Risk Reward & Position Sizing – Forex Money Management

Where beginning traders run into trouble is becoming “convinced” that THIS setup is a winner; it just looks SO solid to them that they don’t see how it could possibly not work out. They then proceed to over-leverage because they are so convinced of the trade setup, and the stage is now set for an account blow-out.

Where beginning traders run into trouble is becoming “convinced” that THIS setup is a winner; it just looks SO solid to them that they don’t see how it could possibly not work out. They then proceed to over-leverage because they are so convinced of the trade setup, and the stage is now set for an account blow-out.

The setup may indeed workout and the trader may clean up, but you can be assured it only takes ONE episode like this to lose a huge chunk of your trading account and kick off a cascade of emotional trading mistakes. This is how losing traders think about the market; they forget that each trade setup is simply another execution with about the same probability as any other similar setup; they do not have a thorough understanding of risk to reward scenarios or position sizing. This article will hopefully give you that understanding.

Thinking in Probabilities

Aspiring forex traders often spend countless hours searching for that perfect trading system which they think will make them rich by following a particular set of trading rules in a robotic manner. Unfortunately, most traders fail to realize that the real “secret” to successful forex trading lies in a thorough understanding and implementation of risk reward scenarios and position sizing. Forex trading is at its very core a game of probabilities, to become a consistently successful forex trader you will need to view each trade setup as a probability. When you learn to think in probabilities you will be on the path towards trading success, because you will be viewing the market from an objective and mathematical mindset instead of an emotional and illogical mindset.

What ultimately separates winning traders from losing traders is how they think about the market. Winning traders view each trade setup as just another execution of their trading edge, they then think about how to minimize their risk on the trade while simultaneously maximizing their reward. Through the power of risk to reward scenarios and position sizing, professional traders know how to effectively manage their risk on each trade and as a side-effect of this knowledge they also manage their emotions. When you begin to view each trade setup as just another execution of your trading edge and effectively implement position sizing and risk to reward scenarios, you will also be managing your emotions because you know your possible risk and possible reward BEFORE you enter the trade, you then set and forget the trade and therefore there is nothing to become emotional about.

The Not SO Secret, Secret.

Anyone who has studied forex trading for any period of time has undoubtedly heard the old axiom “Cut your losers short and let your profits run”. The funny thing about this saying is that no one ever really expands on it by telling you HOW it is actually done or how it can be applied to today’s forex markets. Most traders hear this and they begin by setting really small stop losses with unrealistically huge targets on each trade. The problem with this is that the forex market does not move in a straight line, it ebbs and flows, sometimes having a large move and then an even larger correction before swinging back in the original direction. If you do not properly understand the power of risk to reward scenarios and position sizing, this volatility will end up killing you sooner rather than later.

Risk to Reward Scenarios

Let’s get right to the meat of this issue now, risk to reward scenarios are what you should be thinking about every time you find a trade setup. If you are trading price action strategies for example, you might find a really good looking pin bar formation on the daily chart…the first thing you want to do is define your risk on the trade. Risk management should be your main concern as a forex trader, most traders take the other route; worrying mainly about rewards and not actively managing their risk. Get that idea out of your head. From now on you are to think of yourself as an aspiring professional risk manager, get the whole idea of becoming a professional trader out of your head. Once you learn that risk management is the most important aspect of trading you will become a professional trader as a result, so concentrate on effective risk management and the reward aspect will take care of itself.

Back to our example…you have found a great looking pin bar strategy on the daily chart, now you must find the safest place to put your stop loss so that the probability of it getting hit is as low as possible, you want to give the trade as much room as possible to work out while still maximizing your risk to reward scenario.

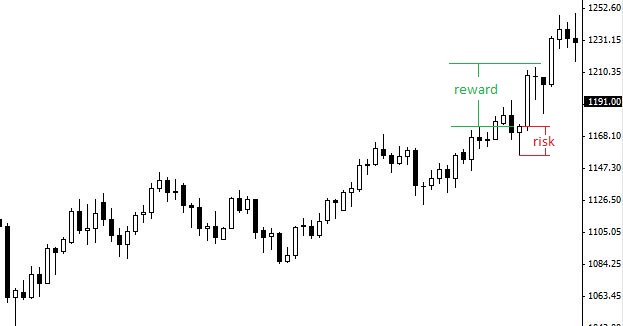

In this daily gold chart we can see a pin bar has formed in the context of an uptrend. Your stop loss is placed just below the low of the pin, if you enter at the pin bar closing near $1175.00 your stop loss will be about $20/oz because it would be near the low of $1156.35, we will say $1155.00 to make it an even $20. Now, how do you figure your reward now that you have properly defined your risk?

It depends on the condition of the market you are trading. For this example of gold, it was in a very strong uptrend at the time, in this case it is acceptable to expect a reward of at least triple the amount you have risked or more. In this particular example we exited near $1215.00 for a risk to reward of 1:2, meaning we made 2 times our risk on this trade setup.

This is but one example of the many risk to reward scenarios that setup themselves up each day in the markets. When you have a strong entry method, like price action setups, combined with an understanding of risk to reward scenarios you begin to think in probabilities. This is how professional traders think about the market. For example, if this same pin bar setup above occurred in a range-bound market or in the course of a downtrend, you would not likely set a target of more than 1 to 2; therefore the trade would be a lower probability setup. This is what is meant by thinking in probabilities. You must learn to take into consideration the strength of the price action signal in question but also the context it is occurring in. Many traders simply set unrealistically large profit targets for their trades with no rational behind them besides greed. I can promise you that you will blow out many trading accounts if you don’t learn to take profits by setting logical reward scenarios of 2, 3, or 4 times your risk, if you trail your stop you can sometimes pick up 5 times your risk or higher, it all depends on market conditions and whether or not you can deal with letting a 1 to 2 or larger winner turn around and move against you because you were hoping for a bigger reward.

Position Sizing

Position sizing is the glue that holds risk to reward scenarios together. Where most traders mess up in position sizing is in fitting their stop loss to their desired position size instead of fitting their position size to their desired stop loss. For example, say you are risking $100 per trade and you see a really good trade setup. The only problem is that the most logical spot to place your stop loss is 200 pips away. This is a critical juncture where many traders make a mistake; if you need to place your stop 200 pips away to give your trade the best shot at working out, than you simply reduce your position size down to meet this stop loss size. So if you were trading 1$ a pip before, now you will trade .50 cents a pip, .50 x 200 = $100.

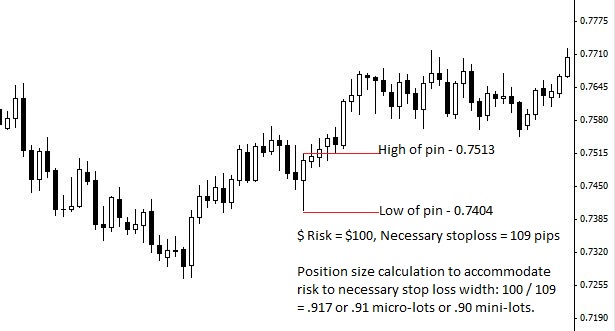

To illustrate the example of adjusting your position size to fit the necessary stop loss let’s look at a daily chart of AUDUSD currency pair. Notice in this example our desired risk amount is $100, but our necessary stop loss distance is 109 pips, because the safest spot for our stop loss in this example is just below the low of the pin bar. So, after dividing the risk amount by the stop loss distance (1oo / 109), we get .917. Now, some forex brokers allow you to trade micro-lots, this basically means you have the flexibility to trade a position size as small as 1 penny per pip, in this case you could trade 9.1 micro lots (.91 cents per pip), you would not want to go up to 9.2 micro-lots because your risk would then be over $100: (.92 x 109 = 100.28$), at .91 your risk will be just under $100: (.91 x 109 = $99.19). If you use a broker that does not allow micro-lot trading than mini-lots are your next option, typically these are flexible up to .10 cent increments, this means you can trade .10 cents per pip at the smallest position size. In this case you would just trade .90 lots which would be (.90 x 109) $98.10 risked. This is how you should view position sizing; always adjust the number of lots you trade (position size) to meet the stop loss distance that gives your trade the best chance of profiting. NEVER adjust your stop loss to meet a desired position size, this is GREED.

It really is as simple as that. Most traders end up doing the opposite of the above example however. They end up arbitrarily placing their stop loss just so they can trade a larger position size, this is a mistake born out of greed and will end up killing your trading account in the end. Proper usage of position sizing not only means you will have more winning trades, but it also means you will trade more objectively, because you are placing your stop loss at logical points above or below support or resistance levels, instead of randomly placing it a set amount of pips away from entry. When you combine position sizing with risk to reward scenarios you truly have a “set and forget” trading method which will put you in the proper trading mindset; calm, confident, and objective. There is simply no need to risk more than you should on any one trade when each trade is simply another execution of your edge. This edge may take 100 trades to play out and bring you consistent profits, so to put too much emphasis on any one trade is simply a mistake.

On each trade you make, you should use our Forex Trade Position Size Calculator Here.

Give yourself the best shot at becoming a consistently profitable forex trader by combining a great method like price action with the power of position sizing and risk to reward scenarios. To learn more about these concepts check out my Forex trading course.

I will approach my trade set-ups as probabilities as well as being an inspired risk manager.

Nice one sir I have really benefited from this wonderful position sizing article but one thing remains I don’t know how to calculate pips,pips value & position sizing for gold,crude oil and s&p500mini on meta trading platform.please help me out,thanks in anticipation sir I am a swing trader. Showing e.g in addition will be highly appreciated sir.

Thanks Coach… Great Article/Read. It’s A Lot To Take In At Times. I Find Myself Having To Read At Least 1-2 Articles A Day Just To Let The Information Stick. Thanks A Bunch… Appreciate It…

it is great lesson those who are willing to be consistent trader. thanks lot sharing your knowledge those who are willing to learn to profitable trader

I have no word to explain your great work

This is clear and important but what % of your balance do you usually risk per trade and what is the max risk in total for all open positions?

Thank you, Nial!

Informative article! Thanks

That was a great article especially on the secret to lot winners run and cut short losers but on position sizing I grasp nothing but will reread once again thankyou NAIL.

Nial God has made you great. Your stuff here is great it has opened my experience more. Thank you, go on being great. l Iove you.

I bless you Nial.I have been reading a lot from other sites but the day I found this site,I decided to loyally follow your reality from here,Facebook to YouTube.God bless you

I bless the day I stumbled into ur site. My view Of The forex market has change ever since then. I was abt viewing the forex business as a no a go area for retail traders like us no matter ur knowledge. But now my view has change with all the articles abt forex trading I ved come across on ur site. Honesty I must tell u that I ve now beginning to feel and act lyk a pro in the forex market. Knowledgeable Is Power.

Long live my mentor

Great stuff Nial real eye opener

Thanks Nial for this invaluable info!

Very impressed with the standard, and the amount of free information you provide.

As a newbie I am learning so much but feel it’s time to enroll in your Pro Trading Course and up my game.

Thanks again.

Phil C

Thank you! Excellent lesson!

thanks nial,

now I know, nobody can predict the market movement even with the strong decision from expert, but with risk reward and position sizing will make traders win, stop to doubt where market will move, but focus on risk reward and position sizing on every trade.. thanks again nial..

That is fact you may think you correct it is a sell but boom it rallies up .

best explanation of position size i’ve come across so far.

thanks Nial

I was just looking at your videos when I came accross this article.

Thank you Nial. As always,this is another inspiring lesson.

A great insight to what I truly am doing wrong right now. I haven’t gone to real trading as of yet for obvious reasons – I am not ready yet and I am thankful for that. Every single day I pick up more and more tricks to implement to the way I trade. The thing is that I have a proper mindset to get what I set out to do correctly but what I lack is the intellectual aspect of how it should be done and Nial is just the guy who is able to provide me with just the thing. Every single Nial’s article clicks 100% every time with me and I am truly astonished about how it’s possible although at time’s it’s really hard to grasp some concepts since some aspects of my ego like to get in the way to try and make me think otherwise. Persistence is the key here.

Nial

Just want to say Thank You.

This article was great in helping me understand position sizing. (finally)

Don

Thanks Nial . Nice one realy planning to use it

thanks nial,I really like this concept.

You truly are an authority!

Update: After attaining immense confidence from your lovely articles on Risk/Reward,Position sizing and others, I started trading once again(Demo). But this time purely on the basis of Price action(EDGE) and applying all the rules that I learnt from you. Loss/Win Ratio:33.67/66.33 but inspite of that I am profitable due to Risk/Reward(The important lesson that I learnt from you) I am feeling confident once again and I am developing the traits of a pro trader as you outline in your articles. Although I haven’t paid to train with you, I have learnt so many valuable things from your website that I was lacking in the 4 something years of my trading. I definitely owe you one,Nial! Hit me up when you’re in Mumbai.

the holy grail is embedded in position sizing and R-R, i just realised it lately after so moany years of frustration, you dont need a super accurate system. a half decent system with a right psychology and proper money mgt is key to financial success in forex.

Dear Nail,

I have never been more confident as a trader. I always wondered how i could day trade and keep my day job, i actually thought of quitting my job to concentrate on Trading but your articles have really changed the way i view the markets, I just relax and wait for price action signals. Thank you Nail, keep the good work

another master piece! nial, u are trully an inspiration and the best of the best as par fx

Excellent article. I have to read it several times to completely understand it and I got it. Perfect. I am on my way. Have a nice day. Josef CZE

Nice one bro. Thanks. Continue to keep us enlightened.

this has been the reason i risk more % of my capital thereby making lose big,thanks 4 sheding lite on it, God bless u in aboundance

I always found it difficult to make an adequate decision on stop loss , I really like this concept of position sizing. I will definitely give it a try

makes allot of sense Nial, thank you

Great Article Nial,I wish I had of known this position sizing info years back when I burnt up a sizable options trading account through greed & ignorance.

Thanks Niall for another well explained concept, and the fundamental core of being successful in this business of risk and probability.

Nial,

thank you for this article…

i have never been so happy with my trading like i am from the time i started reading from you…this article is the best tool every trader should have in their trading tool box. i have used it thrice and every time it has been a success. i recommend it to all traders because not only does it keep you tension free, it also helps you build your confidence.

Nial you are the BEST.

may God richly bless you with health and wealth…

Grace.

Nail, this is very good, I love it, keep the good job on. I can see all your videos are always along the trend, but there are some good trade that comes with counter trend, so, my question is how do we recognize this kind of pin bar that we work well on counter trend?

Nial,

each time I watch your video or read your article it gives me the couragre to continues.Your selflessness desire to help new traders grow is unbelievable. Remain blessed.

Nice one Nial, thanks.

What do you guys use to calculate the position size?

An Excel sheet or an online calculator?

One cannot go beyond this article. I have printed this out and pasted it on my wall. Everything else remaining the same, position sizing is the be all and end all.

Hi Nial,your article on risk/reward is very educative towards the mastery of the entire forex business.The entry point put at 50% retracement of the pin bar is still a problem for me-a newbee.Position sizing is another mountain to cross.I wish to thank you all the same for what i have gained so far from your mentorship. Please do more for me in these areas.Long may you live in your GOOD services to humanity.Thanks.

Hello Mr. Fuller

It is always refreshing to re-read certain articles and this is one of them. Risk to reward and position size are now in my quiver and will be there when I start to look at charts again.

Hi Nial,

Inspiring as always. Thanks a lot.

good read Nial!

Thanks for the info.

Keep up the good work!

Cheers Mick.

If I never learn anything else this article says it all.

Thanks. Eddy.

Really good article, as always you really explain things in a way that even a caveman can understand it.

Thanks Nial.

Nial,

Thanks for this article. It was truly appreciated by me and apparently many others. Keep up the good work.

Nial,

You are wise beyond your years and it is much appreciated that you are willing to share your knowledge with us. Thank you for the investment of your time and energy on our behalf. It is most beneficial…h

An excellent article and essentials for trading. How have you achieved so much experience about trading at so young age.

I am 57 years old, trading and learning since many years but could not succeed in my trading endevour.

After following your all lessons, I hope finally I will do better and better.

Thank Nial

Very useful advice for me, see things very differenty now.

Thanks Nial

Thanks Nial. Please keep them coming. Nobody ever told me this before. I will put it into demo-practice. As for the full course, I am still saving!

A nice article! Nial.i ve been much better reading ur articles than any other article i d ever read on fx trading before now.thanks

Hi Nial, I learn alot from your videos, and story’s thanks alot Nial.

Nial…This is a very good article and it does help in keeping focus where it should be.As you did with determining the risk is there anymore info which you can give on determining reward. i.e whether it should be 2:1 or 3:1 and so on. Thanks

Michael D

this is a lovely article…it has really enlightened me as i’v had a lot of problems with placing my stop-losses. Hopefully, my trading will be better henceforth. thanks Nial

Thanks Nial. Position sizing and risk reward ratios are crucial to my forex trading. i need to read it over n over again to master it.

Great article on the most important but ignored aspect of forex called risk/reward.A big thanks to my only Mentor,NIAL FULLER

I will praise you for years to come.

Thanks Nial

Thanks nial, excellent as always.

very imformative, the greed thing IS a killer to you account and being calm and decisive when trading is starting to give me more consistant Wins, Thanks.

Thank you Nial – I appreciate the work you put into these articles. They are pure gold. I had been searching the net to find good, plain English information that would ‘tell it like it is’ and am happy to say I’ve found it with your site. Thank God for smart, decent young Aussie men who want to help us novices learn to trade. Thank you so much for all the good content you share with us Nial.

Nial,

A very good wake up call for those who constantly over trade. A very good reminder and encouragement for those who contantly struggle to overcome the psychology. A very good advise for the newbie like me.

cheers

Thanks for the great article Nial. I need to constantly remember these principles when trading. It is too easy to forget them and then my losses start adding up quickly.

Hey Nial: Nice article. Still working on the emotional part of this business. But I have a handle on position sizing and risk reward scenarios. This is a crucial part of trading. It keeps us in the game. Thanks for the time you devote to these articles. They are inspiring.

Nial

Nice to see some one trying to really help new traders.

You didn’t mention how different currency pairs effect the calculations ie when trading in a pair that aren’t in you held trading currency. how do you calculate those?

I needed to read this at this time, home run.

thank you so much for your generous sharing, nial.

Finally an understanding of risk/reward. You make it all look so easy. You have a great way of explaining things. Can’t thank you enough.

Thank you, you reminded me of the book “fooled by randomness”” I am going to read it again

Hi Niall,

Your best post yet ! Like Sofia above I was wondering if you ignored your 50% pin bar entry method on your AUD / USD example …

All the best,

Alan

its just for examples sake. the entry type was not the focus.

Hello Nial,

How many trades, in average, do you have each week/month/year?

Thanks for your help!

Please email me for details on that

nice one mate! defenetly enjoyed this one, just need to programme it now! in to my brain!!!!

Hi Nial,

Thank you for this well written article. It will help me and I believe many others who have become frustrated with our lack of knowledge regarding position sizing and risk reward ratios. You have given good examples which are accompanied by illustrations and these are a great help. Thank you for your teaching and your willingness to share your knowledge to help us become better and more confident traders.

Craig

Very useful advice for me.

Thank you Nial !

Hi Niall:

I am one of your subcribers – this is an excellent article. I am working at recognising price action. Proving difficult, but I will get there.

Russ

Thanks Nial – Great article – love the charts with the article. Have a great weekend.

Excellent article. Reall like the examples.please keep up the good work!

hii,This is an intelligent conclusion and a wise way of trading,but still need to master it properly.I think with this step one will end up doing fine.

Hi Nial

I was just looking at your videos when I came accross this article. It’s a great read on position sizing. However, I did have a question for you, the example that you gave in AUDUSD is a pin bar but from the videos I have just seen you define a pin bar as having a tail that is 66% of the range and that you only trade it on a 50% retracement?

Was this example just to demonstrate position sizing or have you changed the manner in which pin bars are defined and entered?

Many thanks

Sofia

Its a tutorial on maths and risk reward, not methods of trading, thus it was not perfect pin corect, still a valid buy signal though.

I like your approach of trading in terms of probabilities.

This article comes at a perfect time for me as I have been “practicing” on my demo account and not seeming to get ahead much because I have been inconsistent in my risk/rewards.

Keep it up!

Thanks Nial