A Simple Plan To Dramatically Improve Your Trading

Let me ask you a question, and please answer yourself honestly: Do you have a plan of action for your daily trading routine or do you just open your charts and randomly start trying to find trades with no logical guidance behind your actions?

Let me ask you a question, and please answer yourself honestly: Do you have a plan of action for your daily trading routine or do you just open your charts and randomly start trying to find trades with no logical guidance behind your actions?

Plans give you a “roadmap” of how to go about getting what you want in life. Not having a plan for something makes it harder, it doesn’t matter what it is. Even if you are planning a family vacation that should be full of enjoyment and relaxation, if you don’t have at least a basic guide as to what you will do each day, it’s probably going to end up being confusing, semi-chaotic and highlighted by fights and disagreements rather than fun and laughter. Planning makes everything simpler and easier to accomplish, and a simple plan can put even a complex or lofty goal within reach.

Today, I am going to lay out a simple plan that you can use to improve your trading. The only “catch” with this is whether or not you have the discipline to stick to it. Most people struggle with discipline in the markets, but simplifying your daily trading routine can make it easier to stay on track and remain disciplined. So, let’s discuss the various components of this simple plan that I’ve designed for you and then next week you can get started following it and see if your trading improves.

Note: The steps below are meant as a basic trading guide or plan to help struggling or beginning traders. If you are serious about using this plan, then you should follow it for at least two or three months and then tweak it as you see fit after that.

Step 1: Trade only major markets

The first step to this simple daily trading guide is to be sure you’re only analyzing some of the major markets. I like to stick to the major forex currency pairs as well as spot Gold, Crude Oil and Dow. Here’s the symbols for the markets that I follow the most frequently and the ones you should follow for this simple trading plan:

EURUSD, GBPUSD, AUDUSD, NZDUSD, USDCAD, USDJPY, EURJPY, GBPJPY, AUDJPY, XAUUSD, WTI, DJ30

That’s 12 markets, more than enough to focus on. If you’re in the USA and you can’t trade spot Gold, Crude or Dow then just focus on the currency pairs I’ve listed.

There really is no need to analyze 20 or 30 markets like many traders do. Besides, if something big happens that really moves the markets, it’s probably going to show up as a price action signal on one of the 12 markets I’ve listed above anyways. If you really want to simplify your daily trading routine, you should scale-back the markets you analyze so that you are just focused on a handful of major markets. The first step in this simple plan is to figure out the markets you will trade and make sure you’re not looking at more than 10 or 12 per day, the list that I use above is suitable for any currency trader to use.

Step 2: Clean up your charts and only trade daily charts

Next, it’s time to get your charts setup. Open the daily charts of the markets I’ve discussed above, or whichever 10 or 12 you want to follow. If you don’t know how to get your charts looking like mine, then read this metatrader 4 tutorial that I wrote, it will help you get all setup.

The second requirement for this simple trading plan is to only look at and trade the daily chart time frames, if you start looking at the 4 hour and 1 hour charts or below, you will have broken your discipline, and I can only vouch that this plan will work for you if you follow it to the T.

Step 3: Pick one setup to trade

This step is critical; you will only be trading one price action signal for this trading routine. Last week, I wrote an article on how to master your trading strategy, I suggest you go read that before implementing the plan I’m laying out in this article. Eventually, you can try learning different entry signals, but for the purpose of this simple trading plan I am designing for you this week, you should only trade one signal. If you start to see that you’ve stopped losing money each month and that your account is growing slowly but surely after using this plan for two or three months, then you can start implementing different entry signals. But, for now, I need you to understand that you have to narrow your focus, remove variables and reduce clutter from your mind and charts to really “turn the corner” in your trading, and the best way to start this process is learning to become a master of one setup at a time.

Step 4: Follow this money management plan

For purposes of simplicity and to show you the power of risk reward, all the trades that you take while following this plan will be set at a 1:2 risk reward. That means, your profit targets will be twice the dollar amount as your risk.

For purposes of simplicity and to show you the power of risk reward, all the trades that you take while following this plan will be set at a 1:2 risk reward. That means, your profit targets will be twice the dollar amount as your risk.

The way to place your stop loss properly is to use the surrounding market structure to figure out the most logical place to put it that gives the trade the best chance at working out but also is not too far away. What this basically means is that you should not place your stop an arbitrary level because you want to trade a certain position size…this is greed, and it will end up working against you in the end. You should have predetermined your 1R risk per trade (this is the dollar amount you risk per trade), then when you find a setup you want to trade you figure out the safest and most logical place to put the stop loss…then you adjust your position size so that you are only risking your predetermined dollar risk amount.

You will place your profit targets with the aim of getting a 2R reward on every trade; that just means two times your risk. However, in placing targets you do also need to consider the surrounding market structure; if a logical 2R reward is not realistically possible because a large key level is in the way, then you might have to reconsider taking the trade.

After you figure out the most logical stop placement you will then adjust your position size down or up to meet your predetermined dollar risk amount. If you need more help on this topic of position sizing, check out this article on risk reward and position sizing.

Step 5: Track your progress in a trading journal

The next part of this simple plan is to make sure you’re recording everything in your trading journal. If you do not have one you can get a trading journal here. Keeping a journal of all your trades is probably something that many traders forget about or that falls to the wayside after a few weeks…but you can’t let it. You NEED the track record created from keeping a journal to make trading feel more like a business and to bring more of a process into your trading routine. The actual process of entering your trades and journaling them will help to keep you disciplined because it reflects back to you your trading results. If your trading results show that you’ve made emotional trading errors like risking more than you knew you should per trade or entering stupid trades that you knew you shouldn’t have…you will see these things in your journal and hopefully you’ll stop doing them.

It’s easy to be lazy and gamble your money in the markets, but when you are forcing yourself to keep a journal of all your trades you will be a lot more aware and conscious of your behavior in the market. If your behavior is that of a gambler, you will then clearly be able to see that YOU are the problem with your trading and that you need to adopt the proper trading mindset to succeed. If your trading journal begins to show a pattern of consistency in following your risk management model and your trading strategy…it will be something you can proud of…few traders have a track record that they are confident in showing to other people or potential investors. You have to use the trading journal as a tool to reinforce positive trading habits and help eradicate negative ones, and you do this by forcing yourself to manually record your trades, think about them and analyze them.

Step 6: Follow the plan

Now, clearly the plan I’ve laid out today will not work if you don’t follow it. You need to be sure that if you commit to this plan you actually follow it. Give it at least two months, and then evaluate where you’re at. Maybe you’ve stopped losing money and are breaking even now, maybe you’ve made a nice profit each month, either way it’s an improvement over losing money each month, and that is the point of the simple plan I’ve laid out here today for you; to get you off the track of hemorrhaging money from your trading account and onto the track of slowly but surely becoming a profitable trader.

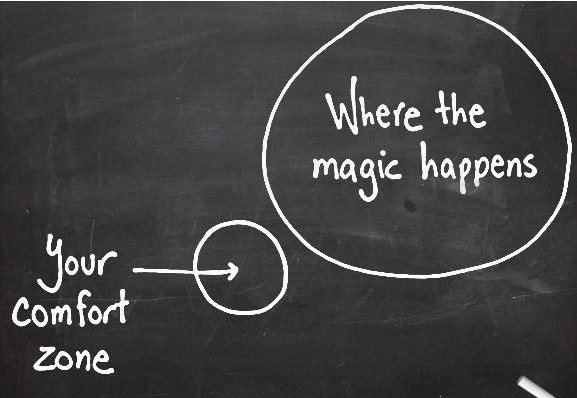

Step 7: Challenge yourself

Perhaps the best way to think about the guidelines I’ve laid out for you in today’s article, is that they are a challenge to yourself. Many people have trouble completing even the seemingly simplest tasks; reading a book from cover to cover in two weeks, getting to work on time or early each day, exercising three times a week consistently…whatever the task, it can be very hard for many people to stay focused on it long enough to see its benefits pay off. In trading, this trouble with focus and discipline is an even bigger problem than in most other things we do; because in trading your hard-earned money is on the line each day.

Perhaps the best way to think about the guidelines I’ve laid out for you in today’s article, is that they are a challenge to yourself. Many people have trouble completing even the seemingly simplest tasks; reading a book from cover to cover in two weeks, getting to work on time or early each day, exercising three times a week consistently…whatever the task, it can be very hard for many people to stay focused on it long enough to see its benefits pay off. In trading, this trouble with focus and discipline is an even bigger problem than in most other things we do; because in trading your hard-earned money is on the line each day.

To end today’s lesson, I want you to do something if you’re really serious about following this simple plan that I’ve laid out here today. I want you to either print out this lesson and sign the bottom of it as a pledge that you will follow it, or write yourself a little “commitment” pledge and print it out and sign it. Hang this paper on your wall next to your trading desk or put it somewhere where you will see it each day before you trade. The first step to becoming a profitable trader is seeing if you have the discipline and patience to stick to a simple plan like this for two months. After two months, come back and leave me another comment on this article or drop me an email and tell me about your trading results. If you want to learn more about simple trading strategies that can help you dramatically improve your trading results, checkout my Price Action Trading Course here.

Thank you very much,for your wisdom you share,I will commit to your challenge of this plan for 2 months.

A great article on how to prepare a plan in an easy simplistic way thankyou Fuller.

Thanks Mr. Nial! wrote out to himself this plan, now I myself will check, I will adhere to it not ukosnitelno

Its greate

Thanks a lot man

just awesome. im following

Yes this is what i have been trying to do all these years but now that i see a reputable trader confirming it, my confidence in trading price actions formations on key levels has being reinforced. Thanks

Actually a great article……. to do something in a practical way.. In believing to trade on one price action (pin bar strategy) something similar I thought of doing, When I hear you telling kind of plan is a kind of ring the bell… I am taking first step right now…..

See you later with results!!!!!!!!!

Best Regards.

Today – June 10, 2013 – is day #1 of my 2 month commitment to strictly adhering to “the plan” using the Pin Bar Trading Strategy.

Your are a genius Nial. They say no one is perfect, I say you are a perfect Trader and mentor.

Dear Nial …this article gave me a big confidence and good trading setup for myself ……thanks for your wonderful article……

Dear Nial, So far I have found you the most valueable coach of forex, around the web. I agree with your approach to trade in daily chart but I am unable to find entry and exit exact points …….!

Dear Nial!it is a grate pleasure to be your student, following up your trading strategy.I have promise myself to follow all your steps.Most sincerely price action is the answer. thanks for been there for US.Grate GUY. Thanks.

thank u so much sir nail,I have been trying to create a plan all the three years of being a forex rookie but if I create one,am not always able to follow it.I am seriously in on this,I will make sure I put everything I know aside for now and use this plan,afterall I have tried my way it didn’t work so its time to try something new.God bless u sir.

see you all in two months.

Hey…

How far have you gone following the plan

Excellent article! Thanks Nial

good write up i love it GOD Bless You

very enterpricing article keep it up

Thank you Nial for your terrific articles. Your videos and articles have helped me a lot. These past two weeks have been quite a struggle, my head is now all messed up! I will comit to this challenge for two months and come back and post a comment.

Am taking your challenge, 3 days into it I’m ahead by over 400 pips!! yippee!!!

Thanks Nial – good to have the focus of what to do. We do it in many areas of life – but frequently not in the areas that really matter and where we should be focusing.

Thank you for this simple but doable plan. I am going to spend the time to set this up. I especially agree with your point about keeping the trading journal. Each step you list is important and getting into a routine that makes trading like your own little business is brilliant.

anbelievable wonderful article. Nail, I have struggled many years to be profitable trader, and I did not succeeded. But now, I am sure I wil succeed, and tell my success history

thanks Nail, may God bless you and your family.

As Usual Nial,

very nice lesson, it looks as if this was written for me.

thnks Nial

Thanks Nial. I’m getting serious about Trading, and will follow this plan… :)

Hi Nial.

Thank you for this great article. Challenge accepted. Good news to follow in two months time.

Regards

Colin

Hi Nial, I don’t know of any other forex site that delivers such great content and value to the reader as you do with your site. You outlined a great challenge to get going in 2013. Highly appreciated.

Thank you I am committed.

Thank you I am committing.

Thank you Nail. I’m getting better every day because the way you show me to focus!!!

carlos

Thankyou Nial! I will commit to try this or 2 months and will write here about the results (Iam positive that its gonna be positive!!)

best mentor in the planet

Thanks again mate.

Challenge accepted! And I will come back and leave you with good news about my trading results in two months time.

Thank you, Nial….

I loved your article thanks alot

thanks for this great article i fully honestly follow this plan i promise you

The best article. I’m in for the challenge. Will follow all rules to a “t”, writen out into a journal. Will be a bugger not to go down to 4hr and 1hr though but looks much less stressful and much simpler. thank you for sharing so much!!

Thank you!!

A timely reminder for me to get my trading back on track,

thank you Nial.

Very important article at this time. pls keep on the good work, more grace to your elbow

That is it

Thanks you so much for this lesson !

Keep going…

Cheers :)

Thanks Nial, a nice and strict lesson for me.

Thanks Nial, having a plan is only part of the solution. Following through by being committed can be difficult but overtime the reward is priceless. I found by sticking at it long enough you naturally become more inspired. I’m constantly reminded how important it is to be patient when trading the markets. Discipline for me continues to redefine freedom with positive input + positive output = positive outcome. Thanks mate.

Yes I suffer from the “what if’s” as well. Now that I have seen perfectly good setups come and go as perfectly good lost opportunities, I feel completely demoralised. Its true if I don’t look at as many charts I won’t be spoiled for choice and have better clarity of thought. I think I will also be more confident with specialising in a trading plan rather than multiple trading set ups I am looking for, this giving me a singular focus to develop and work on rather than the chaos I am trying to master. Now that I have aired that I feel much better.. I think I just realized too that the ” what ifs” comes from my inquisitive mind seeking out more information to master or understand what I see in front of me, which also paralyses me into non action because out of fairness I also have to entertain the notion of the downside potential of a set up. I find this un acceptable viscous loop keeping me stuck inside a comfort zone of academic certainty, rather than acting on my own courage of conviction in combining my execution with respecting a plan – I have to remember any trade I make also includes stop losses and wisdom follows.

awsome article Mr Fuller

I am going to have a go at this. I can only spread bet where I come from. Thank you

This is exactly what I have been waiting for. I knew I needed to narrow my focus…just didn’t know how or what to focus on. I like the idea of having strict guidelines to focus on otherwise i am all over the board. This works well with my learning style. Thank you so much Nial for the well written piece. I am excited to get going again with more structure.

Here’s the bottom line. I’ve read or seen all this from you before without taking much specific action. I am now, beginning with the Monday markets, going to run this exact test as suggested for two months. I will restrict the pairs to those recommended. I will keep a journal, which I have done poorly on in the past, and I will pay strict attention to an appropriate R:R.

Thanks for the prodding, Nial.

Columba

thank you Nial Fuller, that was a nice article.

Good article. Thank you for having the discipline to continue teaching and helping everyone. It would be easy for you to just sit back and let other people run this program but having these articles shows the commitment you have made.

I open the charts with no plan so this is for me. I let the journal fall away the last couple of weeks too. I look forward to implementing this plan. Thanks.

Another wonderful article

Thank You Nial.

Hi Nial,

Thanks so much for your trading lessons. I’ve really been following your lessons from the ‘side line’ ( not a member yet) for about a year now and I’m proud to say there is a big improvement. I’m still demo trading for more than a year now and this month, Feb. 2013, I’ve made 9 trades so far with 6 rewards and 3 losses. I only trade from the daily chart and I must admit it was really hard to part ways with the intra-day charts. I’ve become more relaxed, learnt to be disciplined and for all trading without indicators! Nial, thanks for every lesson, I think now I can try going live.

Judith.

Well that’s 16 currency pairs now down to 8.

1 Hour and 4 Hour Charts now Daily.

Trading plan written out in simple English.

Journal work sheets printed out and ready.

My birthday in 2 months time on 20th April. Determined to

see this through. Promised to buy myself a

birthday present to celebrate my commitment to this plan.

Thanks Nial I really needed this wake up call.

good article…thanks !!

Nial

Thanks for such a simple plan to follow.

I believe I am on the right track as I already follow the majors in the list. No to de clutter the screens and only follow the daily chart, get rid of the rest. Set up New profile in mt4 on Sunday and of we go on Monday. Let the challenge begin.

Thanks again Nial

Gary (clueso)

Dear Nial,

Your concepts are not only useful for trading (brilliant), but also so valuable for whole life. thank you very much.

Gold….literally

I pledge to follow the simple trading plan.

/s/ George B

THANK YOU

You understand everything about trading

SIMPlCITY and DISCIPLINE

We are ALL so lucky to know you

Thank you so much

thank you soo much!!

your lessons weekly is very helpfull and motivational!!

you are the guy!!!

whats WTI market? Thanks, A.

Nial,

believe it or not i exactly follow this plan and same currencies you have mentioned, i dont even look at 4 hours. And seriously it has improved my trading and i have been profitable ever since.

I will try the seven steps with discipline and patience. thank you to teachers

Excellent article just at the right time. I’ve been trying to stick every of above mentioned points for a while, but I’ve never put it together and sticked to it. After this lesson, I’ve made new charts and made the commitment for the upcoming 2 months. Thank you, Nial.

A good and sencirely advice always.Love your artiicle and a must follow guideline Thankyou,Nial.

Thanks Nial again! Love the simplicity.

great nial. hope we could all stick to these clear steps.

Dear ‘Prof’, the major mistake I have always made until I started reading your lessons was placing trades at random. Any trade I takes that is not planned out on the basis of daily signal has always been a loss. Until I started trading daily set up that I started making profit.

All your Lessons have been a great treasure for me. Thank you.

Very thoughtful and educating,I have been following all the steps for month and is working seriuosly for me.

Thanks You so much Nial

Dear Niall,

Can you guess how many trades will be triggered weekly and monthly if one uses PIN BAR entry method?

Spot on Niall. I was getting nowhere myself until I really starting getting the discipline as described above. Then I went from having a good day, then a bad, good, bad, etc, to looking at longer monthly or weekly targets and improving my $ and pip take along the way.

There are umpteen trading strategies that really work (inside bars, retracements, pullbacks, pins, engulfing candles etc etc) and for sure why they don’t is the actual trader themselves. That’s where I was a while ago – getting nowhere until I took stock of what I was doing, then started applying your approach to discipline. I trade different setups, but I realised that it’s down to me, not the magic forex fairy, to really make things happen.

Hi Nial,

This is all I want a guide to follow thanks great topic.

Thanks Nial for your good advice. Simple plan makes life and trading much easier!

I’m in on this one! Get back to you in two months time…thanks for all the great articles in this site! Happy and safe trading!

Nice one Nial. Always a pleasure to read your material

Thanks Nial

This is great. I just wanted to comment on step 2 of the plan. It’s true what you saying here and I have proved it myself. When I started following your tip, this was the first tip I implemented on my trading strategy, I have been trading EURUSD on a clean daily chart with only my supports and resistance. This has increased my winnings.

Dear, Nial your way of trading has helping me a lot now you have come with this simple but at the same time very difficult plan for some people to follow including me, my major problem is discipline and confident I analyzed the market well but when it comes to place the trade a bunch of silly ideas cloud my mind even if the signal is clear there is always a big ‘WHAT IF” on the back of my mind avoiding me to be confident I’ll follow this plan to see if I can control myself

Eternally grateful to you

for all your help

God Bless

thank you master. still another good one as usual. thanks, thanks.

Really Good one

Thanks Nial.

This is antidote to clear the toxin in the trade.

cheers

…Your lessons Nial Fuller and time spent on Learn to Trade the Markets will not be futile

I am ready for the challenge and i will commit to my trading plan.Your lessons Nial Fuller and time spent on Learn to Trade the Market..I will learn to trade the markets successfully and profitably.Thank you mentor