How Often Do Professional Forex Traders Actually Trade?

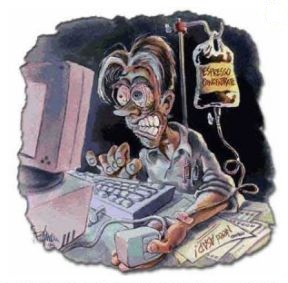

This article is going to challenge some of your beliefs about trading, especially the beliefs you hold about how often you should trade and the consequences that your trading frequency can have on your forex trading account. Hopefully after reading it you will gain some powerful insight that will help you stop over-trading or prevent you from turning into an over-trader like the guy in this picture on the right.

This article is going to challenge some of your beliefs about trading, especially the beliefs you hold about how often you should trade and the consequences that your trading frequency can have on your forex trading account. Hopefully after reading it you will gain some powerful insight that will help you stop over-trading or prevent you from turning into an over-trader like the guy in this picture on the right.

One of the biggest obstacles standing in the way of amateur traders becoming professionals is their lack of recognition and(or) acceptance of the fact that trading less frequently almost always produces more consistent and more profitable long-term market performance than over-trading and interacting with the market too often (ie: Day trader market junkies).

Professional traders view each interaction with the market through a realistic lens that does not filter out the risk involved with every potential setup, whereas amateur traders tend to think less about the risk involved and more about how much money they can make if XYZ happens. This is an important point to take into consideration before you enter your next trade.

• The extremely slippery slope of over-trading

If you have had any experience trading real money in the markets you very likely have experienced first-hand just how slippery the “slope” becomes once you start over-trading. Most traders do not even recognize they are guilty of over-trading until they have lost so much money that they are forced to take a break from the market, it is then that they typically realize what they have done; entered numerous trades with no sound logic or rational behind them.

Professional traders are always aware of the dangers of trading too frequently, they know that it is a very short stretch from entering one too many trades to full-scale addiction to the forex market and to chart watching. In essence, amateur traders that get caught up in a fit of over-trading in the forex market are simply gambling; continually entering the market randomly while hoping for a windfall profit. The professional trader is not a gambler; he or she is a risk manager who simply seeks to flawlessly execute their edge in the market only when it is present.

This typically means that most professional traders are not day trading or scalping, instead they are focused on multi-day positions and look to take a good slice of the action that takes place in the market each week or month. This typically means taking multi-day positions in trending markets, because it is easier to take larger chunks of price action out of a trending market by holding multi-day positions than it is to constantly jump in and out trying to scalp the market each day.

Trading less frequently like this also makes you more immune to the slippery slope of over-trading. Even if you are following an effective day-trading or scalping edge, when you trade with the high frequency demanded by day-trading and scalping strategies, you drastically increase the odds that you will give in to the ever-present temptation to jump into the market when your edge is not truly present.

• You can’t get hurt from the sidelines

The value of simply NOT BEING IN THE MARKET cannot be overstated. Many amateur traders don’t even consider that being flat the market can actually be a very lucrative position, not to mention it is the SAFEST position you can take in the market.

The value of simply NOT BEING IN THE MARKET cannot be overstated. Many amateur traders don’t even consider that being flat the market can actually be a very lucrative position, not to mention it is the SAFEST position you can take in the market.

To understand why not being in the market is actually a lucrative position you have to look at it from a different perspective. Let’s say point A is being flat the market, and point B is where you trading account stands relative to point A after a losing trade, you obviously had more money at point A than at point B, thus point A (being flat the market) is actually a lucrative (profitable) position compared to point B since you have more money in your trading account at point A than you would have had if you had lost that money in the market and went to point B.

The fact that most amateur traders simply do not even consider the fact that being flat the market is valuable is directly related to the fact that they simply do not believe the market is as risky as it actually is, or they simply ignore this reality. Professional traders are fully aware of the risk involved in the market, therefore they inherently understand the value in being flat the market, and thus they trade less frequently than amateurs.

• How does trade frequency relate to long-term trading performance and a trader’s mindset?

Once you identify exactly what your trading edge is, and the market conditions that are best to trade it in, you can begin to trade with patience and precision because you now know EXACTLY what you are looking for in the market. In essence, you have to master one forex trading strategy at a time, so that you can almost instantly look at any price chart and tell if your edge is present or not. Once you obtain this level of trading mastery and skill, over-trading or entering a position when your edge is not present will seem silly to you and just down- right stupid (because it is!). To put it more succinctly, you are more aware of whether or not you are over-trading when you are completely aware of what your forex trading strategy is.

Due to the fact that professional traders have mastered their forex trading strategy, they trade less frequently than amateur traders because the pros are looking for a very specific event to occur in the market, rather than throwing darts in the dark like so many amateurs do. So, it almost goes without saying that once you totally mastered your trading edge, entering trades when your pre-defined edge is not present will have a negative effective on your long-term profitability. So, trading with precision and patience inherently means trading less often, but it also means greater profits in the long-run, which is the whole point of trading.

Traders who follow their trading strategy to the T actually enjoy the patience and the down time in between trades, it becomes routine and comfortable over time. They do not feel a “need” to trade when there is no setup that fits their criteria. Operating from this confident yet carefree state of mind while interacting with the market is the way you reinforce positive forex trading habits, like patience and discipline, because when you wait patiently for your edge to appear and then execute it with effective risk management, you will see positive results after doing this for a series of trades, these results will reinforce the positive trading habits that produced them.

Amateur traders tend to reinforce negative trading habits like over-trading and over-leveraging by getting lucky a few times while committing one or both of these trading errors, it really only takes one big lucky winner while over-trading or over-leveraging to condition your brain to constantly over-trade and(or) risk too much.

• So, how often DOES a professional trader trade?

There is obviously no set answer for the number of trades that professional traders make each month, as every trader is different. However, if you are currently losing money in the markets you can safely assume that professional traders are trading less frequently than you are. If you are currently stuck in a rut of over-trading, one thing you can do if you are not already, is switch to strictly trading off the daily charts. Higher time frames lead to less trades but more precision and accuracy of the trades that you do take, you can also employ “set and forget forex trading” on the daily charts that requires only minor tweaking and minimal involvement beyond identifying your edge and setting the trade up.

In conclusion, if you take nothing else away from this article, just remember that professional traders are on average trading less frequently than you are simply because they fully accept and understand the risk involved with any one trade, so this tells you that you need to reduce the frequency that you trade or that you interact with the market. Let’s say that price action trading is going to be your trading strategy, once you master this trading strategy and you know exactly what you are looking for, there is no reason to sit at your computer all day staring at your charts. Set up a routine each day that you follow; you check for your edge, and if it isn’t there you come back the next day, or the next 4 hours or whatever your routine is. But, you don’t ever need to sit there and burn your eyes out watching the charts if you know what you are looking for. If you don’t know what you are looking for and you want to learn a very simple yet effective trading strategy that can give you a solid edge in the market, you should check out my price action trading course and online member’s trading community.

I learnt a lot from your article

Keep it up

Wise words, especially concerning over trading. Newbies should not trade in a real account for at least 6 months and after they understand the markets, get a trading system and have practiced that system on a demo account over and over again until they can get a solid winning percentage. I had crappy teachers at first but finally found a couple of good teachers. Saved and made me a lot of money.

Thanks for article!

Good article. The daily schedule is very good at testing patience.

Before now I traded like amateur with a gambler minded but now I know one can be a professional or a profitable trader as the case may be. I want to be a professional. Thanks.

Great post! Have nice day ! :) mputu

Nial , you have spoken the truth .. I have experienced the over trading .. lost a small bit .. Not all days are trade-able .. Spoken straight from your heart … You are the Best because not all coaches warn this syndrome effect of gambling vs trading.

Thanks Nial, again you gave a useful, effective article, then i learned to become a professional trader

I was recommended this web site by my cousin. You’re wonderful! Thanks!

It is a fantastic article.

Best lesson in i have ever learnt in Forex Trading.Factors a great trader needs to know and learn.Amazing article Nial.

Yes, one lesson to be learned is overtrading. Once you find your edge you are more prone to trading less.

Thanks,

Paul

G’day Nial,

I opened my first trading account 8 weeks ago and struggled to keep a positive account. A colleague of mine, who has a membership with you, just introduced me to your website and offered some of your sound advice which I have taken on.

Your membership looks reasonable, and your advice is so valuable. I look forward to becoming a member. Thank you.

yep :) over trading will lead into bad losses :) that’s why some people called FOREX as sucker games :D but who cares right! cause if they loss it doesn’t mean we loss to!) IMHO ;)

Another very valuable lesson. Another lesson learned. Thank you very much. Josef CZE :-))))

Nial,

This ex-teacher has yet to score a paper of yours less than A+. And, I have read “a bunch of em.”

Could it be … that actual experience and genuine concern for the trader are two key reasons?

Thanks again….Larry

Nail, I think I am over trading. But I like it, trading day charts is for people with a big account. I think so. Thanks for all the info

This article was spot on. Trading for the sake of trading is always a bad idea. Many find it gives them a buzz but this is dangerous. It’s a probabilities game, I need to be very confident prior to entry and understand my reasoning for taking that position. Still I will always adopt strict risk management so I could afford many bad trades before I would start to worry. That said if in doubt I simple stay out. Remember not every day is a trading day!

A good word. Thanks for this and all the materials you make available.

Thanks Nial, another great article.

The cost of the course is nothing compared to the value of the daily commentary, videos and articles like these. You are the real deal. Thanks Man!

Stevek

Hi Nail,

Excellent article!. A word is enough for the wise.In UK you pay alot to hear or read essential,trade transoforming adviselike this.Just to share with you,I had four trades yesterday,nice setup on PB strategies,today all four return very good profit.I will definitely take your course by month end.Keep the good work,I look forward to master the act of trading through your lessons and coaching.Welldone!!

Rufus

Helo

once again i want to thank you for this eye-opening articles on trading less frequently and trading on higher time frame like 4hour and daily chart. I have come to the realizatin that only by following the pros can one make in forex. thanks

Thanks for keeping simple!

thanks, i also believe that to achieve great thing in life it’s through endurance .

Thank you so much for the information. Everything you said hit me right between the eyes. Please keep the information coming. There are some of us that really need it.

Thanks to you nial i am real getting a edge to my trading.

Thanks Nial, Another great article. All I wanted to say is said in the comments before.

Respected Nial,

You are truly the “Guru” for all the traders in the universe.

Keep it up. May Lord! bless with you more success and peace in life.

Thanks for the great article Nial. I agree with you 100%. The only thing that bothers me a bit about trading the daily is the larger stop loss required.

Cheers

Wendy

You can just adjust the position size. Position sizing means that no matter what the stop distance, you can still risk the same $$ amount.

Maybe this has been my problem, not making the required pips so I trade more as result I over trade.Some food for thought.

Excellent lesson and o so very true. Thanks Nial.

Thanks Nial, you shed light on my problem as well. You wake me up with every article of yours. Thanks a lot for this great article.

Excellent Article. It’s as if you’ve been looking over my shoulder the past couple of weeks. In the back of my mind I knew what I was doing wrong …… but all I wanted was 20 pips a day. Over trading was clearly the trap I was in. Happy to say that this is Friday, I did realize earlier this week what I was doing wrong. Oddly enough I stopped watching 15 min. and 1Hr charts. I started to focus on 4 hour and Daily.

Today I managed 220 pips. Feeling good but definitely not cocky. Your article was a very timely read for me today. Thank you so much Nial. I can honestly say you’ve just captured another follower.

Nial you may be the only trainor that gives straight clear answers on how to trade. How explain to me why 90% of traders even after they read this will continue to over trade?

People just become addicted, and obsessed with the market, they don’t trade with patience, they don’t trade with a plan, trading is a business, not a game.

Just wanna thank you for such an enlightening discourse. Much have I learn. Much appreciated.

Less is More. Thanks Nial for the time and effort you give to sharing what you KNOW.

NIAL! you are the man! truely genius,am learning new things here everyday,Iam introducing new traders to your site everyday and the are all interested in your course,just keep it up.

Cheers mate. Thanks for the support

NIal, You are always “right on the money” so to speak with your lessons. I get much out of them and most of my lessons come exclusively from you. Yes I indeed have fallen victum to overtrading and have lost real money. I stepped out of the live trading over a month ago and stick only to Demo trading. I won’t go back to live trading until I have mastered a method. I wanted to share my gratitude, for you do give much of yourself and we all do appreciate that. Thx

Hi Mr. Fuller

I am simply going to say that I echo what Timothy J has expressed.

I would rather be out of a trade wishing I was in rather in a trade wishing I was out. Patience and discipline.

A very valuable lesson learned. Thanks very much.

You are right. i wish all traders gets to read this before starting out. But, of course they just jump at the market hype and hope to make all the money without thiking about the risk and more so the health of thier eye. I mean sitting all daylong in front of the screen burns.

Thank you Nial. Great article!

Nial,

I really enjoy reading your articles. It is comforting to know that all my mistakes are common & have solutions.

I do agree as soon as I gamble, over trade & over hedge it results in a downward spiral. Long term trading & patience are essential but harder said than done.

Please keep writing your articles.

Bel.

Yes, Nial, this works. And even beyond what we newbies tend to write about. I read all your directions, and they climb down right in the back of my mind. And what do I realize? That I am a lot more patient with my other daily job and with my kids back home, day to day. So, this is a lot more than trading. This is a laidback perspective of life. Does it get any more exciting than that?

cheers

Marton

This is greatly helpful. You are indeed a trading coach.

Nial, one of your best yet and so true. As someone who has been trading forex for 3 years now, I can safely say that every time I used to drop down to anything below a 4 hour -preferably daily chart – the stress level went up and the losses occured.

This web is perfect mirror. Thank you for seeing myself :).

Ant.

Commercial traders use the 4hr and daily charts says a former Wall street trader i met.

This is the best website on forex trading I have ever seen, I am addicted to reading your lessons and watching your videos. I will be joining your group soon Nial, I can’t thank you enough. Awesome work on everything you do, it’s appreciated.

Nial, this was an extremely good read, I find that you always seem to know what problems I have , you are like a mind reader. This lessons resonates with me perfectly because I have been over trading and breaking all the basic rules. I think you said it best when you talked about “being out of the market as a position” .. Seriously, you have truly helped me over the last few months develop a deeper understanding of trading. I will be taking less trades with more precision and patience from now on.Thank you.