Why Didn’t I Take That Trade ! ?

After completing our courses and tutorials, most traders have no problem reading the charts, and they can typically find good trades quite easily. However, there seems to be a big gap between being able to find good trades and being able to pull the trigger on them. The number one thing I find from talking to many beginning and frustrated traders is that they have a problem with simply executing the trade, not in finding it.

After completing our courses and tutorials, most traders have no problem reading the charts, and they can typically find good trades quite easily. However, there seems to be a big gap between being able to find good trades and being able to pull the trigger on them. The number one thing I find from talking to many beginning and frustrated traders is that they have a problem with simply executing the trade, not in finding it.

What is it that causes intelligent people who are accurate chart-readers and trade-finders to have such difficulty deciding to pull the trigger on a perfectly good trade?

Here is why you probably didn’t take that trade…

Often, a big reason why people don’t pull the trigger on perfectly good trades is that they simply lack confidence in their abilities. Traders, especially beginners, often think trading is much harder than it actually is. Thus, they second-guess themselves when looking at an obvious trade setup and instead of just executing the trade, they start questing it and questioning themselves, because it just ‘couldn’t be that easy, could it?’

Another reason why people have issues pulling the trigger on perfectly good trade setups is that when they move from fake money to real money, things can change. There’s emotion involved when you move to real money because something is on the line now. You know you could lose money you’ve worked hard to earn, this can play havoc with your trading mindset. Whereas, when you were demo trading with fake money, you probably were totally calm and took obvious trade setups with ease, with no second-guessing. Therefore, managing your risk to a dollar mount you’re comfortable with potentially losing per trade, is critically important when you start trading live, because you must remove as much emotion as possible to achieve that demo-trading mentality.

Then, there is the issue of “Murphy’s Law”, which means basically that anything that can go wrong, will go wrong. It goes something like this, you had some great calls / trades that you didn’t take and then another similar trade comes along and you trade it and it’s the one out of ten that results in a loss, then your confidence takes a huge hit and you get ‘gun shy’ on the next good trade, don’t take it, and it turns out to be a winner. This can obviously become a vicious cycle that can cause you to get frustrated and cause you to end up taking bad trades at some point, because you get so mad at all the good ones you missed you just finally jump in on a bad one, which results in more losses. It’s almost comical, if money wasn’t on the line.

There is also something I call hindsight addiction that affects one’s confidence in pulling the trigger on trades. Many traders don’t even realize it, but they’re addicted to their hindsight analysis. They become afraid to enter a trade without being able to see what happens next on the chart. This is a big reason why I am generally not a fan of back-testing, but I prefer forward-testing, or demo-trading in real time, to test your abilities before going live.

How to stop being afraid of good trades…

Here are some steps you can take to train yourself out of these habits and beat your mental demons…

To rid yourself of the fear of pulling the trigger on a trade, you must remember that to make money in the market, you must take as many instances of your trading edge as you can, and over time, if that edge is profitable, it should pay off. This is an idea from the late-great Mark Douglas that I explain more in-depth in a recent article I wrote based on his teachings, read it here.

The idea is, you should be trading the trades you’re confident about as well as the ones you’re maybe even only 50% confident about. At the end of the day, how confident you are in a particular trade signal can vary greatly, depending on many variables, some of which even probably have nothing to do with the charts (how your day went, the state of your relationships, etc).

Now, that doesn’t mean go out and ‘spray bullets everywhere’. You should filter your trades, but don’t over-filter them; don’t convince yourself that there’s never a trade worth trading. You need to filter but not too much. Check out an article I wrote on how to filter good trades from bad.

The goal is to be confident about your trading edge and back yourself when it appears on the charts. You will need to think like a sniper, but not be afraid to pull the trigger.

Some steps you can take…

- If you find yourself struggling to pull the trigger, decrease your lot size so that at least you’re in these positions and feeling the influence of real money on the line, so this will prevent you from hating yourself in hindsight if you call the trade but don’t trade it.

- The less you look at your charts, the less you will have time to think about whether its right or wrong. Staring at a chart will allow anyone to convince themselves out of anything. Limit screen time to 15 – 30 mins a day. Also, focusing on the daily charts and end of day trading, will help with the psychology of filtering.

- Don’t just look for single bar trade signals, read and feel the chart from left to right. Think of a chart like reading a book from left to right; you need to know what happened on the previous page to know what’s happening on the current page and to make a plan for what might happen next. The market is an ongoing book, being written as we speak, it’s important to know what picture is being painted by the market.

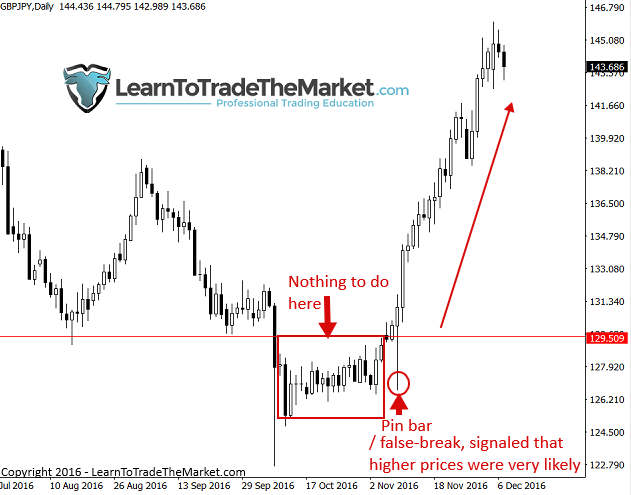

In the GBPJPY daily chart example below, there wasn’t anything to do through this giant period of data but once we got that pin we could read what happened; consolidation, false-break, confirmation (pin bar signal). We won’t go into detail here, but we saw a false-break signal on the GBPJPY, those who were short got caught short, and This pin was a signal and the short covering that followed, fueled the run higher.

The signal itself is confirmation, but to get more confidence we need to read what happened from right to left…The signal is the FLASHING LIGHT, then go read what happened on the chart…

Price action analysis is not only about single bar signals, it’s about reading the charts and reading the ‘story’ the price action is telling you from left to right, much like the pages of a book. I dedicated an entire section of my professional trading course to this powerful concept and for many of my students this was the ‘ah ha’ moment in their trading career. Glancing at a price chart, being able to read it like a language and confidently anticipate the markets next move is a skill all traders should aspire to.

PLEASE LEAVE A COMMENT BELOW – I WOULD LIKE TO HEAR YOUR FEEDBACK :)

QUESTIONS ? – CONTACT ME HERE

My main mentor 👍

Thanks for sharing.

Now I can understand myself through your teaching.

This is a nice comparison of a price chart to a language. Just like any other information it has to be acquired (heard/viewed) and interpreted (analyzed) for an action/response/trade to follow.

The above chart had two lovely moves from the pin bar at key support. in between two months of both of them appearing at key support!

Patience is key here. Now i am more relaxed in trading and constantly being reminded to take the trade and trade my edge.

Thank you Mr Fuller :)

It’s true. Beginer trader finding difficulty in pulling the trigger.

Looking for only price action signal is not enough. Full chart must be observed to action the trade. This article will build the confidence in beginer or struggler traders.

Excellent…

Wow just what i need to see. This is my 1st day on a live account

thanks Nail such useful information….happy newyear

Hello, this article is about me and for me :)

Thanks Nial :)

Thanks Nial for great articles.That’s all i need to improve in confidence to become “sniper”.

Happy New Year 2017….GBU

There is very important and useful info in this article

Thanks a lot. I have to read more of your docs. Happy new year!!!!!!

Very good article. Thanks, Nial!

Great one as always, thanks Nial!

Thank you Nial, it is really hard to pull the trigger. That article is a good motivation.

Extremely clear article, thank you. It felt like you had written this for me personally, since it sheds light on right where I am in the journey to become a trader. It’s been a long journey, and I am hoping to go live in 2017. As I look back, I see how far I have come, and I have Nial to thank for that. Best wishes to everyone in 2017. May we all prosper together.

I wish you happy Christmas in areas and a very prosperous year ahead, you are damn too right with your article

i have witnessed many trades fly off with wings that i should have short with my arrow while still on the tree. The remaining is story of shadow chasing. Next year will be a different ball game

Thanks a thousand times

This article is good added value to the course (which I signed up for in last November): Psychologie is big part of the trading.

Thanks Nial, excellent article and well explained.

Thank you.

very constractive article. you are wonderful. I have lost a lot of money before I start to read your articles, but now I am beginning to be a successful trader, because of you. May God bless you and your family.

Thank you Nial. You have identified a common problem a lot of them face and suggested very good tips to overcome. Merry Christmas and a Happy new year.

the best and clearly explanation of trader mindset I ever read.

This is awonderful learning its great useful for us .

Thank you

greattttt and nial sir please upload new video

You are a teacher and a mentor put together.Each time I read your post, I get fresh inspiration. Though I am not trading now, but hope to very soon. Very many thanks.

If only I had chosen you as a mentor from the very beginning my account would be in a happy state. However thanks Nial do you know how hard it is to get the right advice ?

Years mate, however I now have a trading apprentice and I understand why you teach, its not for the course fee its only there to make the student take an appreciation of what is being taught. “When the student is ready, the teacher will appear”

Merry Christmas my Aussie mate . [ its bloody 40c in the shade in OZ ]

Good admonition.

I just lost a trading opportunity this last Monday because of fear. This article is real.

Thanks Nial

That is a typical Nial excellent article Youre a phenomenon on forex trading Keep it up , TEACHER

This is the article what I presently needed – similar problem appeared to me since two weeks. I was close to ask you for advice. Most trades I lost due to second- quessing and on the end opening the position to late or ….against the trend. However I still believe in my trading edge ;-) need more patince –

Thanks Nial and Merry Christmas from Mediterranean Sea

This article is so true……confidence in your trading ability is key.

What you describe is absolutely true, especialy the Murphy’s law part !! I can say I’m an “expert” now, since I’ve wipped two accounts. But I keep going !

Thank you for the advices

Thanks so much Nial great article

Great article Nial. Have a great holiday and Merry Christmas

Hello Nial,

Thank you and a Very Merry Christmas, You hit the nail on the head once again, Loved it.

I love this article, especially “Hindsight Addiction”, It’s all so true.

However, I have found the easiest way to avoid all of this emotional tribulation. Is to trade on a Real account ( Real Money), Starting with the smallest lot size, like Micro lots.

This way by the time you get to Mini , and Standard Lots, You will have so much Experience, and Confidence,in your System and Ability. to handle emotions of dealing with Large , and Serious money.

Merry Christmas my friend.

Keep up the Good work

That’s an excellent explanation and teaching,

Thank you so much.

Great article again, Nial! You’ve said before about reducing your lot size, which I’ve been doing and it’s really helped a great deal. I don’t fret about if the trade will work or not, but I’m slowly building confidence with small lot sizes.