appealing I agree and am considering a similar trade although not exact. I don’t believe oil will go to negative price, no :)

thank you sir

Nial good day. I am LORNIE from Philippines. I am excited on your price action strategies…. Even though I am a neophyte…. aka student ; despite of age I believe I can learn fx trading…. I want to learn from you and your team THE SCALED STYLE OF PRICE ACTION METHODS…. on my naked eyes as clicked, I find simple….. But as I know a bit further IT WAS THAT DIFFICULT TO READ, WATCH, REDIFINE THE BAR CONGRUENT TO MARKET DIRECTIONS. Any twist of help coming you and your to improve my learning level and skills in dealing w/ charts, I appreciate much. Thanks. Your follower, Lornie.

Hey Nial, much like you we locked down and prepared several weeks before the crises hit the ground here in Slovakia. Have several months of food stocked up, a few acres of land, gardens planted and 100 chickens in the backyard. Im sure our realestate business will slow down a little in the short to mid term, but like you say the world will go on. In any case the markets are showing up some nice little swing trade opportunities to keep the roof over the head, Very succinct take on whats happening around the world, great insights. Hope all is well with you and family, stay safe in these crazy times.

Him Nial

Can you please share us with a sweekly forecast for this week.

Thanks

Hi Nial,

You have been a great mentor for many years, I value your comments on this subject and many others , please stay safe and well Over there and look forward to a better future.

Thanks

Peter Miller

Hi Nail,

My name is Hoong Soon-kean. I am from Malaysia. Please tell me how can i trade the NYSE stocks。

Many thanks。

DEAR NF,

I REALLY THANK YOU,FOR YOUR FOLLOWING TRADING AFFIRMATION

“I do not know what trade setup will win or lose, therefore I must take every trade that matches my trading plan without question”

I HAVE SURVIVED FROM RECENTLY COVIND-19 CRASH

YOUR TLS METHOD IS NEXT TO GOD/HOLYGRAIL

This is a very courageous write-up and as well something that can repatriate the hope of many traders by telling them that there’s hope for better tomorrow. Nail has really encouraged me immensely and also made me to believe that the market will soon bounce back. I almost gave up to be sincere with you. Thanks a lot Mr Fuller and keep expecting my enrolment in a short distant time. BRAVO!

Hi Nail, thks 4 the recent article u jst publish and it came at a time when all ur followers really need it.

I give credit to u 4 my success in trading today. Ur blog is a life changer 4 trader who chose to follow what u preach and do.

As regards to the current market Condition, all I see is opportunities and opportunities with great caution

Hey Nial, nice post!

In the last decade did you ever closed a year with negative balance?

What is a good average annual return in terms of R-multiple? (for example by risking 100€ and make 2000€ at the end is good?)

Thanks.

Hey Nial

Good to hear from you about this deadly dease. As for me I new in trading I don’t know what happened in 2008 and 2009.

We hope things will go well. Since I started to trade I never expirience movement like this.

Thanks Nial for take the time to send us this information .

Dear Neal! Thanks for this important and timely article. You have clearly put everything in its place. I can really learn a lot in this difficult time. Your advice on using a wider stop loss with such market volatility helped me a lot. I wish all members of the community to remain vigilant. Take care of yourself and your loved ones.

Hi Nial. many thanks and be safe

My strategy now is the one exposed in your article: Take the profits and run.

I may have extraordinary profits, buy no extraordinary losses due to the Stop Loss (I have not experimented significant slippages in this sense with liquid currencies). I do note close on Take Profit, I close when there is a kind of violent movement in my favour. I may re-enter when the movement is corrected.

USDCAD is very prone to these movements during the New York session. Buy I say this just from my trading experience, no systematic statistical work behind.

I hope all well and good, from my confinement in Barcelona (Spain), with my best wishes for all.

Hi Nial, excellent opinion, i share the same view. But something you said confused me. You said that, and I’m going to quote you: “there are amazing opportunities to trade the short term swings and trends across a range of markets. In recent weeks there have been a plethora of trade entry opportunities offering high risk-reward payoffs”. My question is: how are you viewing these opportunities? Because I’m seeing these giant movements and, price action signals are not on the table, at least in the Daily chart. Going down in time frames, on 4 hours charts I’am also seeing low opportunities. PS I have a very structured plan. I trade one signal on daily chart, and one signal on the 4 hours chart. My signals give to me about 6 to 12 trades a month, considering both strategies. But in the last two weeks the signals are very rare, specially on daily chart. These recently giants candles are very unusual, and price action is quite a mess. My question is: What are you seeing on charts to afirme that “there have been a plethora of trade entry opportunities”? PS2: I’m not criticizing you, I’m just confuse, and I will appreciate a answer from you.

I’am also seeing few** opportunities

Hello Nial,

Trust you’re safe?

Now that oil prices are in the negative I noticed a lot if price actions on oil stocks. So much buying and selling. What do you advice? Is it a good time to buy?

Hi NF, I’ve really been expecting your post as regards the pandemic CVD’19 and it’s effect on the market. I really appreciate this post as it as calm my nerves as regards the expected future of trading and also reaffirm my goal for financial freedom through the market. Thank You, Mentor. I hope to hear from you soon. Be safe!

thank you my teacher

Insightful and eye-opening! Thanks Nial.

Hello Nial,

Thanks very much for the above article. Ive been meaning to ask this question, its about the (DJI) dow Jones Industrial that just crashed 13%. my question is, do we have it to be traded on our platform?

Once more thanks for the article.

Hi Niall as numbers will worsen in the coming months with retailers, restaurants and other businesses forced to close would Swiss and yen be safe haven currency indexes in your opinion in comparison to the DX? Thanks

Hi Nial,

Many thanks for your email and thoughts.

It is appreciated.

Just wishing yourself and members all the best, keep strong.

Jim Watts

HI Nial,

Thanks for the updates and blog posts.

Do you think with this free time you may have these next few weeks you could do some new videos on YouTube of trades you’ve taken recently.

All the best

Dan

Very good article

Exactly what I was thinking about a month ago there is always going to be winners and losers in times like this the opportunities are there it’s a matter of taking the right ones easier said than done but that’s how the winners come out on the other side of all this be patient trade well and be a winner!

Thanks Nial, great article all round i.e the patient trader philosiphy , wider stop use. I agree entirely with what you have said on buy and hold approach on the ETF Indices.

Great to have a voice of calm in the current media circus. Thanks for taking the time to send us your views Niall. As Warren said be greedy when others are fearful. I am just trading the price action that i see in front of me as per my trading plan with the wider stops you recommend. Best regards and Stay safe.

Insightful. Thank you Nial Fuller

I catched 230 PIPS on GBPUSD, 300 pips on AUDUSD and 350 pips on EURGBP. I like this movements because price action has not let me down. I am really profiting.

‘V’ Shaped Reversal? I take some heart in your optimism. Rather a sideways trading range for a year or so IMO.

Thanks for d encouragement

I have 7 days off starting Thursday and I plan to focus on building my knowledge on price action and finding my edge on trading.

I also plan to revisit the price action trading course materials which I think would be extremely helpful for me.

I am thankful that you send me details of trading, as we were on our quarantine because of ncov, im happy reading your post . Thank you for this details of trading, in my trading i have losses money in my real trade.. I am hoping that you could help me making my trade more profitable.Thanks.

Hi Nial, I appreciate your article which came on time like this. I wish to find out from you if your weekly news letter is suspended because of the reality of this CONVID-19 I haven’t receive this week one. Anyway, thanks for your courageous words.

Hi. No it’s not suspended, it will be posted as usual.

Thank you Nial

Hi Nial,

Thanks for the article. Like you mentioned, it is a good time to look for opportunities and not panic. There will always be opportunities as long as the markets are still open.

Great information as always! Your world views and wisdom are calming. Thank you. Also I agree with your call on President

Trump retaining the oval office.

Hi Mike. Still looks likely Trump will win again, yes.

Thank you so much great Nial. I would like to be getting personal guidance from your wealth of knowledge.

I live in Nigeria and have read some your Price Action series. I am planning to start demo trading immediately I get a lap top.

We sincerely appreciate your uncommon guidance in Forex Trading.

Much thanks!

Hi, Nial.

Thanks for the blog.

Given that the FED has cut rates to zero, it would make not sense to hold bonds.

Eventually, the hot money would return to equity.

Can you update us via email when there is a turn of tide towards bullishness.

Thanks,

Alex

Short term Traders can watch the price action signals and key levels for turning points.

Long term Investors can’t afford to wait to pick the bottom or turning point as they may miss it, so many serious investors would be slowly buying over the next few weeks and months to secure an ‘average’ price down at these cheaper levels.

Nice one from you sir,

I like your articles and I also trade price action signals, thanks for your good work

Hi Nial, I am very sorry to read about the situation going on in your country.At the same time congratulate you for the precautions you have taken.Here Sun is getting hoter and hoter day by day and so covid could not make any damage so far.Hope things may change for the better before cold season comes.With prayers to GOD and with thanks for your guidence and help.

It’s not too bad in my country at this stage, let’s hope the worst is behind us.

Hi Nial, thank you for this and your other articles. I rushed into day trading and have lost a lot of money in the market volatility and on crude oil on Thursday. I really wish I had come across your website earlier as I made all the typical mistakes such as emotions, confirmation/recency bias and putting high risk amounts in. Lesson well and truly learned!

It looks as though oil will continue to drop in price and I’m hoping to try to recover some of my losses by going short. I appreciate there are costs to leaving money in over a couple of weeks, however wouldn’t it still be better than nothing? What would you say is the best way to capitalise on the drop in oil price in the coming weeks?

Thanks in advance.

As a USA citizen, you’re dreaming if you think Trump is going to get elected again (it’s not Clinton now). You under-estimate the anger against him by sensible Republicans. And when he bails out his buddy corporations while Main Street suffers…..watch!

I’m wasn’t dreaming in 2016 and I’m not dreaming now. There is a very good chance he is re-elected. They said I was crazy in 2016 calling for a Trump win, and they may call me that again in 2020. I am looking at data points rather than predicting based on a political bias of any kind. Things may change closer to November 2020, who knows at this stage given the state of the world.

Look no further than the 2018 mid-term results. People are sick and tired of the cult here.

Prior mid term results have not always predicted a change in party, look at history, mid term party changes occur and then it swings back the other way. It is not an accurate predictor and voter turn out is often very different.

Well, Thanks alot Mr. Nial. Indeed your article has broaden my understanding and future trend forecast with respect to how the Markets and world leading economies are resisting and reacting to the threat of the COVID-19. But how will u predict the trends as Central and Reserve banks have been working collectively by cutting rates to boost the immediate economy and that of their allies in business?

Hey M-t Fuller,

Thanks for the article! I wish health to you, your loved ones and your team!

Thanks Nial definitely gives me/us as amateurs some insights as to the workings of the stock and Forex world in such times. Looking forward to be part of some of the opportunities that arise from the chaos.

Nial,

Mate you have nailed it. Trading the PB’s making me $$, just have to be more hands on.

You and family endeavour to keep well as Mine are.

Thanks for your common sense approach.

Nial all the best to you and yours, and stay healthy.

Nial,

I can only confirm, that I fully agree with your thoughts. What I can add is that as always we know what will be the course of action but critical question is about timing. I mean when it backs to normal. In such circumstances experience equals patience.

Regards.

Thanks, Nial – I think you got it. Best to you and your family.

I got more pics of the trading stands

Thanks boss

Would you laugh at this stratergy…… enter at 1445…. exit at 1480.00 ….. enter at 1390.00 exit 1270.00 or give it a thumbs up???

If there is key levels or signals on the GOLD chart, and you have a trading plan, then I wouldn’t laugh. Read the commentary from this week.

Dear Nial

Thank you for the very informative article.

Your thoughts on gold xau/usd – I’ve placed my trades at your predictions but am a bit nervous! -do you think a dive to 1250.00 is possible?

I like your take on this Nial. I’ve just joined your mailing list and have been reading various articles. There’s a trader called Steve Copan in the UK. I’m on his mailing list too and he warned of this coming in an email back in November, calling it like a ‘1929’ type event. I put my Super into cash thankfully and am waiting for a recovery. In the meantime I’m honing my trading skills on Demo only. Look forward to the blog on Trump later on. Stay safe.

You can’t time the markets, and listening to people call tops and bottoms, they will be wrong 5 times out of 6 over time. It may have worked this time, but probably won’t next time. 1929 was a 90% decline, that just isn’t going to happen in today’s world, at least not whilst the USA fed exists.

History shows that the buy and hold approach on the SPX index ETF has outperformed almost every asset class for the past half-century or more. I am not saying go out and buy that, but it’s worth looking at the stats to understand how equity markets perform over time. Apart from short term trading for revenue, I personally invest for the long term across various asset classes, and if there is a 50% move in a share price, I am not going to panic.

Your situation may be different of course, depending on your age and objectives.

To me this started with options expirey last month. Will be interesting to see what happens this month if they cover the puts and buy the calls.

Not sure if this will make it past the moderator, but re timing markets, I agree but as I’m only a few years off retirement and was hammered in the GFC, I felt I had little choice but to cash out. And yes I was lucky.. But don’t we as traders (albeit in the short term) time the market to a degree anyway? I also agree re trading for revenue and investing for the longer term, but I think there are always those people in any field of human endeavour that look at things differently and so can see things others miss. From what I’ve read you also often have a different take on things which i like. And as for the Fed et al…..let’s not even get started on the entrenched corruption in such organisations, that was clearly displayed in the GFC….. All the best.

Darin. Trading and Investing are 2 different things. I was only saying don’t try to time the market perfectly when investing in stocks long term. When your trading then absolutely agree that timing and picking the swings/turning points is crucial.