The Key to Lasting Forex Trading Success

Today’s lesson is going to ask you to dig deep within yourself and ask, “How bad do I want this?” How bad do you want to become a successful trader? Are you willing to do whatever it takes, even if that means significantly changing how you think about trading?

Today’s lesson is going to ask you to dig deep within yourself and ask, “How bad do I want this?” How bad do you want to become a successful trader? Are you willing to do whatever it takes, even if that means significantly changing how you think about trading?

Most people find change very difficult. There are things involved like egos, pride, being lazy, etc. But, the simple fact is that change is the first step toward putting a ‘cork’ in your old trading habits which have been destroying your account, and getting on the path to trading success.

What follows is a brief discussion of why and how you need to change your thinking to succeed at trading. If you read this whole lesson and really make the change to your thinking, you will experience a significant improvement in your trading experience and performance.

First, you need to change how you think about trading

One of the things that gives traders a lot of trouble, is getting too attached to any one trade. In fact, you should have zero emotional or mental attachment to any one trade you take.

As I discussed in my article on randomly distributed winners and losers, whilst your trading edge might have a certain winning percentage, let’s say 60%, you need to understand what that means…

What a 60% winning percentage means: It means that over a large enough sample size or series of trades, you can expect to win about 60% of the time.

What a 60% winning percentage does NOT mean: It does not mean that any one trade has a 60% chance of being a winner.

Many traders get confused into thinking that ‘this’ trade will be a winner, or even that ‘this’ trade has a 60% chance of winning, when in fact this is simply not the case.

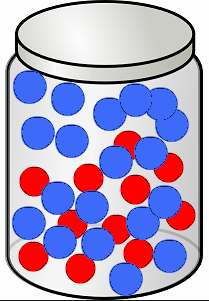

To think about this from a different perspective, imagine a large jar of marbles of two different colours, let’s say red and blue. Let’s say each marble represents a trade that you took, there are 100 marbles total, 40 red and 60 blue. The red marbles are losing trades and the blue marbles are winning trades. So, you have 60% winners and 40% losers, when translated to your trading method, this shows that you can expect to win 60% of your trades.

To think about this from a different perspective, imagine a large jar of marbles of two different colours, let’s say red and blue. Let’s say each marble represents a trade that you took, there are 100 marbles total, 40 red and 60 blue. The red marbles are losing trades and the blue marbles are winning trades. So, you have 60% winners and 40% losers, when translated to your trading method, this shows that you can expect to win 60% of your trades.

HOWEVER…here’s where the thinking part gets tricky. If you shake up that jar of marbles so they are randomly distributed within the jar, and you stick your hand in blindly and pull one out, you don’t know if it will be a red or blue marble. Thus, you would not be ‘expecting’ a blue marble, because you know there are red ones in there as well, randomly distributed.

This is how you need to think about your trades. You need to think about them being randomly distributed events, even if you expect to win 60% or even more, over time. Once you begin to realize that any given trade has an equal chance of being a winner or loser, you will stop giving too much emotional and financial importance to any one trade. Once you do this, it opens up the pathway to carefree trading and allows you to truly induce the proper trading mindset.

I get emails from traders telling me they are ‘excited’ about a trade setup. This makes me cringe because it implies they’re expecting something from that trade setup, they’re expecting it to work out for them. But, they shouldn’t. They should have no expectation of any ONE setup, because each setup has a random outcome. It’s the SERIES of trades while trading our edge (price action) that gives us a chance to make money.

When you remove all expectation and attachment to any one trade, you automatically begin to do other things properly, like managing your risk properly and not fiddling with trades after they’re live. Because you realize that each trade setup may or may not work out, you don’t want to over-commit to it and you don’t want to get in its way. You risk an amount you’re OK with losing and you let the market do ‘its thing’, because you’re just letting your edge play out over a series of trades.

Think in probabilities to avoid emotional trauma

Think about a slot machine for a minute. You put money into a slot machine knowing upfront that it’s a random event, so you have no real expectations of winning or losing on any pull of the arm. Thus, expectations of the outcome of a slot machine are in alignment with the reality of the event itself.

In trading however, you see a pattern form in the market and because maybe the same pattern worked for you last time you start to expect that it will work again this time. Once you commit to this way of thinking you are setting yourself up for potential disappointment and emotional trauma. You are forgetting that each trade has a random outcome that is unconnected to your recent trades. Just because this same exact pin bar was a winner before, does not mean the next one will be, even if it’s exactly the same.

Now, obviously if you have an effective trading edge like my price action strategies, you can greatly improve your chances of a winner over a slot machine, but still, the outcome of any one event (trade) is random. So, you cannot allow yourself to be affected by the result of any one trade.

This trade has no influence or connection to the next trade. If this trade was a loser, the next trade might be a winner (or loser) and if this one was a winner the next one might be a loser (or winner). If you have a 60% win rate on your edge, remember that it is realized over a SERIES of trades, and that might mean you have 5 or 10 losing trades in a row. It doesn’t mean you panic though. You stick with your plan and strategy and you keep taking the trades as they form, because you need to trade a large enough sample size to see your edge play out.

Your goal should be to eliminate the potential for the market to disappoint you by realizing that trading is not about being right or wrong. This is how you to need change. You need to eliminate any potential for disappointment from your trading by thinking in probabilities. Remember the jar of red and blue marbles the next time you enter a trade. You are simply blindly dipping your hand into the marble jar each time you take a trade, so don’t expect to pull out a blue marble, just know that it will be EITHER a red OR blue marble, and that once you pull them all out, you will have 60 blue (winners) and 40 red (losers). IF you can do this, you will be thinking in-line with how the market actually exists and you will be putting yourself in position to profit from the market, rather than getting battered by it like you probably are now.

How to eliminate trading mistakes and start making money

All blown out trading accounts are the result of a snowball effect of trading mistakes. You get too attached to a trade that you ‘just know’ looks ‘so perfect’ it ‘can’t possibly fail’, and so you double up your risk or triple it, hoping to hit a ‘home run’. When that trade then fails, you experience severe emotional trauma and frustration. This causes the snowball effect to begin. You start feeling mad that you lost, you get angry, so you jump back into the market and risk even more, hoping you make back your lost money. This can go on and on until you blow out your account, which doesn’t take very long.

All blown out trading accounts are the result of a snowball effect of trading mistakes. You get too attached to a trade that you ‘just know’ looks ‘so perfect’ it ‘can’t possibly fail’, and so you double up your risk or triple it, hoping to hit a ‘home run’. When that trade then fails, you experience severe emotional trauma and frustration. This causes the snowball effect to begin. You start feeling mad that you lost, you get angry, so you jump back into the market and risk even more, hoping you make back your lost money. This can go on and on until you blow out your account, which doesn’t take very long.

The point is, all of this emotional strife and frustration and the snowball of trading mistakes it causes, can be AVOIDED by changing how you think. That is to say, by thinking about your trades in terms of probabilities, as discussed above, you will circumnavigate the main reason most traders lose money; expectation.

Think about when you were demo trading. You probably did awesome, as many forex traders do. Why did you do awesome? Because you had the right trading mindset… You had no real expectation about any trade because no money was on the line so you didn’t care if it that particular trade lost or won. That’s it right there; you have to not care if you lose or win on any one trade, and you do that by thinking in terms of probabilities. IF you can do that, you will be well on your way to finally making consistent money in the markets.

As always, if you have any questions please feel free to contact me here.

Please leave your feedback below and remember to share this article.

good trading,

Nial Fuller

Patient move mountain…. Thanks ????

Cheers!

This randomness in a market means one has to have patience because you have to wait for your winner because maybe the last few trades were losers so this means one must be patient and avoid the fact of always judging the market outcome because that is beyond once ability trade your edge and let the market do the grinding to give you the outcome after following your plan.

Excellent lesson, Nial, as always.

The example you gave of the large jar of marbles has helped me shift my understanding of randomness per trade entry. Finally, after 12 years, I fully understand what Mark Douglas meant in ‘Trading in the Zone’ when he expressed the fundamental rule that anything can happen at any time in the market. Your explanation was easier for me to understand.

I will never place another trade entry with any expectation other than the marble might be red or blue and I won’t care, as long as my setup is shouting loudly to make the trade.

Thank you.

Unique article! It needs to be re-read constantly as a mantra. Thanks

Hi Neil,

I have followed you for a long time. I totally agree with your philosophies

Pete

Nial, your blogs help me tremendously. It is very obvious that you have a real command over this subject matter, thank you

your lessons are very rewarding

We should not get emotionally attached to any single trade..

Thanks Prof. for another great article.

good information,have much to learn,thankyou for giving your time to and knowledge freely

Talk of hitting the nail in the head. I think this will help me overcome my fear of trading, being afraid to be wrong. THANKS NIAL

Sanjay,

Confidence to pull the trigger comes from following your trading plan (if you have a plan, if not stop trading immediately).

If you have a trading strategy that is profitable, verifiable and repeatable and you would know this through hours of back testing.If you see your set up form then enter the trade according to your plan and don’t deviate from the plan, over time should see results. Just my 2 cents.

a good one Mr fuller”things are not always what they seem in the market ; They sometimes become opposite of what you expect them to be.

im so grateful, having you as a coarch.

I say thank you once again.

Dear sir,

After i saw your website, my trading approach was totally changed.Now i turn out to be a winner rather than loser.Thanks a lot sir for your set and forget approach.Really this is the one that changed my trading career.Great work sir.Keep it up.

Thank you for the best information…

thanks to wonderful articles, always learning to Nial.

You are cool as ice. Thank you Nial.

As we used from you, Nial !

You always dissect the matter& get to the point right away on the face,

What is remaining is :

JUST PICK THE JEWELS& FOLLOW NIAL THOUGHTS ON THE WAY FOR A BETTER TRADING.

Good day, Nial! When I set a pending order, think about the advantages and the risks to my position in the specific market situation. I appreciate its advantages 70-80%, so expect to succeed. But, in the process of price movement I force myself not to intervene in the development of the transaction. It’s hard. I convince myself to believe that my original decision to open position was correct. And usually it helps.

You are so right . I have only realised this of late and have been trading using this exact philosophy. I have been making consistent profits over the last month while also having several losing trades. It is early days but I am very excited using my present strategy with this philosophy. So far so good. I like the way you think Niall. You have a very common sense approach to trading without all of the B S you hear from other coaches. Keep it up.

Paul

Hi Nial,

Nice to have your new article in my inbox.

Obviously, you’re one of a few good men in the forex trading world that share your most valuable thought and knowledge to others. I’ve read most of your articles and always waiting another new one. Thanks Nial. God bless you…

All your article reshaping me toward becoming a pro trader. Thanks Nial.

Thanks Nial. It was very helpful.

Right, we should change how we think about trading. Trading should be enjoyable work for us.

As always Nial your articles are the best. Seriously they are good in lots of ways even outside the realm of Forex.

Hi Neil,

Seriously, I like all of your articles and no doubt on that. Thank you sharing mate.

Niall, we agree on a lot of things, but I disagree that each trade is random. There is definitely skill involved in reading the charts, so when I open a trade, I opened it because I think that the market is going to move in my favor, not because it’s going to move randomly. It’s true that the market will move irregardless of my prediction and that I shouldn’t be emotionally attached, but it’s definitely not random.

The idea is that when trading your edge (pattern or signal etc), the ‘outcome’ of each trade is random, as you don’t know if each particular trade will be a winner or lose. I never suggested that placing a trade was gambling or random.

Hello Justin. I think you may have misconstrued the meaning of randomness as explained correctly by Nial. An event is by definition random because its outcome is unkonwn at the time the decision was made. Therefore, each trade is random by nature because its outcome is unknown at the time the decision was made to take the trade, regardless of your belief or personal opinion on how that particular trade will evolve over time. It is the possibility of any outcome to come true that makes it possible for us traders to hope to win over a long series of trading decisions.

Nial, your articles are alwas spot on. Finally i have started making consistent money by following your price action lessons. Tanx alot

Great News Letter !!!!

thanks for the article i ve been eager to join your Forex trading training but i don’t have enough money to pay, nevertheless, i ve been following all your great article and it has improved me allot.

thanks and god bless you

Learning every day and sometimes the hardest lessons are the ones that cost the most in lost funds…

As always….the best of the best information.

Nice!!!! Is hard to think is only money when you losing, but we need to! Thanks so much, good lesson.

Thank You.

Mr Nial, you’re indeed a mentor and model to emulate in your approach to FX Trading . I’m glad to be part of this great website of yours .. Thanks for your efforts in making others to succeed

Great read Nial’s.

I agree 100% with what your saying!

Everyone should read this article every Sunday night

before the week starts. (Trading In The Zone).

Gary

Vancouver, BC Canada

5 star lesson!!

Mark Douglas couldn’t have said it any better himself.

Great article.

I am just one week into your lessons and study of your articles. But my performance in forex has dramatically change. I make persistent profit as I follow your posting daily. Thanks for this wonderful job.

As always a magnificent article .

This is what I would call a great teaching lesson

Thank you Neil for your dedication and your knowledge.

Alfredo Garcia.

very helpful trading lesson

Thanks Nial. God bless you loads.

Good one; then trading in the market is a deep river. We just have to be nuetral about its effects.

Well! that is all truth about trading. we can only change our self and not market. I believe in all wrote in there and hope we can put all that to use. You trade the strategies i love most wish to have financial capability to be in your circle. Thanks again for writ up.

Great article Nial. Right in line with how I approach trading and it is good to be reminded that you can have 5-10 losers in a row within a 60% overall success rate. You can also even out your results by applying your edge across a number of currencies, commodities and stock indices, with small position sizes in each. The analogy of a casino operator comes to mind – taking out the house advantage from a large number of players, tables and games.

Nice article Nial. After reading your articles I am trying to follow them. Even if I found good setup I fail to enter the trade. Watching it sitting on the sidelines. This is my problem. Need to overcome it in coming days.