Cure Emotional Trading Problems with Price Action Trading

Forex price action trading strategies provide much more than just high probability entry signals, they also work to influence the proper trading mindset. Many traders know that in order to find success in the Forex market they need to be disciplined and remain calm yet confident in their interactions with the market. However, very few traders understand just how much the specific trading strategy they use can influence their mindset and emotions. Since not trading from emotional impulses is a necessity for making consistent money in the market, it is of paramount importance to use a simple method like price action trading so that you do not unknowingly contribute to your own confusion and emotional stress in the Forex market.

Forex price action trading strategies provide much more than just high probability entry signals, they also work to influence the proper trading mindset. Many traders know that in order to find success in the Forex market they need to be disciplined and remain calm yet confident in their interactions with the market. However, very few traders understand just how much the specific trading strategy they use can influence their mindset and emotions. Since not trading from emotional impulses is a necessity for making consistent money in the market, it is of paramount importance to use a simple method like price action trading so that you do not unknowingly contribute to your own confusion and emotional stress in the Forex market.

Why Emotional Management is Critical to Trading Success

Traders who do not pre-define their Forex trading activity will inevitably fall into a cycle of emotional trading ups and downs. The problem with emotional trading is that it can be very hard to realize you are stuck in this rut until you get out of it, it’s sort of like the old saying “can’t see the forest for the trees”; it is hard to obtain the proper trading perspective when you are caught up in emotional impulse and feeling.

If you want to become a calm and calculating forex trader who never has to deal with emotional trading mistakes, you will really need to first understand why emotional management is so critical to trading success. The reason emotional management is so vitally important to forex trading success is because the market simply does not care about how you feel or what you think. To put it another way, you will not gain any upper hand in the market by acting on your feelings of fear, greed, hope, anger, euphoria, or desperation. In reality, there will be a positive correlation between how much you trade from emotion and how much money you lose in the market. This means that the more you trade based on emotion, the more money you will lose. It may take a year or even 5 years for you to blow out your account, and you may have many winning trades in between, but one thing you can bet your house on is that if you do not learn to control your emotions while trading the market you will eventually drop into the 90% statistic of losing traders.

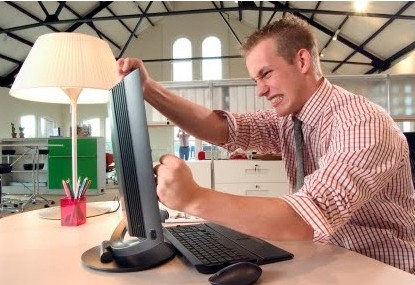

Over-complicating Forex trading can easily induce emotional trading, leading to lost money and lost time.

If you are using a Forex trading strategy that is too complicated for its own good or is just simply too confusing for you to understand, you are likely to end up entering trades out of desperation or frustration. Many traders use fancy sounding indicator trading systems or Forex trading robots, these systems sound nice and might look sophisticated to the untrained eye, but in the end they are doing nothing more than inhibiting your view of the natural price dynamics underneath and the predictive power they contain.

Traders often shoot themselves in the foot right out of the gate by using complicated trading strategies that require them to cloud up their charts with a million different bells and whistles. Many traders are not even aware of how much stress and complication they put on themselves by using overly-complicated trading strategies until they switch to a simple trading strategy like price action trading. The switch between lagging indicator based methods or trading software to raw price action trading strategies is often described by Forex traders as an “ah ha” moment, like turning on your headlights after trying to drive in the dark your whole life.

How the simplicity of price action trading can work to foster and maintain an objective trading mindset

Once you begin sliding down the slippery slope of emotional trading mistakes it can literally take a near miracle to pull you out of this habit and get back on the right path. The simplicity in price action trading will permeate through all your Forex trading activity and thinking and will work to foster and maintain an objective or emotion-less thinking pattern about the Forex market. This type of objective thinking pattern is the cornerstone of consistently profitable forex trading, and the fact that many traders lack this thinking pattern is the biggest reason why most traders fail in the end.

To put it concisely, the difficulty in successful forex trading lies in the difficulty most people have with disciplining themselves in the Forex market, not in the actual act of analyzing a chart and entering and exiting trades. Many people are drawn to Forex trading because it does look very easy on the surface; anyone can look at a price chart and identify a trending market or a range bound market and make a decent prediction about what price is likely to do next. The real difficulty in achieving Forex trading success lies in the fact that most people lack the ability to keep themselves accountable each day and maintain an objective mindset. So, if you can acknowledge that Forex trading is not really as technically difficult as most people think it is, but that the real difficulty lies in maintaining control of your emotions, it only makes sense to use a simplistic, logical, and effective method like price action trading strategies.

The importance of making a Forex trading plan based on price action setups

There really is only one real way to make sure you do not fall into the trap of emotional trading mistakes; developing your own personal forex trading plan. Making a trading plan based on simple price action concepts will be easy to follow and won’t bog you down with the haphazard details that many other trading strategies contain. By having a Forex trading plan based on price action setups you can create a daily trading routine that you can use to physically and mentally treat your Forex trading like a business. If you do not do this than the risk of entering into the emotional trading cycle becomes greatly elevated. The main concept to keep in mind is that you need to approach and think about all aspects of the Forex market from a simplistic point of view. This theme of simplicity should resonate throughout your Forex trading strategy, your Forex trading plan, and your Forex trading mindset. Once you have achieved this level of universal simplicity in your Forex trading, you will likely no longer experience emotional trading mistakes. To get started trading simple price action trading strategies that will help you eliminate emotional trading mistakes, checkout my price action trading course for more information.

you are great…

i feel more confidence after learned price actions strategy from your sites, just one or two trades a week, give me a bunch of scores. and.. i’m very hungry awaiting for the “next shoot” like a sniper

Great article!! I am a price action trader too. I wasted so much time and money on indicators in the past, which are all rubbish. I like the cleaniness and simplicity of price action chart, it just suit my trading style. Since I start using price action for my trading, i have a significant improvement in my winning rate. Hope to learn more from you here!

“YEP!”

Another winner Nial.

You have the skill to make “The Hungry” want to take a bite…then another bite and then………….

Thanks …..just one of 5000 of your gluttons……Larry

Damn you goooooood, tnx for all!

Thanks for the article, Nial. They are incredibly helpful.

I was just about to give up fx trading, but your views have encouraged me to give it one more go.

Thanks so much1 ROD

Thanks Again Nile!

Always appreciate the advice. The article points out my biggest problem, the emotional aspect of trading. I’ll have to keep working on it.

Thank Nial ,simplicity is all best and I a m getting loaded here a m gonna share this in Botswana

Great article Nial.

This outlook on the market makes a lot of sense.I’ve recently completed an expensive Forex course,with comparitively complex strategies,I’ve burnt up 90% of demo trading funds following this crap to a tee,So I am looking forward to putting your lessons to the test. Thanks Nial.

Good info again. Thanks Nial

good teaching indeed ,nice meeting you.

Great Nial. Thank you for this lesson. That’s very important for me. Regards.

Thanks Nial,

What you say is true. Our biggest obstacle to trading is within ourselves– our uncontrolled emotions. Trading is a mirror that reflects back your weaknesses in character. It takes humility,knowledge,and effort to change one’s self.

Very good article there Nial.

Especially that part about there being a positive correlation between entering trades emotionally and losing money.

Also the part about it simple. So true. Many people will add on all these exotic indicators and don’t know what they are looking for.

ive used all kinds of indicators for the last 3 years, write out step by step instructions on how to trade with them. but when it comes down to it ive never stuck to the system for more than a couple of trades, always naturaly go back to what the candles are telling me. now only taking signals off harami and engulfing candles, ignore everything else.

now feeling guilty for grabbing a quick 600gpb from the japanese tsunami today.

Good article Mr. Nial, the lessons invaluable! i will begin to work on this. Thanks.

Thanks Nial, very great article, great lessons. Now, everyday I open your website, read and learn. I think you are a very brilliant person, genius yet so simple. Thanks again.

Thanks Nail, that article will keep me in check on how I am doing.

Thanks Nial it’s information like this which makes me glad I joined your team

Great words of wisdom there. I good reminder to keep me in check. This can supply to other areas of life as well.

Thank you,

Lisa

Thanks Nial for a great article. Am starting to go thru your course again for a second time and things are starting to gel as i relate my practice account experiences to the material again. Definately setting and forgetting is a great way to go. A little harder to do that on a couple of live trades that I have taken, but practice will improve things I’m sure.

Nail, being reading your article and watching your videos for months now, all i can say is that you are God sent

Thanks Nial,

Really i am gaining a lot of knowledge from your site which i ever not known atleast 1% of what u have said in this article..

the honest approach in this article is truely uplifting, anyone even thinking about trading should read this !

wonderfull, thanks.

I am struggling to control my emotions. Thanks for all the informations sent.

This is a very fine article Nial.

Your trading plan is very good. It should acts like a check list before enteringa trade.

Nial Thanks for all the information so far received. I am

still unable to identify the entry points to the trades

I am still looking at the vidio’s and statages determind to

become proficient and profitable. Thanks again Dennis

greet as all focus on price itself the no.one indicator

Thanks

Thanks, Nial. Your article reminded me to improve and more discipline in my trading.

Great article. I have improved my trading results choosing just a couples of set ups and forgetting about changes at the middle of the trade. Emotion free and expending just a few minutes a day. Thank you Nial for your excellent lessons.

Good morning Mr. Fuller

My ego is very subtle and deceptive but through constant awareness and practice on a demo account I have and still am going through the “do not’s” that you clearly explained in your article. I have had of just recently success in controlling my emotions and the discipline of the mind, it took only a little over a year. Yes the ego is a very tricky thing to deal with in life, harness it, control it and then direct it purposefully. Thank you Mr. Fuller for another good article.

Great points, and can definitely recommend the trading course :D

Thanks Nial, This article has struck a cord, emotional trading is a hard habit to break. Your perspective is refreshing and thoughtful. Best, NorA

Hi Nial,

good article.It kind of outlays some of my habits even on a demo.Am hoping to liquidate some of these “obsessions” before I get a live acct in the near future since I keep going and looking at charts without having a mindset on my trade.

However, your inside bar reversal pattern method helped me with the eur/usd just yesterday @ 136174 despite the rssi beeing over bought but I was glued to the chart.It is cumbersome yet thrilling.I have to hone down on my risk management since I put a stop a tad larger tha my reward of 2:1 and closed before hitting limit not knowing wht the us smi would be.Still I dont even now what that means but it looked tooincomprehensible so I closed the position about 30 pts away on friday.

Thanx for all your input. Cheers Nico

since price action indicates the real market sentiments and emotions,trading price action strategies eliminates your own emotions and prejudices.

Hi Nial, thats exactly what i looked for.

Many thanks :)

Good stuff again Nial. I am always glad to get your lessons as it keeps me in check. And going back over the old lessons works real well also.

Cheers

Doug

Great Nial

Makes a lot of sense I noticed that in my trading if I enter with a clear mind, The trade goes my way.

Other-wise not.

Thanks

Thanks Nial! very informative and of great help.

There is a saying, the good things in life are free. This is true, after some time in the forex market I began reading your articles on trading psychology and it has helped me to turn one of my accounts from losses to breakeven. Thanks though I do not yet have your course on price action , I will get one in due course for now I am using bollinger banks to identify resistance points and use price action on the resistant points to make early decisions.

Another great article.a