Simple Forex Trading Method

There are many different trading techniques available on the internet that you can use to trade the Forex market with. Whether or not they are actually effective and worth using over a long-term basis is another story all together. The problem with most Forex trading techniques is that they are too complicated or they rely on a system of rules designed to mechanically trade the market with. The issue here is that strict rule-based trading systems fail to take into account that the Forex market is dynamic, volatile and can vary widely from one minute to the next. A paradox of learning to trade the market lies in the fact that to effectively profit form complex and often erratic price movement, one must un-complicate their trading as much as possible and learn to trade with a simple forex trading method, otherwise you will just make an already complex task more difficult than it needs to be.

There are many different trading techniques available on the internet that you can use to trade the Forex market with. Whether or not they are actually effective and worth using over a long-term basis is another story all together. The problem with most Forex trading techniques is that they are too complicated or they rely on a system of rules designed to mechanically trade the market with. The issue here is that strict rule-based trading systems fail to take into account that the Forex market is dynamic, volatile and can vary widely from one minute to the next. A paradox of learning to trade the market lies in the fact that to effectively profit form complex and often erratic price movement, one must un-complicate their trading as much as possible and learn to trade with a simple forex trading method, otherwise you will just make an already complex task more difficult than it needs to be.

It is almost an inherent characteristic of traders to assume that the more complicated their trading method is the better their returns will be. The fault in this logic lies in the fact that a “naked” price chart is as close to a clear aggregate picture of market participants’ belief structure regarding the impending price direction of a currency pair as you will ever get. Any trading technique that adds any sort of indicators or programming language onto naked price movement is simply going to make an already difficult task, significantly harder. For this reason, a simple Forex trading method will always win out in the long-run over a complicated messy indicator based trading system.

Trading Methods vs. Trading Systems

Another important aspect of learning to trade strictly off of pure price action on a naked price chart is that by doing so you are employing a method instead of a system. Many people get the two confused and seem to think they are the same thing. In fact, a “method” of trading the market is a way of not only entering and exiting trades, but of making logical sense out of the daily price dynamics, in essence a simple forex trading method provides you with a useful perspective on the market that is adaptable to changing market conditions. A “system” is a rigid set of entry and exit protocols that really teaches you nothing of price dynamics or how to read a price chart, it is essentially a way for people to try to make trading as effort-free as possible, when in reality all it does is make it harder and more confusing.

The main problem with rigid rule-based trading systems is that they tend to work well while a market is in a particular trading condition…the trading condition they were built for, usually trending markets. However, it is almost impossible with current technology to effectively write a piece of trading software that will be able to read and interpret price dynamics as well as a human being can. Being a successful trader means you know how to read the subtle clues on the chart effectively, and it means you know when to trade and when not to, a computer system does not have this capability to the refined degree a human being can obtain. Thus, a computer system will continue firing off trade signals as long as its parameters are met, not taking into account any other variables that a human being might consider. The most successful traders and investors in the world are clearly NOT sitting in front of their charts waiting for a black-box trading system to ding off a buy or sell signal…they use their eyes and brains to decide when to enter and exit the market, and this depends on having a thorough understanding of how to read and trade the price action on the charts.

Simple price action trading strategies

Price action analysis is the art and skill of learning to interpret the price movement that is captured each day on a naked price chart. Let’s take a look at a few examples of some simple price action trading methods:

Trading price action in trending markets:

You probably know the merits of trend-trading by now, if not, then you need to learn them very quick, because trading with the trend is the easiest way to make money in the markets. The trick is that the markets are not always trending, and you have to be able to read the price action on the chart to determine if a market is trending or not. When trend trading, it is important to understand that even in trends the market is going to ebb and flow, meaning it’s not going to move in straight up or down for very long. Markets tend to push in the direction of the trend and then retrace back to a ‘value’ area, which is just another way of saying “support or resistance”. The idea is to look for simple price action setups after the market has retraced back to a value area, as it is at that point that the trend has the highest point of continuing, providing you with the best risk reward potential on the trade.

In the example below, we can see a nice uptrend in the GBPUSD and a pin bar buy signal that formed as the market retraced back to a near-term support level within the uptrend. This trade resulted in a very large risk reward for anyone who took it, as we can see below:

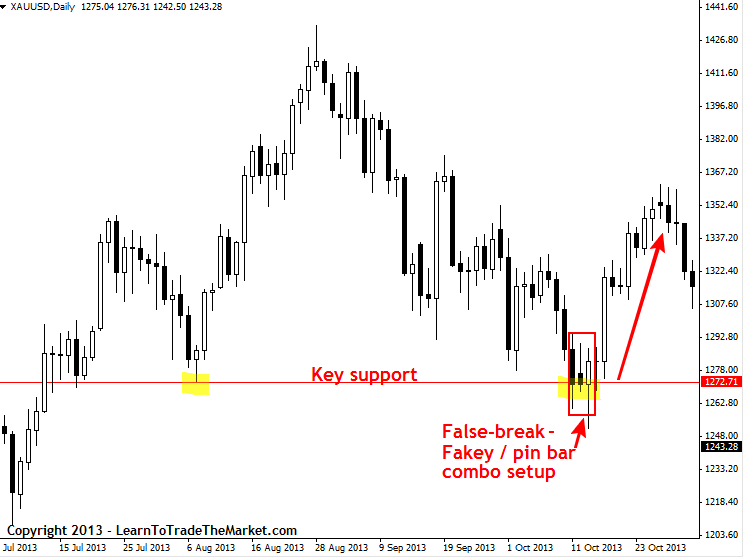

Trading false-breaks of key levels:

One of my favorite ways to trade with price action is to look for a false break of key levels of support or resistance. These false-break tend to result in powerful moves in the direction opposite the false-break, because they suck in all the weak players who buy at the top or sell at the bottom of a move and then squeeze them out, usually resulting in a large rally or sell-off, depending on the direction of the false break. A false-break will often be accompanied by a fakey trading strategy, but sometimes just a pin bar setup or other price action pattern can be a false-break too.

In the example below, we are looking at the daily spot Gold chart and we can see the market hit a key support level down near $1272.00 and then “faked out” the market by falling below it briefly and then pushing higher. This was a false-break of a key support level and a fakey / pin bar combo setup formed there as well, resulting in a large surge higher over the ensuing days:

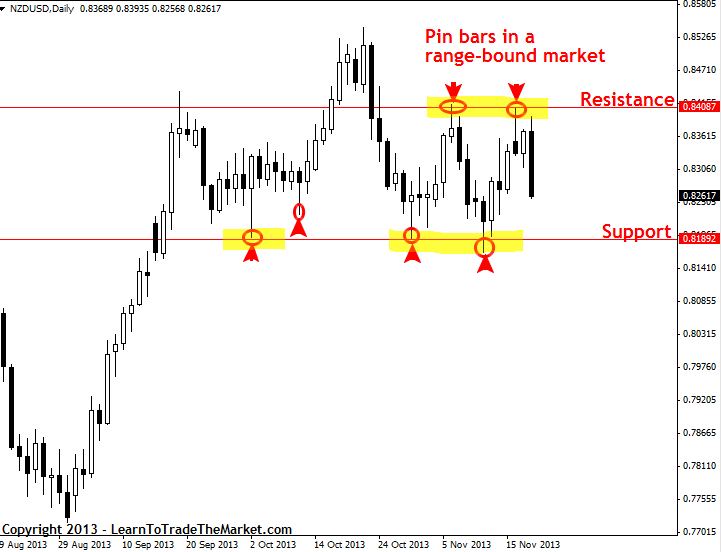

Trading pin bar signals in range-bound markets:

Markets become range-bound a lot, and by learning to trade with simple price action strategies you can very effectively take advantage of a market in a trading range. Most indicator and software-based trading systems fall apart when markets shift from trending to range-bound, and it’s during these range-bound situations where traders using these systems tend to give back all their profits, or more. Since markets probably spend the majority of their time consolidating within trading ranges, you will either be sitting on the sidelines a lot or getting chopped to pieces if you don’t learn how to properly trade in trading ranges.

In the chart example below, we can see the daily NZDUSD chart has fired off a number of profitable pin bar signals from the support and resistance of the trading range it’s been in recently:

Conclusion

A simple Forex trading method like price action analysis allows you to “read” a price chart, rather than trying to interpret a group of indicators that are derived from price anyways. The old saying, “straight from the horse’s mouth”, is applicable in this regard, why would anyone try to interpret a combination of lagging indicators or a software trading program when they can much more easily and accurately learn to interpret and trade based off the derivative of all these indicators, which is of course price action. The short answer is because they are led to believe that these indicators will make them profitable traders by people who are not actually traders themselves. Any profitable and professional trader knows that simple Forex trading methods are the quickest route to learning how to trade effectively. To learn more about trading with simple price action strategies, checkout my price action course for more information.

Excellent lesson! Thanks

Okay Nial, you got me interested. I’m off to read your K.I.S.S article and have a look at the training vids. Currently getting lost in a maze of indicators, patterns, strategies and guru’s telling me the way it should be done. As I like the way you write I reckon it’s worth checking out your info.

All the best

Andy