How to Build Your Own Forex Trading Plan

I get a lot of emails from traders regarding Forex trading plans, and from reading these emails I have found that most traders either do not have a trading plan, make their trading plan too complicated, or don’t know how to build one. So, today’s lesson is going to provide you with some insight into exactly why you need a Forex trading plan and then I am going to give you an example trading plan so that you know how to build your own. Let’s get started…

I get a lot of emails from traders regarding Forex trading plans, and from reading these emails I have found that most traders either do not have a trading plan, make their trading plan too complicated, or don’t know how to build one. So, today’s lesson is going to provide you with some insight into exactly why you need a Forex trading plan and then I am going to give you an example trading plan so that you know how to build your own. Let’s get started…

What a trading plan is and why you need one

First, a trading plan should be thought of as a template for trading the markets. Perhaps an even better way to describe a trading plan is that it is a check list. This check list will contain each aspect of making a trade in a logical step by step sequence that acts as your objective guide to trading the markets. In essence, a trading plan will state your overall short and long-term goals as a trader and will provide you with a clear check list of how to achieve them.

Note: Do not think your check-list / trading plan has to be ridiculously long or detailed. After you have mastered an effective trading strategy like price action trading, you will be able to consolidate all aspects of your trading method into concise components. Once you do this you will have created your check list / trading plan that acts as your guide to decide if you should enter a trade or not, your check list can contain words and images and we will see an example of one below.

The reason why you need a Forex trading plan is because you need a way to make sure you do not trade based on emotion. Trading can be an intensely emotional profession, and if you do not follow an objectively constructed trading plan that pre-defines all of your actions in the market, you are almost certainly going to become an emotional trader, also known as a trader who loses money.

Perhaps the most beneficial thing a trading plan does for you is that it keeps you out of second-rate / uncertain trades and uncertain market conditions. This will naturally lessen the amount of losing trades you endure which will improve your overall winning percentage. Many traders end up ‘running and gunning’ in the markets instead of learning to trade Forex like a sniper, and the reason they do this is because they haven’t set aside the time to create their own effective trading plan. I am telling you right now that the fastest route to increasing your profits is to trade with less frequency and with higher quality, a trading plan will naturally aid you in this endeavor, now let’s look at the various components of an effective Forex trading plan:

Components of a Forex trading plan:

These are the necessary components of a Forex trading plan, you can add more if you like, but don’t get too carried away otherwise your plan will become too long and complicated for you to follow. I will give you examples of each of these in the section that follows:

• Begin your trading plan with a positive affirmation that you read aloud

• State your short-term and long-term goals in trading the markets

• Define your trading strategy and all aspects of how you will analyze and trade the markets

• Define your money management strategy, this includes things like risk and reward per trade; what reward is realistic given the market conditions? What dollar amount am I OK with losing per trade? What’s my long-term strategy for withdrawing money from my account…how much money do I want to withdraw each month after I become profitable?

• Miscellaneous components to check: things like, major currency pair, trading time, news events, etc

• Make yourself double-check everything before entering the trade, and ask yourself this question “Is this trade jumping off the chart at me basically telling me I’m stupid if I don’t trade it, or did I have to think about it for an hour and justify the setup by reading 20 different Forex blogs?”

• End your trading plan / check list with another positive affirmation.

An example Forex trading plan:

(Note: this is a hypothetical example, the numbers are arbitrary, but you can use this as a template to make your trading plan. These are not the personal details of my trading plan but do reflect the general layout of my trading plan. You may wish to add other components to your checklist as this is just a general example of what one might look like.)

Forex Trading Plan

• Daily trading affirmation:

“I will never enter a trade without first consulting my trading plan, because my trading plan is what keeps me objective and eliminates emotion from my trading, and that is what will make me consistently profitable over the long-term”

“When I enter a trade, I will not touch the trade or edit the trade, removing all emotions and remaining firm on my initial observations”

” I will never trade over my risk threshold and will stick to my pre-determined $$ risk amounts”

• Trading goals:

Short-term trading goals: To make consistent profits each month and supplement the monthly income from my job. To be a patient and disciplined trader who follows my plan.

Long-term trading goals: To build my trading account up to $25,000 through mastery of my trading strategy, patience, and the discipline to follow my trading plan every time I trade.

To avoid over trading, be patient, remain disciplined and stick to my plan always.

• Forex trading strategy:

This is the process I will use to scan the markets for potential price action trade setups:

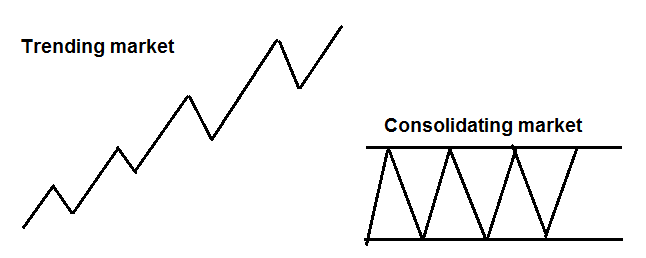

1) Analyze the market conditions: is the market trending or consolidating? – You need to first determine what condition the market is in. I teach traders how to identify trending and consolidating markets in my trading course, but, basically you just need to identify the general direction a market is moving and try to trade with that direction. We are looking for higher highs and higher lows in an uptrend and lower highs and lower lows in a downtrend, also, I teach how to use the daily 8 and 21 EMAs to identify near-term market momentum. For consolidating markets we are looking for a market that is consolidating between an obvious support and resistance level. So, in your trading plan you might have a picture like this or similar to remind you of what you generally should look for:

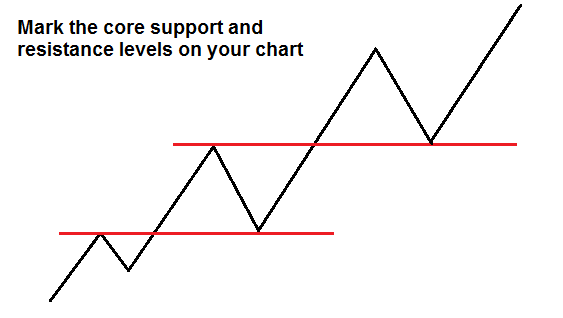

2) Determine the core daily support and resistance levels and draw them on the charts: – After you determine whether the market is trending up, down, or consolidating sideways, you need to draw in the core support and resistance levels on the chart. These are going to be the confluent value areas that you watch for price action strategies to form near to trade back in the direction of the dominant market momentum, or in the case of a consolidating market, towards the opposite boundary of the range.

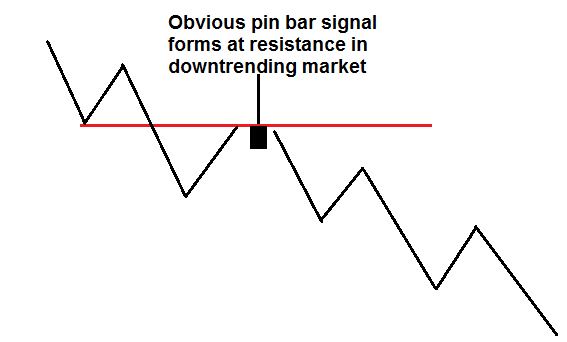

3) Look for price action signals that have formed at confluent levels in the market, make sure to trade only very obvious and confluent setups: – You have to know exactly what price action strategies you are looking for before you build your trading plan. Below we see an example of a bearish pin bar strategy in a down trending market. You should have images of ‘ideal’ examples of each trade setup you plan to trade within your trading plan, this will help to remind you what high-probability setups should look like.

• Money management:

4) What is the most logical stop placement on the trade setup? What dollar amount am I 100% OK with possibly losing on this trade setup? – Remember, we want to always calculate risk based off dollars, not pips or percentages, to read more about this point, check out my article on measuring risk reward in dollars.

5) What is the most logical exit strategy or reward placement on this trade setup? Is a risk reward of 1:2 or greater logically attainable given the current market conditions and nearby core support and resistance levels?

• Other considerations:

6) What currency pair am I considering trading? Is it a major pair: EURUSD, GBPUSD, AUDUSD, USDJPY, EUJPY, GBPJPY, USDCAD, USDCHF, NZDUSD? (see this article for the best forex pairs to trade)

7) What trading session did this setup form during? Did it form during the European or New York trading sessions which are the most important, or did it form during the quieter Asian session (see this article for the best times to trade Forex)

8) Did I check Nial’s daily members’ market commentary to see if I am analyzing the markets in-line with what he teaches? Also, did I check Nial’s important upcoming economic news to see if an important release like Non-Farm payrolls is about to be released?

• Double-check the trade setup:

9) Make sure you only trade obvious setups – “Is this trade jumping off the chart at me basically telling me I’m stupid if I don’t trade it, or did I have to think about it for an hour and justify the setup by reading 20 different Forex blogs?” – Ask yourself this or a similar question before you hit the buy or sell button

Conclusion:

I hope you now have a better idea of how to build your own Forex trading plan, how it can be structured and what types of components it should contain. There really is not much else I can say to reinforce the notion that creating and using your trading plan will allow you to achieve your goals in the market much quicker than if you don’t have one. You really have to believe me on this and stop trading without a trading plan. You would not start or run any other business without a proper business plan in place, so why do you think you can trade successfully without a proper trading business plan?

Once you put your own trading plan together you must ensure that you actually use and follow it each time you interact with the market, this will work to reinforce positive trading habits like patience and discipline, and it is these habits that will make you money over the long-term. If you have not yet mastered an effective trading strategy like price action to forge your own Forex trading plan from, you should check out my price action Forex trading course and members’ community.

I have bought Nial Professional Trading Course about 10 years ago, and every time I go through it I always find new leads and ideas. Those were the most wisely spent dollars in my trading studies.

This is a great article especially on confluence in the daily charts this helps one to avoid the smaller time frames which leads to market reversals and adrenaline trading which very much stressful.In money management always consider risk before you enter a trade because the outcome may lead tp profits or losses and that is fact .Thanks a lot Nial Fuller.

I will study the template given in this article and follow the execution in my trading. Thanks to the esteemed Coach Nial I have learned again!

So much free information here, thank you for the opportunity you’ve offered us.

I SO MUCH APPRECIATE YOUR EFFORTS TO THESE ARTICLES, I HAVE LEARNT A LOT FROM YOU, I HAVE IMPROVED IN TRADING 10 TIMES LIKE BEFORE

THANKS SO MUCH NAIL

I always look forward to reading your articles. I always learn something that improves my trading.

You are one a million Niall. Devoting a great deal of your precious time in teaching us the way forward completely amazing and commendable. All I can say is thank you Sir for you kind gesture. Remain everly blessed. Uchechukw Megarich Nwankwo.

Since joining Dec 2017 Nial has helped improve and sharpen my entry exit skills to the point where now I trade as a full time trader.

I always look forward to reading your articles. I always learn something that improves my trading. In the near future I plan on taking your course. I took a course 3 years ago it wasn’t even nearly as informative as yours. Thanks to your articles I know what kind of trader I am based on my personality. You’re awesome at what you do.

Thanks heaps Nial

Last one year I’ve been reading and study all your articles mate ( recommend by my frnd) you are one of the best teachers in this industry. Keep doing the good work. Cheers Nial. You’re the best!

Thank you Sir Nial for this Article , this is a very big help for me ….

Great article Nial! This was very helpful in creating my trading action plan.

It´s perfect

Thanks for guiding us sir,

it may be too late for me finding this article, but surely obey ur instructions sir

It’s going to be ending of mine day, but before finish I am reading this impressive article to improve my experience.

I have to restart again, First build a Plan

Want to be professional, so have to do like professional.

Nial, I bring you results!

Thank you so much I will built my trading plan.

“Begin your trading plan with a positive affirmation that you read aloud”

I agree, that a trading plan can be shortened into a single trading mantra once you get used to it.

I like this post. Thanks for sharing

Your article are so great that I have to note it immediately in my notebook and stick it on the wall to review every morning. I hope to read the more perfect article from you.

I cant tell you well enough how your articles have improved my trading.

Thanks so much and soon ill join you i the members area.

Amazing article!

Thanks Nial. I am revising my plan in light of this article.

Thanks Nial, you have made everything so Mich clearer and simpler with this article!

it had to be said u hit the nail on the head.

thanks for an excellent site.

I hope i can put this to good use. of all i have read and heard, this method look more applicable than any other. Thanks Nial.

Hi Nial,

Hope you are well. Thank you for another fantastic and priceless lesson.

Thank you for all your help

Thanks and Regards

Gurpal

Thanks Nial for the wonderful outline of a great trading plan. One knows one must have one but as yet I have never ever actually written mine down in this form. I will start on it immediately and I am sure that this will help me to become more consistant.

A truly super New Year gift thanks a million

The example of a real life trading plan is a great help. Many articles talk about a plan in a general way but your article gives a practical structure on which to build a personal plan.

Brilliant, this will help me a lot, thanks Nial

Nial Hello, Thanks for this very important lesson about trading plan.

It was just what I was looking for, a big thank you for your teachings.

Denis

Hi Nial

thanks for your help as always

Hi Nial,

Happy New Year!

Great write up! I certainly will incorporate this in my documentation of my unwritten and harphazard plan, finally this month. Please i also need you to write something on the proper use of trading Journal and how they can lead to the amendment of trading plan.

Again, how often should trading plans be changed

Regards, sodiase

THANKS .THIS IS VERY TIMELY AS AM DET PREPARING MY TRADING FOR THE YEAR GOD BLESS YOU. THIS LESSON IS VERY Valuable one

Thanks Nial. This helped me a lot to write a good trading plan. Now I have one and I’m going to trade with it.

Happy New Year Nail. This is a very good start of the year. Your strategy is quite good followed closely on price action. I have there before followed and earned myself some good amount, but i need to be consistence. That’s the challenge i have. To follow my trading plan, i keep changing and sometimes i am not serious on following whichever the trade plan i have. Its high time i do it this new year. Thanks for your education.

NIAL! Thank you for another VALUABLE Lesson. Yours is

a great service from AUSTRALIA—Please keep it coming.

I believe,it will surely change the fate of those ,who

would follow it in letter & spirit.sincere REGARDS, AMIN

Excellent! Thanks

You are my mentor infact God sent angel pls dont stop posting your lesson to me so helpful thanks

I considered myself an ingrate if i refuse to let you know that you are my mentor pls l want you to coach me but currently am not financial sound to pay for your course llove you so much thanks alot

Thanks Nial.

Trading plan are really important to follow

Timely lesson for me.

Nial,

This is a superb offering to your trading community. It is invaluable and I am sure it will make an incredible difference in my trading as well as others who might have needed a better trading plan.

Cheers,

Taf.

Nial i love your analysis pls keep coming THANKS

thanks nial

Thanks Nial. This article has prompted a review of procedures.

Some good guidelines, but you may want to consider positive affirmations and goals, rather than stating what you will “eliminate” or “avoid.” The mind can play tricks on us.

Thanks Nail for new year Gift, God bless u.

Jeet

thanks everything you are good God bless

Many thanks Nial for the article and also for your price action system which as really built up my confidence in forex trading. A big thank you for a great job. Why do I feel this way if anyone may ask? For the past four years I’ve been trading countless systems trying to make money in trading instead of training to be a good trader, your trading course and articles as really help me to understand what I’m doing with being a good trader and I must say you’re one of the best I know so far and I’m very grateful.

Best regards

Fantastic. It is a lot simplier than I thought. Many thanks.

Hi Nial,

That is an excellent article. I like that bit where you say if one has to visit over 20 sites to justify your entry. Earlier on in my trading career I used too visit and google on the outlook of the currency I was about to enter. However since I mastered the price action set up I have been exercising ALMOST if not everything you have mentioned above and my trading plan is almost similar to the example you have given above.

Kind Regards,

Kennedy, Nairobi

Nial,

Great article. Clear, concise and to the point without being overly complex.

Thanks

Terry

Thank you for your effort, and well constructed with clarity!

thanks Nial for this wonderful article..it was timely.

especially number 3, because sometimes signals form on wrong points and i follow them only to loose more money.

the problem am left with is News interpretation ..

Grace

Another example of an article that compels one to comment on its brilliance.

Very timely lesson, Nial! Thanks.

I am in the midst of preparing my new trading plan and this lesson will make it so much easier.

Nial u are simply a forex guru, all ur lessons have made me a better trader. Thank u very much

Thanks Nial

Have a great achievement n Happy New Year to everyone.

Cheers

Thanks a million Nial, like Filo I have a plan which is to long and complicated, and your lesson will help me in a big way condense it down.

Thanks Nial

Steve

fantastic, fantastic, just what we need as we head into the new year.

Excellent article Nial, trading plan is very important to keep the trader accountable, to not overtrade, to only take quality setups to not meddle with the trade once it’s entered.

Please keep enlighten us.

Happy New Year everyone,

That has cleared alot of things up for me.

I have a trading plan but much too complex.

Also I like the affirmation . Saying what I want out loud will help it come true.

Great start to 2012,

Thanks Nial

Filo

Excelant Nial. I am nearly there What you say is just about what I am doing now. just a couple of things in your lesson I have not done. Great lesson Nial thanks mate

good article…….necessary for success

Very good article Nial – well put. Thanks.