Stop watching your Forex Trades – You’re a trading addict

Stop watching your Forex Trades – You’re a trading addict

If you find yourself unable to sleep at night and rolling out of bed at 4 a.m. to check the trade you entered the day before, you just might be a trading addict. Many traders do this and it is mainly a result of either risking too much or over trading. A good rule of thumb for determining your risk tolerance is whether or not the amount you have risked keeps you awake at night. If you find that your thoughts are dominated by the current trade you are in and what is happening with it, it is likely time to reduce your risk or just stop trading for a while. Many traders get addicted to trading the forex market without even realizing it. Forex trading success means that you often aren’t in the market; in a sense if you are correctly trading the forex market it should actually be pretty boring to you. This is because you should have pre-defined all aspects of every trade you enter so that there are no thrilling or devastating surprises.

Once you find that you have reached a happy medium where you are still actively trading but are not really thinking about your trades, or even forgetting about them, you will be on the track to success. This is what I call a “set and forget forex trading method” and it is the way that I personally trade and the way that I have found success in the markets. I think it is important to stop and really think about meddling in live trades and what good can possibly come out of it. If you know that you are more objective when you are NOT in the market than what good do you think you will do by watching your trades and trying to adjust trading parameters once the trade is live when you are likely to be much more emotional about it? The barrier between successful forex traders and the heaps of amateurs that lose money on a regular basis is overcome by understanding that you cannot control the market and that you give yourself the best shot at success through pre-defining all trading parameters thereby minimizing emotional involvement. Unfortunately many forex traders do the complete opposite thing by minimizing objectivity and maximize emotional involvement, thus they lose money.

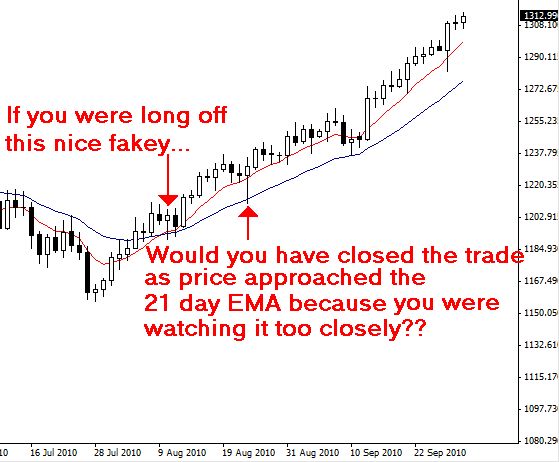

Finally, let’s look at some recent chart examples of how watching your trades and messing around with them while they are live can directly limit your trading success:

Take a look at the current gold chart. Had you entered long at the nice fakey setup that formed with the trend on August 10th and then let it run for a week or so you would have experienced a rather large draw down as the pin bar formed on August 24th. Now, if you were still long and had not pre-defined what your exit strategy was, you would have likely made an emotional trading error from watching this trade on August 24th and would have freaked out as price sold all the way down to the 21 day moving average and then reversed back with the trend. If you had just let the trade go and not looked at it because you had your stop at break even and were employing a set and forget trading mindset you likely would still have been in the trade and profited nicely as a result.

Click the following the link to see a video about set and forget forex trading.

If you would like to learn about my forex trading educational course click here: forex trading course.

Turn a bad thing into a good thing. Instead of focusing on the negative make it a positive. For example, a person that watches his trades should just take up daytrading.

Rules:

Have set hours (from 5pm to 9pm) forex is 24 hours so you can trade whenever

Use an email alert tool(phone and gmail notification setup), also avoids emotional trading

Have a defined exit plan(email alert is setup for entry)

Have fun while you wait(games, even a movie on computer, music,etc)

trade watching is bad. i agree. in the case above, at least a break even stop should have been there as it went up about $40 initially. additionally one could have exited at take profit before the bar u mentioned, as it was a good profit before and one should not be greedy. and when they saw the pin bar form, they could reenter.