Don’t Measure Your Profits in Percentages or Pips

Today’s article is very important; it is a very different article from anything I’ve written and anything you’ve probably read. Due to the controversial nature of the concepts discussed in today’s lesson, I need you to hang with me until the very end…

Today’s article is very important; it is a very different article from anything I’ve written and anything you’ve probably read. Due to the controversial nature of the concepts discussed in today’s lesson, I need you to hang with me until the very end…

Before we get into today’s article, let’s discuss the angle. This article is meant for shorter-term term traders who generally only take 1-3 positions at a time. Thus, it does not apply to diversified stock portfolios or hedge funds with many different assets under management for very long periods of time.

Not everyone will agree with the concepts I discuss in this article, but this is how I track trading performance and how many other successful retail and prop traders track their performance. This is what I do and it’s what I suggest…

Most forums and blogs discuss percentage and pip returns on traders’ accounts. However, in reality, measuring returns in percentages or pips is not the most effective way to track your trading performance. Every trader is different, and every trader brings with them a different set of mental variables and funds to trade with. Since this is the case, you should track your performance in terms of dollars risked vs. dollars gained (risk reward), which can ultimately be reflected in the number “R”, instead of percentages or pips. Now, let’s discuss WHY measure trading performance in terms of dollars risked vs. dollars gained, or R, is the best way to track your returns in the Forex market.

• What is “R”?

“R”, as I define it, is a value that reflects the profit factor of a fixed risk Forex money management strategy. Now, for those of you who don’t know what “profit factor” is, it is simply a value that reflects the profit of winning trades divided by the losses from losing trades. For example, if you gained $100,000 in one year of trading, but lost $50,000, your profit factor or “R” would be 2 or simply “2R”. (100,000 / 50,000 =2)

Thus, R is a measure of your overall risk to reward across all your trades, by knowing what our R value is for a series of trades we get a very quick and relevant view of our effectiveness as a trader. Think of it like this, if you have a 2R track record over a large series of trades, you can expect to make $2.00 for every $1.00 you lose in the market, a 3R track record would mean you can expect to make $3.00 for every $1.00 lost, etc. This is clearly the most useful and relevant way to track your progress as a trader, anyone who is considering funding you will want to see a long track record that shows a solid R value; the higher the R value the better.

• Percent risk vs. fixed dollar risk

The percent risk model deserves some special attention since it is probably the most popular risk-management model out there. I won’t go into a long drawn-out analysis of this because I have already written an article that you can read on this Forex trading money management topic. However, I would like to briefly explain why the percent risk model is not the way I manage my trading account…

Risking say 2% of your account on each position you trade might be a good idea for diversified stock portfolios or for large hedge funds due to the large number of assets they have under management at any one time, but for the private prop or retail trader who typically only trades 1 or 2 positions at a time, this percent risk rule is simply not the best way to manage your trading account.

Think about it like this, if you make $300 on a $300 trading account, that’s a 100% gain, but is a 100% gain really that relevant if it’s only $300? It’s a lot easier to make a 100% return on a $1,000 trading account than it is to make $100,000 on a $50,000 trading account. Are you starting to see why percentage-based returns are not nearly as relevant as dollar-based returns? I hope so.

• Account balances can be deceiving

It’s important to note that a trader doesn’t have to have a lot of money in their account to trade a large position size. Due to leverage, a trader with a $1,000 account can trade a position size similar to a trader with a $20,000 account. You would never put all your trading capital in one Forex account; I personally trade large size, but I don’t ever keep more than $50,000 in my trading account, because I simply don’t need more money than that in my account due to leverage.

So, the reason why account balances aren’t really a good baseline to determine your risk per trade from is because you can control a large position size with a relatively small deposit of money, so you simply don’t need to and shouldn’t keep all your trading funds in your trading account. You see, large and small accounts can trade similar position sizes, so what matters more is your personal tolerance and comfort level for risk and making sure that this in agreement with the knowledge that you could lose on any one trade you take.

• Avoid tying up trading capital in one account

A trader who is a millionaire does not want or need all their trading money in their trading account. Why? As we alluded to previously, due to leverage, you can control a large amount of money with a small amount. I have the ability to put a million dollars in my trading account, but I don’t. I don’t need to since I can trade the position size I want with only $50,000 on deposit. Therefore, traders don’t need to tie up all their trading capital in one account; they can leave most of it in a more conservative interest-earning account or put it some other asset. I withdraw money each month from my trading account to make sure it stays at my pre-determined base level of $50,000.

This is yet another reason why the dollar amount risked per trade is more important than the percentage of account risked; simply put, account size is more or less irrelevant due to leverage. So, we measure our returns in “R”, not in percent or pips.

• Risk tolerance varies between traders

A highly skilled and successful Forex trader, who knows how to follow his or her trading edge with rigid discipline, will naturally be more confident with their trading ability and risk tolerance than a beginner. Position sizes can vary greatly between traders, as each trader will have a different comfort level in regards to the amount of money they risk on any one trade. Risk tolerance is highly personal and discretionary, and this is yet one more reason why measuring performance in terms of dollars risked vs. dollars gained is the most relevant and effective way to track your returns. Think about it like this, a trader who is highly skilled and proven to be consistently profitable will probably have a higher risk tolerance than a complete beginner. Therefore, since risk tolerance varies greatly between the two traders, and indeed between all traders, measuring returns in terms of risk: reward and determining your “R” factor, makes the most sense.

• An example of how to calculate your overall R number:

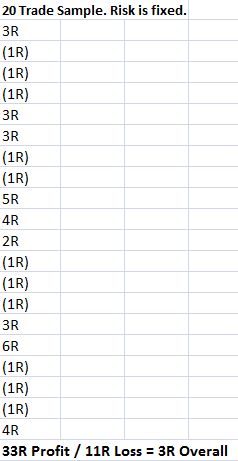

In the table below we see a scenario of 20 total trades. We assume a fixed risk for each trade. Risk tolerance is different for every trader so we left it undefined. It could be $200 per trade or $2,000 per trade; it really depends on your financial situation and personal tolerance for risk. What’s important is that your risk is fixed so that you can calculate your overall R number in terms of risk:

So, as we can see in the chart above we gained 33R but lost 11R, this means our R factor is 3. So, essentially, for every dollar risked in the market, over a series of trades, we can expect to make three dollars. In other words, our overall risk to reward ratio for this series of trade is 1:3. You should also notice that 11 of the trades were losers, or 55% of the 20, and only 9 were winners, or 45%. This also goes to show that if you understand and implement proper risk reward strategies you could make money even while losing the majority of your trades.

• Mini case study: The Prop trader

I have managed private funds and worked with enough prop traders to know that in the “pros”, what really matters is return on risk…not percentages or pips.

Example:

A trader working on a London prop trading desk operates in a debit / credit system; their account is either or positive or negative at the end of the trading period. The bosses will take a look at the trader’s account value at the end of each month and they are mainly concerned with return on risk. They will calculate the risk taken for the month and compare it to the return. A prop trader is only paid if their R value is greater than 1, because an R value less than 1 means they lost more money than they made. Proprietary trading firms are looking at the return their traders bring relative to the risk, in dollar amounts…I can assure you that at the end of the month or year, all prop firms, banks, hedge funds etc. are primarily looking at risk vs. return in dollar amounts; because as we have already established, percentages and pips are essentially irrelevant.

• This isn’t a free ticket to risk more per trade…

I would like to make one more important point to close. Please do not walk away from this article thinking it’s a “free ticket” to start risking whatever you want per trade. In the end, risk tolerance is discretionary and personal, and I mention this frequently. You have to decide before you enter any real-money trades exactly what you are comfortable with losing on ANY trade, because you never know which trades will win and which trades will lose, even if you are using a

high-probability trading strategy like price action. A good general rule of thumb to determine risk tolerance is if your trades are keeping you awake at night you are probably risking too much.

As you can see by today’s lesson, we are different at learn to trade the market; you aren’t going to find “status-quo” Forex trading training material. The free and members’ materials are all derived from my years as a successful trader and things I have learned from other successful traders who mentored me in my early days. I know that not everyone will agree with me, and that’s fine by me, I’ve never been one of the “herd”, my concepts and strategies on this website are the way that I trade and they are what I teach in my community.

Good trading, Nial Fuller

I WOULD LOVE TO HEAR YOUR THOUGHTS, PLEASE LEAVE A COMMENT BELOW :)

Any questions or feedback? Contact me here.

Great article. That’s very true and reasonable. It doesn’t help measuring risk to reward with percentages or pips because at the end of the day, it boils back to how much dollars a trader made or lost

Thank you so much Nial for the article if it wasn’t for your article I wouldn’t know how to start over, I’ve been trading for a while and lost a lot

Thank you for your valuable knowledge, Nial, I will try to learn and improve more from you

love your concepts and style of communication. Thanks again and again.

Each time I read your articles, my wife asks me “why are you smiling” and I tell her Nial is speaking to my faults and deficiencies. ai have a lot of unlearning to do. bad habits must go with 2021.

Thumbs up.

Hi Nial

Thank you for the great article. It will help me a lot. I have been taking trading seriously for the past 5 to 6 months and I had been up and down. I took a $180 to $2 000 twice but blew it and l have to start from scratch because of a lack of knowledge. From now on since I have the knowledge of R, I will track my trades and I will risk money, not pips or percentages.

Thanks again

Learning More And More Each Day Nial… Thank You So Much For Sharing Your Knowledge… It Is Greatly Appreciated. I Am A New Trader Trying To Learn The Ropes And Learning From You Clearly Shows Me That Trading Should Be Done The Right Way…

The Best Way Is To Learn The Right Way…

I think I m getting a better picture as I reading this important articles and I planning to to read and practice them too

Cheers! Thanks for the feedback.

Thank you so much

We keep learning

A few successful forex traders I follow always refer to ” R “. I figure that If It’s good enough for them then It’s surely something us mere mortals should adopt.

I am a beginner trader but i have reading your writings concerning trading they are really motivating me and they do make sense.

Personally it makes a lot of sense to me ????

Thank you , we keep on learning

Hi, Nial!

Thank you for that article.

I never heard about such approach before, but through this text I saw that this is really important and exceptionally useful!

100% I put it into my trading strategy.

Thank you so much!

Best regards, Dmitriy.

You are just the best at what you do………THANX NIAL.

Hi Nial

I agree , leverage is what it’s all about

I trade Indices intraday , I’m happy with a 1-1 RR as I trade high probability set ups , 1to 3 trades per day

I use price action along with confluence levels for my entries with as tight a stop as I can get

Very interesting reading your take on the markets, no bullshit & a lot of common sense

Regards

Jeremy

I like measuring my trading performance in Rands (South African) rather than pips. I can’t buy anything with pips or percentages. Since I know my ‘R” factor is 2,2 meaning for every Rand I lose I gain 2,2 rands. So to me now a losing trade is a means to profits.

Thank you! A few months ago I needed a better way how to monitor performance of my trades and I develop RRR points (you called it R). It is the best way to watch my progress. People around me use pips, but they can’t trade different positions (50 pips on SL and 150 pips on SL) because they don’t handle position size. So my way is much better and more accurate. But because I am not a consistent trader (yet) my opinion is… just opinion against bigger and more successful traders.

Thank you, you show to me that I am right :)

Thanks Niall – this concept of “R” has provided great clarity for me – has instantly changed my mindset

I have read many trading websites online, 3 article posts from your website is worth 1000 websites online. You bring the best knowledge. thank you

Hi Nial,

Really like your R method of measuring ones trading results. Really make a lot of “cents”.

I’m thinking if a trader profits 2R on a given trade and 1R on another trade — is the first trade actually twice as good as the second? Seems that you must incorporate a time factor into your analysis and thinking. What if the first trade took two months to complete…and the second trade only took two days? NEED TO COMPARE “APPLES” TO “APPLES”.

So…I’m going to start to use your R concept to measure my trading results but at the same time incorporate a time factor as I look at how long I was in EACH of the two trades.

So a trading result might go something like this, “On my last trade I profited 2.5R per trading day”. Thanks Larry

Dear my Prof Nial, I wish that you see or read my mind.

You have really hit the nail on the head as it concerns

money management.

Thank you again.

Thanks Nial

Glad you wrote this lesson. Can now see the logic of fixed amount risk per trade.

Hi Nial, all your articles are excellent and is really hard to say which one is the best. I can only recommend your Price Action course for everyone, daily commentary, forum.. … on your web.Thanks

MY dear NAIL,Thank you so much for your excellent articles.

You are simply marvelous. GOD BLESS YOU.

Warm REGARDS

AMIN MALIK

Thank you Nial for another great article, I’m always learning more from them.

Nice Article Nial !!

Hi, Nial, that is a good article again! I understand that you actually say – risk a certain amount (for most of us it will be a %) but not of your forex account but of your overall money that you can afford to use for trading. I like it very much as it inspired me not to put all the money to my trading account. Thus I can “diversify” and feel safer – in case my broker should get into troubles… Thank you!

Greetings, All,

If you are not yet successful in trading in the markets but desire to become consistently successful, I can think of no better “path” to take than signing on to be trained and mentored by a successful PRICE-ACTION trader such as Niles Fuller.

Best regards,

:) Marv

Good insight!Keep it up.

Fantastic Nial !!!!!

Simple, effective and common sense, thanks again Nial!

wonderfull!!!!

Thank you for what you just post now is every good thing that we calculate our trading the risked rewards riot. Thank you

I measure my trades the same way….wouldn’t even thought of doing it any other way….I love the way you keep things simple.

Cheers

Mike

Great article! Really sums up what i’ve been reading from before into one article, concise and to the point! Now i do have a thoroughly better understanding of this area of risk management. Very good lesson indeed, thanks once again!

Leslie

Another top notch article. This is exactly how I trade and in fact have always viewed money management. Straight forward common sensical approach… why make it any harder than it has to be. Cheers Nial!

RR ratio is one of moste important thing in recording your trades, of course. And it helps to keep emotions back. And RR on amount is only reliable.

Fantastic article Niall!

I would like to ask a question though..

What is the best way to calculate your risk/reward scenario after taking 100 trades if you decide to risk 2% of your account value on every each trade? Your R on every trade will be different.. Does it mean that you have to keep the same amount of money at risk for some period of time on all trades that you make?? After every trade your account value will change so you 2% risk (R)will change too.

Thanks in advance

Piotr

Nail,

Thanks Nail, Excellent article and very informative. You are reading the minds of trader.

Regards,

Azeem

Thanks niall,

Another great lesson. I make so much money with your pin precise techniques. 25 pip stops, high leverage, and R multiples are the way forward!

Steve

Good In each trader take this point out every trade period get closure progress about their trading

Very important advice that one’s account can consist in moneys available for use but not just sitting with a broker. Very good lesson”

This gives a good perspective of trade performance.

Great stuff Nial.

Greetings from KENYA

i like the idea

Once again great piece of advice ! Thank you.

Nial,

I have been using the “R” multiple in measuring performance for a while now which I learned from the “Dr Van Tharp” news letters.

However, it took quite a while before I finally realized what he was on about.

Your explanation is much more concise and I am sure it will be of great benefit to all traders.

Well done.

Regards

Robert

Incredible article, Nial! Your explanation is truly eye-opening. I do think that trading performance should be measured in risk versus reward and the “R” concept is easier to understand. But in my small account, as I’m improving my accuracy along the way, I need to put survival my priority so position sizing must be done carefully to give the price action trading strategies enough chances to work. My best wishes all for you. Please, keep enlighten us.

All the best,

Nyoman L.

Right ON Nial – this is key to understanding performance. Thanks for the nice summary.

Good stuff….ton of value!!!!

Thanks Nial, I would just like to say that I really admire your dedication and consistency in getting out great articles for both non and paid up members to learn from. As a paid up member I believe I am now (after recently implementing your methods)in a better postition than I ever have been after 3years (of not using your ‘simple’/ profitable methods). Keep up the great work

Thank you Thank you Thank you SIr !!!!

Solid article with a simple formula. And I was always curious how much you kept in your trading account. ;-) The quality of your trading forum is getting better all the time, btw. A nice handful of clear and obvious setups discussed in August. Bring on September!

hi nial

again you show how you wish to help us not control or sell us striaght out of the box you say what it is and were it is and this i very much like about your teaching method. not trying to extol some seceret insider info that only you have discoverd.but how to use what you know and learned and what others that do this for a job know to be real facts and approches to trading forex etc.

thanks greg

Hi Nial,

Hope you are well. Thank you again for another fantastic and terrific lesson.

Thank you for all your ongoing help and support

Thanks and Regards

Gurpal

Nial,

Very informative. I have been searching the net for this type of information. I always suspected that the pros traded heavier. Of course this is reinforced by a successful track record and higher risk tolerance.

Thank you for introducing me to this perspective of the “R”. The logic is flawless.

Thanks Nial,

Again I have learned something useful from you.

i will implement – gradually, but surely – the magic R

as true measure of my trading success.

Please keep the lessons coming!

Mick O.

Thank you Nial.

that you gave me a full lesson for trade in forex and i have got a lot number of knowledge to invest in forex.I especially

liked R method to find the difference in gain and loss in trade.Now I easily find the risk in trade due to use of R method .this is a great thankfull to you for help me and i hope you will continue help me and make me able to trade in forex.thank you.May God live long you.

Records

Mazeedkhan

At the end of the day we want to make MONEY!!

Your outside the square Nial, Just they way I like it.

Top article yet again,

Have a great weekend LTTTM

Nial

Wow, what a fantastic article (I think there are a few minor typos by the way). Why hadn’t I realised this before?

I inherently understood that my percentage returns on my account were ridiculous (essentially that’s because I have a very small trading account, which I have doubled in value), but I hadn’t thought through why that was…

“R” Really makes sense to me and has already helped me to plan my traders better (its not the first time you have mentioned risk/reward or ‘sniper’ concepts), without me realising it! I have changed my approach to reward on risk, all predefined before I concider placing a live order, not my previous approach of: “its a Support / Resistance level, put the trade on, hope the level holds and then take half off if it gives +20 pips and move stop up to break even, or if it doesn’t hold; pray to the ‘trading gods’ for a spike back to get the orders closed out for break even”

Please do keep up this excellent material, its priceless (yet you are prepared to publish it for free), truly you are an amazingly generous person, Nial. Thank you so much

best

Paul

Thanks Nial.

This aticle needs a clear mind to understand

the concept of trade.

Great

Cheers

Great article, Nial! On the web there are many articles and traders´ stories about how many pips they got in a particular trade, but each time I read these things I ask myself “what does it mean?”, because it tells me nothing.

It is IMHO a very big difference to risk $100 or $1000 or more per 1 trade, mainly from psychological point of view.

I think I have learnt another new thing about trading due to your article.

Thank you.

Peter

Thanks Nial,

You are reading in my minds. I wanted today ask you via e-mail about your approach to money management. Excellent!

You are the best teacher in the world!

Regards!

Michal

Great Artical. I also measure in dollar amount, measuring it in any other way “disconnects” you from what is really going on.

Thanks for this refreshing Artical. Keep them coming.

Sanjay

Can i say that as a member of Nial’s trading Community that it is a great place to learn how to implement and master these strategies in a really supportive, yet helpfully critical enviroment – For the price that is asked this does give a person a chance at making frex work for them in whatever capacity they choose.

Thanks Nial for this community.