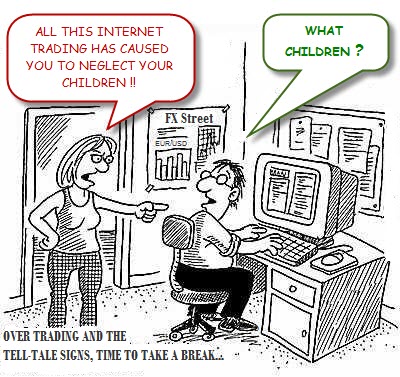

Over-Trading in the Forex Market is Extremely Dangerous

Over-trading is the most prevalent and damaging trading mistake amongst traders. As a Forex trader, you have the potential to enter a trade 24 hours a day, about five and a half days a week, and this around-the-clock temptation to be in the market is nearly irresistible for many people. Indeed, many traders may not even be aware they are over-trading because it is an extremely easy mistake to fall prey to, for this reason, you have to be well-prepared by making sure you understand what constitutes over-trading and by learning how to resist the temptation to trade too much.

Over-trading is the most prevalent and damaging trading mistake amongst traders. As a Forex trader, you have the potential to enter a trade 24 hours a day, about five and a half days a week, and this around-the-clock temptation to be in the market is nearly irresistible for many people. Indeed, many traders may not even be aware they are over-trading because it is an extremely easy mistake to fall prey to, for this reason, you have to be well-prepared by making sure you understand what constitutes over-trading and by learning how to resist the temptation to trade too much.

In this lesson, I will discuss exactly what over-trading is and how you can work to defeat it. You really need to take the threat of over-trading seriously, if you do not make an effort to avoid over-trading, I promise that it will destroy your trading account sooner or later. The biggest ‘revelation’ I had in my own trading was that not being in a trade is a very valuable and lucrative position…

Are you over-trading?

As I mentioned above, many traders don’t even know when they are over-trading, this is mainly because they get so wrapped-up in the emotion of trying to make money or trying to make back lost money that they completely forget about their trading strategy and trading plan. Quite simply, if you are entering trades that are not good examples of your trading strategy, you are over-trading. This obviously assumes that you have first learned and mastered an effective trading strategy, if you have not, then you really have no business trading a live trading account. Many traders start throwing their money around in the market without any real clue as to what they are doing or what their trading strategy is, this is also known as gambling.

Thus, the following actions qualify as over-trading:

* Trading without having a mastered an effective trading strategy.

* “Forgetting” about your trading strategy because you are too wrapped up in the emotion of trading.

* Feeling like you always need to be in the market. After a winning or losing trade you immediately start searching for another trade.

If you are doing any of the above things you are trading too frequently. It is my belief, after answering thousands of emails from traders and helping them in my live seminars and in my members trading community, that most traders’ failure and struggles in the market are a direct result of wanting or ‘needing’ to be in the market all the time.

Being flat the market is an extremely valuable position

One very important point that many beginning and struggling traders either do not understand or are unaware of, is that simply not being in the market IS a position and it is a very valuable one at that. Consider that if you choose to enter a trade that does not meet your trading strategy criteria and you lose on that trade, you have just senselessly lost money that you would not have lost if you were trading your strategy consistently. Therefore, since you had MORE money in your trading account before you lost some to over-trading, had you elected to not trade, AKA stay “flat the market”, you would have chosen the more profitable option. In this way, being flat the market instead of over-trading will result in you having a lot more money over the long-term, thus it is a very lucrative position to take in the market.

One very important point that many beginning and struggling traders either do not understand or are unaware of, is that simply not being in the market IS a position and it is a very valuable one at that. Consider that if you choose to enter a trade that does not meet your trading strategy criteria and you lose on that trade, you have just senselessly lost money that you would not have lost if you were trading your strategy consistently. Therefore, since you had MORE money in your trading account before you lost some to over-trading, had you elected to not trade, AKA stay “flat the market”, you would have chosen the more profitable option. In this way, being flat the market instead of over-trading will result in you having a lot more money over the long-term, thus it is a very lucrative position to take in the market.

Now, I know what some of you are thinking right now, you’re thinking “But what if I over-trade and I make money on the trade, isn’t that more valuable than not trading at all?”. The short answer is NO.

Here’s the longer answer:

When traders get lucky and make money by essentially randomly entering the market (over-trading), whilst it may seem like a good thing in the short-term because your trading account increased in value, what you are really doing is setting yourself up for a disastrous account blow-out. Getting “lucky” on a trade that you should not have entered is about the worst thing that can happen to a trader, and beginning traders are especially likely to fall prey to this mistake. What happens, is that when you win those trades that you have entered on a whim and while you were not being disciplined (over-trading), you are reinforcing bad trading behavior, and bad trading behavior only has one outcome; losing money, usually a lot of money, or all of your account.

How money management affects trade frequency

Risking too much per trade seems like a rather easy mistake to make sure you don’t commit, however, it is a very common mistake that many novice and struggling traders tend to make often. The problem arises when you think you have a setup that looks like it just “cannot fail”, you then decide to double-up or triple your normal dollar per trade risk, the trade then goes against you and you lose a rather large percent of your account very quickly. This induces over-trading, because you feel an urge to “get your money back”, which inevitably leads to more losses, and the eventual loss of your entire trading account.

Traders who get lucky and hit a couple big winners while risking too much are at particular risk to blowing out their accounts quickly because they are riding an emotional high of making a lot of money really fast and have also psychologically rewarded themselves for risking too much money, they then begin to over-trade while continuing to risk too much and it will then only be a matter of time before this cycle of getting lucky while risking too much comes back to bite them in the form of a devastatingly huge loss. Learning correct forex money management techniques is critically important to making sure you don’t risk too much per trade. You can essentially kill two birds with one stone by making sure that you are managing your risk properly on every trade you take, as this will not only keep your losses contained below a dollar amount you are comfortable with losing per trade, but it will also significantly decrease the emotion you feel after a loss, which will help you to not jump back into the market to try and “make back” the money you just lost.

The solution to over-trading

The only real solution to over trading is patience. You must have the patience to wait for a quality price action setup to form at a confluent level in the market and preferably with the dominant trend. Most novice traders over-analyze the charts and begin to look at lower chart time frames like those below the 1 hour chart, which are inherently less reliable than 4 hour charts and above, this causes them to think they are seeing a quality signal when really all they are seeing is regular market “noise”. Stick to 4 hour charts and above when first starting to trade and be EXTREMELY picky in what price action setups you trade, this should at least partially fix your over-trading problems.

The only real solution to over trading is patience. You must have the patience to wait for a quality price action setup to form at a confluent level in the market and preferably with the dominant trend. Most novice traders over-analyze the charts and begin to look at lower chart time frames like those below the 1 hour chart, which are inherently less reliable than 4 hour charts and above, this causes them to think they are seeing a quality signal when really all they are seeing is regular market “noise”. Stick to 4 hour charts and above when first starting to trade and be EXTREMELY picky in what price action setups you trade, this should at least partially fix your over-trading problems.

Only YOU have the power to stop over-trading. If you cannot dig deep within yourself and muster the discipline required to stick to your trading strategy and only trade when it is CLEARLY telling you to, unfortunately you will never make it as a trader. The only real solution to over-trading is to understand that slow and steady wins the race. In trading, the ‘race’ should be thought of as more of a “marathon”, and if you don’t pace yourself for the marathon you will quickly blow out your trading account. I suggest that you first master an effective trading strategy like the price action strategy I teach in my trading course and members’ community and then ONLY trade it on the daily chart time frames. You should demo trade until you are making consistent money on the daily charts, this may take 3 months, 6 months or a year, but if you cannot trade a demo account with discipline and consistency you will never be able to trade a live account successfully. The good news is that you can conquer over-trading just like I did along with many other successful traders. It will take an understanding and acceptance of the points discussed in today’s article and an unyielding passion to trade properly, and that essentially means trading with patience and discipline.

Thanks Mr. Nial! It is written with all the heart

Wise words to take to heart in my training!

Thanks for the lesson, sir.

wards of a pro!!

Nice one!!!! :)

G’day Nial

They are such true words that you posted about over trading to much.Great words of wisdom for everyone in the markets