‘Gun To The Head’ Forex Trading Tactics

Today’s article is going to revolve around one simple question:

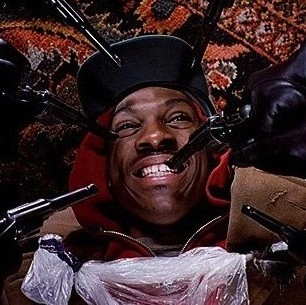

If someone held a gun to your head and told you that your next trade was a matter of life or death, what would you do?

My hope is that today’s lesson will make you think a little differently about each trade you take. Many traders get lazy with their trades, and they fail to see the potential risk in each trade they take. Every trade you take will affect your account balance at year’s end, and whilst trading success is defined over a long series of trades, each trade you take is a part of that series. The point is that if you are being lazy and careless on a lot of your trades, it’s going to affect your overall trading results. By imagining that your life literally depends on every trade you take, you are far less likely to gamble your money in the markets.

My hope is that today’s lesson will make you think a little differently about each trade you take. Many traders get lazy with their trades, and they fail to see the potential risk in each trade they take. Every trade you take will affect your account balance at year’s end, and whilst trading success is defined over a long series of trades, each trade you take is a part of that series. The point is that if you are being lazy and careless on a lot of your trades, it’s going to affect your overall trading results. By imagining that your life literally depends on every trade you take, you are far less likely to gamble your money in the markets.

Many traders simply get too comfortable with the ease of access of the Forex market; they forget that if they’re not disciplined and careful they can lose all of the money in their trading account. Often, traders get into a zombie-like state once they start trading with real money, blinded by the allure of fast money and seemingly ignorant to the fact that they can lose on any trade they take. You need to break these bad habits, and if you take on this ‘gun to the head’ approach to every trade you take, it just might give you the extra push you need.

‘Gun to the head’ Forex trading means that you trade as if your life depends on it; perfect analysis and perfect execution of the trade, from start to finish. There is no room for error or doubt in ‘gun to the head’ Forex trading; you will put your best foot forward and lay all your cards on the table every time you enter the market.

Trade as if your life depends on it…

Your trading account DOES depend on it, and ultimately your life too, if you really want to become a full-time trader. So, why are you still gambling, over-trading, and slinging your money around carelessly in the markets?

Professional traders inherently trade in a ‘gun to the head’ manner; they don’t trade unless there is a damn good reason to do so…AKA unless their trading edge is present. Seems like a very obvious point, but you know as well as I do that it’s VERY easy to just enter the market on a whim when your edge is not truly present. This is more like playing Russian roulette with your trading account than trading as if you know FOR SURE the NEXT bullet is THE ONE.

The more I progress in my career as a trader, the more I develop a habit of passing on trades. Meaning, I like to pass on trade setups that don’t meet my very stringent criteria. I prefer to wait for something more perfect, more obvious, and thus higher probability. I have no problem doing this because I don’t define my trading success over 1 week or 1 month, rather I gauge my success or failure in the markets at year’s end. I know that to be profitable at the end of the year I need to be patient and disciplined on every trade I take; I trade like someone is pointing a gun at my head and screaming at me that if I don’t make a profitable trade they will squeeze the trigger…this is how YOU SHOULD trade too.

If you had a gun to your head…you’d say “No” to A LOT more trades.

Many traders tend to enter the market out of boredom of waiting for a high-probability setup to come along, or simply because they ‘want’ to trade. These are mistakes that you probably would not make if some large burly gentleman was actually holding a gun to your head threatening to pull the trigger if you enter a losing trade…

Many traders tend to enter the market out of boredom of waiting for a high-probability setup to come along, or simply because they ‘want’ to trade. These are mistakes that you probably would not make if some large burly gentleman was actually holding a gun to your head threatening to pull the trigger if you enter a losing trade…

In fact, I am willing to bet that if this ‘gentleman’ was actually holding a gun to your head on every trade, you would trade with more patience, precision, and discipline then you ever have before. So the question becomes…if you CAN trade this way…why AREN’T YOU? Answer: Your mindset isn’t right. You need to obtain a profitable forex trading mindset, and a profitable Forex trading mindset is one that does not easily give into temptation, or trade carelessly, or become lazy. A profitable Forex trading mindset is one that is disciplined and patient, and that does not forget about the risk involved with every trade they take.

Don’t mistake the ‘gun to the head’ Forex trading approach as one that makes you feel pressure to enter a trade. In fact, the idea is to imagine that someone is holding a gun to your head and that they will pull the trigger IF you enter a losing trade. So, essentially, by simply never trading, you would live…AKA not lose any money. That alone is a very profound notion that many losing traders should dwell upon for a moment.

Also, I should point out that even if you are employing ‘gun to the head’ trading tactics, you can and will lose trades sometimes; it’s just part of the game and something you have to learn to not get emotional about.

The ‘gun to the head’ trading approach means that we don’t want to feel pressured or stressed to enter a trade, because the safest route is always to just not enter the market. However, that doesn’t mean we should be afraid to enter the market…it just means that if we have any doubt about a setup, we don’t trade. If you’ve mastered a strategy like price action trading, and you’ve been successful with it on demo, you really shouldn’t have any doubts as to when your trading edge is present and when it’s not. We just want to develop a routine where we can sit patiently on the sidelines and then ‘ambush’ the best setups when they arrive. If you really had a gun to the head that was threatening your life if you lost on a trade, you would have no problem saying ‘No’ to a ‘so-so’ trade, and you would not forgot that another setup is probably only a day or two away.

Use ‘gun to the head’ trading tactics to remain a disciplined trader

Most of the time, traders begin their trading journey full of enthusiasm and positive trading habits. Then, slowly but surely they fall off course after a few big losers, and they soon find themselves in a perpetual state of trying to get their trading account back to breakeven. Typically, traders get into this state by making ‘dumb’ trading decisions like risking more than they know they should on a trade or by taking a low-probability trade setup instead of passing on it. It’s fairly safe to say that you would be far less likely to fall into this rut of trying to get back to breakeven if you really traded as if each trade you took could result in life or death. Obviously, you will continue to live if you lose on your next trade, but the point of this article is that you need to avoid getting lazy like most traders do, and make sure you don’t forget the importance of staying on top of your trading game. Thus, it may help you to imagine someone is holding a gun to your head on every trade you take so that you don’t fall off track and get stuck in an emotional trading cycle.

Here’s a ‘gun to the head’ trading scenario…

…You start by imagining yourself in a real situation where someone is holding a loaded gun to your head; they are telling you that your life depends on this next trade being a winner. After you get into that state of mind, you should decide if that setup is one you’d be willing to trade, given the consequences of a loss. Thus, if you don’t feel totally confident in the trade, and it doesn’t meet your trading plan requirements…you simply don’t trade, and you ‘live’ to trade another day.

…You start by imagining yourself in a real situation where someone is holding a loaded gun to your head; they are telling you that your life depends on this next trade being a winner. After you get into that state of mind, you should decide if that setup is one you’d be willing to trade, given the consequences of a loss. Thus, if you don’t feel totally confident in the trade, and it doesn’t meet your trading plan requirements…you simply don’t trade, and you ‘live’ to trade another day.

I suggest you play out a scenario like this in your head before you enter any trade. Disclaimer…do not ever actually use a real gun in this scenario…I know that sounds crazy, I just have to say that for legal reasons. This is all just meant to get you guys thinking…I really want you to take your trading more seriously, after all, there is money on the line here. If you view your money as time, then your life actually is on the line whenever you enter a trade…because you can lose your money / time if you lose a trade. So, you don’t want to risk any of your ‘life’ on a less than high-quality trade setup…it’s just not worth it.

The ‘gun to the head’ Forex trading technique will lead to less mistakes and less trades, but it will also decrease your doubts and fears, and ultimately put you on a faster track to trading success. To trade in a ‘gun to the head’ fashion, you’ll have to overcome your fear of losing and of risking money…because part of the ‘gun to the head’ trading method, is that you can’t hesitate…when you’re setup is present you trade it flawlessly, without second guessing yourself.

Many traders cannot even get to the point of being able to trade in a ‘gun to the head’ manner simply because they don’t know exactly when their edge (strategy) is present and when it’s not. Using confusing and messy indicators will cause this problem. Thus, the first thing you need to do is make sure you have an effective trading strategy down, only then can you really start to pick and choose your trades like a sniper and trade in a ‘gun to the head manner’. By learning the kind of price action trading strategies that I teach my students in my Forex price action trading courses, you’ll gain knowledge of an effective yet simple trading method that lends itself well to ‘gun to the head’ trading. Price action allows you to filter the ‘good’ trades setups from the ‘not so good’ trade setups with immense clarity and confidence.

I have found that simply trading less often and passing on a trade setup when I see something I don’t like or something that does not look 100% perfect, has kept me out of a lot of bad trades over the years. Ultimately, if you really trade in a ‘gun to the head’ manner, you will end up passing on a lot more trades than you do now and that will most likely lead to a dramatic increase in your winning % and your overall profits.

it was great article, thanks

but this was funny: “Disclaimer…do not ever actually use a real gun in this scenario!!!” ;-)

Right boss

thank !

IT IS AMAZINGLY FANTASTIC SIMPLE AND PRECISE

PRICE ACTION MOVEMENT STRATEGY

WHICH GENERATES GOOD PROFITS IF FOLLOWED IN TRUE SPIRIT

TAKES OUR LEVEL OF TRADING KNOWLEDGE TO PERFECTION AND

MOULDS ONE AS SUCCESSFUL TRADER

A MARVOULOUS EFFORT NIAL FULLER

Yes its true one needs to rationalise each trading decision carefully . Thank you Nial.

A gun to my head and shoot me if I took a losing trade…Wow! “that’s an offer I can’t refuse”. What I like the most from our Guru/Professor/Advisor/Counselor, Mr. Nial Fuller, is that he is not like other websites or self-proclamed forex experts, that are always trying to sell you something. He is truly commited to make from us, learning forex traders, successful traders.

Having read this article, I need to reanalyze before firing my gun. Thanks Nial, it truly helps me.

This is something of late i am really starting to notice in my own trading, when i take a trade that deep inside i know i shouldn’t 95% of the time it is a loosing trade. Like you say it’s being lazy (in my thoughts), trading for the hell of it cause i want to trade and being impatient. A gun to the head would definately sort a few of these problems out.

Thanks Nial- Great post!

The importance of this article was within the very first few sentences.

As usual, a very good article.

If traders think this is a great article, then all it does for me is point out that they do NOT have a consistent strategy for trading that works over 90% of the time.

thanks once again for such a wonderful TEACHING.

I totally agree, and this is something that I learned through studying other successful people in the market. Being super conservative can pay off because we don’t get paid by the number of trades we make, we get paid by the quality..

Dear my Prof, you have given another great gem of information about trading. The problem is not HEARING BIT DOING, just like the great Book admonished that WE SHOULD BE DOERS AND NOT HEARERS ONLY. Thank you again.

Thanks Nial, very thought provoking and bound to make a positive difference….

thanks to you Sir, your articles read are turning me to a successful forex trader. thanks a lot

friendly talk Nial. pls keep it up.

Thank you Nial for the excellent article.

I am spending my time fully reading your all lessons.

This is one of those master pieces I would love to print in enlarge letters and hang it all over my room..:-)).Thank you Neill for another brilliant article to keep us alert and on edge and behaving ..:-))…your patience and time in mentoring us is much appreciated..:-)

I wish I had read this article last Thursday… Very true, very simple words of wisdom but so difficult to follow most of the times…Thanks Nial, anyway!!!

I am transformed. Great article guru.

Hi Nial,

Love this article that you write. I have realise my mistakes in trading FX, is that I am acting like a machine gun, firing everywhere whenever I am on my chart!?

That is the reason why, I have not seen result from my trade!?

I loved your write out, it indeed has pointed out some of my pitfall and mistakes.

Thank you so much!!

very nice article

Great idea! I will only lose one trade.

Thanks Nial just awesome!

This seems obvious but it’s not. Very nice article that I think will go a long way to help me. thanks for the article.

Nail

Guys like you are not easy to come by in this industry,thanks for the time you put in,this is encouraging,thanks for the Will Smith video,it just shows anyone can be successful in trading & generally in life,thanks for been who you are & God bless.

Please i asked a question in my last email,that if i purchase the videos does it automatically makes me one of your member or is there something else i have to do?because i want a mentor like you who is honest & plain,God bless.

excellent, I have noticed that well planned trade wins most of the times. put a gun on your trade, kill it if your trade lose or let it run in profit.

Thanks n Cheers

rather ghastly talking about gun to the head :D

NAIL, YOUR INNOVATIVE APPROACH TO MAKE US “DISCIPLINED” IS SIMPLY MARVELOUS. THANK YOU, FOR CARING AND PUTTING SO MUCH OF EFFORTS TO REMIND US AND TO KEEP US ON “TRACK”

WARM REGARDS, AMIN MALIK

I posted in the members area that I was “pulling the trigger to quick” on my trades. I guess I was the one shooting myself in the head–I was committing trading suicide. Well, I stopped that last week, and I’m going to trade with my edge for now on. I’m going to put the “gun to my head” scenario in my trading plan and checklist.

Thanks you!

Nial…..You have hit a very serious Trading Nail right on the head…Every trader should trade like this and whilst this is something I realise and always try (?) to do I have to admit I fail at all to often….A very timely reminder

Thanks for yet another great post

TheDreamingTrader

If you are unclear about a trade you do not make the trade. It’s that simple and it’s all mental. It’s all due to greed that we put on mindless trades. Our entries must be fueled with confidence every time.

Trades made in doubt might still work out, but in our hearts we known it’s just another random reward that puts us off the path to real trading success. This whole article could be summarized into one word and that word is patience.

Just wondering,,Can we point real gun to our head unloaded ? lol

Hi Nial,

Not too sure about “the gun to the head” analogy…because you would be literally attracting that into your life with the constant visualisation and feelings of terror…

but I do understand your point of instant gratification causing one to sell their future away….

I would personally just go for a walk and come back to look at the setup with a fresh pair of eyes….to avoid seeing things that are not really there….

This is prob one of your best articals…

I have a section in my trade plan called “Values” which reads…

“Be Integrative, Not Divisive When Pulling the Trigger”

And this artical just further adds to my understanding of this..

Thanks!

Sanj

well done, truly awesome article.stick to this approach and you become part of the 10% winners.Prof Nial, you are too good.

this article is a masterpiece.

Thanks Nial, good article.

Another great advice.. Thanks Nial.

Hi Nial

Certainly , all your teachings go the extra-extra mile…

your experience does-not speak; but SHOWS, how wonderful your teachings are. Nial, thanks once again for such a wonderful TEACHING.

hi it was very damn good article.. actually i made a same mistaek whatever u wrote it over here..i just WANNA KNOW WHAT EDGE U REALLY USING WHILE U TRADE LIVE..PLEASE TELL ME.

The most important phrase in this article, it seems to me, is to “overcome the fear of losing.” Gun-to-head sounds like an intent to win or stay out. The main emphasis should be on following your rules, not shooting yourself if you lose. The win or loss is not as important as trading when the time is right. Emphasize the action, not the result.

thanks mr Fuller for your valued lesson about forex tading,it is always benefical for us.

Brilliant article. Thank you.

Nial, Thank you for another needed and helpful communication !!!

Gratefully,

Carolynn U.

A bird in hand is worth two in the bush.

Thanks Nial

Great article Nial.

I like that, thinking outside the box, Nial. Well put.

Thanks Nial for another superb article.

Thanks for the article Nial. If every trader takes this approach they would be more profitable in the long run. As you mentioned, sometimes we just trade out of boredom or the need to turn a quick profit. We must take it as a business and treat is seriously

Gilbert

Don’t worry Nial I don’t own a gun!

Great read, it really hit home with me, the patience & decipline parts. I’m going to work on that part big time.

Always look forward to your articles,

Gary

Hi Nial

Well Done Mate, as always, the point is perfectly made.

Infact so much so that I printed the Old Clint Eastwood’s photo and stuck it next to my monitor, Just to remind me of what you said.

Thanks alot as always.

Perfectly said Nial and JUST IN TIME!!! Feels like you are talking only to me because I am a zombie and I get bored and overtrade.

Great Lesson Nial

It’s a nice premise… trade like your life depended on the next trade being a winner; but too many people trade that way to begin with! Each trade represents the rent payment, or grocery money, or worse yet, their pride.

I would think this strategy, if taken seriously, would prevent most people from trading at all.

The result would likely be analysis paralysis.

I suggest wannabe traders settle on a plan, and stick to the like their life depended on it!

In other words, the loaded gun only goes bang if you place a trade that is not 100% in alignment with you plan.

Then see how many trades you take!

I should have had a gun to my head this morning. I have check lists, but ignored ONE item on the checklist and lost a deal!

Every trader should read this and APPLY IT! Thanks.

Yes, that is one good approach to get the right discipline.

…that last little puzzle bit that needs to be added.

Thanks, and have a great weekend all.

Nial

That ”gun to your head” is just awesome advise trust

that i can have the discipline to follow through

This article is a very good analogy for many of us, amateurs. I do believe that we are not that bad traders, but basically undisciplined traders, which ends up for us as losing trades. Gun in the head forex should be a constant reminder or image everytime we look at the fx charts.

Teacher, thank you for that sensible reminder.

Ha Ha Ha !! very tricky approach.I like it.Very good for developing self descipline.Thank you Nial

great nial. thats a nice weapon.

best advise i can spend my wk ponding on it.thanks master

Tanks a lot,

this post is very important to do the right thing in the right moment.

Tanks…under the gun ;-)

Thanks for the great wisdom Nial. You know many times we forget we are trading money or our life savings. With time as a trader you can feel it when a set up is right for you to enter and be comfortable with the consequences of the trade. Keeping this in mind will save us a lot of money and sorrow in our lives.

thanks a lot Nial

haha thanks nial as always.

Hi Nial

Excellent thought provoking lesson as always, thank you very much

I spotted two potential trade set ups this week and although they were good from support / resistance level combined with fib re-tracement level and immediate price action (candle formation), I was not placing an order to trade either one of them because the first criteria for my trade set up was not present (happens to be alignment of direction for two moving averages on the daily and 4 hour time frame)

A day later I added to the posts to say that I was glad I hadn’t traded them, because they hadn’t worked out.

Previously I would have traded them, because they ‘ticked’ most of my criteria requirements.

So, this week definitely supports your recommendation from my perspective. I’ll keep it in mind as I count the number of “almost” perfect trades that do work out (that I don’t trade) and the number that do (inevitably there will be some of both, it will be interested to see what the majority are over time). If more than 50% ‘would have worked’, I will need to refresh my trading strategy!

have a great weekend, best

Paul

ESSENCE OF TRADING

ONE OF THE BEST CARDINAL PRINCIPLE.

EXCELLENT MY GURU !

I like this article. Definitely emphasizes the point of trading with caution. Those mindless trades are usually the ones that get me.