The Trading ‘Secret’ That Will Decide Your Success or Failure

Fact: If you take three traders with the exact same abilities and trading talent and pit them against each other, on average only one of the traders will survive. It doesn’t matter if a guy is playing poker with his mates or they are trading together at a coffee shop, the last-man standing will ALWAYS be the guy who managed his bank roll properly.

Fact: If you take three traders with the exact same abilities and trading talent and pit them against each other, on average only one of the traders will survive. It doesn’t matter if a guy is playing poker with his mates or they are trading together at a coffee shop, the last-man standing will ALWAYS be the guy who managed his bank roll properly.

This article is going to show you how to not only be the “last man standing”, but to be a disciplined winner and hopefully come away with a larger bank roll than you started with. Today, we are going to talk about the capital management “secrets” that will give you the edge over any other trader in the room or your mates at the poker table, so pack your cigars, because if you manage your capital properly you might just walk away a winner next week :)

The best offense is a good defense

As a trader, if you really want to have a chance at long-term success, you need to learn VERY quickly that your mental energy must be focused on the trading variables that you CAN control. Obviously, we cannot control the market or make it do what we want (although certainly some traders act as if they can), but we can genuinely control most other aspects of trading; 1. Trade entries, 2. Capital preservation and money management, and 3. Our exits…these are all things we DO have control over.

The KEY point there is capital preservation and money management; properly controlling the amount of money you risk per trade (your leverage and exposure to the market) is the primary thing that will make or break you as a trader; in fact, it will decide the fate of your entire trading career. Any professional trader knows that capital preservation is the most important part of their day to day routine as a market professional, this can also be called “playing defense” in the market.

Great traders and fund managers think about how much they could lose before thinking about how much they can win; this is essentially the OPPOSITE of a gambler’s mentality. Gamblers suffer from an uncontrollable mental sickness whereby they focus almost entirely on how much money they could win with almost no regard for losses, this is borderline psychopathic behavior. Unfortunately, this behavior is also very common for many beginning and struggling traders.

Why some of the best traders and market analysts end up as “nobodies”

I’m sure you’ve heard of some of the huge hedge fund blow-ups that have occurred in recent years. The two primary causes for these have been fraud and excess leverage. Excessive leverage can also be called “irresponsible use of risk capital”, aka NOT practicing proper capital preservation.

As Scott C. Johnston points out in his popular blog “The Naked Dollar”, many prominent hedge fund managers and traders have blown-up hundred-million-dollar portfolios because they did not manage their capital properly. It only takes one hot-head “young-gun” trader to think he is “sure” of something to blow-up a huge fund by taking an extremely over-leveraged bet on some company or some news event.

As I alluded to in the opening paragraph, you can take two traders or investors with the same amount of skill and trading knowledge and one will achieve long-term success while the other continuously loses money and blows up trading accounts. The difference between the two traders is that only one of them may have the mental abilities to manage risk, plan for losses, manage trades and execute capital management correctly and consistently (meaning with discipline over time). Thus, a good trader is truly defined by his or her ability to manage risk and control their exposure to the market…not by their ability to find trades or analyze the markets, contrary to popular belief.

SOME OF THE BEST TRADERS WITH THE BEST TALENT WILL ALWAYS BE NOBODIES, they will always be losers, and they will never make the headlines, because they completely lack mental discipline or skills with capital/portfolio management, and that is where it counts. So heed this advice and listen up…it’s one thing to find a good strategy, it’s another to stay in the game long enough to see the fruits of the trading method; if your capital management and risk control sucks, you’re going to be a loser, it’s pure math, plain and simple.

Capital preservation IS exciting…you just aren’t thinking about it right

I know why many traders don’t focus enough on capital preservation and risk management: because they mistakenly think it’s not “fun” or “exciting”, but that’s only because they aren’t thinking about it right or they don’t fully understand how powerful it is.

You see, the KEY to making money over the long-term in the markets is simply staying in the game. You need to preserve your capital good enough so that you stay in the game long enough to see your trading strategy play out and reward you.

The only way to make consistent money as a trader is to have small losses (because you will have losses so better to keep them small) and a few big winners in between. It seems simple, but if you can’t do that, you can’t make money. Now, the hard part in all of this is having the mental state of mind to manage capital properly on a per-trade basis, one must consider dollars risked on the trade and also the leverage used, one must also calculate if this risk is justified but not get too emotional about it. You should always have a max dollar loss per trade pre-planned, but you may risk less than that amount obviously, it all depends on how confident you are in the setup. In essence, you need to have a mental “obsession” with capital preservation, and drop your obsession about rewards and profits. Ironically, if you can do this, you will then start to see the rewards that you were so obsessed with before.

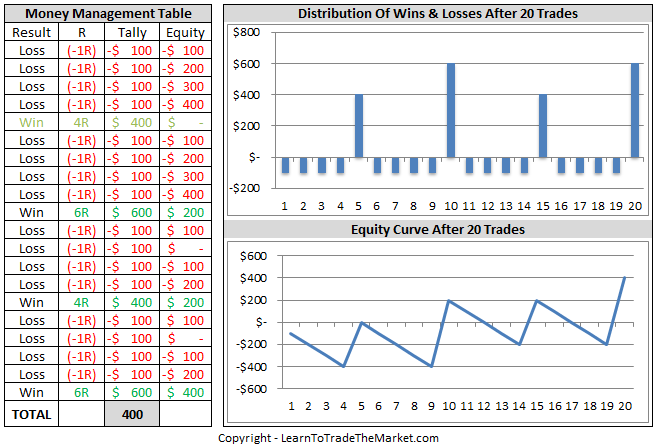

Visual Example : In the example below, let’s look at how proper capital preservation and risk management can allow you to stay in the game long enough to see your equity curve increase consistently over time. Notice how this trader has made ‘lots of very small losses’ and those losses are ‘consistently the same value’. We can also note this trader has the ‘occasional big winner’. It’s hard to believe this trader has achieved a profit with a very low strike rate of just over 20%. It’s easy to see that over time, this trader is likely to make money or at the very least break even. Let this example serve as wake up call to those of you who don’t practice disciplined capital preservation. Study these examples below and go out and start practicing it in the real world.

The key points to take away from the above graphs are that you should have a max dollar amount you will let yourself lose on any one trade, and you must not deviate from that threshold. Do not under ANY circumstances over-leverage or risk too much per trade; the market will ALWAYS be there tomorrow, so ignore the temptation to “go all in”.

However, that said, some trades you can go in a little harder on than others, but the key is that you stay under your overall per-trade dollar risk amount. So, if as in the example above, your per-trade risk threshold is $100, then you can risk any amount on a trade from 1 to 100 dollars. Some trades you may decide to risk less than $100 on, some you might want to use the full $100…this is where discretion and your ability to analyze and gauge the market comes into play, but the key is that you DO have that “cut off” point where you KNOW you will never lose more than a certain dollar amount. This is really the “key” take away point of this whole article.

The best traders cut their losses and they get the hell out when they know they are wrong, and they NEVER put their portfolio, their major assets or their shareholder’s assets at major risk if they get a trade wrong. They plan ahead obsessively and they always know the “worst case scenario” for any trade or investment. These are the traders, investors and fund managers that stand the test of time and experience success while the others blow-up accounts and fall to the way side.

As far as HOW you actually preserve your capital, it mainly involves knowing how much you are emotionally OK with losing PER TRADE and understanding position sizing and risk reward. I won’t get into that today because I’ve written other articles on it that you can check out. See my article on risk reward and position sizing for more.

Conclusion…

Whilst sound capital and risk management is certainly the “key” to success in the markets, combining these money management skills with an effective trading strategy will give you an extremely potent edge in the market. Combining my price action strategies with sound capital preservation and risk management skills has enabled me to stay in the game for 12 years. Of all the traders I know and have met, the one thing they always describe as their “secret weapon” and the reason for their success, is focusing on capital preservation; keep losses consistently below a certain dollar threshold and secure profits and let them run when you can. Capital preservation and risk management is your most definable edge in the market, and it’s an edge you have full control over, so don’t take it for granted or abuse it. Your other genuine edge needs to be an effective trading strategy like price action. To learn more about how I have incorporated money management and price action entry signals to grow my account over the long term, checkout my Price Action Trading Course and Members Area for more.

Thanks Nial for being candid.

I can see I’ve been doing it wrong.

Now I gonna fix it.

Thanks.

thanks Nial Fuller very valuable article well worth the time to read it

dear Nial ,

since I started your course (few days ago) every time I find answer for the question I ask myself ( why I am losing money ????? ….. what is the missing in my trading plan/strategy ???????

really I realized every think .

every time I read your articles , I realize exactly ( what the mistake I did for each trade).

I would like to call your articles and course ( THE HOLY BOOK OF TRADING )

many thanks

You are great Man

Hi NIal!

Each of your articles gives useful and important knowledge to us.

They all combined into full and strong mindset which help avoid common mistakes in trading, even if some of us just started learn how to trade.

Thus we can learn proper skills from beginning and thank you for that!

Thanks. Excellent article

Thanks Nail. got great knowledge

Nial’s article is always cool

Reading your articles is never a waste of time, I thank you My Mentor. Salute!!!

Hello

I recently red a couple of new articles, and as usually they are great.

You are my GOD Nial !

Nial you are spot on about money management, I myself use the 3% rule and my stops are the amount of money I am prepaired to lose.

terry Shead

i challenge my self that u are right.thanks nial………

Money management is the key to guarantee of return of capital and return on capital. The first time I experienced stability on my account balance for 3months with over 150 trades was because I used money management.

good article, thanks nial….. the most important trading rule ,is to trade defensively paul tudor jones

Boo Haaaa! It is not about timing the market it is all about spending time in the market that makes the money.

J Vander

thank you so much Nial.

Hi Nial, another incredible article, thanks for your precious sharings as always..Norman

Excellent article! Especially liked this:”Great traders and fund managers think about how much they could lose before thinking about how much they can win”. Thank you, Nial!

Nial, you are always a life saver! keep-up the good work. Thanks.

Outstanding example about the most important thing every trader should know proper money management is the key to success.

thanks nial you are like my trading I learned from you dont post (trad0e to often but when you do its a diamond !!!

this is g8t.

nice article.

Hello Nial,

Another great article, another step on the path to prosperity.

Another Great Lesson.

We are always learning with Nial.

Thanks for your words of wisdom.

I got this months ago and I love that it is the first thing I think about when entering a trade now. I look at a stop that I can justify, set the size and make sure it equals my dollar risk amount. Thanks for this mate, Gye

This is the first important step for any Trader !

Clearly explained ! Thanks !

It is great.

Thank you for great article. This article & What crocodices Can teach you about Forex trading help me improve my trading formula. Thank you again.

Right again, Nial. This is one of my weaknesses…risking too much on trades that I end up losing big eventually.

Fantastic article as usual.thank you nial.May God bless you and your whole family.

Nial, you never stop to amaze me. Even if you have gone over this topic more than once, each time you put in such a way that it appears as though you are hearing it for the fast time. Any one struggling in trading just needs to listen to Nial, and if your trading does not change, accept that trading is just not for you.

U are a master of forex

Thanks again MASTER for that wonderful article….

This is on of the most important thing that needs to be considered as a trader “Capital preservation”. Everybody knows it, but only few realize it and follow it. Thanks for reminding this as a lesson.

Thanks Nial, you are training the mind of a (potential) trader so well

“if your capital management and risk control sucks, you’re going to be a loser, it’s pure math, plain and simple”.

Thankyou Nial..

Excellent stuff Nial….”the best offense is good defense”. My trading career takes a new direction from this wonderful article because it provides the obscure fundamental framework for success in trading.You have made my day! Keep up the good work Professor Nial!

Thanks Nial. It is a MUST to remember risk management!

Thanks Nial. Always good to read your articles with today’s lesson being exceptional!

As always 100%, Thank you.

You are doing a good job.

Thank you Nial…These are words of wisdom to be sure! Thank you once again for the “grounding”

Powerfull lesson.

Nial that’s a new way of looking at trading. Have as much fun just preserving the capital as increasing it.

Excellent article.

Thank you

If only more new traders would know the importance of this simple but super important concept !!! A must in the business of trading….. Thank you one more time Nial ;)

Great!i really like this lesson.it makes great sens to me. i see my problem and solution in this article. God bless u sir.

Very True ! This should be in Lesson #1 for any beginner.. Thanks

Thank you Professor

This was a great article.

I just feel humbled.

Very good lesson that covers all the NEED of trader’s knowledge about trading. Thank you so much Nial ..

Nial, thanks once again for this wonderful article. Any trader who ignores money management, no matter how skillful he can trade, will surely fail. There is no doubt about that. That is why I do not always look at my balance, but how my equity is doing. Thanks once again.

Great and potent mentor of our time. Thanx Nial.

i have always considered this topic as boring, always looked for Strategy – but after reading your article whitch presenteded it in an absolutly non boring way i se how important that is thank You

Another great article, using proper risk management has changed the whole dynamic of my trading.

Another thing, I usually trade end-of-day…but today the inside bar setup on the Dow was to obvious not to take.

+3R

Cheers Nial

Greetings everyone,

Great article, after few ones I havent read after being a bit disappointed because of my weak results with these LTTTM methods and so taken a break for a while.

As I have read this I opened my file with my statistics and added a column with R:R development – and here is what I discovered- I would be up to 7R if all my positions would be adjusted to correct size …

Unfortunately, I dont have my account big enought to be able to do that, however WHAT A GREAT THING I REALISED into future :)

Have a nice day,

Stany

Wonderful Nial. Great article. Many thx

You have said it all, God blees yah!

“In essence, you need to have a mental “obsession” with capital preservation, and drop your obsession about rewards and profits. Ironically, if you can do this, you will then start to see the rewards that you were so obsessed with before.”

:D

LOOOL ! That’s GENIUS ! Absolute Truth !

This week I made a trade on Gold. The trade was a “one off” in which it was way in excess of my normal trade size which is between 4 to 10:1 leverage. However this trade was a winner! It increased my account by 45%!

Another great one..Great timing for me

If the market wants to grab your money, why should you be too willing to supply it. Thanks Nail.

I have come to know the importance of capital preservation after i found this site.

great article Nial

Thanks for the great weekly gems Cheers

Thanks for this article. Trading with a fixed risk amount consistently is really the key in preserving capital while having a strategy edge is what makes us the money.

well said nail, thanks doctor of forex.

From your earlier article on Market Wizards

Soros: It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when wrong.

cheers Nial

this is incredibly a rich resource to any serious trader. thanks, again nial for sharing this tip.

CAPITAL PRESERVATION, CAPITAL PRESERVATION, CAPITAL PRESERVATION.

This is the two words worthy or remembering when you sit to trade.

‘Professor’ Nial has hit the bull’s eye.

Thank you dear Nial.