Set and Forget Forex Trading – Keep Your Day Job

‘Set and Forget Forex Trading’ is as simple as its name implies; you simply “set” the trade up and then “forget” about it for a period of time. This has two major benefits: it makes it far easier to stay emotionally disciplined and it also allows you to go about your life as you normally would, because you will not be spending hours in front of your computer over-analyzing the markets…

‘Set and Forget Forex Trading’ is as simple as its name implies; you simply “set” the trade up and then “forget” about it for a period of time. This has two major benefits: it makes it far easier to stay emotionally disciplined and it also allows you to go about your life as you normally would, because you will not be spending hours in front of your computer over-analyzing the markets…

Often, aspiring Forex traders become lost in a web of confusion with the amount of data that the various financial media outlets plaster all over the internet and television. It is extremely easy to experience “analysis paralysis” while trying to trade forex or any market for that matter. There are so many competing ideas and trading methods along with more fundamental data coming out every day than you could ever hope to digest, it can be overwhelming to even try and make sense of it all and develop a forex trading plan based off this amount of information. One of the biggest psychological mistakes that almost every aspiring trader makes on their journey to success is firmly believing that the amount of economic data analyzed and (or) having a technically complicated or expensive trading method will help them profit in the market. In reality, as most professional traders will attest to, these factors usually have the opposite effect on trading profits, at least after certain point. This essentially means that once you do a certain amount of analyzing market data, any further time spent analyzing this data is likely to have a negative effect on your trading; it causes you to lose money.

Why it’s Counter Productive to Analyze too Much Market Data

It may seem confusing or counter intuitive to the aspiring Forex trader when they first hear the fact that analyzing too much market data can actually cause you to lose money faster than you other wise would. The believe that “more is better”, is a psychological trap that often keeps aspiring traders from consistently profiting in the Forex market and is the reason why many of them blow out their trading accounts and eventually give up all together.

The main reason why this occurs is because human beings have an innate need to feel in control of their life and of their surroundings, it is an evolutionary trait that has allowed our species to perpetuate its existence and ultimately arrive at our current modern day level of civilization. Unfortunately, for the aspiring Forex trader, this genetic trait of all human beings works against those trying to succeed at Forex trading. In fact, most of our normal feelings of wanting to work harder than the next guy or spend extra time studying and researching for our jobs or for school are feelings that are really not beneficial to success in the Forex market.

The problem with trying to apply the idea of “hard work” to Forex trading, is that beyond a certain level of technical chart reading ability and awareness, there really is no beneficial aspect to spending more time on tweaking a trading system or analyzing more economic reports. The bottom line here is that there are literally millions of variables involved in trading the Forex market; each person trading the market is a variable and every one of their thoughts about the market is a variable because these are all things that can cause price to move. So, unless you are somehow able to keep track of every trader in the market and all of their thoughts, in addition to the hundreds of news and economic reports that come out each day, you essentially have no control over price movement. Trying to analyze numerous pieces of economic data each day or trying to come up with an overly complicated trading method is essentially just a futile attempt to control something that simply cannot be controlled; the market.

Thus, the underlying cause of Forex trading failure begins with the idea that traders feel a psychological need to control their surroundings and when this emotional state meets the uncontrollable world of Forex trading it almost always has negative consequences. This problem works to snow-ball itself as well because once a trader loses a few trades he or she begins to get angry and wants to “get back” at the market. The way they do this is by reading another trading book or buying a different trading system that seems more “likely to work” or by analyzing the inner workings of every economic report they can find and trying to predict how it will affect the market’s price movement. Once this process has begun it is very difficult to stop because it makes logical sense to us that if we put more time in and do more work we will eventually figure out how to make more money faster in the Forex market. The difficult truth to all of this is that, as stated earlier, after you reach a certain degree of technical and fundamental understanding, any further research or system “tweaking” beyond that point will actually work against you and the rate at which you study more and do more research is probably about the rate at which you will lose your money in the market.

Less is more in Forex: ‘Set it and Forget it’

So how does the aspiring trader achieve consistent profitability trading the Forex market if we are genetically primed to over-complicate it? The very first step in this process is just accepting the fact that you cannot control the uncontrollable Forex market and checking your ego at the door. The Forex market does not care what you have done in your life before; it has no emotion and is not a living entity. It is an arena where human beings act out their beliefs about the exchange rate of a certain currency pair. These beliefs are a result of emotions, and human emotion is very predictable when it comes to money. The point here is that the people mentioned in the previous section who are doing extensive amounts of research and trying to find the “holy grail” trading system are the ones who are trying to control the market and thus trading based off emotion. These people are providing the predictability for the professionals to take advantage of.

The paradox here is that professional traders may actually do less technical and fundamental “homework” than amateur / struggling traders; pro traders have mastered their trading strategy and they simply stick to their daily trading routine and see if their edge is there. If there edge is not present, then they just walk away for a while because they know that the Forex market is a continuous stream of self-generating opportunities, thus they do not feel pressured or anxious to trade. If their edge does show up then they set their orders and walk away, accepting the fact that any further action will probably work against them because it will be a vain attempt to control the uncontrollable and would not be an objective action.

The logic of set and forget forex trading is this; if your trading edge is present then you execute your edge and do not involve yourself further in the process unless you have a valid price action-based reason to do so. Traders that decide to mess with or tweak their trade once they enter it almost always kick start an emotional roller coaster that leads to over-trading, increasing position size, moving their stop loss further from their entry, or moving their profit target further out for no logical reason. These actions almost always cause the trader to lose money because they were not objectively thought out, but were instead influenced by an emotional reaction that was caused by trying to control the uncontrollable.

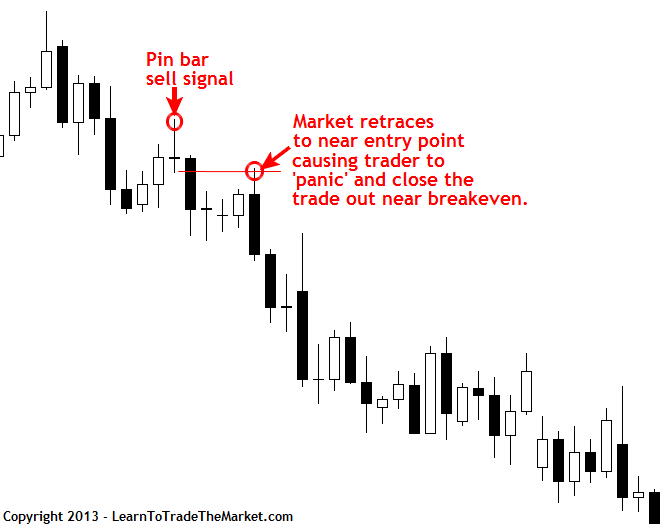

In the chart below, we see an example of how many traders get into trouble by being too involved with their trades. As the market retraced back toward the entry point of the pin bar sell signal, emotional traders would have probably exited for a very small profit or near breakeven because they felt “scared” or “nervous” that they might lose money on the trade.

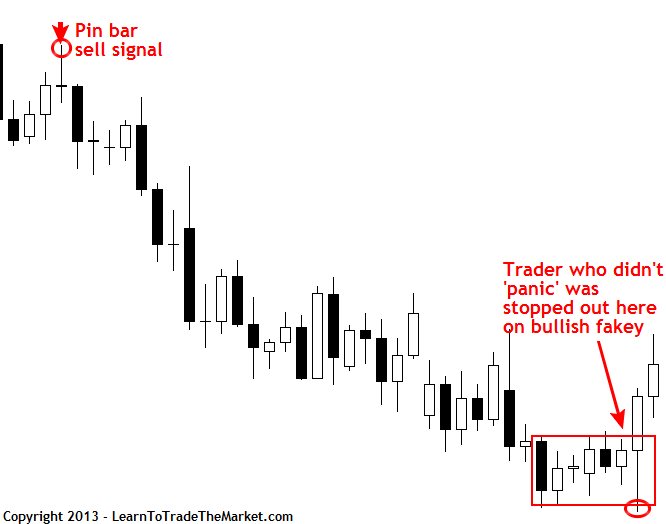

In the chart below, we can see that just as the market got to about the low of the pin bar sell signal where most traders would have entered, it stalled and then fell significantly lower back in-line with the downtrend. Disciplined traders who do not “meddle” in their trades for no reason would probably have still been short and would have clearly made a very nice gain. Note how a traders could have waited for an opposing obvious price action buy signal to exit the trade…this is exiting on logic and price action rather than emotions like fear or greed.

Make Money and Save Time by Doing…Less?

It is a well-studied fact that traders who trade off higher time frames such as 4 hour, daily, and weekly charts and hold their positions for multiple days, make more money in the long run that traders who “day trade” off intra-day charts. The reason many people are attracted to day trading is because they feel more in control of the market by looking at smaller time frames and jumping in and out of positions frequently. Unfortunately for them, they have not figured out that they have the same amount of control as the swing trader who holds positions for a week or more and only looks at the market for twenty minutes a day or even less. That is to say, neither trader has any control over the market, but day-trading and scalping gives traders the illusion of more control. The only thing we really have control over in trading, is ourselves.

The ironic fact about Forex trading is that spending less time analyzing data and finding the “perfect trading system” will actually cause you to make more money faster because you will be more relaxed, less emotional, and thus less likely to over-trade or over-leverage your trading account. Many people are attracted to speculative trading because they want a way to make money that is “less difficult” than their current job, but they soon forget about that and start spending countless hours digging themselves into a huge psychological trap that most of them never dig out of. All you basically need to do to consistently make money in Forex is master an effecting trading method, develop a written out trading plan based on this method and have a solid risk management strategy, you can then check the market one to three times a day for ten to twenty minutes each time. If your edge (price action strategies) is showing up than you set up your entry, stop loss, and target and walk away until the next scheduled time to check your trades.

The ironic fact about Forex trading is that spending less time analyzing data and finding the “perfect trading system” will actually cause you to make more money faster because you will be more relaxed, less emotional, and thus less likely to over-trade or over-leverage your trading account. Many people are attracted to speculative trading because they want a way to make money that is “less difficult” than their current job, but they soon forget about that and start spending countless hours digging themselves into a huge psychological trap that most of them never dig out of. All you basically need to do to consistently make money in Forex is master an effecting trading method, develop a written out trading plan based on this method and have a solid risk management strategy, you can then check the market one to three times a day for ten to twenty minutes each time. If your edge (price action strategies) is showing up than you set up your entry, stop loss, and target and walk away until the next scheduled time to check your trades.

Trading in this manner actually elicits a snowball of positive habits that work to further perpetuate your trading success. This entire article can be summarized by the following two sentenes: People who spend more time analyzing market data and trying to perfect their trading system inevitably induce a cycle of emotional mistakes that work to increase their trading failures and eventually result in lost money and lost time. People who realize that the market is uncontrollable and build their trading plan around this fact will inevitably arrive at a “set and forget” type mentality that induces an emotional state that is conducive to on-going market success and consistent profitability. The trading method used is not as important as the psychological or risk management aspects of trading, but generally speaking, a method that offers a simple high-probability edge such as the price action trading method that I teach in my price action trading course, is the best method to use to maintain your “set and forget” mindset.

As a successful Day Trader I would do 2-3 trades per day and spend no more than 1hr in front of my screen per day. What do you consider a good return on trading over a month?

Guilty as charged here sir, as an amature trader, I spend 8 to 10 hrs infront of my computer digesting data from my trade but the outcome was not good. but after I annalize set my trade and close my laptop, My trades got better.

After trying an number of trading methods I really do feel the siuts me thanks Nial for the advise.

Hello Fuller, good work, you woke me up from sleep bcos swing trading i know for a long time but i have not make use of it but now i will start using it.

great lesson for those ,who are new one in trading ,thanks neil,i will apply your lesson to my practical .

Great post. I really need to work on this. I think my problem as a new trader is the fact im un sure what i have done is right and over analyse. As you have stated this causes problems and in the end normally turns out by using your simple price action set ups i was right anyway in thr long tun but never let it play out. Have a feeling adopting this strategy and being disciplined to stick to it can really help me. Thanks

Well structured content about FX. Loved the way you have prepared and expresses it.

Hi Nial,

Just starting out. This will help me a great deal.

Thanks for videos. Great job.

Your the best

nice article nial ……i am very much interested in studying your course ……..you are doing a good job and i want you to continue it……………

Perfect article

Very good and it’s true.

Still trying to implement it perfectly…

You are correct, coming from a recently converted to the “set it and forge” of trading..

Bobby

Yet another weapon in my trading arsenal. Many thanks Nial

I found my “method” thanks to you

E

Hi Nial,

The video tutorials are great!

Thanks

Hi Nial,

Just read this again. I needed to create a firmer belief in set & forget and the following did it for me:

“accepting the fact that any further action will only work against them because it will be a vain attempt to control the uncontrollable and would not be an objective action”

It was truly a blessing that I searched for “price action” in google and came across LTTTM.

Sanjay

Nial, I consider myself to be complete novice at trading and have not been very successful at the outset of my trading career. However, I discovered your website about two weeks ago and implementing some of your price action techniques (having deleted all of my indicators!!) I have had an incredibly profitable 2 weeks. Lets hope it continues…and that you continue posting amazing tips!

BOTTOM LINE = “Rocket Science it’s not — self discipline it is!”

Nial, Once again excellent content, Must be read and re-read until fully understood!

good work , keep it up

Nial I recently purchased your course its content and your teachings by yourself and your team is simply amazing.

It has taken me about 2 years to arrive at this point in my life, although I was always looking for a set and forget way of trading but never knew where to look or what system I should be useing.

Now I have got my answers and I am totally confident that I will be earning very soon and in the short term will become a full time trader and in the longer term will only get better as long as I follow what is being taught and keep my discipline.

The reason being your site and most on it are very helpful and eager for everyone to succeed.

Experienced traders helping inexperienced ones can only be a positive way to learn, long may it continue.

Early days yet but a big thanks for being part of your community.

Don

Hi Nials, Thanks for the great article!. I tried intraday trading and its too stressful. My father inlaw is a professional trader for the last 10 years, and only uses “price action” and swears by it, Its like you never listen to your parents advice but when someone else gives you the same advice from a different angle it makes sense.. I want to thank you nials for comfirming to me the right way to trade. Tim

I started trading in the market 3 months ago and at first i became a heavy day trader and lost 90% of my investment. I had lost all confidence in my trading and thought i would just play around with the 10% i had left. So i got home from work in the afternoons read a few market reports, put one or two trades on and leave it for the rest of the night. I did this for the whole month and to my amazement that 10% i had left grew to over 3 times to what i initially invested. So it just goes to show that if you can be patient enough you just might make alot more.

Hello Mr. Fuller

Yes I am re-reading this article also. After giving it a thought of do I want to try and read the minds of millions of traders or do I read and absorb your mind(though your articles) and apply to my mind. Even then the task is sometimes taunting.

If I had learnt about trading price on the longer term trend – Daily, I would have been a millionaire by now. Thanks Nial.

best article covering phycological and technical aspects too. btw i am saying this after reading ooks from van tharp and many other curreny trading books (not saying they are bad) but this article deserve to be considered in same league only difference is its well summarised in less than two pages rather than a book. just wrote this comment as wanted to appreciate the thinking and good intentions to help naive (experienced(those who claim)) traders. can work in all markets.

Very nice secret of success in day trading

Just came across this article and I have to say, I thought Nial described me!!!!! Every single word in it is so true. A powerful article. Should have learned that before i started trading :-). Well done Nial, cant wait to find out more about your experiences.

Listen to what the man says – price action, price action, price action – there’s no other way.

I have always been a BIG fan of Nial Fuller! He preaches what he teaches or in layman’s term walks the talk compared to those who disguises themselves as traders, but are really nothing more than salesmen in wolves clothing. I’ve followed Nial’s trading philosophy and his PIN bars trading methodology for quite sometime now! And, like many of us, I am a true convert from intra-day to swing trader. So thank you very much Nial for sharing your in-depth knowledge with us.

I couldn’t agree more with Nial in regards to the set and forget, and his whole website for that matter. One thing that will enable a trader to sucessfully implement “set and forget” is to make sure you are not trading with money you need, release the attachement to the money. Thanks again Nial.

All I can say is, nials you hit this nail right on the head, I’ve been struggling with daytrading for a while now, and I’m losing money fast, its too stressful..I read this article this morning and laughed to myself, because its true, higher timeframes are the best. Just been on holiday for a week and decided to trade on a higher timeframe (1hr – 4hr) Less stressful and very profitable too. Thank you nials for your great articles, they are worth there weight in gold to me and my family.

Trade and forget, i’d love it but what really worries me are those times the market blows past my stop so fast that my close out trade does not take place. If I am not there to keep an eye on the trade i could end up losing a lot more money.

Has this happened to anybody else??

Joe

(Don’t think i’m being negative on Nial here, i’m not. After 18 S-T-R-A-I-G-H-T months of negative trading i am now finally in positive numbers after following his advice….wish i’d found this site 19 months ago)

Very very mechanical way of trading Nial, thanx and good trading!

Ken

don’t watch any news. only look at technicals. i used to look at all the news, and developed panic attacks. dont do it and risk your health! follow what nial says

I totally agree with this article, chart watching is stressful and my trades on higher tf has proven more peaceful and profitable. I have enjoyed the videos and wish you continued success – Delvin , Jamaica

Nial.Thanks a lot

thanks for the tip.

I’ll do your course

Hi Nial,

thankkyou for that,

THANKS!

Nial, thanks for the video and comments. Keep more short clip video’s coming please:) I know you’re a busy man though.

I’m curious, as a professional trader, the average number bad trades you make based on your price action strategy… I know the goal is to have more gains than losses, or at least have your few gains outweigh your many losses, but I’m wondering what to expect of myself once I get a good grip on your trading system.

Thanks agian!

Larry..right. This message hits straight to the face. I have the same conditions that almost mention here. I have full time job but analyzing the long term trend in 4hr charts, but trading and taking entries in 15min-30min charts at early US seesion. I could not follow well the market and stay disciplined with stops. My family time had been impacted by me, follow the markets (PC Screen) almost all day.

This Set and Forget approach would be great if I really can learn it and apply it. I will make my best to make it.

Nial….Thanks a lot. Please share more about this Set and Forget strategy.

Regards

Mauricio

Nial, I’m in the process of weaning myself off intraday ducking and diving, because (a) I want a life, and (b) it isn’t sufficiently profitable when you consider all the hours and stress. Thanks for continuing to take the time to keep stating the obvious facts of Forex trading.

Robin

Hi, Nial,

This idea, while it’s been around for a while, has finally started to sink in. I love the excitement of day trading, but I’m losing money, and my relationships are suffering. So I’ve started trading the long-term charts. What a difference! Thanks a million!

Goof stuff Nial. I am the sort of person who will enter a position on the daily but spend all day/night watching it move on a 5 minute chart. Not great for the heart rate. I guess you just have to relax and let what will be, be.

Cheers

Alex

Hi Niall, loving the videos you have been sending over the last few months.

What you are saying in regard to higher time frames makes absolute sense. I’ve started to trade from the 4hr tf since the new year and am see improved results.

This article hits me straight in the face. I am guilty and I plan to change my problems. That is by learning Nials set ups, and set it and forget it. Thanks Nial.

Larry

Im so proud of you ,i take every word you say…

Eli

It took me five years to completely understand the gist of these words. Once I did, things became much easier and profitable.

Brava…

Hi Nial, Nice article. I like the idea of “set and forget” I’m bad for moving my stops too quickly to BE, usualy after i’m up 1X risk. Their still geting hit and then the trade does turn out as planned. Any Tips? Thanks for the vidieo’s and the course.

As far as I know, this is the honest truth – price action and all the instructions you gave above. Thanks Mr. Nial for this. I learnt more things.