Pyramiding – A Money Management Strategy To Increase Profits

In today’s lesson I am going to teach you guys how to “trade with the market’s money”. That’s right, I am going to show you how to scale in or “pyramid” into a winning trade, without taking on more risk. This essentially means you will add to an open winning position without taking on more risk and possibly even creating a risk-free trade, all while dramatically increasing your potential profit. It’s not too good to be true, but there are certain times when scaling into a trade works better than others, which we will discuss in today’s lesson. (Note: scaling in is the same thing as adding to a position or pyramiding in)

In today’s lesson I am going to teach you guys how to “trade with the market’s money”. That’s right, I am going to show you how to scale in or “pyramid” into a winning trade, without taking on more risk. This essentially means you will add to an open winning position without taking on more risk and possibly even creating a risk-free trade, all while dramatically increasing your potential profit. It’s not too good to be true, but there are certain times when scaling into a trade works better than others, which we will discuss in today’s lesson. (Note: scaling in is the same thing as adding to a position or pyramiding in)

You’ve probably heard the saying “Cut your losers short and let your winners run”, but how do you actually do that? Today’s Forex trading training lesson is going to teach you how to properly scale into an open trade that’s in profit, so that you get the most out of your winning trades. You probably know that many of the major Forex pairs have been trending quite nicely recently, if not, then check out my recent Forex market update to learn more. With all these strong trends that are taking place recently, I thought it would be good a idea to chuck out an article to you guys about how best to maximize your winning trades. So, let’s get started….

Note: When you finish reading today’s lesson, please leave me a comment and let me know if you found this information helpful!

How to safely scale in or “pyramid” into a winning trade

Note that I have “safely” in italics above, that’s because there are basically two ways that you can add to a winning open position:

1) The stupid way – Scaling into your position but not trailing your stop up or down to reduce risk on the previous position(s), thereby voluntarily taking on more risk (something you should NEVER do).

2) The smart way – Scaling into your position at predetermined levels and trailing your stop up or down each time you add a new position so that you never risk more than you are comfortable with losing, or more than what you have predetermined is a good 1R value for you (1R = the amount you risk per trade).

I am going to teach you guys how to safely pyramid into your trades today, but before we get started I need to stress one thing:

WARNING: Just because you can scale into an open position that is in profit doesn’t mean you SHOULD. There are certain times when the strategies you are about to learn will work well and certain times when they won’t. In general, you can try to scale into a winning position when a market is in a strong trend or during strong intra-day moves. You should not try scaling in when the market is range-bound or trending in a choppy manner with a lot of back and filling.

Now, because you are adding a new position each time your current trade moves a certain distance in your favor, your breakeven point on the whole position moves closer to the market price. This means the market doesn’t have to move as far to put you into negative territory. Now, this won’t be a problem if you have trailed your stop loss on the previous position(s) so that you maintain your overall 1R risk, but where traders get into trouble is scaling into positions and not moving their stop losses to reduce risk. If this all seems a little confusing right now I promise the diagrams below will clarify…

Example scenario:

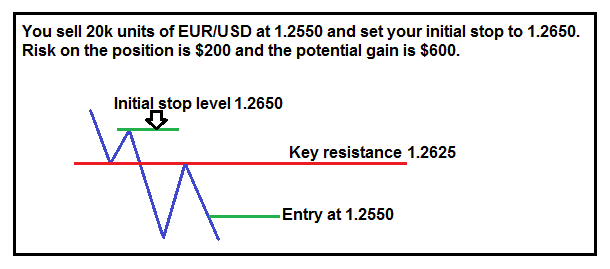

Let’s say the EURUSD is trending lower like it has been recently. You see a solid pin bar entry strategy that formed showing rejection of the 1.2625 resistance level. You decide that since price has respected this level and it’s obviously a “key” level, it’s a good place to set your stop loss just above. So you decide to put your stop loss for the trade at 1.2650….we ALWAYS set our stop loss BEFORE deciding on a potential profit target. This is because risk management in Forex trading is the most important aspect of the whole thing…if you don’t properly manage your risk on EVERY trade you WILL NOT make money.

Next, there is no obvious / significant support that you can see until about 1.1900, so you decide to aim for a larger profit on this trade and see if the trend won’t run in your favor a bit. Your pre-defined risk on the trade is going to be $200, to keep the math simple let’s say you sold at 2 mini-lots at 1.2550; 100 pip stop loss x 2 mini-lots (1 mini-lot = $1 per pip) = $200 risk

You decide to aim for a risk reward of 1:3 on this trade, so you set your initial target at 1.2250 and you plan on adding two positions to this trade, 1 when you are up 100 pips and another when you’re up 200 pips. You plan on doing this because the market is trending strongly and you have decided based on your discretionary price action trading skills that there’s a good chance the trend will continue.

Here is a diagram of what your trade looks like at the beginning:

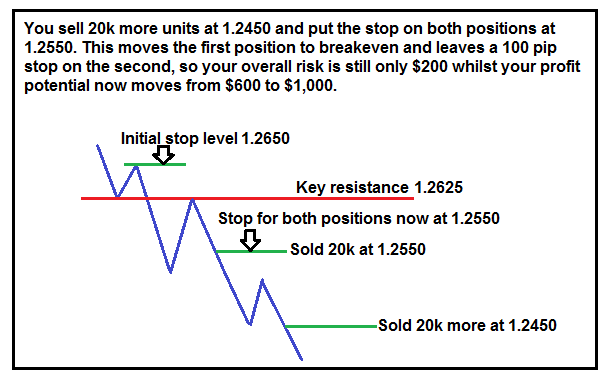

The trade pushes on in your favor and you decide to scale in with another 20k units at 1.2450. Your overall position size is now 40k or $4 per pip on the EURUSD, this increases your potential reward to $1,000 if price hits your target at 1.2250. Since you trailed down the stop on your initial position to 1.2550, that position is now at breakeven, the stop on your new position is also at 1.2550, meaning your overall risk on the trade stays the same at $200.

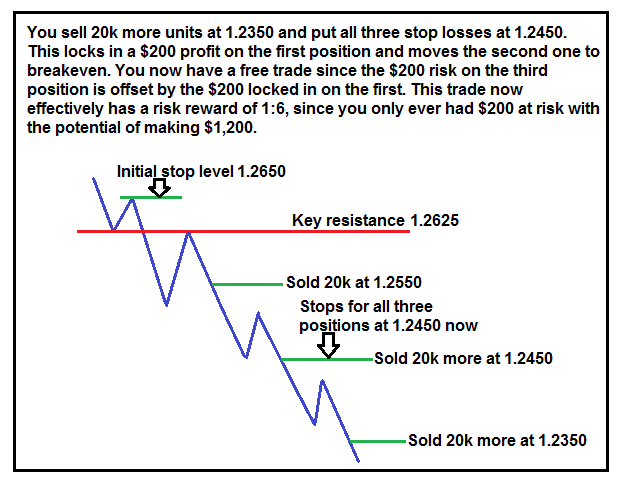

Next, the trade continues on in your favor and you decide to pyramid in with another 20k units at 1.2350. This means your overall position is at 60k or $6 per pip on the EURUSD. Your overall reward potential is now $1,200 if your target of 1.2250 gets hit; note that your reward is now double what it was when you started whilst your overall risk is now at $0 as you’ll see now…

You trail down the stops on both previous positions to 1.2450 thereby locking in a profit of $200 on the first position, reducing the second position to breakeven and offsetting the $200 risk on your new position to $0…you now have a breakeven trade. The catch here is that the market is only 100 pips from your breakeven point on the whole trade, so there’s a bigger potential of the whole position getting stopped at breakeven…the good part is you have increased your potential for profit without taking on any more risk.

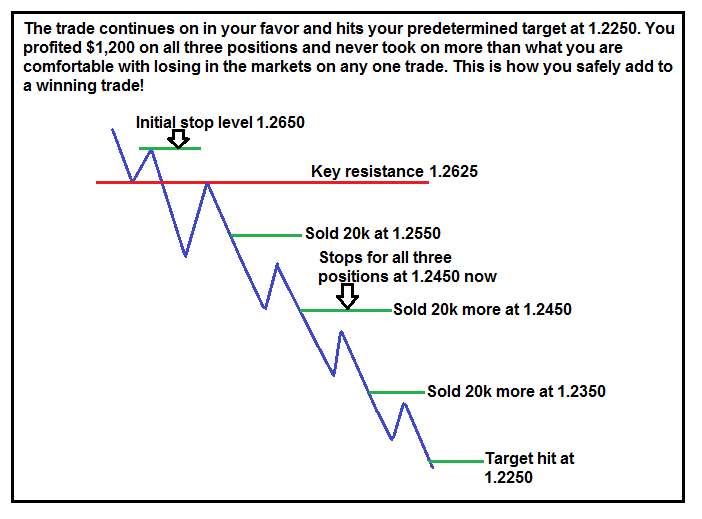

The trade continues on in your favor and hits your target at 1.2250, all three positions are now closed and you’ve netted a 1:6 risk : reward. You never risked more than $200, which was your predefined 1R risk amount, and you gained $1,200. This is an example of how to take advantage of a strong trending market like we have seen recently in the EURUSD and other markets.

Why I don’t scale out

I am sure that some of you are probably wondering about scaling out. I am not going to get into it too deep in today’s lesson, but if you want to read a previous lesson I wrote that discusses scaling out, check out my article on forex trade management.

I will say this: I don’t scale out, and I don’t recommend you do either. But, obviously what you do in the markets is up to you, however, I will briefly explain to you why I personally believe scaling out makes no sense. When you scale out of a trade you take partial profits on your full position as the market moves in your favor. Sounds good on the surface right? Well, the problem with it is that you are limiting your gains on a winning trade. We want to maximize winning trades, not minimize them. What I am saying is that by scaling out you are purposely limiting a winning trade.

You see, when you scale out of a trade you are cutting down your position size as the trade becomes more profitable by moving further in your favor. What this means is that as the trade moves in your favor you’re going to be holding the smallest portion of your position at the MOST profitable part of the trade…doesn’t seem like the best way to let your winners run does it? Remember…trading is about maximizing your winning trades and limiting your losers…I only see scaling out as minimizing a winner, and THAT is why I don’t scale out.

I prefer to either take a predetermined 1:2 or 1:3 profit on a full position or IF the market is trending strongly like I discussed above in the diagrams, I will try to scale in. Either way I am not minimizing my winning trade like I would be if I were to scale out. So, to be clear, I either take profit on my full position at my predetermine target level, or I scale into a trade that’s in the context of a strong market trend….what I don’t ever voluntarily do is minimize a winner by scaling out!

Final word on adding to winners…

Finally, I just want to stress again that you should not try to scale into EVERY trade that goes into profit. You need to decide BEFORE you enter a trade if you think it has the potential to run in your favor; you need to decide before you enter if you are going to add positions to a trade by scaling in. You don’t want to leave anything to chance, and you want to make as many decisions as possible before you enter the market, since that’s when you’ll be the most objective and logical.

Finally, I just want to stress again that you should not try to scale into EVERY trade that goes into profit. You need to decide BEFORE you enter a trade if you think it has the potential to run in your favor; you need to decide before you enter if you are going to add positions to a trade by scaling in. You don’t want to leave anything to chance, and you want to make as many decisions as possible before you enter the market, since that’s when you’ll be the most objective and logical.

Take note of the EURUSD and some of the other major Fx pairs over the last 3 to 4 weeks (as of May 31st 2012)…these are the types of market conditions that give us good potential to try and add to a winning trade. Note that these market conditions don’t happen extremely often, but I wanted to teach you guys that you can add to a trade without taking on any more risk…and that was the point of today’s lesson. If you want to learn more about how I trade with simple price action strategies and my overall trading theory, check out my Forex trading course and members’ community.

Good trading, Nial Fuller

I WOULD LOVE TO HEAR YOUR THOUGHTS, PLEASE LEAVE A COMMENT BELOW :)

Any questions or feedback? Contact me here.

Nial you’re down to earth, no nonsense trading methodology and teachings is not only a breath of fresh air, but also, always seems to make complete sense. Especially not scaling out of winning trades!

Pure GOLD as always! Brilliant

Thanks for motivations

Thank you Nial for this trading lesson,I am going to apply this strategy when an oppportunity arises.

I really like this.it is very amazing.thank u for the work sir.

WOW… This Article Is VERY DETAILED And VERY INFORMATIVE. I Am Really Glad That I Am Learning To Trade From A Mentor Such As Yourself Coach… Thanks For The Info… DEFINITELY PLEASE KEEP UP THE GREAT WORK… Because I Know I’ll Be On The Receiving End Of Learning It All…

Thanks. Very interesting article. I am not ready for such a strategy but maybe in the future when I have more experience in trading.

It’s interesting, didn’t think before.

Adding a position to a winning position note that traders.Thank you Fuller.

Great article indeed! I like the idea of scaling in…

This is wonderful approach, Nial!

Thank you, it’s amazing)

Everyday I’m learning from you..

You are my miracle.

Nial,

Member here as of June 23, 2018. This strategy is genius. I am learning a lot in your course and articles. Thank you.

Best,

David

It makes lot of sense because don logic to scale in to high probability potential winning trades than to limited the profits by scaling out. So only with much patience and discipline to wait for those rare set ups , and when they appears and if there is potential for nice R then we just taking the risk to see if those trades will work in our favour or not

Thank you Nial for the info, its so understandable and will definitely make me a better trader. Wish you all the best in your trading.

Hi Nial. Thank you for the very informative article. Do you stay on the daily chart when watching for retracements to scale in on your position/s or do you move to the 4Hour chart (move between the daily and the 4Hour chart)?

Congratulations on the competition.all your explanations are always on point and simple and easy to understand.im glad i subscribed to your newsletter ive grown so much as a trader from the day i started reading your trading course and newsletter.

Great Info Nial, thank you for sharing. Wish you more success!

Thanks Nial. A great article on something I struggle to get right.

Cheers Mike

Congrats Nial on your awesome 369 % performance in the 3 month competition. Showed me how much I have yet to learn .I will keep trying though and today´s article is a road arrow in that direction.

Your name Nial(in Icelandic: Njall) is also the same name that the leading figure in the most celebrated story in the Icelandic saga´s, the “Niala”(Njala), carried. This person was known for his intellect and gift of foresight and all his friends sought his advice on major matters. Even that was not enough since his enemies burned his house to the ground with him and all his family inside. Maybe you should read it.one day, even if it tells of distant events that happened over a thousand years ago. The author is not known but he could not have written this saga had he not had first hand knowledge of these events that took place in the tenth century in Iceland around the advent of Christianity and Leif´s Ericsson´s discovery of America in the year 1000 A.D.. I could try to get you an English version of this if it is not in your book store.

Life in those days was not unlike trading. He who was better at risk management might survive when others might loose. You do carry the name Nial with full honours. I have enjoyed your lessons and I am always picking up bits and pieces in the articles. One day I hope I will become a better trader and then the lesson today will contribute to that.

Humbled by the comments Halldor, thank you.

This was really cool Nail. Before My understanding was to take more trades to earn more. How can I earn more by taking less trades?

thank you, your explanation and diagrams are very clear

Hey,Nial

Great article as always

Thanks…

Thanks Nial. You have a way of putting complex concept into bite sizes for people to understand. I am a recent member and really love your articles and your training video. Thanks!

Thanks Nial,

Great lesson and has helped me see the overall “Edge” of scaling in when a Trending market/trade is identified

Thank you again

Good lesson.Helpful to new trader like me.Thanks

thank you sir you are a good forex teacher i liked all your articals so thank you for your effort s & take care

Thanks Nial. Wonderful artical

thank you nial for a great lesson

Nial, this is a trading lesson that holds everything together. Thanks.

Dear Nail, Thanks for the very objective lesson.

Actually the more I read and dip down into your trading lessons , the more I realize how it is important to back up your self with such useful ,great and highly skilled educational materials.

Happy new year to you and to all our member community and hopefully 2014 will be great for all of us.

CHEERS..

FARKAD.

This article is very helpful. It gave me a clear understanding on how to scale in positions without increasing your risk.

Great topic for a video (hint, hint). And the last step for me to master. Thanks Nial.

Like it so much.

Loved that lesson really help full to reduce exposure and increase gain

Thanks Nial for teaching such a good technique……i am newbie trader and love to learn…….Thanks

Thank you so much coach. That is new skill which i would training hard. :)

Very interesting! Never really thought about scaling out in this way… Always thought it was a way to “lock in profits”, but I can see the benefit of NOT doing it. Thanks for that!

This article was extremely helpful. I have heard of scaling in and out a number of occasions but didn’t know how nor did I have enough experience to try it. Now, with your easy to follow Pyramiding article, I can say that I understand the environment on which to scale in a position and no real reason to ever scale out of a position. Excellent…Many Thanks to you Nial.

This is a very helpful article to me as I only scale in when a trade goes against me, but this Pyramiding article opens my eyes on how to properly adding position WITH the TREND not AGAINST the Trend. Thanks Nial

Hi Nial, Your information always very helpful, sincerely,thanks for that!

I can’t tell you just how grateful I am that I came across your website. I am currently “pyramiding” a long term long position on the usd/jpy since the 80.00 level, then did another level at the 84.00 and just did a third “step” at 87.50… amazing!! I plan to do a fourth when i get a daily pinbar break above the 90.00!!

Thanks Niall!

This is the first article I find on the matter which makes crystal clear explanation. Bravo, Nial!

the final jigsaw just fell into place. thanks nial, all the trading pieces are now complete. bravo! master

Pyramiding is about re-investing existing paper profits as you ride your winning trade.

Each time you should reinvest less because leverage increases, so 75% should be a good number to aim for.

Also use a trailing stop which is a no-brainer.

Pyramiding = key to ammasing forex wealth

A 21k trade could easily end up being 120k profit just by reinvesting your profits and adding positions every X pips. (determined by your trade and entry lots)

This is very helpful. easy to follow and understand. thanks for sharing this lesson

Great article. Thank you for sharing your knowledge with us.

Hey Nial,

That’s great tutorial. I’m very new to trading and i would hope to learn more from you~!!!!

Many Thanks,

Lee

very good information.

I like it very much.

Great lesson and easy to follow too, thanks

there is yet to be an incisive piece. nail, you did it again. thanks

Great lesson indeed. But as I have been wounded several times in Fx market, I don’t think that I can scale now. I prefer take the smallest profit and get out of the trade.

Really love this article, easy to understand and you always seem to emphasise the common sense approach. Love it! K

thanks,will make more now than scaling out

good one,Nial.i’ve yet to come across an article from you that was’nt great.you’ve helped me become a better trader.

Nice Nial, but I will live this to the pros and continue keeping it simple as one of your article says.

Good article and very clear, thanks Nial!

I think I will practice this technique on demo a few times first though.

Great article as usual. Thanks

Wise words Nial! Thanks for all your tips!

Really helpful, Nial. Many thanks.

Execllent Lesson Nial. Will take some time to master this.

Hi Niall

Great free info – will check this out real time

Nice one thanks Nial.

Great strategy! It would be very useful for the beginners!

Another fine article. The explanation is simple to follow and understand. I will practice scaling in and let you know how I progress.

Hi Nial,

thanks for this educative article. Regards Jaroslav

Hi Niel, thanks for this article. i have been breaking my head over adding on to winning trades since ages. I had success with this approach a couple of weeks back, but last week i made a loss with it. Now i realise its because i didnt maintain well thought out and proper stops. Your guidelines are a big help. Thanks :)

Agree totally on the adding on to positions that show strong trends and break key levels. I have been using this more and more on forex with the day and H4 charts. Too many bozos are preaching scaling out which for me is a disaster zone.

Cheers Nial – keep up the good work

Great Lesson….

Good content as usual for inexperienced traders.One thing I could never understand is why would you scale out of a winning trade. I give you 10/10 for your course.It is absolute value for money. Regards Charles

Excellent – Thank you

Great lesson once again. Thank you for your insights and willingness to share your knowledge with others.

OK, Nial.Great!

Fantastic article, I found it to be very helpful..it really does show how to maximize a winning trade. Very simple and easy to understand. Thanks Nial!!!!

As always a great article. thanks

with ref to scaling out of a trade, i learn’t that by scaling out you reduce your cost position, should the trade go against you, but you only scale out at the next S/R depending on the direction S/L. What are your thoughts on this, i would be interested.

As you have now become a good figure to follow in my trading career I was stuck for 2 yrs but then i came across price action. AMAZING, its’changed everything. Thank you nial.

hi nial, thx for great article.

i think your article good for trending market, but no effect for sideway market.

so if i apply your method, i think i will add 10k at 1.2450 and 5k at 1.2350.that’s my idea.

thx again.

Great article, Nial. Enjoyed it very much, and very timely….I will take your advice to heart. Cheers.

Thanks Nial,

Enjoy very much your article.

Great lesson

Cheers

Hi Nial,

I’ve been trolling the internet for a while looking for decent fx education which doesn’t cost thousands of dollars, or costly subscriptions for mediocre strategies. I recently joined your site and have found that your articles and lessons have switched on the light and shown me the power of price action. Pyramiding your trades is another great concept for me to learn.

Many thanks for providing a great place for newbies like myself to develope into experienced traders. GH

woah!this is an interesting topic

Thanx nial i find the lesson very educative on the current market conditions…

The above lesson is exactly how large sums of money are made by shrewd traders/investors and the times I have made the most money are due to pyramiding. Protecting profits is key and its such a good feeling when you are well up in a trade and you cant loose, with the trade still running in your favour. This is the beauty of trading. Money management can be exciting!

Hi Nial,thx for another excellent educative article like many before. I like your teaching style.

NICE! Will be looking to use this in some of the strong trends that are on at the moment.

Hi Nial,

I Bought your course last week but Since I started Following your website, Am feeling totally changed my account with winning trades, and this great lesson can increase more, Thanks for your Efforts.

Nial Fuller, you are a genius and truly a wonderful instructor. Very lucid and clear article. You make it simple and easy to understand. I have been a member for 2 years now and recommend you strongly to all the sensible traders i know. By the way when is your seminar coming up please.

As always great lesson Nial with your price action I have had a 70% success rate over the last three months.

I wish to echo a previous request to put this on video for us we are extremely lucky to have such a Mentor!!!

Thanks again Nial

thanks for last to lessons as well using your style platform seeing diffrent set ups from new york close and ema 21

Great article Nial. You always convey useful information in a clear & concise manner.

Really really helpful stuff, Nial. Thanks a lot!

good lesson thanks nial

Yeah, this was helpful for me, Thanks Nial. Gives me confidence to NOT having to scale out of a trade for fear of loosing what I have gain. Now I know how to add on more trades and watch my risk managment. BIG Thanks.

Thank you Nial:

This is the article just what I want.

Besides,your personal suggestion is very practical because Keeping trades simple is the best policy.

Great Info and you make it easy to understand.

Thanks.

This is great and well educating as it has always been.

You changed my trading styles and I now believe forex trading is real. Since I started reading your trading lessons, I have not blown up my account unlike in the past. Good work!

Thanks Nial.

gr8 article Nial, but i want to know, does one have to wait for a PA setup to occur b4 scalling-in? i mean, after the first setup, does one need to wait for another b4…?

thanks a lot

Great Lesson! Makes sense! It’s also important that you add to your winning trades and not to your losing trades in the hope that they’ll turn around and keep increasing your risk.

thanks again nial

Outstanding!

Thanks, Nial!

Thank you for your valuable teachings Nial.Nice value added method for maximizing profit.

Fantastic info,! Thanks a lot Nial!

Very insightful piece Nial, as always brillaintly written and extremely useful.

I enjoyed the article. I don’t particularly like scaling in. The information on scaling out was helpful to me. I have scaled out on usd/jpy and reduced my profit by $34,000. I will never ever scale out in my trading life. I thought by scaling out I was reducing my risk but now I have realized I was minimizing my profits. This scaling out lesson will save me on future profits. Thank you very much!

With this in mind now I believe the butterflies in my stomach wont haunt me in any way. I normally minimize my profits with early exits only to see it hit moments later. Your analysis is mostly perfect. Thank you so much guru.

Excellent!

Thank you Nial!

Not an just good plan,

a great method and wonderful !

Hey mate another great article. Since taking on your advice on daily chart affirmation i’ve totally changed my whole stategy. I’ve netted a 1:3 and 1:2 in my last 2 trades. I tried a trailing stop on my last trade and totally messed it up or it would have been 1:6! Maybe this could be your next article on the Metatrader?

Thanks again.

Really amazingly clear, Nial, Thank you for sharing here!

Nial,

I just recently bought your course and everything is starting to make sense to me. Price action is key. This was a very good article on pyramiding profits. Thank you for all the information you provide.

Nial,

As always, alot of great education. :)

Thanks…..

Thanks Nial. How to scale in has always perplexed me. Your illustration has cleared some of my doubts.

Also your thoughts on NOT scaling out has set me thinking.

Because I normally take out half position when price has moved eqyuivalent to R1 in favour. Your comments have now set me to rethink about it.

Thank you again for your thoughts and candid explanations.

Have a good weekend.

Great lesson Nial! One request. If possible could you produce a video. Given a more vidual explaination to todays lesson? I believe many would benefit from it. As always thanks!

That is another piece of brilliance .

Thanks Mate !

I liked it. Thanks, Neal!

Very helpful. Thanks Nial

Another great one Nial, thanks.

Thanks for all your efforts Nials, great article.

Amazing insight again to successful trading methology.You have been my saviour. Before i found your trading website i was confined to the 95% of lossers bin, but now i have the confidence and belief to be able to make money in Forex and the bottom line is precisely that and not just being successful. Thank you for inspiring me.

Peter

Finally! Now I understand what pyramiding in to a trade means and how to do it! You make things so easy to understand. Thank you for an excellent lesson on a subject that has puzzled me for ages.

A nice and knowlegdeable article

Truly a great method to maximize profit. I will definitely implement it into my trading. Thanks Nial.

Hi Nial,

Thank you so much for this expository insight in to the inner-working of fx trade management.Am so obliged to your efforts,keep em’up.

The previous two say it all. What can be added? Thanks for this

Hi Nial – this is very clever. I caught the inside bar / pin bar combination on the 28th May (thanks to all your brilliant instruction :) and entered short @ 1.2480. I gained 100 pips and then opted out cos it got a bit scary (only started with Forex in February this year).

In the future, if I can see a pair trending strongly I’ll ignore my itchy feet and stay put until the winning trade has run it’s course. You’ve made this pretty basic – THANK YOU!

Nice lesson Nial, thanks you very much

This is great. I need to invite you to Nairobi for some courses

Fantastic, you’re fx trader very professional!!!

great article- what more does your full course contain?

Does it have tips and exercises for people with psychological baggages?

Amio, yes it does.

Wow! great lesson. You are very generous with us!

Excellent – Thank you

Great article Neal,

As a relative newcomer this is most valuable and as you say timely in these markets.