How To Catch Big Moves In The Forex Market

How often do you see big moves in the market like we have seen recently, but you never find yourself profiting much from them? How often do you close a trade out prematurely just because it’s gone against you a bit and you ‘freaked out’ because you thought it would result in a bigger loss?

How often do you see big moves in the market like we have seen recently, but you never find yourself profiting much from them? How often do you close a trade out prematurely just because it’s gone against you a bit and you ‘freaked out’ because you thought it would result in a bigger loss?

Making ‘fast money’ and building a small account into a large one, aren’t things that just ‘happen’ to successful traders. As any consistently profitable trader will admit, it takes a consistent conscious effort to hit big winners in the market. The inevitable retracements and ‘whip saws’ that hit a market are events that shake out most amateur and inexperienced traders. The mental discipline required to simply ‘do nothing’ after you enter a trade, and instead let the market do the ‘work’, is something that not many traders possess. It’s not acquired overnight, but it is something that you can develop and grow over time.

Here are some tips on how you can give yourself a better shot at catching big moves in the market…

The psychology of holding a trade

A simple fact of trading, is that if you want to make a lot of money, you’ve got to have the mental fortitude to hold trades for longer than you might be comfortable with. The irony of trading is that to make money ‘fast’ and build your account up, you’ve got to have patience, and to be clear, I’m not talking about your average daily-life type of ‘patience’. What I’m talking about here is an iron-clad, bullet-proof, bad-ass type of patience that 90 to 95% of the world’s population simply doesn’t possess.

Think about this for a minute…

Most traders do very well on a demo account before they go live. Think back to when you were on demo, or maybe you’re on demo right now. I’m willing to bet you’re holding trades for a few days or a few weeks even, and you’re not interfering with them very much. Maybe you’ve even entered a demo trade and not checked it for a week because you were too busy at work, then when you did check it again you were up 20 or 30%, this is not uncommon.

On a demo account, traders tend to be less-involved with their trades because they simply don’t care that much since there’s no real money on the line. The end result, is that they stick with their original trade idea most of the time. This is the main reason why people tend to do very well on a demo account.

Thus, traders often do very well on demo for the reasons just discussed, then they get all psyched up to start trading live and open a live account. However, what happens most of the time, is that traders become far more involved with their live trading account, simply because there’s now something at stake; real money. This over-involvement leads to the trader changing their mind on trades, jumping in and out of the market with high frequency, second-guessing themselves, and a whole host of other trading mistakes. The end result is that they don’t catch any big moves in the market, and they will eventually probably lose money.

The point is this; the psychology of holding a trade is a very very tricky thing. To succeed on a live account, you need to do what you did on demo; which is basically just “less”. It’s hard to achieve, since real money is on the line, but if you really want to catch big moves in the market and make big money, you’re going to have figure out a way to ‘sit on your hands’ more often when trading a live account.

The power of ‘doing nothing’

Trading might be the world’s most rigorous test of one’s mental discipline and strength. In the face of a trade that’s moving against you and in negative territory, how will you react? Conversely, in the face of a trade that is up a nice profit, but has not yet hit your target, how will you react? The most difficult thing to do in each of these situations is also the most profitable thing to do over the long-run; NOTHING.

Closing out a trade for a small loss, before it hits your stop loss, is an example of letting fear control you, and doing so directly limits your profit potential because you’re not giving the trade proper time to play out and you’re also voluntarily taking a loss.

Closing out a profitable trade too soon can also be detrimental to your overall trading success. If you have pre-defined your profit target or profit taking / exit strategy before entering the trade, you will only be doing yourself a disservice most of the time by not sticking with that exit strategy.

Remember: Anything you predefine, before entering a trade, is going to be more logical and objective, and thus profitable over the long-run, than any decision you make whilst in a live trade, under the influence of your hard-earned money being at risk.

The POWER of simply sitting on your hands and doing absolutely nothing whilst in a live trade, cannot be over-stated. Your true power and advantage as a retail trader, lies in your ability to remain patient and in control of your behavior in the market.

Examples of the power of ‘doing nothing’

In the current market environment, trades are taking longer to unfold and this market is designed to shake you out. There is a lot of volatility within the price swings lately.

Let’s take a look at a couple of recent trades we’ve discussed in our daily market commentaries to see some examples of how not letting the market shake you out would have netted you some serious gains…

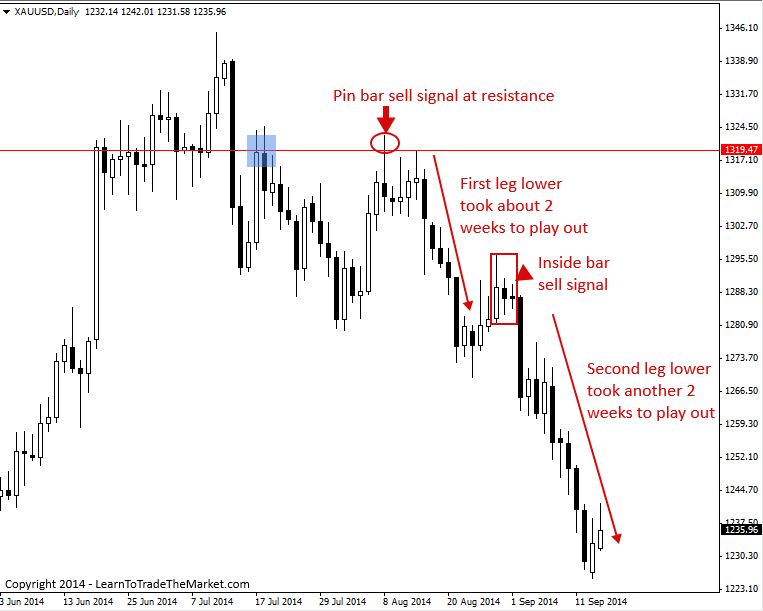

The chart below shows a couple of recent trades in the spot Gold market. The first, was a pin bar sell signal that we discussed back in our August 11th commentary. Note that the move lower from this pin bar signal took about two full weeks to play out, and the first week price basically consolidated sideways and drifted higher up the pin bar’s tail. Many traders likely got shaken out during this time and then sat on the sidelines in frustration as price fell dramatically lower over the next 5 to 7 days, without them on board.

The next signal in the Gold chart above was an inside bar sell signal, we first discussed this signal in our members daily trade setups commentary. That trade did come off pretty easily but we can also see that had you closed it immediately following the big down move on September 2nd, you would have missed about another two weeks of downside movement, which had you just left the trade open, would have racked you up some serious profits. The two trades in the above chart show us a very clear example of the power of simply ‘doing nothing’ after you’ve entered a trade.

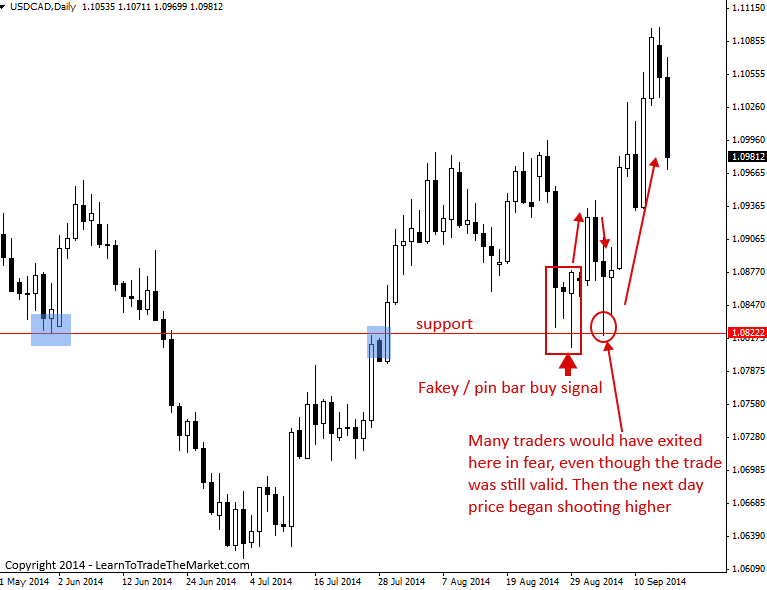

The next example we are looking at is a recent fakey pin bar combo trade on the USDCAD daily chart. Note, we had a clean fakey / pin bar combo signal from a support level, (this was also a 50% retrace level, as we discussed in our original commentary on this trade).

The main thing to note here is that price initially popped higher from this signal, triggering many traders into the trade, then over the next two days it began falling again, probably bringing anyone long into negative territory. However, most traders would have had their stop loss near the low of the fakey / pin bar signal, or just below it, and we can see that price didn’t quite reach that level. It may have been very difficult to hold that trade at the time however, with price retracing back almost to the stop loss point, and many traders likely exited prematurely (before their stop loss was actually hit), just before price rocketed up without them on board.

This is a clear example of why ‘set and forget trading’ is so powerful and how simply sticking with your original trade idea and ‘doing nothing’, is the fastest / easiest way to make money in the market…

Conclusion

In closing, I want you to do something for yourself; STOP guaranteeing your losses. In other words, give your trades a chance to play out in your favor, stop prematurely closing them before your stop loss is hit, just because you are afraid of absorbing a full loss.

You should always predefined what you’re comfortable with potentially losing on a trade, and just accept that as the cost of doing business in the market. However, if you cut your trade before your original stop loss gets hit, you’re not letting your trading business have the proper room it needs to grow. Yes, you may avoid some full stop-loss length losses by exiting a trade early, but this will not be the case every time, and so the times it’s not the case, it means you’re going to be taking a loss while also eliminating a potential winning trade, and this is very dangerous and it’s not how you build your account or make money over the long-run.

One 3R winning trade will pay for three 1R losing trades. Therefore, when you cut a potential winning trade out of fear, let’s say that trade would have been a 3R winner, you are voluntarily giving up more than 3R in profit! (The loss you take, assuming it’s a little less than 1R since you exited prematurely before you stop loss was hit as well as the 3R winner you forfeited).

This is just not the proper way to trade. It’s not how you catch big moves in the market and hence, it’s not how you build your trading account or become a pro trader. However, this is how most traders do in fact trade, and it’s also why about 90% of them don’t make money in the long-run.

Here are some tips to help you stick with your original call / trade which will help you catch bigger moves in the market:

- Don’t look at low time frame charts because even small / meaningless daily chart retraces will make you nervous and shake you out if you’re fixated on them on small time frames.

- Learn to trust your trade and trust your gut. If you don’t learn trust to your trade decisions and see them through, you will never make consistent money over the long-run in the market.

- Don’t over complicate your trading. Trade a simple method like my price action trading method and stick to a simple trade management plan, which can be as simple as ‘set and forget’.

- Closing trades early guarantees a loss, don’t ever guarantee yourself a loss in the market unless you really have to! Stick with your original call most of the time unless the price action is clearly changing against your original position. About 90% of the time the best decision is to simply let the market do the ‘work’ and let the trade play out with little to no involvement on your part.

Catching big moves in the market, building your trading account from a small one into a big one and becoming a successful long-term trader are all things that can only happen if you are willing to simply ‘do nothing’ most of the time as your trades play out. So, you need to ask yourself, are you ready to ‘do nothing’, or are you going to over-complicate your trading, over-involve yourself in it and lose money and time as a result?

Good trading – Nial Fuller

Point(s) taken.

Nice and very relevant piece. Thanks for the good work. If I may ask, what will you say/advice on moving your stop loss to entry when the Thrace is already in profit? Eric (Nigeria)

nial this lesson is powerful is the best of the best thank you good bless you men

Tks so much, Nial , you gave me many hope in this world of forex !

Trading concept is too strong, like!!!

Govern by doing nothing that goes against nature!

Nial’s lessons are very powerful

A really excellent piece of advice and great encouragement to hold the line and stick with the trading plan. Thanks for that Nial

yes very good idea to make profit keep it up

Your write with precision and accuracy about the market. You will forever be relevant to this great industry.

Thanks for the great lesson. For me the point about ‘not voluntarily taking a loss’ is so important. And also not interfering with the trade once set. All good. Thanks

I first read this lesson just after it was written. I didn’t really comprehend the importance of it at the time. After nearly 4 yrs of trading…and only just becoming profitable in the last year…I can tell you that it’s probably the ‘MOST Important’ lesson Nial has ever written, especially if you trade the Daily and weekly charts like I do!

It’s always important to ‘go back’ and read these lessons. Nial is the ‘master’ of trading Psychology. Once you understand & can control your emotions you can start to make really good gains with much less stress and anxiety. Believe me!

Thank you Nial.

Brilliant concept.

“Do Nothing” and still make a profit.

good job.

Excellent. You are describing one of my problems exactly. It is now up to me to continually remind myself not to interfere. One of the more noticeable things that I see during my weekly review is that my original reasons for entering a trade remain valid. I need to remind myself to “stop Micro-Managing”.

Learn to trust your trade and trust your gut. If you don’t learn trust to your trade decisions and see them through, you will never make consistent money over the long-run in the market.

As always, thank you

Hello, Nial.

Perfect article Nial, I’m really enjoying being part of this trading site. With each of your article, I’m a successful professional trader. It’s really giving me the boost and better understanding of forex trading…

Thank you very much.

You are a genius Nial. Thanks for being generous with your trading wisdom.

My trading career took a positive turn since i discovered you. Something has been happening to me lately. As far as i am concerned, following your trading principles and techniques is the best guarantee for a successful trading career.

You are highly recommended as every trader’s coach.

Thanks for great your articles once again.

This is really an awesome article!!! am just started the trading a week back. its really useful for me!!

Thank you Nial :)

Absolutely brilliant article. Every trader wanting to be successful should follow this advice. I will certainly try! Cheers Greg

Thanks Nial

Good commonsense trading.

From sunny uk.

Terry

Thank you so much,coach

Hi Nial,

Your generosity to share your knowledge with all traders is most touching and traders who have taken your advise to heart and are succeeding will remember you for ever. You have indeed made a difference to traders who are following you..The way you wite is so appealing and gripping that one can’t fail to ignore you.

Fear and greed are the two emotions that drive the market and makes or breaks the trader. What you say is very true, one needs to be still inside, detached from his trade and watch the action till end of story which is either taking your loss or profit. I love watching the markets- the fight going on between the bulls and bears and as long as I just remain an observer the trade should and would pan out my way.

Trading is almost like meditation where you the meditator is observing your thoughts but not getting involved with the train of thoughts.

Brilliant read – yet again…:-)….I do close my trades much too soon….guilty as charged..:-)….will let them run…..will remember to let them run…:-)

I trade 4 hour chart and it happened on Friday with EURUSD I took a nice profit of $200 when the market started to breath against me but when I checked after 2 hour i could have made $400 more. I like the markets because I learn a lot about myself quickly that any other activities I do. Thank you very much for the reminder that I still need to release this urge, this wanting to do something.

Hi very good article. in cricketing terms we mentioned — leave a good length Outswinging ball with Bat and Pad Together and Head fell down to smell the swing and leave the ball to left us. its called well left. and that way we can preserve our wicket. Wait for the over pitch ball to be hit all along the V for a four.Like wise as you said we will have to Wait for the Perferct Oppurtunity to Enter and finished it with Perfect Target –(in cricketing words Perfect Follow Through.) intraday Patient won’t give us any fruit. atleast 3days to 7 days needed to achive any profit as you siad.

thanks for your guidence.

Nail,

You’re good at presenting fundamental trading principles in very dramatic writing style.

Keep up the good work.

Mike,

From cloudy Tokyo

Thank you for another great blog Nial !

From my own experience I’d like to add that many beginning traders seem to overtrade their accounts. On their demo accounts they practice with amounts (eg. 100k) and risks (eg. $1000) that they are not ready to risk on their real accounts. So as you’re pointing out, once real money is involved, and the trades start running against you, it is not easy to sit on your hands and remain calm ….

It is very fundamental lesson of how to get success over long time period as fx trader.

I really do appriciate it and thankful that Nial reveals this articel.

This is great article and real in fact.

Hi Nial ,

It was a great article which is very helpful , thank you .

I’m the one who often loose confident to hold more longer profit position.

I need to learn more about “psychology of holding the trade & the power of doing nothing”

It really worth to learn that strategy , and learn how to trade “set & forget” , even so hard to do that :)

Thanks ,

jim777

it takes guts and developed mind eyes to keep a trade for long. As you stated in the course outline, the market is designed to Trick , Trap and Test your Guts. I wish to develop a great insight to market momentum will helps to calm the nerves in a tricky situations of the market.

Gee Nial, You write this lesson just for, or all about me. Probably whats cost me most of my losses in the last 2 years now… Thank for all the added insight…

Thank you Neil,

This lesson is really very helpful.

Now onwards, I will do nothing, it’s market job…..

Thank you once again….

Julian

Toronto, canada

Great wisdom for traders!!

Thank you Nail… I’ve learnt that and practicing it . It pays off

Very Very good Arcticle, A piece of GEM.

This is what happening with me, know everything/ every S/R, every pattern but result is still struggling trader,

This lesson is very much a explanation of my problem, I took 2 big losses in USD-JPY long at Lows in daily chart, knocked out on pinbars, when I looked for other charts than that chart become a rocket and I was still on ground.

I will now stick to your tips and strictly follow them, that might turn the table for me.

Nial You are a great person, your article help us a lot.

Keep on helping us

Thanks

I like your sentence in the above-mentioned beautifully written article that

“STOP GUARANTEEING YOUR LOSSES” !

There is a great lot message in this article for every potential upcoming trader.

THANK YOU VERY MUCH SIR for motivating and encouraging for profitable trades.

We all like your seasoned mentoring.

GOD BLESS YOU.

I ‘learned to trade’ Price Action after doing Nial’s course in under 6 months!

It’s taken me over 2 years to learn patience, self control & discipline. Only now..am i becoming profitable!

Thank you! I like to read it because you exactly pointed at my first mistakes. Now I’m still waiting on a crash on the GPB. It can last for weeks but it will happen!

Greetz,

Michel

Makes sense to me. I’m lucky i found you at the beginning of my trading career Nial.

Best wishes, Greg.

Hi,

I am n italian trader have you Trading System/Strategy for trading on Bund futures?

Paolo, price action trading is universally applicable to all financial markets.