Bring Your Trading Account Back From the Dead

So you’ve lost 50% or more of your forex trading account and you feel like you either want to give up trading all together or just start going crazy and trading everything you see because you ‘don’t care’ anymore.

So you’ve lost 50% or more of your forex trading account and you feel like you either want to give up trading all together or just start going crazy and trading everything you see because you ‘don’t care’ anymore.

Has this happened to you? Is this happening to you now? If so, you’re not alone, many forex traders end up in a similar situation early-on in their trading careers, and it’s what they do at this point that has a big influence on whether or not they sink or swim in the markets.

The most important thing to understand is that you CAN CHANGE whatever it is that you did (or are doing) to cause so much damage to your trading account. The most important thing I can tell you is that if you are willing to listen and accept help you CAN become a successful forex trader and you don’t have to throw in the towel, and you definitely should not take the ‘I don’t care anymore because I lost so much money’ attitude with the remainder of your account…I assure you this will result in you fully blowing out your account and after that happens you will feel like a full-fledged gambling junky who just maxed out their credit cards at the casino. Let’s look at 5 things you can do to ‘bring your trading account back from the dead’…

Step 1) Ask yourself honestly, “How did I do this much damage to my trading account?”

The first step in recovering from a near-account-destroying series of trades is to stop trading with real money and then take some time to reflect on how you were trading just before you lost all that money. You’ve got to remove yourself from the markets when you do this first step. Heck, if you need to, close your trading account altogether and then reopen it at a later date when you know what you’re doing and feel confident in your approach.

I can almost 100% assure you that the reason you lost a lot of your account, nearly blew it out, or did blow it out, was the result of one of these three things:

1) You were not following a strict risk management plan or you were not focusing properly on the fact that you can lose on any trade you take. Essentially, you probably were risking more than you should have per trade and you probably knew you were doing this but ignored it. You probably were not behaving as if you can lose on any trade.

2) You probably traded too much, gambled, over-traded, whatever. The fact is, most traders blow out their trading accounts either from risking too much money per trade, trading when no high-probability edge is present (over-trading), or a combination of the two. Usually it’s a combination of the two, although either one alone can certainly do massive damage to your account or cause you to blow it out all together.

3) The other big reason why many traders lose large chunks of their trading accounts or blow them out all together is because they simply don’t have a trading strategy or they don’t really know what they’re looking for in the market. Maybe they haven’t really ‘mastered’ their trading strategy yet either, whatever the case, if you are going to risk your hard-earned money in the markets, you better be DAMN SURE of what your high-probability entry edge is, otherwise you are just gambling your money away.

Step 2) Understand that you’re going to HAVE TO focus more closely on risk

The next thing you need to do after figuring out what caused you to lose so much of your trading account, is to understand that going forward you’ll have to focus more closely on how much you are risking per trade. Furthermore, you need to also be consciously aware that ANY trade can lose and that your trading edge has a random distribution of winners and losers. Being aware of this fact whenever you’re thinking about entering the market should keep the temptation to risk too much at bay. Traders who lose a lot of money trade as if they are ‘sure’ every trade is going to be a winner, this causes them to ‘load up’ and trade with position sizes that are too big and induce emotion within them.

The next thing you need to do after figuring out what caused you to lose so much of your trading account, is to understand that going forward you’ll have to focus more closely on how much you are risking per trade. Furthermore, you need to also be consciously aware that ANY trade can lose and that your trading edge has a random distribution of winners and losers. Being aware of this fact whenever you’re thinking about entering the market should keep the temptation to risk too much at bay. Traders who lose a lot of money trade as if they are ‘sure’ every trade is going to be a winner, this causes them to ‘load up’ and trade with position sizes that are too big and induce emotion within them.

Bringing your trading account back from the dead is going to be a slow process, you’ve got to understand that. Since you’ve lost so much of your money you won’t be able to trade as big of position sizes as you could before, and this is just something you’re going to have to accept. You need to understand that if you focus on the mechanics and the process of successful trading now, later you will be able to make increasing amounts of money. It’s called ‘delayed gratification’ and it’s basically the key to long-term and consistent success in any field, including trading. Unfortunately, trading appeals to our evolutionary need for ‘instant gratification’, putting us in a constant of state wanting to do the wrong thing for our trading accounts simply because the wrong thing is usually what feels good and tickles our ‘instant gratification’ brain area.

So, you’ve got to understand that whenever you risk more than you know you should, you are behaving in an ‘instant-gratification’ / more emotional manner, and this is the opposite of what creates long-term success in the markets. Thus, one of the keys to rebuilding your trading account is understanding that you need to delay gratification by managing your risk to a level that allows you to trade emotion-free or nearly emotion-free on every trade you take.

Step 3) Don’t trade until you KNOW what you’re looking for in the markets!

Next, you need to be aware that unless you are 100% confident of your trading strategy and you’ve turned it into a comprehensive forex trading plan, you really should not be trading with real money. Whilst you’re taking time off from the markets to regroup and fix your trading problems, make sure you not only understand and know how to trade your strategy, but also that you like it. If you’re currently trading a strategy or system that you find messy or confusing, ditch it and learn a new one. Obviously, I recommend you trade with price action, because it’s clean, simple, and effective, but it’s ultimately up to you how you decide to trade.

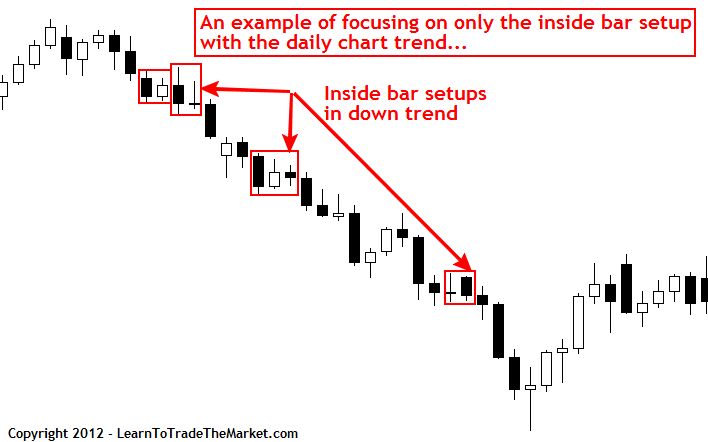

One of the best ways to really get familiar with your trading method and to really ‘master’ it, is to take one aspect of it and master that before moving on to the others. For example, if you are a price action trader you might focus all your efforts on spotting inside bar strategies with the trend on the daily charts of the major Forex currency pairs. This would be your PRIMARY FOCUS until you are seeing consistent profits over a period of two or three months. Once you achieved this you could then move on to other setups and implement other aspects of price action trading into your trading arsenal.

Here’s an example of focusing only on the inside bar setup on the daily charts:

Step 4) See the forest for the trees

You need to focus on learning to be a good trader…not on how much money you can make IF you become a good trader…that really is pointless. It’s a bit like focusing on showing off your trophy after winning a big race without actually thinking about preparing for the race.

Yes, the underlying reason why most traders lose money in the markets is because they look at a price chart and they see dollar signs. What I mean by that is they don’t think about the long-term view, but instead they get caught up in trying to get-rich-quick or in trying to make ‘a lot’ of money on every trade they take. They forget about the FACT that they cannot make money on every trade, they are going to have losing trades, and that they never know what will happen on any one trade.

You’ve got to always have the bigger ‘forest’ picture in mind, and not get caught up focusing too much on the ‘trees’, or any one individual trade. Sure, you need to stay true to your trading plan and only take valid instances of your trading edge…so every trade you take IS important, but the point I am trying to make is that no one trade is going to make you a successful trader. You become a successful forex trader by being consistent and by understanding your success is defined over a large series of trades, or over a relatively long period of time. It’s not defined by two or three trades or over two or three weeks of trading.

By learning to think like this you should have an easier time managing your risk properly and not taking trades that you know are stupid. As you adopt this way of thinking, you will be more inclined to focus on the process of being a good trader rather than on viewing the markets as your own personal ATM. Focusing on the process of trading properly is what makes you money in the long-run. The things that ‘feel’ like they will make you a lot of money fast, like over-trading and risking too much per trade, will actually cause you to lose money and are probably why you are reading this article. In trading, we basically have to do the opposite of what feels good if we want to succeed over the long-run.

Step 5) Replace your old habits with new ones

Finally, the number one thing that you need to do if you want to begin building your trading account back up and trading successfully is change your trading habits. The reason you lost control before and lost a lot of money in your account or blew it out, was because you did not have the proper trading habits. Habits take repetition and time to develop, so you have to follow the insight in this article and in my other forex trading articles and start following a positive course of action in your trading. If you do this consistently, eventually your old habits of gambling and generally trading in an undisciplined manner will be replaced by effective and positive trading habits.

Finally, the number one thing that you need to do if you want to begin building your trading account back up and trading successfully is change your trading habits. The reason you lost control before and lost a lot of money in your account or blew it out, was because you did not have the proper trading habits. Habits take repetition and time to develop, so you have to follow the insight in this article and in my other forex trading articles and start following a positive course of action in your trading. If you do this consistently, eventually your old habits of gambling and generally trading in an undisciplined manner will be replaced by effective and positive trading habits.

The way that you begin to change your trading habits is to take action. You can’t just sit here and read this article and think by reading it and understanding it you’re going to magically wake up tomorrow with new trading habits. You probably have negative trading habits ingrained into your mind right now, and they developed over time and through repetitively being inconsistent and undisciplined, so it’s going to take time to replace them. You’re going to have to make an effort to be disciplined and consistent in your trading. This is something you need to consciously remind yourself of and be aware of, it’s not enough to just understand you need to do something…you have to ACTUALLY do it if you want to change!

Most people know they need to eat healthier and exercise to change their bodies, but just knowing something is not good enough to make it happen…you’ve got to take action from the information you know to be true, otherwise your trading results will not change, nor will anything else in your life that you want to change.

Very truth I also blow my trading acc ×4

I liked and I enjoyed it. Thanks Nial.:-)

Thank you Nial! This article I really liked!

Thanks Nial, as usual you have hit the nail right on the head. These articles are God sent and really help a lot. Personally i do learn a lot from them.

Thanks Nial, your articles have been very helpful and useful

Hi Nial

Great article, I almost blew my account. I’m taking Iit easy now, and only trading 4hr and daily.

hai frnd ur really grt8 professional trader and motivator et etc keep it up man. .

Great article (as always…) This article comes at a good time for me, I will read it often and use it as a reminder of the things a good consistent trader must master. I’m so glad I found your guidance. Thanks a lot !!!!!

Thanks Nial,all your articles are very helpful,keep up the good work.

Very insightful and helpful article. I particularly like the end. It explains to me what Sir Terry Leahy meant when he said that a good plan without action is worthless

Thanks Nial,

Excellent, and it helps a lot reading your articles viewing the problems that can occur from different angles.

Cheers

Keeep up the good work.

thanks nial keep up the good work

Do you think that i would be able to make up to 20% of my account balance per month if i concentrate on trading an inside bar on the daily chart,Thanks.

Great article. The long term view, the series of trades is an excellent thought. I have also focused on why I was not able to think long term, why I was a sucker to short term gratification. Time to look inside and be honest with myself.

Just came in the right moment! I just blew off my account :( your article is encouraging, I hope I manage to bring my account alive again. Thanks

Hi Nial,

This article, really opened my eyes literally, by changing all the bad habits to good one at trading…

each an every time i read your line its really makes me very exuberant and really improves my trading.

Thanks, Nial. Great lesson as ussual.

Very nice input Nial

thank you very much for nice article.

Thanks to this lesson that will be the very beginning of my forex trading

I have not yet started to trade live because I am not able to lose a lot of money and I have to play the safe card, if possible. all best wishes in future work.

Hi Nial,

It’s like you were sitting at my desk, looking at my account balance, and saying, this (idiot) needs some help, and FAST.

A very timely article for me, as all your articles are. Time for me to start taking some action. It’s my cash after all.

Kind regards

This is a real talk.You are FX Messiah,you ve known the way FX looser feel.We need more of this from you.Thanx

Right on!

Anyone who puts into practice what Nial has said in this article will see his/her account grow like never before!

How do I know this?

I am a living testimony to the truths therein.

Wishing you all good trading and Nial, thank you so much.

Thanks Nial You are a Blessing to Forex Traders Like me.

God Bless You.

Thank you, The great master

Well done!!I appreciate what are you doing. Thank you!!

very nice article nial.in cricket a basic rule is if there is a chance to take a single run get it swiftly.the fours and sixers will come. and also play the ball according to the merrit of it’s length with proper batting technic.likewise in our forex market we will have to play according to the market.not for our greed and anger.once again very nice article nial. thank you.

Good article. It mentally gives support and provides guidance.

Gives confirmation of the next step to lost trader. Thanks a lot. You are the real mentor. I don’t think, anyone will find such mentor, who gives positive and negative insights into trading. You are real friend, brother and mentor.

very good, thx for the many reminders to be a great trader. as some might say, peak performance is meditation in motion

Thanks Nial. Another great article as always!

Too true Nial,

I needed to adopt this introspective method and it is paying dividends.

Slow and steady,analyse and improve.

This article comes at a good time for me.My account have lost a bit of ground after the good work of last year and the early part of this year, thanks Nial

THANKS NIAL, I do like your summission,pls keep coming. my trading experince had greatly increase since i have being reading your article. i love your strategies and approches to chart analysis very simple and straight forward, thanks soooooooooooooo much.

Hi Nial,

I am one of the newbies, who is working on his trading habbits, discipline, patience etc. I must admit, after I read in your article about focusing only on inside bars I went to see how they work in the market and I couldnt believe how efficient they are. Have to read more about it. Thanks for inspiration.

Michal

Nice. Thanks!

Thanks for this great article Nial. after loosing just over 50% of my account this article talks to me. Looking back I can see the mistakes I made (overtrading and using low quality setups). Now is time to change my bad habits to good ones if I want to succeed in this business

Keep up the good work

Gilbert

Yes, I did need to read this. One question. I’ve read it somewhere, but now I can’t find it again: An “example trading plan”. Can you direct me? I can’t seem to find it. Not to follow word for word, but to use to construct my own, based on my available time and comfortable risk. Just a ‘checklist’ to follow, to improve my self control. Close to blowing my entire account, so help would be appreciated!!

Brilliant article. I know the exact feeling of what it feels like to reduce one’s account by 50% overnight due to sheer stupidity. Instead of asking yourself ‘how much money am I going to make’ on this trade ask yourself ‘how much money can I possibly lose’ if I take this trade. If you change your mindset in this regard then you’ll be well on your way to becoming a successful trader. It’s like business – take care of the expenses and the profits will take care of themselves. Nial, many thanks for your great articles. Your ability to clearly explain your philosophy to trading is very unique.

Thank you very much Nial. I am a beginner to forex. Can you help to me

Thank you, Nial. I rarely write something on your site but this time around, there is something I’m seeing as you write this article for us this week. I can see how I’ve journeyed these 10 months working every single trading day, analyzing the price movements, reading on your daily commentaries and either sitting on my hands or putting on a trade. I realize how all the internal struggles and understanding are slowly coming together in an organic way. I still make those over trading mistakes, but less and less now, understanding and feeling more strongly seeing the forest for the trees, that any single trade no matter how likely can turn against me, that the wins and loses are random, and that the method and the risk management will see me through. Your communications are expressions of hope, that even for me, there is light at the end of the tunnel. Thank you, Nial.

Great job Nial, excellent article

Great article. Inside bars work better in daily charts,I guess.

What a true market authority you are Nial. Congrats for this great article.. Please do keep them coming!

Great article..Its all about discipline and you have outlined that very beautifully. I will save this and read it time and again when i feel im missing my basics..

Thanks

Sathya

My man! you’re an artist

Thanks Nial, nice to know this before trading the real money!!

What a wonder !. I have neither knew Nial or met him anywhere.

But he has written an article entirely for me knowing precisely the working of my inner mind. What a Magician is he? !!

Thanks

Wonderful thought n advice

Cheers

Excellet article Nial. It is very hard to stop trading with real money, especially when down, and only trade using a demo account. This article feels like it is directed at me because I have experienced much of it. Thanks!

Hi Nial,

Thanks for the lesson. Well I lost three accounts for my clients last year because I wasn’t using stop loss orders. I was trading EUR/USD between 1.45 and 1.40 until the range broke. I resolved this year to use stop loss orders and determine risk for every trade I place. Normally 50 pips stop loss per trade and it really works for me. Though some trades don’t work out, I wake up looking at my account and able to trade another day with a fresh mind and no stress.

5 Minutes to Learn, a Lifetime to master.

i just blew 50% of my account….entering too early and missing out the big moves and not trading properly on these big moves….

funny that – enter the losers, miss or screw up the winners

aaaahhhh!

i wont give up….but will TRY REALLY HARD not to make the same mistakes above to turn things around!

10/10 Nial, I would definitely recommend your lessons to any new traders. From one trader to another….you have hit the nail on the head with this article! well done

thanks for your article. i am in nigeris. how can i pay for your course using mastercard? how much is it now ?

I just wiped out another trading account, by trading emotionally and greedy. It’s time to learn an strategy that can be used in the long term succssesfully, thanks for the tips.

Thank you,

Heard about you from my Madam, Alice. Good job you are doing.

Thanks Nial. I need a SYSTEM to guide me in the form of a checklist before I enter a trade. After every trade, I note my trade details on a spreadsheet and the last column indicate the mistake I made.(if I know off course). If feasible, this mistake becomes part of my checklist before entering the next trade. In this way it will help me to PREVENT making the same mistake! Do not rely on your memory, you will forget the mistake you made last week! For instance, if you keep on making your stop loss too small, make this an item on your checklist,etc. Then do some more study on stop losses. I cannot operate any other way! Blessings! arend

Excellent article. It’s all about Discipline, Trading strategy and understanding your OWN Emotions. I am trying really hard to achieve this.

Nial,

Another excellent article for newbies. Makes you review all your bad habits…. and should let you “tweek” your process..

Thanks Nial. I think I really needed this article at this time.

I think this is one of our best articles…. Good example of inside bar setups….

thanks alot Nial,ways to change our mental to trade profitly,keep up the good work

Thanks Nial I read all your articals & allways look forward to them.In This artical I have just about been through all of these things you speak about. But now I am slowly on my way. I am not there yet but feeling stronger every day, still making small of mistakes. but one thing I have noticed about myself is that my money management is 100% better then it was 12 months ago I still make mistakes here & there. So things are looking very good at the moment, thanks to you Nial. You are a great mentor Thanks

Thank you, The great master! Lol :) This is true stuff. I have learnt a lot from you, and will keep learning more. A million thanks.

this Article is useful for success Trading

thanks Nial

It’s funny how you manage to hit every nail on the head with what I am or have experienced in my trading thus far! It’s awesome to know others go through this, seeing the light at the end of the tunnel heh

It is all very true. The only question is: how one can make sure that the high-probability edge is present. If you use the previous day closed candle – it is already too late. The daily amplitude does not allow to enter with R:R ratio more than 1:1. If you use today’s candle it might change to opposite.

you definately are the man in this business. your approach to trading has completely changed my approach to and perception about trading. just blew 20% on impatience but I have decided to base my trades on price action set-up on the daily and 4h only. also plan on getting the course once I get the cash. thanks bro. you are the man. great articles by the way.

Thanks nials, another fantastic article. Legend.

Nice Article. I can’t fully express how a better trader Ive become since stumbling on your blog. Keep up the good work.