Are Expectations Destroying Your Trading Account?

Instant gratification is something we all enjoy; the sooner we get what we want, the better we feel. However, in trading, we don’t often get what we want exactly when we want it. The innate human desire for instant gratification is the destroyer of many traders’ accounts, and maybe it’s even destroying yours right now.

Instant gratification is something we all enjoy; the sooner we get what we want, the better we feel. However, in trading, we don’t often get what we want exactly when we want it. The innate human desire for instant gratification is the destroyer of many traders’ accounts, and maybe it’s even destroying yours right now.

Trades often take longer to play out than we expect, and this causes a lot of problems for traders. We are wired to want to be rewarded right away, this is why people get addicted to things that are bad for them like drugs and gambling; these things provide them with instant gratification, or a ‘quick fix’. However, as you are surely aware of, what feels good is not always good for us, and this is especially true in trading.

Expectation is often the enemy of trading success

Trades do not often play out exactly as we want them to. This plays with our emotions because as I mentioned above, we are all naturally wired to want instant results. Thus, there’s clearly a clash between what we expect from a trade and from what a trade usually gives us. Indeed, many traders expect some unrealistically large profit on nearly every trade they take, so they place profit targets that are 500 pips away from their entry and then when this target inevitably doesn’t get hit, they experience emotional pain and distress.

Similarly, traders often have unrealistic expectations of how long a trade will take to play out. Hey, I’d like every trade I enter to immediately hit my profit target as much as the next guy, but that just isn’t reality. A trade can sometimes take weeks to play out, you need to keep this in mind because you will never make big money in the market if you don’t give the market time to move in your favor. Some of the greatest hedge funds will take positions and ride trends for weeks, making millions as a result, this is a clue to how big money players behave in the market.

Next time you place a trade, you should be prepared to see it out and let it run for days or weeks if need be. Don’t get scared by an intra-day fluctuation against your position and exit too early, as you may miss out on a good move or a strong trend run.

It’s also very important that you understand that each day and each week the market can only move so far, so don’t have unrealistic expectations of how far your trade might move in a certain period of time…

How the Average True Range (ATR) can help your trading

There’s a technical tool that can help you approximate how far a market may move in the coming days and weeks. It’s called Average True Range or ATR, and it is a volatility indicator that can give us an idea of how much price movement to expect in any given day or week. Simply put, a market experiencing a high level of volatility will have a higher ATR, and a low volatility market will have a lower ATR. The ATR shows us how far a market is moving per day (or whatever time frame you have it applied to), from the day’s low to high (daily swing).

For an in-depth tutorial on how we use the ATR tool you might want to read this article here.

The ATR is not an ‘exact’ forecast of how much a market will move, rather, it shows us how much the market has been moving recently, in other words, how volatile it has been. This is important because it does provide us with a good approximate price range to expect the market to continue moving within for the days or weeks ahead.

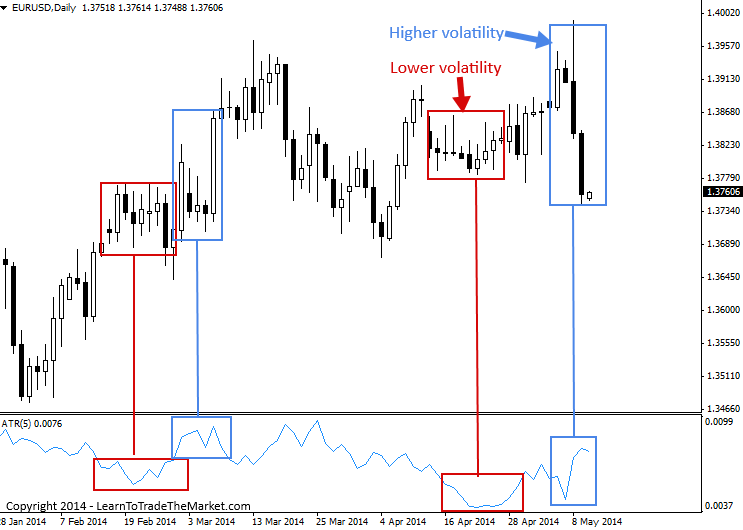

Below is a daily chart of the EURUSD with a 5-period Average True Range indicator in the lower pane.

Notice how the ATR decreases in value as the volatility of the EURUSD decreases, and increases in value when the volatility increases.

I will generally use the 5 period ATR, but 5 days may be pushed out to 7 or 10 on a daily chart, however I usually stay at 5, especially for a weekly chart. 5 days of data is one week on the daily time frame, and it’s an accurate picture of current market volatility.

The ATR can help us understand current market volatility, and this can help us plan stop losses and targets. Obviously, you won’t want to place your stop loss inside the current daily ATR range, because your trade needs room to move.

The ATR can help keep your expectations in-line with reality, because it’s a reminder that a market will only move so far per day or per week, statistically speaking. For example, let’s say you’re in a trade and up 180 pips on the GBPUSD and that week the market has moved 200 points from its low to high (or vice versa), and the ATR tool shows the weekly average range is only 200…it’s a clue that the move for that week may be over and that you shouldn’t be greedy and expect more; it may be time to exit.

You can combine the ATR with key chart levels for stop losses and targets as well. If you see a key chart level that is opposing your trade, and you’re already up say 120 pips on a trade and the ATR for that week is 150, well then the approaching key level combined with the fact that you’re approaching upper limit of the recent ATR weekly range, is a good clue that you should ‘take your money and run’.

It’s important to note, the ATR is not a ‘hard and fast’ tool, but rather a guide that can help keep you grounded and help keep you in reality and out of ‘dream land’. I also want to be clear that the ATR is not an indicator for entry or exit, but it’s a tool to help you see market volatility and the average recent ranges of a market, to help you plan and manage your trades.

How to apply the ATR tool in In MetaTrader 4 Platform:

(Note: you can download mt4 charts here)

1) Click on in the ‘insert’ drop down menu at the top left.

2) Then select ‘indicators’ for the drop down menu.

3) Next select ‘Average True Range’ (should be first one)

4) Then you just need to select a color for the ATR and input the period. I like to use a 5 period ATR but will sometimes look at the 7 or 10 period ATR as well

Accept the consequences of your trade BEFORE you enter it

In trading, it’s critical that you get your expectations in-line with reality, as we mentioned above. This means taking a realistic and logical approach to things like stop loss and target placement (ATR can help with this as discussed above), and not expecting a ‘homerun’ on every trade. It also means not expecting a winner every time you trade. The best traders in the world still have losing trades and many lose 50% or more of their trades. What they know is that money management, patience and discipline is how you make big money in the market, and these things are naturally at odds with our innate desire for instant gratification.

Ignoring what feels good at the moment, is a skill you’ll need to develop if you want to attain long-term trading success. This includes having patience to let trades play out, as they often don’t play out as quickly or seamlessly as we would like. You need to learn to avoid bailing on a trade at the first turn against your position, the market ebbs and flows, and moves against your position are a normal part of trading. You need to develop a plan before you enter the trade, and stick to it, don’t become overly-influenced by the normal daily fluctuations in the market. If your trade plan is still valid and makes sense, then you need to let the trade play out if you want to see your edge work for you over time.

Using the ATR, as described above, can help you control your expectations of a trade and keep them in-line with reality. However, I’ve found that what can help even more, is to simply take some time BEFORE you click that buy or sell button, and really accept the consequences of the trade you’re about to put on. You have to be OK with losing the money you are risking, so you need to really consider your position size before you enter that trade. Is the dollar amount you have at risk an amount that you’re willing to potentially lose for the opportunity to see if your trading idea plays out in your favor?

If you accept the consequences of your trade before you enter it, you will not be as affected if the trade takes longer than you expected or wanted it to. You will be more apt to sit there patiently and just let the market do its ‘thing’. Most of the time, interfering with a trade while it’s live is a bad idea. I’ve found over the years, that just sticking to my original trading plan and letting the trade play out either for a stop out or a profit, is the best route to go. I call this ‘set and forget’ trading, to learn more about this trading technique, checkout this article on set and forget trading. As always, feel free to email me here if you have any trading questions.

Well Said Nial.In fact I just lost a big chunk of my account this weekend just because I became greedy and didn’t obey my own trading rules.It is easier said than done.The battle is not against the market, it is against my nature.I only wonder how long it will take me to overcome myself.Life continues.Tomorrow will be better.Cheers!

I will try this new tool it look very useful, i moved through the expectation struggle and day dreaming lol, thanks Coach for the lesson, Keep the good Work.

wonderful stuff. thanks

Good stuff nial. I look forward to your lessons each week. Glad you are constantly giving us new tools to look into like the ATR. Peace

Hey Nial, I just wanted to thank you for everything you do. I’ve been a member for a little over a year now and I can’t believe how much on-going value you continue to provide us. The new course version is awesome, so many in-depth examples and explanations. I love it.

You set the bar high and we are following you to that high

Thanks

great article, thanks Nial

so with ATR we can use to help set stop loss distance and profit? thank for article nials

Absolutely … The daily ATR distance is a clue for the minimum stop distance on daily chart setup.

Each week you provide us with such valuable lessons Nial, I can’t thank you enough. My experience on your site and of being a member has been nothing but positive. I still can’t believe how much you provide for such a small fee. I spent thousands of dollars on other training services before but I didn’t really learn anything useful about trading until I found your site.

Thanks Nial. I really enjoyed reading this and learning about average true range. I can’t believe all the information you share on your site and all the in-depth training you provide in the members area. I’m so glad I stumbled upon your site while searching google about forex trading!

Another excellent article Nial. I have heard about the ATR before but never really knew what it was for until now. Should we use this on every trade to help us place our stop losses and profit targets?

Nice Article. I am proud to be a part of the community. The website rocks! Awesome work. Kudos man!

As always !. A great article.

Many thanks Nial.

Alf.

What I like about Nial’s writings is that it is always very simple. Clean writing, Clean charts, Clean mindset.

Unlike the dirty and chaotic approaches popular elsewhere. Nial is a true forex mentor and a good leader.

Hi, this article is great. I have left trades only to see them go in my favor. I will never do that. Best advice ever!!

Thanks coach, indeed an insightful article. Love your teachings!

i love the way you teach.Thanks.

Hello NIAL,

As usual, one of the milestone article ever. Thanks for the article.

hi boss thanks for your articles I am a true believer of what u write.

nice article Nial, i really love your articles