Snowball Your Trading Success and Stop Losing Money

The market has been somewhat difficult to trade in recent months; many of the major currency pairs have been rather erratic and “choppy”, and until recently, very quiet. There is ONLY ONE SINGLE THING that kept the profitable trader from losing money during market conditions like these: PATIENCE. The most IMPORTANT thing that I have learned over my 10+ years trading the markets, is that patience really does pay, and what’s more, a lack of patience will make YOU pay.

The market has been somewhat difficult to trade in recent months; many of the major currency pairs have been rather erratic and “choppy”, and until recently, very quiet. There is ONLY ONE SINGLE THING that kept the profitable trader from losing money during market conditions like these: PATIENCE. The most IMPORTANT thing that I have learned over my 10+ years trading the markets, is that patience really does pay, and what’s more, a lack of patience will make YOU pay.

The “Snowball effect” is a very good metaphor to explain the importance of patience to a trader and also the how a lack of patience can quickly destroy trading accounts…

Wikipedia defines the phenomenon known as the “Snowball effect” as “…a figurative term for a process that starts from an initial state of small significance and builds upon itself, becoming larger (graver, more serious), and also perhaps potentially dangerous or disastrous (a vicious circle, a “spiral of decline”), though it might be beneficial instead (a virtuous circle).”

Here’s what I would tell you if we were trading side by side:

Imagine me ‘banging on your trading desk’ trying to get this point through to you: THE SINGLE BIGGEST REASON YOU’RE EITHER GOING TO MAKE IT OR BREAK IT AS A TRADER IS BEING ABLE TO WAIT, WAIT, WAIT…and then wait some more….and THEN you POUNCE and go hard when you see a setup that is so obvious you literally don’t have to think about whether or not to take it.

In choppy trading conditions, when the market is behaving erratically or simply ‘backing and filling’ on itself, the primary thing that separates successful traders from struggling traders, is the ability to muster and maintain extreme patience, following a trading plan with obsessive discipline and executing trades without hesitation.

Poker, chess and other strategy games are won when the opponent ‘walks’ into your trap. The great mind games like poker, chess and trading, are all won through strategy, discipline and execution without hesitation. The strategy part is where patience comes in, having an effective trading strategy means nothing if you do not have the patience to wait for your strategy to provide you with high-probability entry signals.

Having this patience as you trade, will work to “snowball” your trading success by reinforcing the fact that trading with low frequency is not only easier, far less stressful and time consuming than high-frequency trading, but is also the “key” to trading success for most traders. Conversely, traders who have little or no patience end up creating a “snowball” of increasingly worse trading, because they grow increasingly desperate and emotional the more they over-trade and lose money in the market. Thus, your job is to make the snowball effect work for you rather than against you, and the way you do that is by simply sitting on your hands until a “damn” obvious trade setup comes along…

A case study of patience in “action”

These days, I am so relaxed in regards to how often I trade, that I may only trade one or two times a month. Part of this is because I’ve been very busy recently with redesigning my website as you may have noticed and with planning a seminar in Singapore for my members. However, a funny thing hit me as I was so busy recently, I noticed that whilst I was still staying in-touch with the markets each day, I was not analyzing the charts as often as I usually do and I also was not really seeing any obvious trade setups.

These days, I am so relaxed in regards to how often I trade, that I may only trade one or two times a month. Part of this is because I’ve been very busy recently with redesigning my website as you may have noticed and with planning a seminar in Singapore for my members. However, a funny thing hit me as I was so busy recently, I noticed that whilst I was still staying in-touch with the markets each day, I was not analyzing the charts as often as I usually do and I also was not really seeing any obvious trade setups.

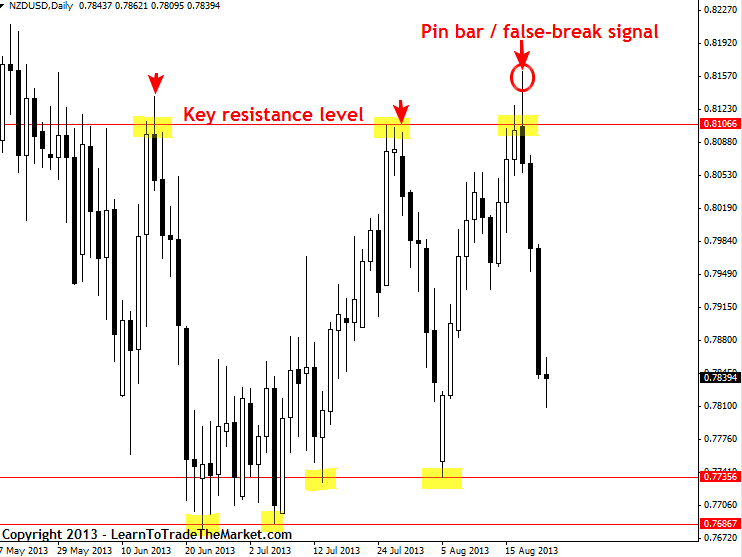

Then, on Monday of this week, a very very obvious pin bar reversal / false-break signal formed on the Kiwi/Dollar daily chart at a key level of resistance up near 0.8105 which we had been discussing and watching in the members’ community over the previous weeks.

I had not traded for about a week before this signal formed, I had simply been busy doing other things while casually scanning the markets for setups each day; nothing intense or over-analytical. Then, when I saw this setup in the NZDUSD which we talked about in our August 19th commentary, I knew that it was a valid trade and something I wanted to risk some money on, so I acted quickly to setup my entry order, stop loss and profit target and then went to bed. The trade actually hit my target as I was boarding a plane to Singapore the next day.

Now, just a little “inside info” here, personally, I approach trading from the mindset of trying to do everything to not be in a trade. A good trader will try to find things wrong with a trade setup before entering it…if you have a difficult market with a lot of chop, staying flat on the sidelines is a no-brainer for the successful trader. Conversely, these are usually the exact same times when the amateur / struggling trader cannot keep his or hands in their pockets and continues to try and “force” trades out of the market, eventually giving back any recent profits they may have made. I discussed a “case study” of this common trading error in my article on how to find your trading ‘mojo’. Just remember; in a quiet market, patience is the only thing that will save you, that is the most important thing to take away from today’s lesson.

I wasn’t worried about this NZDUSD trade after I put it on, as I said earlier, my profit target actually get hit while I was on an airplane to Singapore. I don’t worry about all the little intra-day movements against my positions, I just let the trades come to me and then execute my orders, if the trade results in a loss, then I can live with that because at least I know I waited for a good setup that qualifies under my trading plan and I didn’t over-trade. The only time you should feel regret about a loss is if you traded when you knew you shouldn’t have or you risked more than you were comfortable with losing.

Here’s the NZDUSD daily chart showing the pin bar / false-break sell signal that many of my members and I traded this week. I will sometimes wait two or three weeks for an obvious price action signal like this to form:

Several things are worth noting about this trade:

1) This was not a hindsight call. My members and I were discussing the key resistance near 0.8105 in the members’ daily commentary and in the forum for about one or two weeks before the signal formed there. This is called anticipating trade signals and is a key part of my trading approach and relates back to that whole “strategy in mind games” concept I discussed earlier in this lesson.

2) I could not fault this signal. If I cannot find anything wrong with a particular signal than I will trade it. Normally, I do indeed find things wrong with signals, and that approach has saved me countless amounts of money over the years whilst other traders who are less-picky were losing money on the same signals most likely.

3) I had not traded for a while before this NZDUSD signal formed, I was waiting in the “darkness” like a sniper waiting for his target, and then when it formed, I had been anticipating its arrival and so I acted with total confidence in the setup, win or lose.

4) As I was doing during the two weeks leading up to this signal; everyday, casually scan your watch list of markets that you prefer to trade, but do not sit there all day staring at them. Checking in at the end of the trading day will give you a clear picture of what happened that day, and the closing price on the daily chart is very important as it will help you see false-break type signals like the NZDUSD pin bar false-break in the chart above.

If you find yourself posting on forums asking other people if you should take a particular setup or not, you probably shouldn’t take it. I don’t risk my money in the market unless there’s a setup so damn obvious that I will feel stupid for not taking it, but when I do go in, as I said before, I will go in with a position size that is big, but that I’m comfortable with losing because I believe in the setups I trade.

How the lifestyle of a pro trader supports their trading success

Proper trading habits (trading with patience) breeds trading success which breeds a “trader lifestyle” which in and of itself works to further support trading success…it really is a “snowball effect”. Let me explain this more clearly…

Proper trading habits (trading with patience) breeds trading success which breeds a “trader lifestyle” which in and of itself works to further support trading success…it really is a “snowball effect”. Let me explain this more clearly…

The successful trader might choose to go play a round of 18 holes after putting a trade on, or maybe go fishing with his buddies, etc. Meanwhile, the struggling or failing trader is sitting in front of his computer screen biting his finger nails at every little pip that moves against his position. Which of these two traders do you think is trading in harmony with the market and trading with a stress-free trading mindset? Clearly, it’s the trader out enjoying his life and letting the market do the ‘hard work’.

He is doing this because he has long since figured out that what the amateur traders are doing; sitting in front of their charts, over-analyzing everything and over-trading, is both a waste of time and a lot less likely to make him money in the long-run.

The difference between an “obsessed” trader who needs to be in the market all the time and the successful trader, is simply that the successful trader has learned to ENJOY THE DISCIPLINE AND MODERATION and has realized that THAT is what is making him (or her) profitable. Meanwhile, the unsuccessful trader is still addicted to the “hope” of trading and cannot seem to believe that doing “less” will ultimately result in him making more money in the end. Thus, the struggling trader will trade away as if they have some type of addiction to the market. A very similar analogy can be drawn between alcoholics and those who drink socially and in moderation; the alcoholic allows alcohol to destroy their life whilst the responsible drinker has self-control and gets to enjoy a few drinks here and there and go about their lives successfully. In other words, just as you need to control yourself when drinking alcohol, you need to control yourself when trading the market, by having patience and not becoming addicted to being in a trade.

Good traders who get to enjoy the “trader lifestyle” also benefit from it, because living their life fills in the time and keeps them busy and makes them less likely to interfere with their trades or over-trade. Obviously, I cannot speak for “every” successful trader in the world, but this lesson has given you some very clear insight into what has worked for me over the years and I hope you use it to your advantage. If you want to learn more about my patient price action trading approach, checkout my trading course for more information.

Very informative article. Thanks.

excellent lesson! the patience is force!

Indeed Nial , P.A .T .I .E .N .C .E, is the MASTER KEY to unlock success in this profession . I learnt this recently and this well written and simplified article further shade more light on the reasons why I MUST be really patient, no 2ways about it. Nial, you will live long to impact a lot more on generations to come. Thanks so much.

Nial, Thank you. Your timimg with these refresher and encouragement articles is uncanny. I left my pc at home while down the shore and when I came back refreshed I began to see there were not many trades to be had except for yours. Whereas in the past I would have taken several during that time when no good trades were to be had. I am trying to develope the lifestyle of a successful trader with waiting and patience and learning to be that sniper. Thanks again Nial

A great Article,very inspiring me, about how to approach and trade the Market with harmony, how a profesional trader anticipating a trade signal

thanks and God bless You…. Nial

It is good to remember to be patience in this field. Thanks for this article !

Another great lesson, cheers Nial!!

Thank you

I agree, but sometimes even 18 holes make me stressed….

It is now one year that I am following your methodology. First 4 month with paper money, then the first trades.

After 7-8 months I realize that I made very very few trades (and when I forced to get some more, going on 4H 1H charts, I paid).

I was starting thinking that I was unable to find trades, but the very first lines of this article relieve me!

So it seems that this article come in the right moment to reinforce the corner stones of this trading philosophy: Low Frequency, Key Levels, Obvious Price Action Pattern, Risk/Reward Power.

Thank U Nial!

Your insights are priceless Nail.

Thanks !!!

That is really true. I had to wipe out my account twice to understand that (small ones fortunately but gave me excitement and roller coaster of mindset) .One of the most important moment after that was the fact that i found this LTTTM page.

Hope that i am on the next stade and on the DARK SIDE is behind me for good.

I start week and day reading you comments and articles – that is extremely valuable and important things are so well pointed.

We are all waiting for next lessons as we need lessons like THAT.

Thank you as i can see the light now at the end of the tunnel.

Every article you write here is damn good! My biggest enemy is me! Trading is a secondary thing..

Thank you mister.

Am a new trader with no good experience, I thank God to be part of your Group and now i can see dollars

now. Patience,patience, patience

Thank sir and God bless you

Awesome Article again.

Thank you very, you`re right Nial… As of now only PATIENCE is all i need to learn and succeed in trading…Keep up the good work sir..you and your articles are really such blessings to me and to all people want to learn trading….

Nice one Mr Nial but you need to understand you are a pro while some of us are just starting but years from now with consistence,dedication and commitment we will be were you are Thanks

YOU ARE 100% ON TARGET…YOU WILL NEVER SEE INSTITUTIONAL TRADERS, JUMPING IN ON A WHIM FLYING BY THE SEAT OF THEIR PANTS. THEY WAIT UNTIL THE TIMING IS RIGHT. ONCE THEY SEE THE SETUP THEY ARE LOOKING FOR (ALMOST ALWAYS PROVIDED BY THE PUBLIC & THEN AND ONLY THEN TO THEY PULL THE TRIGGER. PATIENCE IS INDEED A VIRTUE!

Excellent article that hits home. Patience has kept me alive in the recent months. If I look back at my winners, they were obvious.

Fantastic reading ,great wisdom. Thank you.

As always, a very important an wise article. Thanks Nail, God bless

If Ive learned anything these past few years, Id say this advice is, THE HOLY GRAIL.

Another great article Nial. I personally hadn’t traded in about 4 to 6 weeks before the signal on NZD/USD, I thought it was just me but glad to see there actually wasnt much to trade.

p.s website is looking good

Nice lesson, life tastes better when successful

VERY POWERFUL STUFF ! for those ready to heed this simple advice.

It has taken me 9 very painful years to come to these very same conclusions.

LESS IS MORE

Nial i think you read peoples mind because this lesson is for may God continue to increase you.

The NZDUSD setup was one of the best trade setup i have ever seen in the recent months

A perfect combination of trading strategies in a single article! That’s fantastic and respectable at maximum…Thank you Nial..Enjoy every single moment..

Excellent and inspiring thanks Nial!

In this eratic market either leave forex trading completely or follow Nial fuller.No alternative is seen

Hi Nial

The article I found excellent.

I also believe that successful trading requires good strategy, a great deal of patience and confidence in the method. Your course provides me with an excellent trading method. Now I control my mind to make it effective, this is the most complicated.

Sincerely, Hector

Great and Excellent way of approach………… Thanks and God bless You…….

I traded the kiwi when the set up emerged and I got 100 pips… It because I always read your articles, Nial…

“Imagine me ‘banging on your trading desk’ trying to get this point through to you.”

This was really powerful. I will practice this imagination exercise before taking trading decisions further. What would you say, if we were trading side by side? I look at all my experience in LTTTM and see this: Indeed it is not hard to guess what would you say. So why not imagine that we trade together? Thanks again chief…

Excellent points as usual Nial – I don’t trade the kiwi, but you deserve this sort of success! & we get to see it is not just luck :-)

Superb advice, as always Nial. Thank you. A very helpful article.

Nial your a wondeful man, keep it up and my God bless the woman tha gave birth to you. I pray that your decendants will be like that of Jonahan Edwards of America who lived around 1703.I also pray that GOD will give me this kind of wisdow so that i can touch the lives of other people , especially Africa and Asia which are ravage by poverty.

Hey during august I learned exactly this lesson.

And the NUD/USD was my best trade so far. 4R :)

patience is definitely the key to success

thanks Niall

PATIENCE PATIENCE PATIENCE. NOTHING BUT PATIENCE AND PROFIT ROLLS INTO YOUR ACCOUNT.

Was this article written for me? I dont know how u are noticing me,

Thank U sir.

Really thank U.