Master One Forex Trading Strategy at a Time

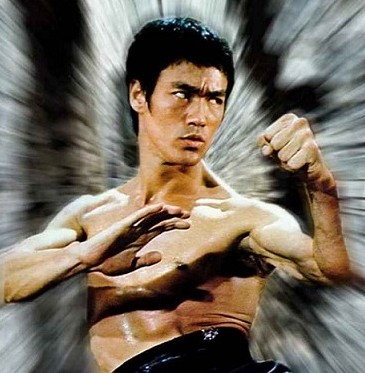

Do you want to become a MASTER of your Forex trading strategy? If so, you will need to have laser-beam like focus, you cannot waver and change strategies every week like many amateur traders do. Bruce Lee was arguably the best martial artist of all time, and guess what? He was not born the best martial artist of all time. He earned that title through dedication and focus…he learned to become a MASTER of his craft…if you want to succeed in Forex you will need to do adopt the Bruce Lee mentality…

Do you want to become a MASTER of your Forex trading strategy? If so, you will need to have laser-beam like focus, you cannot waver and change strategies every week like many amateur traders do. Bruce Lee was arguably the best martial artist of all time, and guess what? He was not born the best martial artist of all time. He earned that title through dedication and focus…he learned to become a MASTER of his craft…if you want to succeed in Forex you will need to do adopt the Bruce Lee mentality…

Forget everything you have learned up to this point in your trading career, because if you truly want to master a new Forex trading strategy you really need to wipe the slate clean of all the confusing indicator and software based trading systems you have likely used thus far. One of the biggest problems that plague traders who are trying to adopt a new approach to the Forex market is that they seem to bring a lot of preconceived notions and failed trading concepts with them. If you really want to excel at Forex trading and adopt a fresh new trading strategy, you need to focus on one strategy or way of thinking and stop allowing previously failed trading methods to influence your current perspective on the market.

• Train your Brain

Learning to master one trading setup at a time will help you properly train your brain to become more disciplined and objective, two characteristics that you absolutely must possess if you wish to excel at forex trading. The process of truly mastering and “owning” one forex trading setup at a time might take months or even years to accomplish, but your chances of making money are increased dramatically by doing so. After you completely master one trading setup you will know almost instantly whether or not your setup is present, there will still be some discretion involved, but owning and mastering a setup means that you have fine-tuned your sense of discretion when it comes to deciding which trades to take and which ones to pass on. Many traders search long and hard for some “holy-grail” trading system that allows them to avoid having to develop their discretionary trading skills, unfortunately for them, professional trading inherently involves a fine-tuned sense of being able to discern between A, B, and C grade trade setups.

The discipline and objectivity that you will require as a result of learning to master one forex trading strategy at a time should spill over into other areas of your trading such as managing your risk and remaining calm and collected. When your thoughts are scattered on multiple trading strategies and (or) you have little confidence in the strategy you are currently using, you are obviously not going to make very wise trading decisions. Learning to master and “own” one forex trading strategy at a time will solve both of these problems because your focus will not be scattered amongst multiple strategies and you will naturally gain confidence in each setup as you master them one by one. Essentially, our goal in mastering one setup at a time is to reduce variables in our trading, many traders do the exact opposite when starting out by actually increasing variables through analyzing greater and greater amounts of technical and fundamental market data. Yet, the reason most traders lose money is not because they aren’t analyzing enough data, it’s because they over-trade, over-leverage, and analyze TOO MUCH data.

• Learn to Think like your Mentor

• Learn to Think like your Mentor

Obviously, if you are looking for a new trading strategy or mentor, what you were doing before was not working for you. Thus, it is paramount to your success as a trader that you adopt the same trading philosophies that your new mentor or trading strategy teaches, wash your mind of what you have learned thus far and completely immerse yourself in this new approach to the markets. In regards to what we teach here at learn to trade the market, this means learning to master one price action setup at a time, as this is how I initially found success in the forex market and so it is also what I recommend all my students do. As I have stated previously, after you master one price action setup you can move on to master another, until eventually your forex trading arsenal is fully loaded.

• Specialization is the Universal Key to Making Money

What do most people that make a lot of money in this world have in common? What do Tiger Woods and Bill Gates have common? Or how about George Soros and Venus Williams? At first you might say “nothing” besides the fact that they all make a lot of money. But what is the fundamental reason, behind all else, that these people and others like them make so much money while the rest of the world struggles to get themselves out of bed in the morning? One word; specialization.

People that make a lot of money focus in on one thing that they are passionate about, and they do it over and over and over until they achieve the result they are looking for. Simply put, you cannot really make a lot of money at anything in life if you master nothing. All of the people in the above example have literally “mastered” one thing, sure they had ups and downs along the way, but they did not let that bother them, instead they transmuted this negative energy into motivation and pressed on because they believed in what they were doing. Had they got involved and distracted with numerous other side-projects or interests they simply would not have achieved what they did. In forex trading we need to focus on one price action setup at a time and become a “specialist” in it, get to the point where you find yourself being someone that other traders look to for advice on the setup that you “own”. Become an authority on each price action setup before you move on to the next, there is no sense in doing anything half-ass in this world, and trading price action setups is no different.

• How to Master the Setup

Mastering one price action setup at a time is accomplished through literally making it the only setup you think about or look for when interacting with the market. You essentially live, breath, and sleep this one setup until you feel confident you know every angle and condition it can or should be traded in. Keep a trading journal to record under which market conditions the setup excelled in and which conditions it performed weaker in. Find all the information out on the setup you choose and learn everything you can about it. Once you do this you can begin implementing this knowledge on a demo account, only after you master this one setup on a demo account should you attempt to master it on a live trading account. If you find you are becoming consistently profitable with this one setup on a live trading account and you truly feel like you “own” it, then and only then should you think about adding a new setup to your trading toolbox.

• One Setup does not mean One Variable

In closing, a very important distinction to make here is that one price action setup does not only mean entering a trade when you see a well defined pin bar or other price action setup. By learning to master one “setup”, we mean you learn to master trading that particular setup in a particular market context. For example, you might learn to master the pin bar strategy in a trending market and only enter or exit at confluent levels within the trend, this is an example of how a “setup” can mean the actual price action setup itself and the market conditions that it is traded in. So, in order to fully master one price action setup you must learn to master this setup in one particular market condition, perhaps you want to master the fakey strategy in range-bound markets, or the inside bar in down-trending markets; the totality of the actual price pattern itself combined with the particular market condition you trade it in is what you must master in order to consider yourself a “master” of one Forex trading strategy. To learn more about mastering the price action setups that I teach, check out my price action trading course.

Thanks alot Nial Fuller ,we need to declutter and master our set ups with other management skills to win the game.

I’ve been struggling with making a decision as to if I should adopt one setup and if it would be enough.

I cannot thank you enough on just how much hope and enthusiasm you have awoken in me through this revelation.

I know what I want now and what I should do.

God bless you bountifully sir.🙏🏼

Thank you Nail this article has helped me know exactly where and how to start trading and I feel on top of the game now

Thank you this article should help me be focused.

Thanks Heaps Nial,

I had to read this article a second time and now see that it makes a huge amount of sense.

Many thanks

Pinbar = Railroad/Engulfing Candle Pattern ?

Excellent article. For me it is engulfing candles and pin bar. I only trade these on daily. Sure I don’t trade much but when I see them at important areas I am successful. I may add more later in my forex career. Patience truly is needed in forex market In order to master price action. Stick to a set up no matter what.

Thank you nial…..the master teacher :)

Thanks Nial,you provided the best to all the traders,we have been trading but your shared information is useful we have been missing those explained parts

which one setup is better to master……………. is it inside bar or pin bar ?

kindly suggest.

thanks.

I would start with the pin bar

thanks Nial, You have given a good foundation on how to master a trading strategy and look the market through it.

Thanks Nial

W Bruce Lee : )

Nial,

Thanks for this it’s really superb the mentorship you are exbiting to me is impressive ! I have discarded all for Price Action !

With it the universe will be the limit to my success .

Keep it up!

Rgds

Godfrey Luyimbazi

Great article Nail! This article really inspires me to become a better trader. Thank you. Thank you.

On the spot Nial, this is in fact very true, one workable strategy is good enough provided we have faith in using it, without it our emotions tend to sabotage our trades before we know it…

It’s a beautiful thing to see all that all that discipline, enquiry and examination of experience come together in an article like this one.

Pure Gold – thank you Nial.

Nail. you are always a great fx teacher. I used to get confuse on where to enter the market and where to exit until I come across your website,now with price action setup my confussion is almost over. Thanks—–ohuizu

your lessons are wonderful ,precise and self explanotory.you are truly a live saver to forex trader of all category.i would surely try to buy your articles. Niel you are wonderful

I have been drinking and eating the inside bar setup..and all my trades were positive..ALL.thanks Nial

Hey Nial,

I find all your articles very interesting, but this one is simply the best; at least for me, this is the one that puts a developing trader on the path to excellence.

Many thanks for all your lessons and videos. You are a genuine guy in this business.

Hello Mr. Fuller

After re-reading this article and understanding it more fully, I look forward to selecting one “Price Action” setup and knowing “market conditions” with that particular “Price Action. Which one occurs most often? Hummm

Thanks Nial…u r the best

Nice one!

… and when Tiger’s ex divorced him, it illustrated perfectly that you lose money when you get distracted.

I loved the concept of being a focused expert in one area before moving on to another…well done! I’m going to break down my trading strategy into separate area’s and become an expert in each!

THX

Every time I read your article or your watch video, I feel more confident than before and best thing is the “Clarity” I get to see through my doubts, confusions, and negative thoughts… I wholeheartedly thank you Nial… God Bless you…

Mr.Nial Fuller

Thank you for your ‘Master One Forex Trading Strategy at a Time’ articales. For a time being I am learning to master on the trend line and pin bars setup, it is a real magical on 1,4hrs and daily chart. I study over the weekend and and wait for the entering point and when to get out. Anyway thanks again for your nice articales.

azmiharun

Thanks Nial for the articles. I think I am finally getting schooled in fx trading. I would like to takr your course.

excellent idea of mastering one trading strategy set-up.

Thanks for all your write-ups and mentorship.I have today made over 90pips on EURAUD from pin bar at horizontal resistance level from yesterday close.

Ehanks a lot

Thanks Nial you have being my great mentor.you have really helped my perspective about the forex market.i cant thank you enough.more power to your elbow.

Mr. Fuller:

Your timing seems to be psychic. This particular lesson is motivational. “Inside bar” is the price action that I have been studying and now with some renewed vigor.

I will look at all your inside bar price action data again along with other important data that is germane.

Thank you

Your student

Thanks Nial,this helpul article has once again come at the right time.Trading forex is not easy but I believe in what I’m doing and therefore I’ll continue to persevere.I’m lucky to have you as a mentor,I thank God for bringing me to your website.

It is excellent article Nial as previous :)

Hi Nial

Great article – thanks for posting these thoughts for the benefit of all the traders.

T Allen

This is great stuff Nial… Im actually in the process of bringing one of my trading friends over to your course. She tried a few different systems and they aren’t working for her so I gave her a quick tutorial on your methodology and she is excited about learning more. Thanks for everything Nial!!